What Else To Know About Unemployment Tax Refunds

The IRS has provided some information on its website about taxes and unemployment compensation. But were still unclear on the exact timeline for payments, which banks get direct deposits first or who to contact at the IRS if theres a problem with your refund.

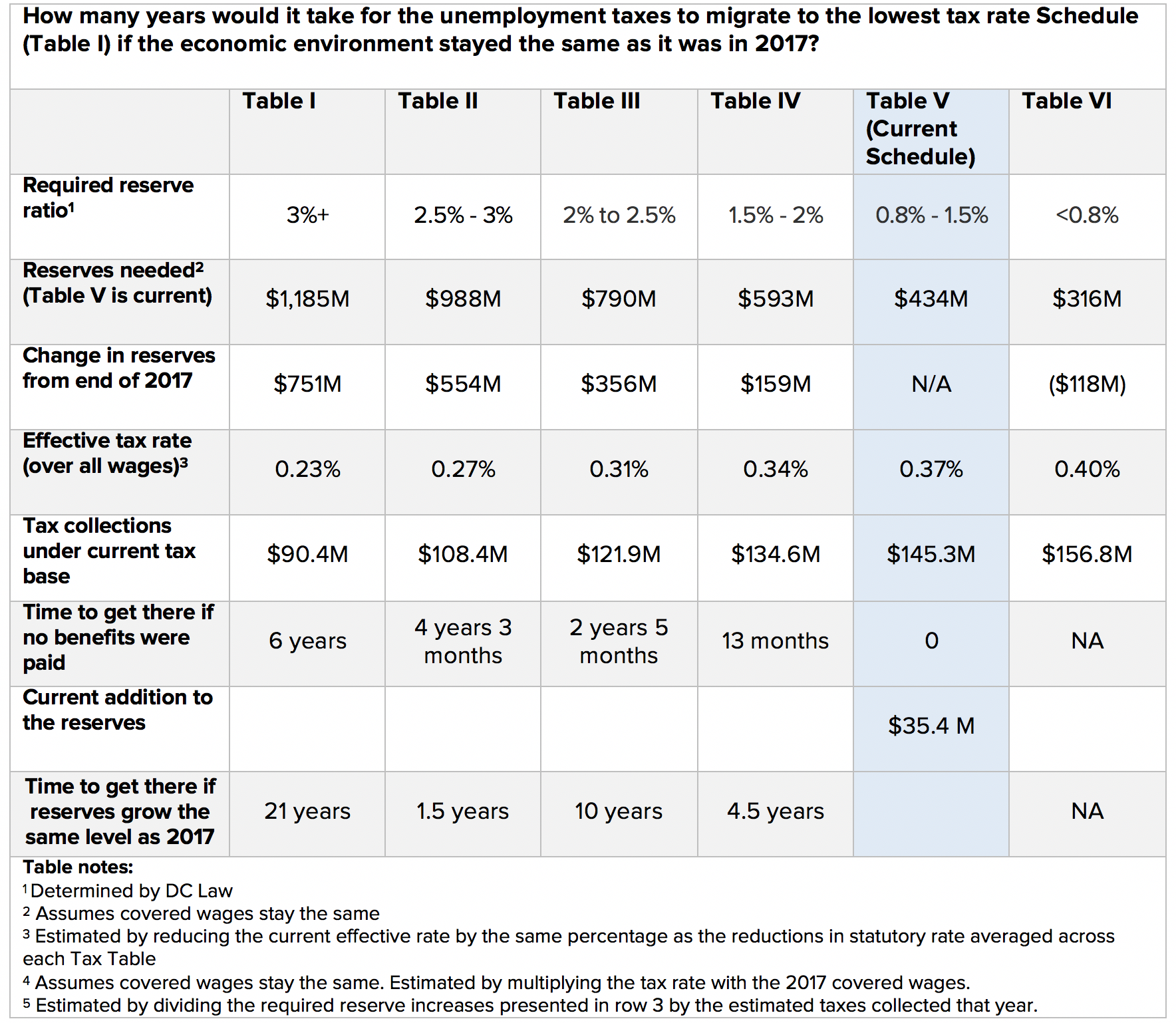

Some states, but not all, are adopting the unemployment exemption for 2020 state income tax returns. Because some get full tax unemployment benefits and others dont, you might have to do some digging to see if the unemployment tax break will apply to your state income taxes. This chart by the tax preparation service H& R Block could give some clues, along with this state-by-state guide by Kiplinger.

