What Is Form 1099

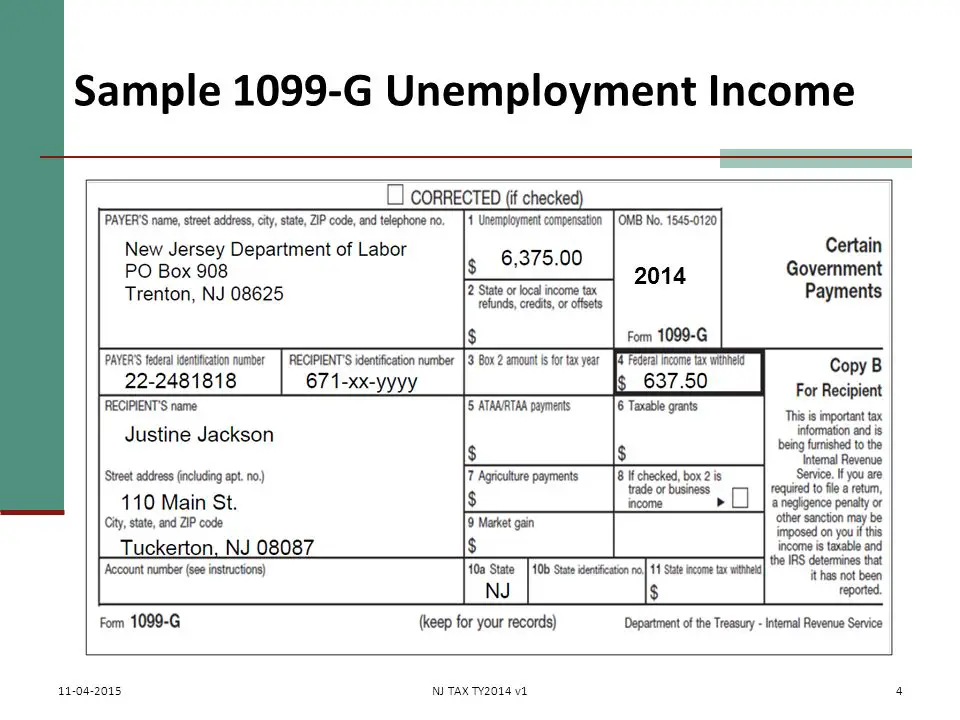

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

You May Like: Do My Taxes Pay For Unemployment

Income Tax 1099g Information

Posted: Your 1099-G will be electronically available in your BEACON portal. If, after 1099-Gs are issued in mid-January 2021, you wish to have a duplicate be mailed to your physical address, you may obtain one by sending your request via to the Maryland Department of Labor Benefit Payment Control Unit at .

Dont Miss: How Do I Sign Up For Unemployment In Sc

Look Up Your 1099g/1099int

To look up your 1099G/INT, youll need your adjusted gross income from your most recently filed Virginia income tax return .

Please note: This 1099-G does not include any information on unemployment benefits received last year. If youre looking for your unemployment information, please visit the VECs website.

Note: We will not mail paper 1099G/1099INT forms to taxpayers who chose to receive them electronically unless we receive a request for paper copies of these forms from the taxpayer. We will automatically mail paper forms to taxpayers who did not opt to receive them electronically.

You May Like: Is There An Extension For Unemployment

You May Like: Can You File Chapter 7 On Unemployment Overpayment

If I Repaid An Overpayment Will It Be Reflected On My 1099

No. DES reports the total amount of benefits paid to you in the previous calendar year on your 1099-G, regardless of whether you repaid any overpayment. If you repaid part or all of an overpayment during the previous calendar year, you may be able to deduct the repaid amounts on your income tax return. The repaid amount should be reported on the tax return submitted for the year the repayment was made.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Also Check: Njuifile.net 1099

How Do I Access 1099 In Quickbooks

How do I access 1099 in QuickBooks?

Can you download 1099 forms? When you file a physical Form 1099-NEC, you cannot download and submit a printed version of Copy A from the IRS website. Instead, you must obtain a physical Form 1099-NEC, fill out Copy A, and mail it to the IRS. Learn how to get physical copies of Form 1099-MISC and other IRS publications for free.

Can I print my 1099 online? Get a copy of your Social Security 1099 tax form online. You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

What happens if I lost my 1099? Often, a lost 1099 may be missing because the issuer has the wrong address for you. A missing 1099 for interest income issued by banks can be also be replaced by asking the bank to send a duplicate. The same goes for K-1 returns issued by partnerships. Banks also often have 1099s available on their websites.

