How To Get 1099 From Florida Unemployment Jobs

Posted: Users cannot retrieve tax documents from Florida DEO . Jobs Offer Details: RELATED: Florida woman works to get thousands of unemployment issues resolved A spokesperson with the DEO said, The Department completed electronically processing 1099-G how to get my unemployment 1099 Verified 7 days ago

You May Like: Can You Have An Llc And Collect Unemployment

Income Tax 1099g Information

Posted: Your 1099-G will be electronically available in your BEACON portal. If, after 1099-Gs are issued in mid-January 2021, you wish to have a duplicate be mailed to your physical address, you may obtain one by sending your request via to the Maryland Department of Labor Benefit Payment Control Unit at .

Dont Miss: How Do I Sign Up For Unemployment In Sc

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Also Check: Sign Up For Unemployment Tn

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2020 New York State Form 1099-G statement is the same as the 2019 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

What To Do If Your Debit Card Has Expired Social Security

If they sent you a card and you didn’t receive it and your current card has expired, you should call them and ask them to cancel the card that never arrived and leave you. Remember, they won’t write you a check in the meantime, because the government has stopped issuing checks for Social Security benefits.

Don’t Miss: How Long Does Unemployment Take To Direct Deposit

How To Check The Status Of My Unemployment Debit Card

Enter your unemployment debit card at an ATM and enter your PIN to verify your balance. You can also get a copy from an ATM if you want to know when the last unemployment benefit was credited to your debit card. Call the government employment agency’s self-service line to check the status of your debit card.

How Do I Contact Edd By Phone

Follow these steps to contact EDD support and make a live call: Dial 18004803287, press 3210. After you enter these numbers, the system will confirm that you are connected to an active customer service representative. The automated phone system puts you in touch with your current EDD support representative.

Also Check: Www.njuifile.net Login

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Browser Compatibility Issue A System Check Has Found That The Internet Browser You Are Using Is Not Compatible With Connecticut Department Of Labors Unemployment Insurance Online Claims System

How to get a statement from unemployment. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits. You must include all the following information. Amounts over 10200 for each individual are still taxable.

If you received unemployment benefits in 2020 and youve already filed your tax returns the Internal Revenue Service is saying you dont have to. Enter the amount from Schedule 1 lines 1 through 6. Proof of Income for Standard Unemployment Compensation.

