Paying Unemployment Taxes At The State And Local Level

At the local and state level, the options to pay for your state and local taxes may differ depending on where you live. Contact your state, county, or local unemployment office to learn about the different options to pay your taxes. These options may include:

1. Requesting to have state and/or local taxes withheld. The steps to request state and local tax withholding differ.

2. Making quarterly estimated payments. The due dates for estimated payments at the state and local level may differ from federal due dates.

3. Paying your taxes in full. If you need your full amount of your unemployment benefits and cannot make quarterly estimated payments, you can pay your taxes all at once when they are due. However, you may receive an underpayment penalty for not paying enough taxes throughout the year.

How To Claim Your $10200 Unemployment Tax Break If You Already Filed Taxes

Tax experts often advise taxpayers to file their taxes early to expedite their refund or to be in a better position to pay their tax bill by April 15. But the strategy may have backfired this year, as early filers who paid taxes on their federal unemployment benefits missed out on an important tax break. Under the American Rescue Plan signed into law Thursday, the IRS will make the first $10,200 in unemployment benefits from 2020 tax-free. Typically, unemployment is considered taxable income at your regular tax rate, which depends on your tax bracket based on income.

Find: Dont Miss These 4 Tax Breaks in the $1.9 Trillion Stimulus Plan

Filing an amended return is not a difficult process, but tax experts have advised people to wait a bit longer to file the amended return in case the IRS finds a way to make the adjustments automatically. Robert Kerr, a Washington, D.C.-based IRS enrolled agent and tax consultant said waiting can give the IRS time to figure out how to handle these returns, MarketWatch reported. He said it also allows tax software companies to update their systems based on the tax law change. Its in everyones interest to get this sorted quickly, he told MarketWatch.

When the time comes to file an amended return, taxpayers can do so online using IRS Form 1040-X. The IRS has made it possible this year to file the amended return electronically as well as by mail.

How Much Will An Employer Be Liable In Ui For Any Given Employee

If the employer was the only employer that paid wages to the employee during the employees base period, then that employer will be fully liable for the UI benefits collected by that employee. If, however, there were multiple employers, each employers liability will be prorated based on proportionate share of base period wages paid to the employee, provided that, if an employers proportionate share of wages paid was for less than 5% of the total, in most circumstances, the employer will not be required to contribute.

You May Like: What Are Supplemental Unemployment Benefits

Do I Have To Pay Unemployment Back

No. Unemployment benefits are yours to keep, except for the amount you may owe in taxes. But make sure youre getting the right amount.

In a few cases that ProPublica found, simple mistakes have led states to overpay unemployment recipients and then demand huge sums of money back. A new bill would shield unemployment recipients from having to repay overpayments made by mistake, but it would only apply to unemployment aid that came directly from the federal government. As of April 2021, the bill is still in committee.

About this guide: ProPublica has reported extensively about taxes, the IRS Free File program and the IRS. Specifically, weve covered the ways in which the for-profit tax preparation industry companies like Intuit , H& R Block and Tax Slayer has lobbied for the Free File program, then systematicallyundermined it with evasive search tactics and confusing design. These companies also work to fill search engine results with tax guides that sometimes route users to paid products. ProPublicas guide is not personalized tax advice, and you should speak to a tax professional about your specific tax situation.

Filed under

Where To Find Your 1099

We will mail a paper copy of your 1099-G to the address we had on file for you on December 31, 2021.

We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31, 2022.

It is too late to change your address for the 1099-G mailing, but you can access your 1099-G online.

- Pandemic Unemployment Assistance payments

- Supplemental payments

- Any other kind of unemployment benefit

The total on your 1099-G includes any amounts that were withheld on your behalf, such as:

- Federal taxes

- Child support

- Overpayment offsets

Your 1099-G total does NOT include benefit payments that were processed in 2022, even if those payments were for weeks in 2021.

Also Check: What Time Does Unemployment Deposit Money In Ny

Taxes On Unemployment Payments

Everyone must pay Federal taxes on Unemployment payments. State taxes depend on the state .

For 2020, if you earned under $150k, the first $10,200 in Unemployment is tax-free .

âStandard paymentsâ and âbonusesâ are both taxable.

