Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2020 New York State Form 1099-G statement is the same as the 2019 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

Read Also: How To Fight Unemployment Denial

Do I Have To Report Miscellaneous Income

Yes, unless the income is considered a gift, you need to report all income that is subject to US taxation on your tax return. The $600 limit is just the IRS requirement for Form 1099-MISC to be considered necessary to file by the payer. You will report this income as other miscellaneous income on line 21 of your 1040.

Why & How Is It Used

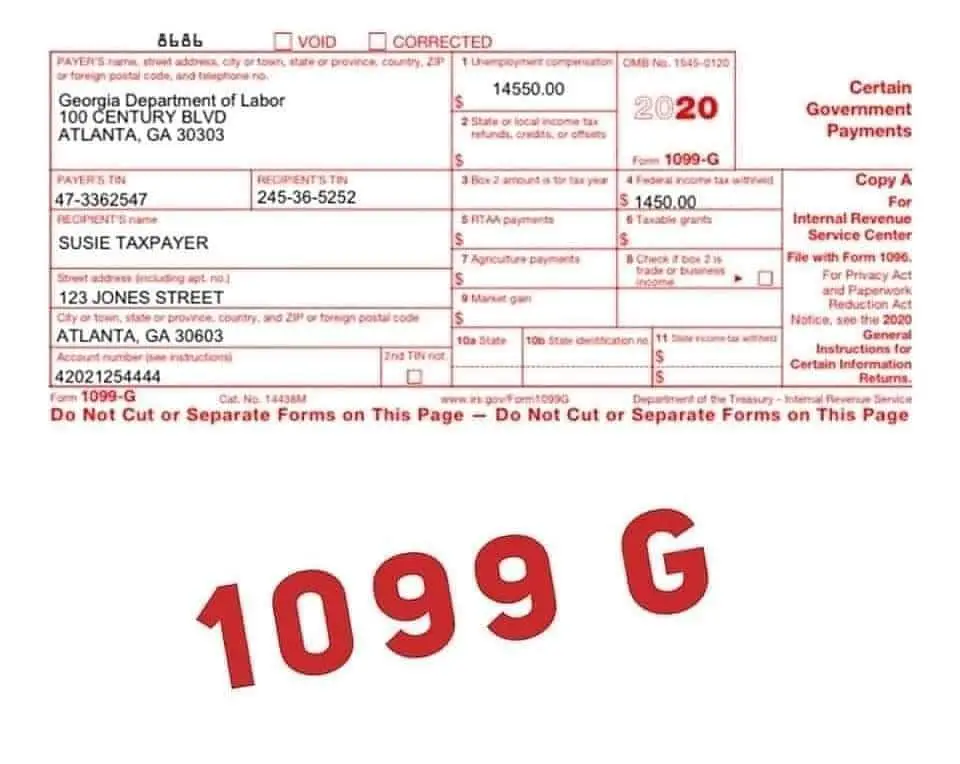

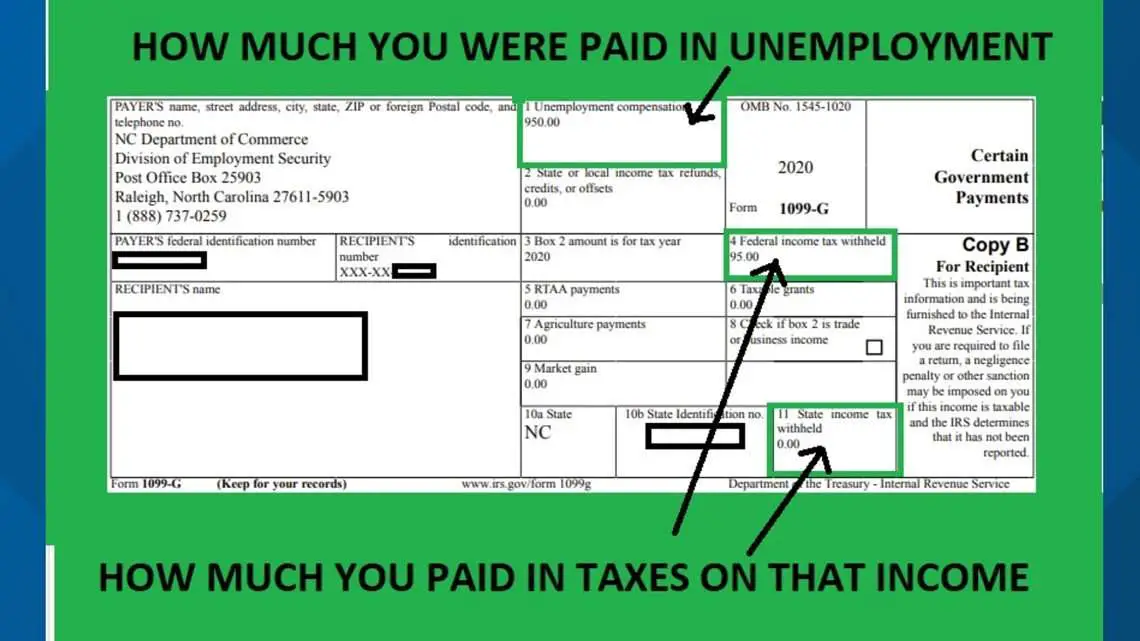

Document can be filed by your employer to report the amount of tax that was withheld from your paycheck. 1099 g form online is used to report the amount that employer has withheld from paycheck for federal taxes. 1099 G form is a document that is used to report the amount of state and local general sales fees for a given year. It is important to note that these are not federal fees like what are used to report on a 1040 tax.

State and local governments use this 1099-G unemployment to report the amount of taxes that were assessed and paid. This way, the IRS has a way to determine how much, if any, is owed in taxes to the federal government.

First part is a summary of the federal taxes that you have paid. It is the beginning of federal Form 1099 G that details the amount that you have paid in taxes. It is the sum of your personal information, such as social security number, the amount of gross income you received, and the amount of fees that were withheld from pay. Amount of taxes withheld may be different from the amount of federal taxes that you owe to the government. This is because the information on the document is reported by the employer, and employer may not have withheld the correct amount of fees . Second part is the state and local tax information.

Recommended Reading: Can I Get An Apartment On Unemployment

You May Like: How Do I Get My Tax Papers From Unemployment

Can You Get A Tax Return On A 1099

It is possible to receive a tax refund even if you received a 1099 without paying in any estimated taxes. The 1099-MISC reports income received as an independent contractor or self-employed taxpayer rather than as an employee. Three payments of $200 each should result in a 1099-MISC being issued to you.

Check Back For Updates To This Page

For the latest updates on coronavirus tax relief related to this page, check IRS.gov/coronavirus. We’re reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. Unemployment compensation includes amounts received under the laws of the United States or of a state, such as:

- State unemployment insurance benefits

- Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund

- Railroad unemployment compensation benefits

- Disability benefits paid as a substitute for unemployment compensation

- Trade readjustment allowances under the Trade Act of 1974

- Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and

- Unemployment assistance under the Airline Deregulation Act of 1978 Program

- Federal Pandemic Unemployment Compensation provided under the Coronavirus Aid, Relief, and Economic Security Act of 2020

- Benefits from a private fund if you voluntarily gave money to the fund and you get more money than what you gave to the fund.

If you received unemployment compensation during the year, you must include it in gross income. To determine if your unemployment is taxable, see Are Payments I Receive for Being Unemployed Taxable?

You May Like: Missouri Edd Unemployment

How To Get Your 1099 Form

Posted: To quickly get a copy of your 1099-G or 1099-INT, simply go to our secure online portal, MyTaxes, at https://mytaxes.wvtax.gov/ and click the Retrieve Electronic 1099 link. This is the fastest option to get your form. To request a copy of your 1099-G or 1099-INT by phone, please call 558-3333. If you choose this option, it could take

When Should I Receive My Unemployment Tax Form

Go the website of your state’s labor department. Navigate to the page that provides information on unemployment claims. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question. In most cases, 1099-Gs for the previous year are mailed on or before January 31. For example, if you collected unemployment in 2018, the 1099-G should have been mailed by January 31, 2019. While on your states website, copy the contact information so you can contact the office directly if necessary.

Also Check: Can You File Chapter 7 On Unemployment Overpayment

How To Get Your 1099

DENVER Many who received unemployment benefits last year are now depending on tax returns but some are still waiting to get their 1099-G forms from the Colorado Department of Labor and Employment .

The CDLE tells the FOX31 Problem Solvers the department is still working to get all 1099-Gs loaded into the MyUI+ system.

Kymmberleigh Oliver tells FOX31 she now has a job but needs her tax refund as soon as possible.

I have bills that have to be caught up because of COVID and the pandemic and being out of work all that time set me back last night and now its just setting me back even further, she said.

The CDLE explains all PUA-related 1099-G forms can be accessed on a claimants MyUI+ account. If a claimant received PUA benefits as well as regular state unemployment benefits, PEUC, or SEB, the 1099 in their MyUI+ account will only reflect the PUA benefits.

If a claimant did not receive their 1099 in the mail, they can complete this form to receive another copy in the mail. Claimants should also complete this form if they need another copy of the 1099 that reflects all non-PUA benefits they were paid in 2020. If a claimant only received PUA benefits in 2020, they should not complete the form and instead access the 1099 via MyUI+.

These requests for copies of an existing 1099s are being completed quickly.

More information is available on the CDLE website.