Learn smart gadget and internet tips and tricks with our entertaining and ingenious how-tos.

Here is information about the child tax credit for up to $3,600 per child and details on who qualifies.

You May Like: Can You Get Ssdi And Unemployment

What If I Didnt Collect Unemployment Benefits In 2020 But I Still Received A Form 1099g

Considering EDD has already confirmed its paid out more than $10 billion in fraudulent claims, there will certainly be tax forms going out to people whose identities have been used to file fake claims.

If you get a form documenting funds you never received, EDD says to call 1-866-401-2849, but I would encourage people to use the online tool versus trying to call, said Amy Spivey, director of the UC Hastings Low-Income Taxpayer Clinic.

You can report fraud on your 1099G form on EDDâs site. Just follow the topic boxes.

If you feel there is an error on your 1099G form and cant get an amended one from EDD before filing time, make sure you dont report that income when you file your taxes.

According to Spivey, if theres a mismatch between the earnings on your return and a 1099G the IRS has for you in its system, youll likely get a notice flagging underreported income. âAnd then at that point, you could respond directly to the IRS as well,â advised Spivey. The downside of that, she said, is that if youâre eligible for a refund, it could delay it.

A Wait For Refunds From States That Arent Taxing Benefits

People who filed their returns early this year in states that are following the federal exemption may need to wait for refunds.

President Joe Biden did not sign the relief package into law until March 11, about a month after the filing season began, so people who filed their returns early may have paid taxes on unemployment benefits that are now tax-free.

The Internal Revenue Service last month announced that it will automatically revise taxpayers returns and send them any refund owed, stressing that filers should not send in amended returns.

Also Check: Can An Unemployed Person Get Obamacare

Tip #: You May Be Eligible For Tax Benefits And Credits

A lower income may help you qualify for a variety of programs, including the federal Earned Income Tax Credit, which can lower your taxes or even provide a refund, depending on your income level and the number of children you have.Other credits that may reduce your federal tax outlay include the Child Tax Credit and the Child and Dependent Care Credit. Your CPA can offer advice on the tax and other benefits that can improve your financial outlook while youre looking for work.

Read Also: Unemployment Office Fax Number

Ii Taxation Of Unemployment Compensation Received In 2020 And 2021

Generally, unemployment compensation is taxable under G.L. c. 62. However, Section 26 of the Act provides that, for the taxable year beginning on January 1, 2020 and the taxable year beginning on January 1, 2021, up to $10,200 of unemployment compensation that is included in a taxpayers federal gross income shall be deducted from federal gross income for purposes of determining Massachusetts gross income under G.L. c. 62, § 2, provided that the taxpayers household income is not more than 200% of the federal poverty level. The calculation of household income follows Section 36B of the Internal Revenue Code and includes all of a taxpayers income, including unemployment compensation. A deduction of up to $10,200 may be claimed by each eligible individual for unemployment compensation received by that individual the deduction is not limited to $10,200 per return.

