Bad News: You Do Owe Taxes On Unemployment Benefits But Theres Help

If you received unemployment benefits in 2021, bad news: You do owe income taxes on those benefits, just like you do on ordinary income. Dont worry if youre in this situation, however: If you elected to have taxes taken out of your unemployment checks, youre in good shape.

What if you didnt do that? First, prepare your income taxes and see how much you owe. Start saving as much as possible as soon as possible so you can afford the tax bill. Next, be proactive and contact the IRS directly to set up a payment plan.

What To Do If You Owe Taxes On Unemployment Benefits

After going through these steps, you may find that you owe taxes to the IRS. If you do, don’t panic. You have options.

However, not paying that tax bill is not one of those options. You should make every effort to pay as much of your tax bill as possible. Not paying your tax bill means that you’ll immediately face additional penalties for late payment, as well as interest that accrues on your unpaid taxes. If you continue to not file your taxes, the IRS may seek legal remedy against you.

Do I Have To Claim My Severance Pay On My Tax Return If I Already Paid Taxes

- Severance pay is a lump-sum payment received from a company when you are terminated due to job closings, company reductions, or even company closures. These payments are typically based on time in service and/or job performance, and as such are taxable as wages. This payment will have the usually Social Security, Medicare, federal and state taxes withheld, which will be reflected on your W-2.

Also Check: Can You Overdraft Your Unemployment Card

Also Check: Unemployment Office Contact

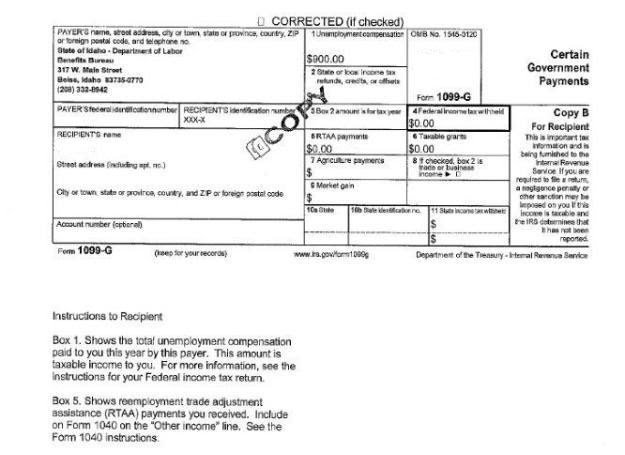

Income Tax 1099g Information

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Maryland Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year. This may be different from the week of unemployment for which the benefits were paid.

1099-Gs are required by law to be mailed by January 31st for the prior calendar year. By January 31, 2021, the Division will deliver the 1099-G for Calendar Year 2020. By January 31, 2021, the Division will send the 1099-G for Calendar Year 2020.

1099-Gs are not available until mid-January 2021. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G may NOT be forwarded by the United States Postal Service. The BPC unit cannot update your mailing address. You must update your mailing address by updating your personal information in the BEACON portal, on the Maryland Unemployment Insurance for Claimants mobile app, or by contacting a Claims Agent at 667-207-6520.

If you wish to request a duplicate 1099-G for prior years, send your request to the Maryland Department of Labor â Benefit Payment Control Unit at .

What is the Payerâs Federal Identification number? The the Maryland Department of Labor Federal ID # is: 52-2006962.

You May Like: How Do I File For Unemployment In Tennessee

How Do I File My Taxes If I Received Unemployment Benefits In 2020

EL SEGUNDO, Calif. â Tax season is in full swing, and with it comes many head-scratching moments.

Nearly a year ago, as the coronavirus rooted itself, millions of Americans lost their jobs or were furloughed â forcing them to file for unemployment benefits.

Those unemployment benefits, until recently, were taxable, as many painfully found out when filing their tax returns this year.

When the American Rescue Plan was signed last week by President Joe Biden, it included â a late addition to the bill â an exclusion on some unemployment compensation. That means that those who received unemployment benefits do not have to pay taxes up to $10,200.

However, many Americans who received unemployment benefits in 2020 due to the coronavirus pandemic filed their taxes before the American Rescue Plans passing and are now unsure what to do. In other cases, some are unsure if they should file or not file at this time.

Navigating the Internal Revenue Service can only add to the frustration and anxiety. So, here is what you need to know.

Did you in 2020 receive unemployment benefits?

If your answer is yes, keep scrolling down. If your answer is no, but you want to check the status of your stimulus check, scroll to the bottom of the article.

In 2020, did you receive unemployment benefits, and was your modified adjusted gross income less than $150,000?

I already filed my taxes. What do I do?

I have not filed my taxes yet. What do I do?

Where is my stimulus check?