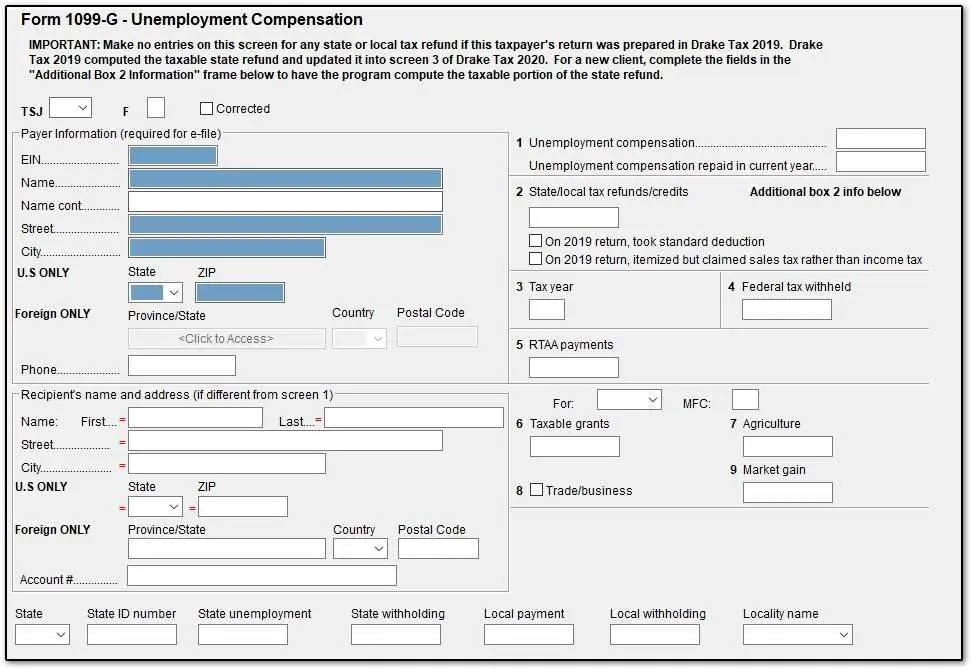

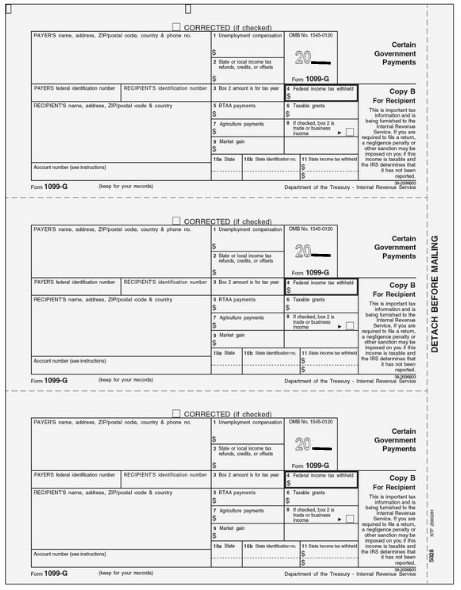

Last four digits of the applicants Social Security number or employee identification number EIN. You should receive a Form 1099-G Certain Government Payments showing the amount of unemployment compensation paid to you during the year in Box 1 and any federal income tax withheld in Box 4. Within a few days of applying for Unemployment Insurance Benefits a process also referred to as filing an initial claim you will receive a Wage Statement in the mail that lists wages reported to the Department during the quarter in which they were paid to you.

Contact the unemployment office in your town and ask them to mail copies of your unemployment statements to you. Arrange for this by walking. Its otherwise known as the Statement.

If you are filing Form 1040-NR enter the total of lines 1a 1b and lines 2 through 7. An issue date within the past 12 months before the applicant filed for UI. We also send this information to the IRS.

Don’t Miss: Bank Of America Kdol Debit Card

Request Your Unemployment Benefit Statement Online

-

Because unemployment benefits are taxable, any unemployment compensation received during the year must be reported on your federal tax return. If you received unemployment benefits in 2020, you will receive Form 1099-G Certain Government Payments .

The statements, called 1099-G or Certain Government Payments, are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

You can choose to receive your 1099-G, electronically through MiWAM or by U.S. mail.

To receive your 1099-G electronically, you must request your delivery preference by January 9, 2021. Your statement will be available to view or download by mid-January. If you do not select electronic, you will automatically receive a paper copy by mail.

To receive your 1099-G online:

1 Log into MiWAM

What Happens When I Run Out Of My Unemployment

When your original application for unemployment benefits expires, you will no longer receive unemployment benefits, unless you can request an extension of your unemployment benefits. If you submit a new unemployment benefit application after your first unemployment benefit application, your benefit year will not start again.

You May Like: How Do I Sign Up For Unemployment In Washington State

Notice To Representatives Of Deceased Claimants

Q: How do I access the 1099-G tax form if I am the representative of a deceased claimant?

A: For the New York State Department of Labor to provide you with information belonging to a deceased unemployment insurance claimant, you must first show that you are legally authorized to receive this information. Authorization often comes from the New York State Surrogate Court, and may be one of the following:

- Appointment as an Executor

- Appointment as a Voluntary Administrator

If the deceased claimant had no assets, or all property owned by the deceased claimant was owned in common with someone else, then no Executor or Administrator may have been appointed. The representative of the deceased claimant must provide proof that they are authorized to obtain the information. In this case, a surviving spouse should provide NYS DOL with:

Please submit proof that you are authorized to receive the deceased claimants information using one of the following methods:

What Happens To My Edd Card When I File For Unemployment Benefits

Your card is valid for three years from the date of issue and is used for all EDD service programs. Therefore, you must keep them until the expiration date. If you have received unemployment insurance, disability insurance, or family leave benefits paid on a debit card in the past three years, you will receive benefits on that card.

Read Also: Can You Overdraft Your Unemployment Card

Delaware Department Of Labor

Disclaimer: These FAQs are subject to change based on new information. Additionally, due to modifications of the UI program as a result of COVID-19 responses, many of the FAQs have modified answers. Please check back frequently. This website is not intended as legal advice. Any responses to specific questions are based on the facts as we understand them and the law that was current when the responses were written. They are not intended to apply to any other situations. This communication is not an agency order. If you need legal advice, you must consult an attorney.

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Delaware Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Delawares UI benefit payment amounts that were issued within that calendar year. This may be different from the week of unemployment for which the benefits were paid.

1099-Gs were required by law to be mailed by January 31st for the prior calendar year. The Division has mailed the 1099-Gs for Calendar Year 2020.

1099-Gs were mailed during the week of January 25th. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G will NOT be forwarded by the United States Postal Service.

Check Back For Updates To This Page

For the latest updates on coronavirus tax relief related to this page, check IRS.gov/coronavirus. We’re reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. Unemployment compensation includes amounts received under the laws of the United States or of a state, such as:

- State unemployment insurance benefits

- Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund

- Railroad unemployment compensation benefits

- Disability benefits paid as a substitute for unemployment compensation

- Trade readjustment allowances under the Trade Act of 1974

- Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and

- Unemployment assistance under the Airline Deregulation Act of 1978 Program

- Federal Pandemic Unemployment Compensation provided under the Coronavirus Aid, Relief, and Economic Security Act of 2020

- Benefits from a private fund if you voluntarily gave money to the fund and you get more money than what you gave to the fund.