- Standard payments

- Weekly payments, either regular Unemployment or Pandemic Unemployment Assistance.

1099-G

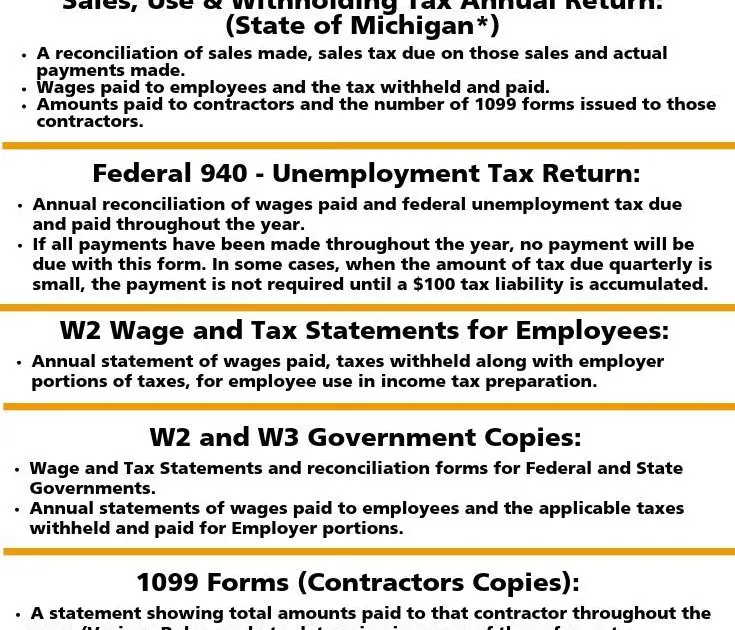

Every January, each stateâs Unemployment department provides a Form 1099-G, which includes the total of all your Unemployment payments from the previous year as well as how much federal and state taxes were withheld for taxes. This 1099-G must be included in your tax return.

You Could Get A Hefty Tax Refund This Year

On the other hand, if youve been having income tax withheld from your pay for a substantial portion of the year already, you may be way ahead on paying taxes for this year.

In a progressive tax system, such as we have in the U.S., higher levels of income are taxed at much higher rates.

When your employer takes taxes out of your paycheck, the payroll department calculates your income tax withholding as if you will earn the same amount all year.

When you get laid off and make far less over the year, you may get a large portion or all of your income tax withheld back as an unemployment tax refund.

You cant get that over-withheld income tax back until after the end of the year. However, you may be able to make adjustments to minimize your over-withholding, giving you more money to live on now.

Don’t Miss: Can I Apply For Food Stamps While On Unemployment

How Much Money Is Withheld From A Paycheck For Unemployment Insurance

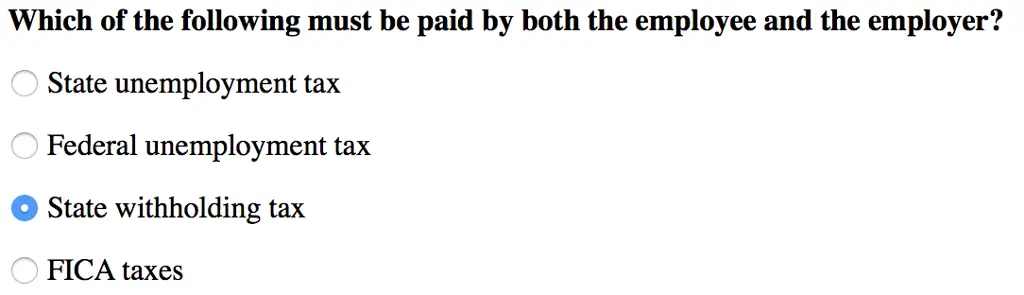

The Federal Unemployment Tax Act authorizes the Internal Revenue Service to collect unemployment tax or insurance. The State Unemployment Tax Act mandates the respective state agency to collect state unemployment insurance. In most cases, an employer is not supposed to withhold unemployment insurance from employee paychecks.