Also Check: Sign Up For Unemployment In Missouri

Do You Have To File Unemployment

You have to file unemployment benefits because they count as federal income. Theres some confusion as to whether U.S. citizens will owe tax on unemployment after the American Rescue Plan Act saw federal income taxes waived in 2021 for the first $10,200 of unemployment benefits received in 2020.

Unfortunately, it doesn’t apply to 2021, and there are no signs that Congress will pass a similar law for 2021 benefits. So, if you didnt withhold the appropriate amount of taxes when receiving unemployment benefits in 2021, youll owe the IRS money for that, especially if you withheld only a small percentage or none at all.

Depending on the state you live in, you may owe state taxes from unemployment benefits as well. Some states dont tax unemployment, while others provide the option to withhold the benefits. In states that dont offer withholding options and do tax these benefits, youll owe money to the state. So, its possible that youll have to pay taxes on both your federal and state tax returns.

ICYMI: 1099-G tax forms are available. If you received unemployment benefits in 2021, you will need this form to file your taxes.To access your form:

Federal Unemployment Programs End After This Weekend

Todays the first day you can file for your tax refund and experts say you should file early. But tax time is also causing some trouble.

Many of you who are collecting unemployment for the first time have encountered issues. WINK News walks you through getting the necessary documents.

Many of you are wondering where to get your 1099-G form. According to its weekly update, the Department of Economic Opportunity says it sent claimants their personalized form by mail or made it available on CONNECT back in January:

- The Department completed electronically processing 1099-G Tax Forms for all claimants on January 17, 2021. All claimants should have access to their 1099-G Tax Form in their CONNECT account.

- Claimants who opted to receive communication from the Department through U.S. Mail should have received their 1099-G tax form no later than January 31, 2021. 1099-G Forms were also made available in CONNECT for these claimants on January 17, 2021.

- If a claimant did not receive their 1099-G tax form by January 31, 2021, they received a 1099-G tax form by mistake, or their 1099-G tax form is incorrect, please for additional resources to obtain the form.

- The Department has created Frequently Asked Questions to provide more information about the 1099-G Tax Form.

But if you still havent been able to access it, there are a few options for you to get it now.

Don’t Miss: Apply For Unemployment Tennessee

Where Can I Find My 1099

If you received unemployment benefits in 2020, the 1099-G form will be available in your Jobs4tn.gov account by January 31, 2020. You can access the form by visiting Unemployment Services and clicking on Form 1099-G Information. From here, you will be able to view the 2020 information as well as print off the form.

What If I Havent Filed A Tax Return

TAXPAYERS had until May 17 to file an extension if they needed more time to submit their returns.

If you didnt file a tax return or an extension, but should have, you need to take action or the penalties you face may increase.

If you file your return over 60 days late, youll have to pay a $435 fine or 100% of the tax you owe whichever is less.

However, there is no penalty for filing a late return after the tax deadline if a refund is due, said the IRS.

If you didnt file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest.

You wont have to pay the penalties if you can show reasonable cause for the failure to do so on time we explain how in our guide.

Read Also: What Ticket Number Is Pa Unemployment On

Irs: Unemployment Compensation Is Taxable Have Tax Withheld Now And Avoid A Tax

IR-2020-185, August 18, 2020

WASHINGTON With millions of Americans now receiving taxable unemployment compensation, many of them for the first time, the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year.

Withholding is voluntary. Federal law allows any recipient to choose to have a flat 10% withheld from their benefits to cover part or all of their tax liability. To do that, fill out Form W-4V, Voluntary Withholding Request PDF, and give it to the agency paying the benefits. Dont send it to the IRS. If the payor has its own withholding request form, use it instead.

If a recipient doesnt choose withholding, or if withholding is not enough, they can make quarterly estimated tax payments instead. The payment for the first two quarters of 2020 was due on July 15. Third and fourth quarter payments are due on September 15, 2020, and January 15, 2021, respectively. For more information, including some helpful worksheets, see Form 1040-ES and Publication 505, available on IRS.gov.

Read Also: Tn Unemployment Sign Up

Will I Owe Taxes Because Of My Unemployment Compensation

- Generally, states dont withhold taxes on unemployment benefits unless asked.

- However, if you qualify for EITC, or the child tax credits, your taxes could be covered.

- You can do a year-end tax checkup to see if you have enough credits and withholding to cover your taxes. You may still have time to make adjustments to lower your shortfall.

- If you are still unemployed come 2021 tax time, you can set up a payment plan with the IRS or work out other delayed payment options.

- The IRS assesses penalties on the balance owed when you file and when you pay late they also compound interest on the full bill daily. The IRS has programs that may forgive your tax penalties. If you qualify, this will also help reduce your interest and lower your overall tax bill.

- Make sure you file your tax return on-time, even if you cant pay. In the short-term, the penalties for filing late are higher than the penalties for paying late.