If you received unemployment compensation during the year, you must include it in gross income. To determine if your unemployment is taxable, see Are Payments I Receive for Being Unemployed Taxable?

Recommended Reading: What Ticket Number Is Pa Unemployment On

How To Contact Bank Of America For Unemployment Benefits

If you have received a debit card for unemployment benefits, disability benefits or family leave benefits in the past four years, your benefit will be transferred to the same debit account. If a previously issued debit card has expired or you no longer have one, call Bank of America toll-free 8662134074 to request a new one.

Look Up Your 1099g/1099int

To look up your 1099G/INT, youll need your adjusted gross income from your most recently filed Virginia income tax return .

Please note: This 1099-G does not include any information on unemployment benefits received last year. If youre looking for your unemployment information, please visit the VECs website.

Note: We will not mail paper 1099G/1099INT forms to taxpayers who chose to receive them electronically unless we receive a request for paper copies of these forms from the taxpayer. We will automatically mail paper forms to taxpayers who did not opt to receive them electronically.

You May Like: Is There An Extension For Unemployment

You May Like: How Long Does Unemployment Take To Direct Deposit

When Should I Receive My Unemployment Tax Form

Go the website of your state’s labor department. Navigate to the page that provides information on unemployment claims. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question. In most cases, 1099-Gs for the previous year are mailed on or before January 31. For example, if you collected unemployment in 2018, the 1099-G should have been mailed by January 31, 2019. While on your states website, copy the contact information so you can contact the office directly if necessary.

Note That Pursuant To The Irs Webpage The Following Now Applies To Your Federal Taxes

How to get my w2 from unemployment online. Call your local unemployment office to request a copy of your 1099-G by mail or fax. Claim ID also referred to as Claimant ID in letters. If you need a copy of your 1099G you can view and print your 1099G for calendar year 2013 on the NYS Department of Labor website.

Then you will be able to file a complete and accurate tax return. To view and print your current or previous year 1099-G tax forms online logon to the online. Include the following in your email.

Both of these companies can look-up the company you work for or they can use your Employer Identification Number to find your W2. The table below links to some of the common websites. If you got unemployment in 2020 but your 1099-G includes benefits for weeks you didnt claim.

Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. Youll also need this form if you received payments as part of a governmental paid family leave program. Your local office will be able to send a replacement copy in the mail.

Follow the instructions to report the 1099-G Fraud. To help offset your future tax liability you may voluntarily choose to have 10 percent of your weekly Unemployment Insurance benefits withheld and. Log in to your UI Online account.

SSN Pin Birthday Zip Code. If you get a 1099-G for unemployment benefits you didnt receive in 2020. Do not include your Social Security number in an email.

1099 G Tax Form Ides

Don’t Miss: How Do I Sign Up For Unemployment In Tn

How To Get Your 1099 Form

Posted: To quickly get a copy of your 1099-G or 1099-INT, simply go to our secure online portal, MyTaxes, at https://mytaxes.wvtax.gov/ and click the Retrieve Electronic 1099 link. This is the fastest option to get your form. To request a copy of your 1099-G or 1099-INT by phone, please call 558-3333. If you choose this option, it could take

How Do I Get My 1099 2020

Online

Recommended Reading: Can You Get Unemployment If You Are Fired

Start Earning An Income With Qwick

Though unemployment can be beneficial in the immediate aftermath of job loss, gig work offers the income and schedule flexibility to fit your needs in the long-term. With Qwick, the shifts come right to you. Once youve registered and attended orientation, Qwick matches your qualifications with available openings and alerts you via text. The gig economy app offers you the freedom to decide when and where you work, so you have the opportunity to focus on your specific needs.

to start earning today, and dont forget to get a 1099!

Donât Miss: How Long Does It Take To Get Unemployment

Federal Income Taxes & Your Unemployment Benefits Twc

Posted: Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS.

Also Check: Pa Unemployment Ticket Number

New Mexico Department Of Workforce Solutions

Posted: By January 31, all 1099-Gs will be mailed out to individuals who had claimed Unemployment Insurance benefits in the previous calendar year. In addition to receiving a hard copy in the mail, in January you will be able to log into the UI Tax & Claims System and view your 1099G. You can also print additional copies if needed.

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

You May Like: Njuifile Net 1099

Delaware Income Tax 1099g Information

Posted: 1099-Gs were mailed during the week of January 25th. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G will NOT be forwarded by the United States Postal Service. The Delaware Division of Unemployment Insurance cannot update your mailing address for this 1099 cycle.