Where To Find Your 1099

We will mail a paper copy of your 1099-G to the address we had on file for you on December 31, 2021.

We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31, 2022.

It is too late to change your address for the 1099-G mailing, but you can access your 1099-G online.

- Pandemic Unemployment Assistance payments

- Supplemental payments

- Any other kind of unemployment benefit

The total on your 1099-G includes any amounts that were withheld on your behalf, such as:

- Overpayment offsets

Your 1099-G total does NOT include benefit payments that were processed in 2022, even if those payments were for weeks in 2021.

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Unemployment benefits provided a much-needed lifeline for thousands of Americans dealing with pandemic furloughs and layoffs in 2020. But on April 15 an unpleasant surprise might be waiting for people who got such aid.

According to Kathy Pickering, H& R Blockâs chief tax officer, many first-time unemployment recipients donât know those payments count as taxable income for both federal and state returns.

Thanks to extended benefits that stretched up to 39 weeks in some states and additional weekly federal support payments, first of $600 and then $300, unemployment benefit recipients could be facing hefty tax bills theyâre unprepared for and ill-able to afford, particularly if they are still out of work.

Legislation proposed by two Democratic Senators on February 2 hopes to prevent this by waiving taxes on the first $10,200 of unemployment benefits a person received last year. However, the bill has yet to be passed and no changes have been made to the existing tax code. So for now, itâs best to brace for a possible hit from Uncle Sam.

If you relied on unemployment compensation last year, hereâs what you need to know when you file your 2020 return: how that aid will be taxed ways to reduce your tax bill and your options if you canât pay in full by the deadline.

Also Check: How Much Am I Making After Taxes

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Read Also: When Will I Get My Unemployment

Also Check: What Is The Percent Of Unemployment

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, 2021. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

Read Also: How Much Is Unemployment In Colorado

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Next Section

Recommended Reading: Do You Have To Pay Taxes On Unemployment In California

What Is Reported On My 1099

DES reports the total amount of unemployment benefits paid to you in the previous calendar year on your 1099-G. This amount is based upon the actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

State Income Taxes On Unemployment Benefits

Many states tax unemployment benefits, too. There are several that do not, and some waived income tax on benefits received in 2021. For example, Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Seven states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

Don’t Miss: How To Apply For Unemployment In Nyc

Learn About Tax Treatment Of Unemployment Compensation

Unemployment compensation is the benefits you received as a laid-off employee, which generally include any amounts you received under any U.S. or state unemployment compensation law. Include this compensation in both federal and Massachusetts gross income in the year you received it.

For certain government payments, Form 1099-Gs are issued, which show you the full amount of your unemployment benefits during the year.

You may request to have your Massachusetts taxes withheld. If you choose not to have your state taxes withheld, you may pay estimated tax payments on this income.

Nonresidents are subject to Massachusetts income tax on unemployment compensation that is related to previous employment in Massachusetts.

Part-year residents are subject to Massachusetts income tax on unemployment received while a Massachusetts resident, whether related to employment inside or outside of Massachusetts.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Read Also: How Do I Open My Unemployment

Recommended Reading: Where To Find My Unemployment Tax Form

Will I Receive Multiple 1099

Most claimants will receive one 1099-G document for 2021. However, some claimants may receive multiple documents if they were reissued Lost Wages Assistance program payments or filed in both regular UI and Pandemic Unemployment Assistance in 2021. To identify which program your 1099-G is for, look for the program code printed in the Account Number box in the bottom left corner of your 1099-G.

Those programs for which claimants would receive a 1099-G include:

- Program Code 001

- High EB – High Extended Benefits

- FPUC – Federal Pandemic Unemployment Compensation

How To Get Your 1099

You may choose one of the two methods below to get your 1099-G tax form:

- Online:The 1099-G form for calendar year 2021 will be available in your online account at labor.ny.gov/signin to download and print by mid-January 2022.

- If you do not have an online account with NYSDOL, you may call:1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via U.S. Mail. The form will be mailed to the address we have on file for you.

Don’t Miss: How Much Is Unemployment In Florida

How Will I Recieve My 1099

1099-G forms will be sent via United States Postal Service. 1099-G forms cannot be sent by email, fax or any other electronic method. 1099-G forms are mailed to the address on record as of January 1, 2022. The USPS will not forward 1099-G tax forms unless it has a change of address on file.