You May Like: When Will Michigan Unemployment Extension Start

Unemployment Insurance Benefits Tax Form 1099

DES has mailed 1099-G tax forms to claimants who received unemployment benefits in 2021. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

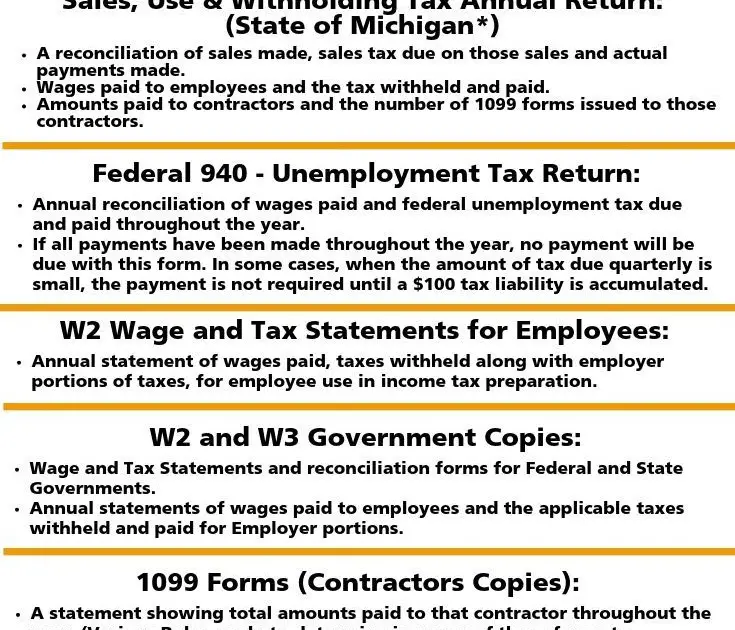

Other Employer Payroll Tax Requirements

As the pay periods go by and tax money is withheld from employees paychecks , businesses may eventually have to file quarterly tax returns with federal, state and local governments. The deadline for filing IRS Form 941, Employers Quarterly Federal Tax Return is usually the last day of the month following the end of a quarter. So, if the first quarter of the year ends March 31, then the first Form 941 would be due April 30. Payments can be made via the Electronic Federal Tax Payment System® .

After the year is over, employers typically need to issue Forms W-2 to employees and Forms 1099-MISC to independent contractors. They might also have to file three additional forms:

- Form W-3 reports the total W-2 earnings from all employees to the Social Security Administration

- Form 1096 is a summary and transmittal form that accompanies other IRS forms

- Form 944 used for filing employer taxes annually instead of quarterly

Also Check: Do I Report Unemployment On My Taxes

How Much Will Your Benefits Be

Once you file for unemployment and are approved, you will begin to receive benefits. Your benefits might come in the form of a check, but more often they will come in the form of a debit card or direct deposit to your bank account. It varies by state. You typically can file weekly online, by email, or by phone.

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum.

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available.

Regardless of how much you make, you never can collect more than the state maximum.

Also Check: How To Certify For Unemployment

How Are Unemployment Benefits Taxed

Unemployment benefits are designed to replace a portion of your regular wages. As such, the IRS treats them like any other wages and taxes them at your ordinary income tax rate.

Whether youll actually owe taxes on unemployment benefits, and the rate youll pay, depends on your overall tax situation and tax bracket.

The state that paid your unemployment benefits should send you a Form 1099-G showing how much unemployment income you received and how much taxes it withheld.

Don’t Miss: How To Fill Out Unemployment Application

Calculating Your Futa Tax Liability

You must pay unemployment taxes if:

- You paid wages of $1,500 or more to employees in any calendar quarter of a year, or

- You had one or more employees for at least some part of a day in 20 or more different weeks during the year.

You must count all employees, including full-time, part-time, and temporary workers. Don’t count partners in a partnership, and don’t count wages paid to independent contractors and other non-employees,

You must pay federal unemployment tax based on employee wages or salaries. The FUTA tax is 6% on the first $7,000 of income for each employee. Most employers receive a maximum credit of up to 5.4% against this FUTA tax for allowable state unemployment tax. Consequently, the effective rate works out to 0.6% .

Tax Exemptions And Exclusions In New York

Employers are required by New York tax law to deduct the amount expected to be payable from an employees gross income. There are several special exclusions and exemptions in this section that may affect how you finish payroll.