Notice To Representatives Of Deceased Claimants

Q: How do I access the 1099-G tax form if I am the representative of a deceased claimant?

A: For the New York State Department of Labor to provide you with information belonging to a deceased unemployment insurance claimant, you must first show that you are legally authorized to receive this information. Authorization often comes from the New York State Surrogate Court, and may be one of the following:

- Appointment as an Executor

- Appointment as a Voluntary Administrator

If the deceased claimant had no assets, or all property owned by the deceased claimant was owned in common with someone else, then no Executor or Administrator may have been appointed. The representative of the deceased claimant must provide proof that they are authorized to obtain the information. In this case, a surviving spouse should provide NYS DOL with:

Please submit proof that you are authorized to receive the deceased claimants information using one of the following methods:

Also Check: Unemployment Benefits Contact Number

Also Check: How To Apply For Unemployment In Tennessee

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Next Section

Continue

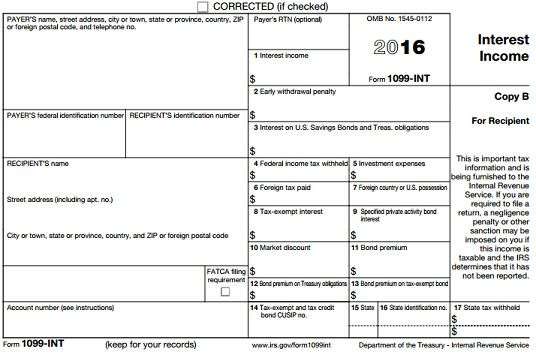

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Read Also: Unemployment Qualifications Tn

How Do I Get My Nys Unemployment 1099

If you have an online account setup with the NYS Department of Labor, you can print the 1099-G form from your online account. Call the Telephone Claims Center at 888-209-8124. After you select your language, follow the prompts to obtain your 1099 form. You will need the PIN you established when you filed your claim.

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2021 New York State Form 1099-G statement is the same as the 2020 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

Recommended Reading: Unemployment Tn Apply

These Are The States That Will Not Mail You Form 1099

Missouri

- To access your Form 1099-G, log into your account through at uinteract.labor.mo.gov. From the UInteract home screen, click View and Print 1099 tab and select the year to view and print that years 1099-G tax form.

- The Missouri Division of Employment Security will mail a postcard no later than January 31, 2021, notifying anyone who has not accessed their Form 1099-G online about the availability of the form and how to access it.

New Jersey

- To access your Form 1099-G, check your email. You will receive your Form 1099-G by email. You can also use the Check Claim Status tool to get your Form 1099-G.

- If you prefer to have your Form 1099-G mailed, you may request a copy from your Reemployment Call Center. It may take 10 business days to receive a copy of your Form 1099-G.

New York

- To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

- If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

Wisconsin

What Is The 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2020 New York State Form 1099-G statement is the same as the 2019 New York State income tax refund they actually received.

Also Check: Pa Apply For Unemployment

How Does The Florida Department Of Revenue Work

Employers with stable employment records receive reduced tax rates after a qualifying period. The Florida Department of Revenue has administered the reemployment tax since 2000. The Department registers employers, collects the tax and wage reports due, assigns tax rates, and audits employers. Every state has an Unemployment Compensation Program.

What If I Believe The Information On My Form Is Incorrect

Information provided on your 1099-G form is based on the records of the Unemployment Insurance Division of the Vermont Department of Labor. If you believe your form to be incorrect, please contact us.

Information for victims of unemployment fraud

In 2020 and 2021, an international crime ring used previously stolen personal information to fraudulently claim unemployment benefits in states across the country. If you believe youre a fraud victim, or if youve already reported fraud to us but received a 1099-G for fraudulently paid benefits, please see the tax information for fraud victims page: .

Recommended Reading: Unemployment Ticket Number Pa

Tax Returns And Third Stimulus Payment

The bills mid-tax season passage may have caused a lot of confusion for unemployed taxpayers trying to determine the best time to file.

But the good news, says , senior fellow at the Urban-Brookings Tax Policy Center, is that you will receive the full amount youre owed, even if there is a delay.

For taxpayers whose stimulus eligibility was processed based on 2019 returns, at some point possibly later this year, but definitely when they file a tax return next year the IRS will bump up the money and send an additional amount or what they would have received based on 2020 income.

In other words, you may have to reconcile your payment using a similar claim to the Recovery Rebate Credit for the previous two stimulus payments.

Donât Miss: Make Money Unemployed

How To Check The Status Of My Unemployment Debit Card

Enter your unemployment debit card at an ATM and enter your PIN to verify your balance. You can also get a copy from an ATM if you want to know when the last unemployment benefit was credited to your debit card. Call the government employment agencys self-service line to check the status of your debit card.