These Are The States That Will Either Mail Or Electronically Deliver Your Form 1099

California

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at and select 1099G at the top of the menu bar on the home page.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by: logging into your account at selecting 1099G at the top of the menu bar > View next to the desired year > Print or Request Paper Copy.

You can also request a paper copy by calling 1-866-333-4606.

Florida

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at myflorida.com and go to My 1099-G & 49Ts in the main menu.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed at 1099grequest.myflorida.com.

Illinois

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at ides.illinois.gov. Illinois Department of Employment Security will send an email notification with instructions to access the document from the Illinois Department of Employment Security website.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by calling 338-4337.

Indiana

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at in.gov. You will find your Form 1099-G on your Correspondence page.

If you opted into electronic delivery:

Michigan

Mississippi

Utah

Don’t Miss: Www.bankofamerica.com/kdoldebitcard

Notice To Representatives Of Deceased Claimants

Q: How do I access the 1099-G tax form if I am the representative of a deceased claimant?

A: For the New York State Department of Labor to provide you with information belonging to a deceased unemployment insurance claimant, you must first show that you are legally authorized to receive this information. Authorization often comes from the New York State Surrogate Court, and may be one of the following:

- Appointment as an Executor

- Letters of Administration

- Appointment as a Voluntary Administrator

If the deceased claimant had no assets, or all property owned by the deceased claimant was owned in common with someone else, then no Executor or Administrator may have been appointed. The representative of the deceased claimant must provide proof that they are authorized to obtain the information. In this case, a surviving spouse should provide NYS DOL with:

Please submit proof that you are authorized to receive the deceased claimants information using one of the following methods:

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

You May Like: Can An Llc Owner Collect Unemployment

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Federal Income Taxes & Your Unemployment Benefits Twc

Posted: Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS.

Don’t Miss: Can You Collect Unemployment And Workers Comp

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Name

- Date of birth

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters weve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

- Name

Where Can I Get A Copy Of My 1099g

If you have a Paid Family Leave claim or you are unable to access your information online, you can request a copy of your Form 1099G by calling the EDDs Interactive Voice Response system at 1- The IVR system is available 24 hours a day, 7 days a week. A copy of your Form 1099G will be mailed to you.

Don’t Miss: Where Do I Go To File For Unemployment

Des: Tax Information And 1099

Posted: What is the IRS Form 1099-G for unemployment benefits? By Jan. 31, 2021, all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account.

Read Also: How To Enroll In Unemployment

How To Get 1099 From Indiana Unemployment

Posted: Call your local unemployment office to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Don’t Miss: Pa Unemployment Ticket Number Status

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

You May Like: Do My Taxes Pay For Unemployment

If I Repaid An Overpayment Will It Be Reflected On My 1099

No. DES reports the total amount of benefits paid to you in the previous calendar year on your 1099-G, regardless of whether you repaid any overpayment. If you repaid part or all of an overpayment during the previous calendar year, you may be able to deduct the repaid amounts on your income tax return. The repaid amount should be reported on the tax return submitted for the year the repayment was made.

Read Also: Can You Collect Unemployment If You Quit Your Job Because Of Stress

Individual Income Tax Information For Unemployment Insurance Recipients

- Current: 2020 Individual Income Tax Information for Unemployment Insurance Recipients

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return.

Total taxable unemployment compensation includes the new federal programs implemented in 2020 due to COVID-19:

- Federal Pandemic Unemployment Compensation

For additional information, visit IRS Taxable Unemployment Compensation.

Note: Benefits are taxed based on the date the payment was issued.

Income Tax 1099g Information

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Maryland Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year. This may be different from the week of unemployment for which the benefits were paid.

1099-Gs are required by law to be mailed by January 31st for the prior calendar year. By January 31, 2021, the Division will deliver the 1099-G for Calendar Year 2020. By January 31, 2021, the Division will send the 1099-G for Calendar Year 2020.

1099-Gs are not available until mid-January 2021. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G may NOT be forwarded by the United States Postal Service. The BPC unit cannot update your mailing address. You must update your mailing address by updating your personal information in the BEACON portal, on the Maryland Unemployment Insurance for Claimants mobile app, or by contacting a Claims Agent at 667-207-6520.

If you wish to request a duplicate 1099-G for prior years, send your request to the Maryland Department of Labor – Benefit Payment Control Unit at .

What is the Payer’s Federal Identification number? The the Maryland Department of Labor Federal ID # is: 52-2006962.

Read Also: Can I Get Unemployment If I Quit

How To File Form 1099

Posted: If you received a Form 1099-G for unemployment compensation that you received during the year, you can enter this in your account go to: Federal Section. Income Select My Forms. Form 1099-G Box 1 Unemployment Compensation. Add or Edit a 1099-G. The exclusion will be applied automatically based on the entries in the program.

You May Like: Where Do I Get My W2 From Unemployment

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Recommended Reading: Can You Overdraft Your Unemployment Card