Income that isnt taxed and is counted separately from taxable income is referred to as exclusions.

Exclusions differ from deductions in that they do not require the taxpayer to incur any costs. The following are certain exclusions that are important to small businesses:

- Independent contractors

- Students enrolled in certain work-study programs

- A sole proprietor, their spouse, or a kid under the age of 21

- Persons whose employment is subject to the Federal Railroad Unemployment Insurance Act

- Freelance reporters under certain conditions

Employees who do not have some taxes taken from their paychecks are eligible for exemptions. Here are some examples of situations when an exemption may be granted:

- Military spouses are exempt from New York State income tax under the service members Civil Relief Act and Veterans Benefits and Transition Act, and full-time students under the age of 25 who had no New York income tax liability in the previous taxable year and expect none in the current year.

- If your company is a START-UP NY participant and operates in a tax-free zone, some or all of your employees pay may be exempt from income tax withholding in New York State, NYC, and Yonkers.

You May Like: How Long Does Unemployment Last In Nc

Will I Get An Approval Letter From Unemployment

Youll usually receive a monetary determination letter soon after filing and a decision letter within two weeks unless some dispute occurs and slows down the process. These documents often come through the regular mail, but states can also offer electronic versions through their unemployment websites.

Recommended Reading: Njuifile.net Sign In

What To Know About 971 846 776 And 290 Transcript Codes

Some taxpayers whove accessed their transcripts report seeing different tax codes, including 971 , 846 and 776 . Others are seeing code 290 along with Additional Tax Assessed and a $0.00 amount. Since these codes could be issued in a variety of instances, including for stimulus checks and other tax refunds or adjustments, its best to consult the IRS or a tax professional about your personalized transcript.