- PUA Claimants: If you filed for benefits in PUA, your 1099-G has been mailed to you. The Department is also currently working to upload 1099-G forms for PUA claimants to the PUA online portal. We will notify you as soon as PUA 1099-G forms are available online..

- If you filed in the regular unemployment insurance system, we are unable to upload your 1099-G to your online claimant portal due to system limitations.

Are Disability Insurance Benefits Taxable

In most cases, Disability Insurance benefits are not taxable. However, if you are receiving unemployment benefits, then become ill or injured and begin receiving DI benefits, the DI benefits are considered a substitute for unemployment benefits, which are taxable.

If DI benefits are taxable, you will receive a notice with your first benefit payment. You will receive a Form 1099G for your federal return only. You can access your Form 1099G information in your UI Online account.

If you received unemployment benefits before filing a claim for DI benefits and did not receive a Form 1099G, contact the 1099G Service Line at 1-866-401-2849, Monday through Friday, from 8 a.m. to 5 p.m. except on state holidays.

If you have more questions, you can contact the IRS at 1-800-829-1040. TTY: 1-800-829-4059.

Recommended Reading: Can I Use Earnin On Unemployment

Unemployment Federal Tax Break

Last year, the American Rescue Plan, gave a federal tax break on unemployment benefits. For Tax Year 2020 , you didnt have to pay federal tax on the first $10,200 of your unemployment benefits if your adjusted gross income is less than $150,000 in 2020. The $150,000 income limit is the same whether you are filing single or married.

For paper filers, the IRS published instructions on how to claim the unemployment tax break: New Exclusion of up to $10,200 of Unemployment Compensation. For online filers, the IRS has stated that tax software companies have updated their systems to reflect the unemployment federal tax break. If you file your taxes online and havent filed for 2020 yet, you may want to make sure your tax software is updated before filing your tax return.

In addition, remember that this is a federal tax break, which means that you may still have to pay state taxes on your unemployment benefits. You can read Kiplingers State-by-State Guide on Unemployment Benefits to see if your state gives a state tax break on your unemployment benefits.

If your state decided to give you a state tax break and you already filed your state return, you should check to see if you are newly eligible for any state tax credits.

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2021 New York State Form 1099-G statement is the same as the 2020 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

Read Also: How Do I Get 1099 From Unemployment

Unemployment Compensation Subject To Income Tax And Withholding

The Tax Withholding Estimator on IRS.gov can help determine if taxpayers need to adjust their withholding, consider additional tax payments, or submit a new Form W-4 to their employer. For more information about estimated tax payments or additional tax payments, visit payment options at IRS.gov/payments.

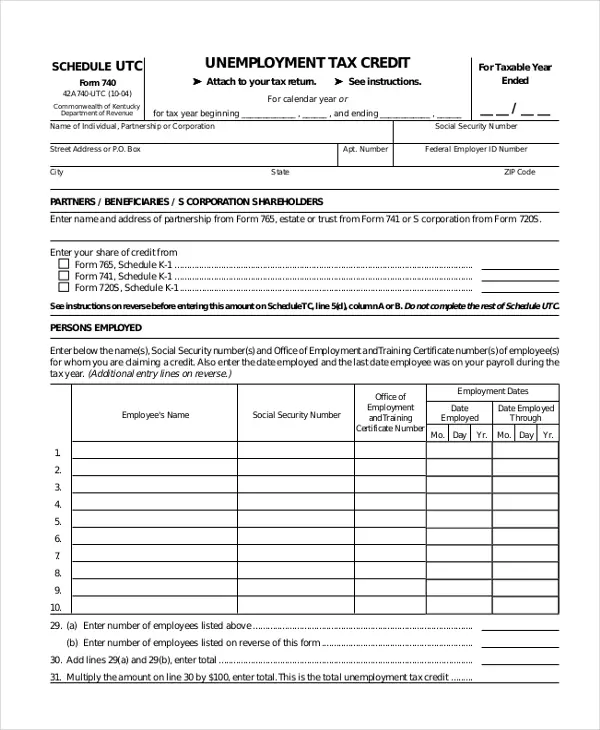

The Federal Unemployment Tax Act , with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax. For a list of state unemployment tax agencies, visit the U.S. Department of Labor’s Contacts for State UI Tax Information and Assistance. Only the employer pays FUTA tax it is not deducted from the employee’s wages. For more information, refer to the Instructions for Form 940.