What Else To Know About Unemployment Tax Withholding

Even though the IRS recommends you withhold a certain amount from your unemployment benefits to cover taxes, your wellbeing comes first. Of course, avoiding a big tax bill is preferable, but if money is extra tight, its more important to pay your utility bills and keep food in your pantry. You can always work out a way to repay your bill with the IRS later. Better that than letting your fridge go unstocked.

Are you still unemployed? Take a look at our unemployment resource. We are here to help. If youre back to work but dealing with a hefty tax debt because of your time away from work, talk to an MMI . We may be able to help you address your other debts and bring some balance to your budget.

Chart: States that tax your unemployment benefits

| State |

|---|

Read Also: Can I Collect Unemployment If I Was Injured At Work

If You Owe Tax That You Cant Pay

If youre receiving unemployment benefits, its likely because youre out of work, and that could cause a hardship if you realize you have a lump sum of tax due when you file your return. For some taxpayers, this could mean deciding between paying the rent and buying groceries, or sending estimated tax payments to the IRS. If you find yourself in this situation, there are some options.

You can apply for a short-term or long-term installment agreement with the IRS to satisfy your tax debt in monthly payments made over a period of time, up to 72 months. Just file Form 9465 with the IRS.

You can also file Form 2210 with the IRS to ask the agency to waive any underpayment penalty thats been assessed against you if you feel it would be inequitable to require you to pay the penalty. You might also qualify for a waiver if you became disabled during the year you collected unemployment, or you retired during that year and were at least 62 years old.

What Is The Maximum Salary From Which Federal Income Tax Should Be Withheld

Only the social security tax has a wage base limit. The wage base limit is the maximum wage thats subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to Whats New in Publication 15 for the current wage limit for social security wages or Publication 51 for agricultural employers.

Recommended Reading: How To Change My Direct Deposit For Unemployment

What Kind Of Unemployment Documentation Do I Need For Filing My Taxes

If you received unemployment benefits in 2020, EDD should have already sent you your 1099G form, which is a record of the total taxable income EDD has issued to you in a calendar year.

If you havent gotten this form for some reason, you can print one or request a paper copy through your UI Online account on EDDs website.

EDD recommends that if your 1099G form shows a $0 amount, you should call 1-866-401-2849 You can also report form problems online.

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Recommended Reading: Ways To Make Money While Unemployed

Don’t Miss: Where Do I Get My W2 For Unemployment

Can You Track Unemployment Tax Refund

If the IRS determines you are owed a refund on the unemployment tax break, it will automatically send a check. You wont be able to track the progress of your refund through the IRS Get My Payment tracker, the Wheres My Refund tool, the Amended Return Status tool, or another IRS portal.

Problems With The Irs

- Low-Income Taxpayer Clinics : LITCs are programs at law schools, accounting schools, or legal services offices that provide assistance and legal representation to lower-income taxpayers who are in disputes with the IRS.

- Taxpayer Advocate Service : TAS is an independent organization within the IRS that can help people navigate through their tax problems and find solutions. Contact your local office.

- Community Legal Aid: Local legal aid services can provide free or low-cost legal help for people with tax problems.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

You May Like: When Will I Get My Unemployment Tax Refund

What Else To Know About Unemployment Tax Refunds

The IRS has provided some information on its website about taxes and unemployment compensation. But were still unclear on the exact timeline for payments, which banks get direct deposits first or who to contact at the IRS if theres a problem with your refund.

Some states, but not all, are adopting the unemployment exemption for 2020 state income tax returns. Because some get full tax unemployment benefits and others dont, you might have to do some digging to see if the unemployment tax break will apply to your state income taxes. This chart by the tax preparation service H& R Block could give some clues, along with this state-by-state guide by Kiplinger.

Learn smart gadget and internet tips and tricks with our entertaining and ingenious how-tos.

Here is information about the child tax credit for up to $3,600 per child and details on who qualifies.

What Can Disqualify You From Receiving Unemployment Benefits

Each state has its own unemployment criteria and rules. Unemployment programs typically require you to be unemployed through no fault of your own and meet work and wage requirements. If you quit or were fired for cause, you usually don’t qualify for unemployment. Self-employed people and contract workers usually aren’t eligible for unemployment benefits, but the CARES Act allowed states to extend unemployment benefits to these individuals.