You May Like: How To Qualify For Unemployment In Tn

How To Get My 1099 From Unemployment To File Taxes

Many taxpayers are unaware that the unemployment income they received is taxable, just like earned income. The key difference is that unemployment income is taxed at a lower rate. Also, thanks to the American Recovery and Reinvestment Act , the first $2,400 of unemployment income is untaxed. In any event, you should list your unemployment income should on your return. Your state unemployment office should send you the 1099-G form listing that amount, but there are ways to request the form in the mail.

Tips

-

If you have received unemployment income at any point during the year, you will be required to complete and return IRS Form 1099-G. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly.

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

Read Also: How Do I Check My Unemployment

Don’t Miss: Desncgov

When Do Florida Return To Work Waivers Expire

For more information, click here. On May 12, 2021, DEO announced Floridas Return to Work initiative. This initiative is focused on encouraging Floridians to return to the workforce, helping employers attract job seekers, and continuing to fuel the states economic growth. Work Search and Work Registration waivers expired on May 29, 2021.

Do You Have To Pay Taxes On Unemployment In Louisiana

You may work part-time while receiving unemployment benefits, but a portion of those earnings may be deducted from your weekly benefit amount. Unemployment benefits are subject to federal income taxes and must be reported on your income tax return. Louisiana taxes unemployment benefits to the same extent as they are taxed under federal law.

You May Like: Minnesota Unemployment Benefits Estimator

Don’t Miss: Minnesota Max Unemployment

How To Get 1099 From Florida Unemployment Jobs

Posted: Users cannot retrieve tax documents from Florida DEO . Jobs Offer Details: RELATED: Florida woman works to get thousands of unemployment issues resolved A spokesperson with the DEO said, The Department completed electronically processing 1099-G how to get my unemployment 1099 Verified 7 days ago

You May Like: Can You Have An Llc And Collect Unemployment

Note On Taxable Income

The American Rescue Plan Act of 2021 contains provisions regarding taxable unemployment compensation. Please direct all tax filing questions to the IRS, and visit their website for the most recent guidance.

Image source: /content/dam/soi/en/web/ides/icons_used_on_contentpages/IDES_icon_blue_warning_67px.png

Recommended Reading: Washington State Unemployment Online

Like Fire Accident Health And Other Types Of Insurance It Is For An Emergency:

How do i get my 1099 g from illinois unemployment. Can i get my 1099 online from illinois unemployment? But you dont have to wait for your copy of the form to arrive in the mail. I donât believe i made a username for the application.

If you canât remember your ui login info, you need to call and ask for your 1099 to be mailed. You could reconstruct the info from your financial records, or extend the filing of your return until you have this. It should have been sent to you around the end of january if you had a claim already.

This is the only way to get a replacement 1099g without contacting the state, which probably is impossible. Enter the amount from box 1 on line 19 of your 1040 form. When you are temporarily or permanently out of a job, or if you work less than full time because of lack of work.

Pua will be reported on a separate form from any uc (including peuc, eb, tra that you may have received. Click the unemployment services button on the my online services page. If this amount if greater than $10, you must report this income to the irs.

Looking for a date on that question. If you havenât received anything, you can have a look at the website and call the phone number which is displayed on the page. To do this, you will need to sign up for an account on the ides website.

Why Middle-income New Yorkers Are Turning Down Affordable Housing 6sqft Affordable Housing Income Affordable

Pin On Laws To Work And Live By

Des: Tax Information And 1099

Posted: What is the IRS Form 1099-G for unemployment benefits? By Jan. 31, 2021, all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account.

Read Also: How To Enroll In Unemployment

Don’t Miss: Can Llc Owner Collect Unemployment

What If Youre A Freelancer In Nj Who Has Clients Based In Ny

If you dont actually step into any of your clients offices in New York, then you can claim that work as New Jersey income, says Feinberg, because 1) your business operates entirely out of your home office in New Jersey and 2) all of the work is conducted at home. Likewise, if you attend meetings in New York, but the bulk of the actual work takes place at home, then you can consider that to be New Jersey income.

What gets more complicated is if you are a freelancer and have to work in other states. Ideally, you would file in every state that you work in, says Feinberg, but that can become complicated if you are traveling to work in multiple other states, not just New York.

Feinberg notes that each case is unique with its own circumstances. You have to look at many factors, he says. If the clients are based in New York, if the checks are written in New York, if your bank account is in New York, etc. These help determine where you should file. The key is to look at the source state of the income.