Also Check: Where To Put 1098 T On Tax Return

Also Check: How To Sign Up For Tennessee Unemployment

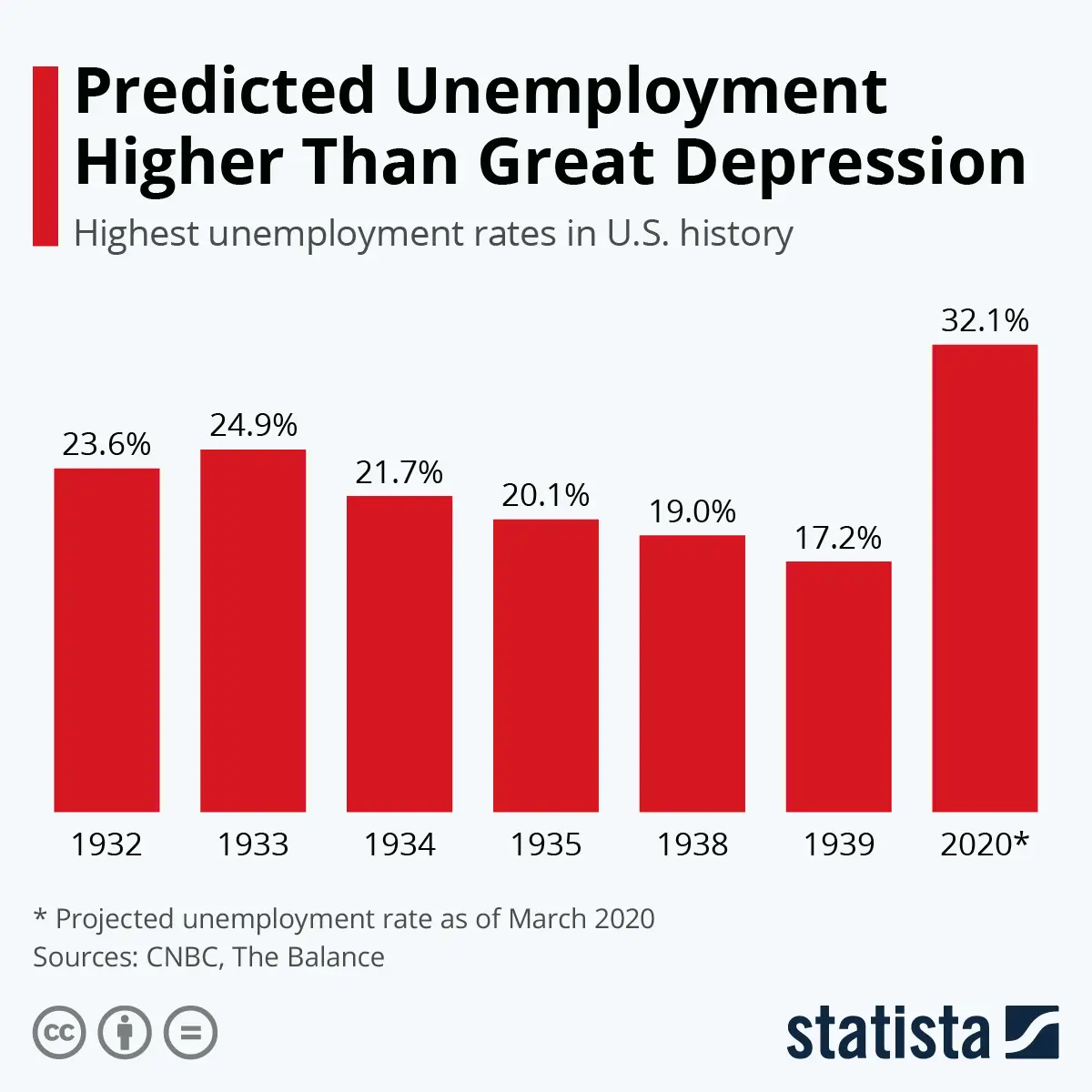

Wait Unemployment Is Taxable

In most years, yes. The federal government considers unemployment benefits to be taxable income, although taxes are not automatically withheld from benefits payments, the way an employer might take taxes out of your paycheck. Instead, unemployment recipients must request that taxes be withheld from their benefits, and the withholding is limited to 10%.

This led to confusion and angst for the unprecedented number of workers who received jobless benefits for part of 2020 and filed their taxes for the year only to find their typical refund reduced or in some cases to be told they owe money.

Michigan resident Bridget Harwood was furloughed from her medical assistant job for three months last year when many businesses in her city closed. The unemployment benefits she received during that time also resulted in a smaller tax refund this year. Instead of the roughly $1,500 refund she typically receives, she got just $72 back.

It was definitely a shock, Harwood said.

It was even worse for Harwoods eldest daughter, who worked at a fast-food restaurant before the pandemic pushed her into unemployment. Harwood filled out her daughters tax return and found that she owed $1,000 in federal and state taxes. When Harwood explained the situation to her daughter who had been expecting a refund to put toward a new car she started to cry, Harwood said.

Read Also: Minnesota Unemployment Benefits Estimator

Is The Irs Sending Out Unemployment Refunds

IRS sends out another 430,000 refunds for 2020 unemployment benefit overpayments. Since the IRS began issuing refunds for this, it has adjusted the taxes of 11.7 million people, sending out $14.4 billion overall. All totaled, officials say they have identified 16 million people who are eligible for the adjustment.

Read Also: What You Need To Sign Up For Unemployment

Federal Unemployment Tax Act Futa Rate For 2022

The Federal Unemployment Tax Act is a federal payroll tax that helps fund unemployment benefits.

In response to the COVID-19 crisis, most states took action in mid to late 2020 and early 2021 to minimize some of the financial concerns that might affect companies in the calendar year 2021. As a result, most states reduced the taxable wage base last year.

In this article, we will talk about FUTA, its current tax rate and how much you need to pay for FUTA.