Using Unemployment Tax Registration

Employers must register with the Texas Workforce Commission within 10 days of becoming subject to the Texas Unemployment Compensation Act. TWC provides this quick, free, online service to make registering as easy as possible.

You will answer a series of questions about the ownership of the business and the number of locations operated. Once the registration is complete, liable employers will receive a TWC Tax Account Number and may be able to file wage reports and submit unemployment tax payments online.

The registration process takes approximately 20 minutes. The system will automatically save partial registration information once the initial details have been entered. Incomplete registrations will be accessible through this Internet site for one year you can come back later to continue the registration process.

Also Check: What Time Does The Unemployment Office Close

Don’t Miss: How To Apply For Unemployment In Pa

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

- Disability Insurance benefits received as a substitute for UI benefits

- Disaster Unemployment Assistance benefits

- Paid Family Leave benefits

Form 1099-G also reports any amount of federal and state income tax withheld.

Income Tax 1099g Information

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Maryland Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year. This may be different from the week of unemployment for which the benefits were paid.

1099-Gs are required by law to be mailed by January 31st for the prior calendar year. By January 31, 2021, the Division will deliver the 1099-G for Calendar Year 2020. By January 31, 2021, the Division will send the 1099-G for Calendar Year 2020.

1099-Gs are not available until mid-January 2021. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G may NOT be forwarded by the United States Postal Service. The BPC unit cannot update your mailing address. You must update your mailing address by updating your personal information in the BEACON portal, on the Maryland Unemployment Insurance for Claimants mobile app, or by contacting a Claims Agent at 667-207-6520.

If you wish to request a duplicate 1099-G for prior years, send your request to the Maryland Department of Labor Benefit Payment Control Unit at .

What is the Payers Federal Identification number? The the Maryland Department of Labor Federal ID # is: 52-2006962.

Recommended Reading: How To View Your Unemployment W2 Online

The Unemployment Tax Waiver Could Save You Thousands Of Dollars

This tax break could provide a tax savings of thousands of dollars depending on your tax situation.

With current individual tax rates ranging from 10% to 37%, the potential tax savings can vary from $1,020 to $3,825, Johnson says. The amount, of course, depends on the taxpayers filing status, income and other factors, such as deductions claimed on the tax return.

For example, if you qualify for the $10,200 tax break, youre single and are in the 22% tax bracket, you may qualify for a tax savings of $2,244. And if you are married and both you and your spouse qualify for the tax break, you may be able to save $4,488.

Read Also: How To Earn Money When Unemployed

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How Do I Get Unemployment Insurance For My Business

Don’t Miss: How To Sign Up For Unemployment In Ky

Can I Get A Property Tax Loan

Property tax loans arent easy to secure. Particularly because most mortgage lenders dont want to take on someone elses headache. But, there are lenders that will approve mortgage refinancing and home equity loans to consolidate property tax arrears.

Most importantly, you have to find a mortgage broker who specializes in these types of secured loans. Otherwise, you will waste valuable time and find yourself in a worse situation.

Turnedaway.ca, as the name implies, specializes in helping property owners who are facing challenges get approved. In fact, we focus on helping consumers who are struggling with:

- Property tax arrears and tax arrears certificates

- Mortgage arrears

- Power of Sale & foreclosure

Certainly, having property taxes owing is not an ideal situation but there are options to help you protect your personal property.

Read Also: What Is The Best Tax Relief Company

Adhd And Tax Disability Benefits

If you have been diagnosed with attention deficit hyperactivity disorder , you could be eligible for tax disability benefits. That said, a diagnosis is not an automatic approval for a tax credit. The reason being that ADHD comes in varying degrees and it needs to be established how this condition affects your daily life. All of the factors need to be considered during the application process. If you or a loved one with ADHD display a certain behaviour which is disruptive to daily life, this could result in a tax credit being approved.

The most important concern is determining the difference between mild and severe ADHD since this will determine whether or not you are eligible. Although this disability is not as clearly visible as, lets say, somebody suffering from paralysis, it can still be debilitating. The Canadian government recognizes this and offers financial support in the form of the Disability Tax Credit.

Also Check: How To Earn Money While Unemployed

Read Also: How Does Unemployment Work In Ct