Dont Miss: Unemployment Pa Ticket Number

Recommended Reading: Www.njuifile.net Tax

Are You Recently Unemployed Due To The Coronavirus

The COVID-19 pandemic caused many businesses to shut down, leaving millions of taxpayers out of work. The Coronavirus Aid, Relief, and Economic Security Act was enacted to alleviate the economic fallout of COVID-19. If you applied for unemployment benefits, the CARES Act allows for 13 additional weeks of benefits until December 26, plus an extra $600 a week through July 31, along with the standard amount you will receive. In addition, many states have additional weekly unemployment funds available for qualified unemployed individuals.

How will new tax laws impact your refund and stimulus?

Which Turbotax Is Best For You

Figuring out all these specifics can be stressful. But doing your income taxes doesnt need to be, when you use TurboTax Online.

However, if you do feel a bit overwhelmed, consider TurboTax Live Assist & Review and get unlimited help and advice from a real person as you do your taxes. Plus, theres a final review before you file. Or, choose TurboTax Live Full Service and have one of our tax experts do you return from start to finish.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Read Also: If Im On Unemployment Can I Get Food Stamps

Stimulus Checks And Expanded Unemployment Benefits

The COVID-19 pandemic has led to severe economic hardship, with millions of Americans losing their jobs. As a response, Congress passed three key legislation that expanded unemployment benefits and delivered direct stimulus payments to provide economic relief. As more and more people about 20 million people since November 2020 are claiming unemployment benefits, these are the key things to know:

What If I Received A 1099

If you received a 1099-G reporting taxable unemployment benefits, but you did not collect unemployment, it could be fraud. In guidance the IRS issued in late January 2021, the IRS advised anyone who receives an inaccurate 1099-G to contact their state agency not the IRS to request a corrected form. If you are a victim of unemployment benefits identity theft, consider opting into the IRS Identity Protection PIN program. An IP PIN is a six-digit number that helps prevent thieves from filing federal tax returns in the names of identity theft victims. Visit irs.gov/identity-theft-central for more information.

You May Like: Make Money Unemployed

Exclusion Of Up To $10200 Of Unemployment Compensation For Tax Year 2020 Only

If your modified adjusted gross income is less than $150,000, the American Rescue Plan Act enacted on March 11, 2021, allows you to exclude from income up to $10,200 of unemployment compensation paid in 2020. This means you dont have to pay tax on unemployment compensation of up to $10,200 on your 2020 tax return only. If you are married, each spouse receiving unemployment compensation may exclude up to $10,200 of their unemployment compensation. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you file Form 1040-NR, you cant exclude any unemployment compensation for your spouse.

The exclusion should be reported separately from your unemployment compensation. See the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure your exclusion and the amount to enter on Schedule 1, line 8.

When figuring the following deductions or exclusions from income, if you are asked to enter an amount from Schedule 1, line 7 enter the total amount of unemployment compensation reported on line 7 and if you are asked to enter an amount from Schedule 1, line 8, enter the amount from line 3 of the Unemployment Compensation Exclusion Worksheet. See the specific form or instructions for more information. If you file Form 1040-NR, you arent eligible for all of these deductions. See the Instructions for Form 1040-NR for details.

These Are The States That Will Not Mail You Form 1099

Missouri

- To access your Form 1099-G, log into your account through at uinteract.labor.mo.gov. From the UInteract home screen, click View and Print 1099 tab and select the year to view and print that years 1099-G tax form.

- The Missouri Division of Employment Security will mail a postcard no later than January 31, 2021, notifying anyone who has not accessed their Form 1099-G online about the availability of the form and how to access it.

New Jersey

- To access your Form 1099-G, check your email. You will receive your Form 1099-G by email. You can also use the Check Claim Status tool to get your Form 1099-G.

- If you prefer to have your Form 1099-G mailed, you may request a copy from your Reemployment Call Center. It may take 10 business days to receive a copy of your Form 1099-G.

New York

- To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

- If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

Wisconsin

You May Like: Can You File Bankruptcy On Unemployment Overpayment

Reporting Unemployment Benefits At The State And Local Level

If your state, county, or city collects income tax on your unemployment benefits, keep your Form 1099-G for reference. You may have to attach it to your state, county, or local income tax return. If so, keep a copy for yourself.

Check with your states Department of Revenue and relevant county and local government tax agency for instructions on how to report your unemployment benefits at the state and local level.

What Amount Do I Need To Report From My 1099

- Individuals who are required to file a tax return must report the total show in Box 1 on the 1099-G form as income.

- However, the first $10,200 of the unemployment benefit you received is not taxable income to the IRS and does not need to be reported if you have not opted into having your taxes withdrawn from your weekly benefit payments.

Read Also: How Does Unemployment Work In Louisiana

Recommended Reading: Unemployment Tn Application