You May Like: Can I File For Unemployment If Im Pregnant

Unemployment Insurance And The Irs

Unemployment insurance is considered income for federal and state tax purposes. Each year all of your benefit payments are reported to the Internal Revenue Service and the Wisconsin Department of Revenue.

You can ask to have state and federal taxes withheld from your unemployment benefit payments or make estimated tax payments.

Donât Miss:

Reporting Unemployment Income For Taxes

Your state’s unemployment agency will report the amount of your benefits on Form 1099-G. The IRS gets a copy, and so do you. The form will also show any taxes you had withheld.

You must report these amounts on line 7 of Schedule 1, then total all your sources of additional income in Part I of the schedule and transfer the number to line 8 of Form 1040.

The IRS reminds taxpayers there are different types of unemployment compensation in non-pandemic years, and most are taxable. The IRS offers an interactive tool on its website to help you determine whether the income you receive while unemployed must be reported on your return. You can take some steps to pay throughout the year if it is, so you can avoid owing the IRS taxes or penalties at tax time.

Recommended Reading: How Do Employers Pay For Unemployment

Filing Dates Have Changed

Taxpayers are adapting to new tax codes and regulations that came with coronavirus financial assistance, and were not alone. The IRS also needs time to adjust its systems and processes for the new tax code implemented by Congress in the last year. Normally, early tax filers can get the task done in January. In 2021, the earliest file date has been moved to . Keep in mind, the April 15 tax deadline has not been moved as of yet.

Dont Miss: Can I File Bankruptcy On State Taxes Owed

Many Americans Face Big Tax Bills On 2021 Unemployment Benefits

- Tax was withheld on just 40% of total unemployment benefits paid in 2021, roughly the same share as 2020, according to Andrew Stettner, a senior fellow at The Century Foundation.

- Recipients who opted not to withhold tax may owe money to the federal government and state, or get a smaller tax refund.

Many Americans who collected unemployment benefits in 2021 may be on the hook for big bills this tax season.

The federal government and most states treat unemployment benefits as taxable income.

However, tax wasn’t collected on about 60% of unemployment benefits paid in 2021, according to Andrew Stettner, an unemployment expert and senior fellow at progressive think tank The Century Foundation who analyzed U.S. Department of the Treasury data.

Read Also: Is The Unemployment Office Open

Reporting Unemployment Benefits On Your Tax Return

You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The amount will be carried to the main Form 1040. Remember to keep all of your forms, including any 1099-G form you receive, with your tax records.

If you use TurboTax to file your taxes, well ask about your unemployment income and put the information in all the right tax forms for you.

TurboTax is here to help with our Unemployment Benefits Center. Learn more about unemployment benefits, insurance, eligibility and get your tax and financial questions answered.

Read Also:

Need Help With Your Taxes

- Code for Americas Get Your Refund website: Visit Get Your Refund to connect with an IRS-certified volunteer who will help you file your taxes. First, you will upload your tax documents online. Then, an IRS-certified volunteer will call you to discuss, prepare, and review your tax return for filing.

- Volunteer Income Tax Assistance and Tax-Aide sites: VITA and Tax-Aide sites are IRS-sponsored programs that provide free tax preparation for those who earn less than about $56,000.

The deadline to file your taxes this year is April 18, 2021.

Don’t Miss: Where To Apply For Unemployment Online

Making Estimated Tax Payments

You might be required to make payments directly to the IRS as quarterly estimated tax payments if you elect not to have taxes withheld from your unemployment benefits. This works out to a payment once every three months. You can elect to do this instead of having 10% withheld from every unemployment check, giving yourself a little bit of wiggle room when money is tight.

You might even have to make quarterly payments in addition to withholding from your benefits. You’re obligated to make estimated payments if you expect that you’ll owe at least $1,000 after accounting for all taxes withheld from all your sources of income, and if you expect that your withheld taxes plus any refundable tax credits you’re eligible for will be less than 90% of what you’ll owe, or 100% of the total taxes you paid last year.

You might want to consult with a tax professional because the whole equation can be complicated. You could accrue additional penalties if you don’t pay enough tax, either through withholding or estimated tax payments.