Payments To Employees Exempt From Futa Tax

Some of the payments you make to employees are not included in the calculation for the federal unemployment tax. These payments include:

- Fringe benefits, such as meals and lodging, contributions to employee health plans, and reimbursements for qualified moving expenses,

- Group term life insurance benefits,

- Employer contributions to employee retirement accounts accounts), and

- Dependent care payments to employees.

You can find the complete list of payments exempt from FUTA Tax in the instructions for Form 940. The type of payments to employees that are exempt from state unemployment tax may be different. Check with your stateâs employment department for details.

If you pay employee moving expenses and bicycle commuting reimbursements to employees, you must include the amount of these payments in the FUTA tax calculation.

In some states, wages paid to corporate officers, certain payments of sick pay by unions, and certain fringe benefits are also excluded from state unemployment tax. If wages subject to FUTA arenât subject to state unemployment tax, you may be liable for FUTA tax at the maximum rate of 6%.

Recommended Reading: How Do I Get My Money From Unemployment

Also Check: How To Sign Up For Unemployment In Pa

How Much Is Unemployment Tax In Ny

The 2021 New York state unemployment insurance tax rates range from 2.025% to 9.826%, up from 0.525% to 7.825% for 2020. The new employer rate for 2021 increased to 4.025%, up from 3.125% for 2020. All contributory employers continue to pay an additional 0.075% Re-employment Services Fund surcharge.

Recommended Reading:

You May Need To File A Tax Return

Generally speaking, if your income is above a certain level including your unemployment benefits you need to file a tax return with the IRS. But what that income threshold is depends on your gross income, your filing status, your age and whether someone can claim you as a tax dependent. This article explains who has to file.

If you do need to file a tax return, that may actually be a good thing. You may also qualify for tax credits and deductions that can get you a tax refund.

Read Also: What Time Does Unemployment Direct Deposit Hit Your Account Michigan

Did The Stimulus Bill Change How Unemployment Is Taxed

Yes. The American Rescue Plan Act of 2021 changed the tax code so that the first $10,200 of unemployment benefits you received in 2020 is free of federal taxes. That means that only the money you received over $10,200 counts toward your taxable income. For couples filing jointly, each person gets up to $10,200 in tax-free unemployment benefits before they have to start paying federal taxes on that income.

This exemption applies to individual and joint filers who made up to $150,000 in 2020. That number is whats known as a hard cliff that applies regardless of whether you file as single, married or any other filing status. So if your households modified adjusted gross income in 2020 was a total of $150,001, you have to pay taxes on all unemployment benefits.

Learn more about the U.S. progressive tax system here.

Important: Many states have not followed the federal governments lead on this. In many states, such as New York, all unemployment benefits are still subject to state taxes. In other states, like California, unemployment benefits are exempt from state tax. And there are some states that simply have no state income tax. Heres how each state is taxing unemployment in 2021.

Effects Of The Unemployment Insurance Exclusion

Chances are, youve already paid your income taxes for 2020. But what this exclusion means is, if you paid taxes on unemployment insurance benefits that you received in 2020, you can get a refund on that money, both on your federal tax return and on your state one, if your state conformed with the federal unemployment tax exclusion.

The IRS is working through the tax returns of people who filed their income taxes before Congress passed the exclusion bill, and sending tax refunds to people who are entitled to them. To get that money refunded, you may not need to do anything at all. As many as 16 million Americans might be eligible for a refund. As of early November, the IRS had issued more than 11.7 million refunds totaling $14.4 billion. The IRS will send you a notice to let you know if youre affected.

Keep in mind, you arent going to get $10,200 refunded. You would be refunded the income taxes you paid on $10,200.

Also Check: How To Draw Unemployment In Ga

Do I Have To Pay To Prepare My Taxes If I Received Unemployment

No. If you made under $72,000 in 2020, you are eligible to file your taxes for free . Even if you made more than that, many tax preparation services now include a 1099-G as part of a simple tax return, which they will let you file free of charge.

But buyer beware: So-called free tax preparation softwares are often trying to push you to pay them more money.