Delaware Department Of Labor

Disclaimer: These FAQs are subject to change based on new information. Additionally, due to modifications of the UI program as a result of COVID-19 responses, many of the FAQs have modified answers. Please check back frequently. This website is not intended as legal advice. Any responses to specific questions are based on the facts as we understand them and the law that was current when the responses were written. They are not intended to apply to any other situations. This communication is not an agency order. If you need legal advice, you must consult an attorney.

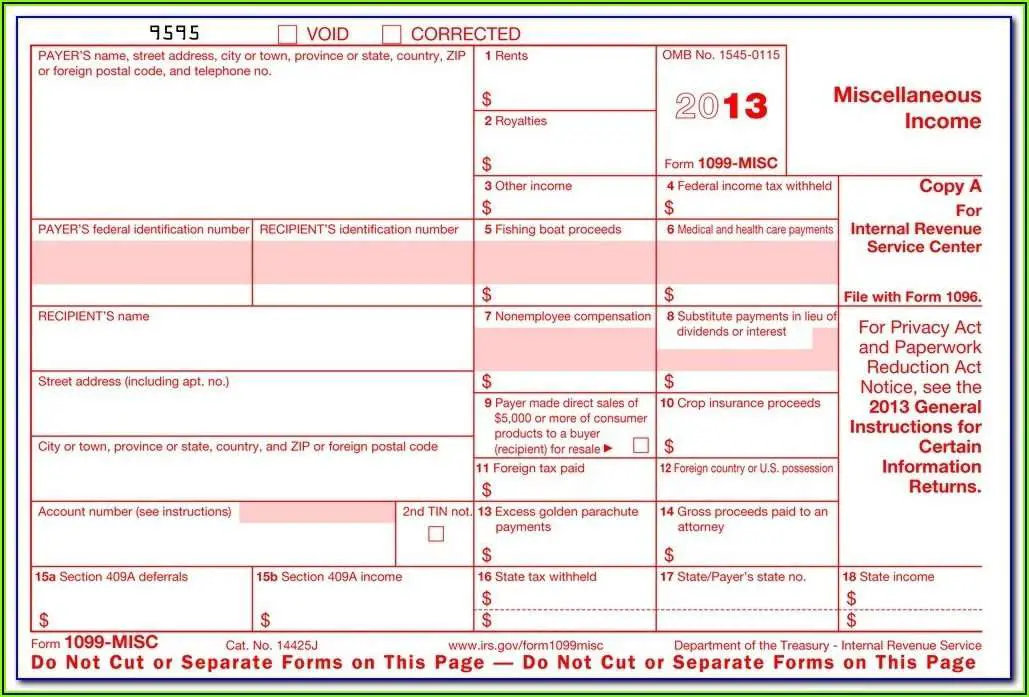

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Delaware Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Delawares UI benefit payment amounts that were issued within that calendar year. This may be different from the week of unemployment for which the benefits were paid.

1099-Gs were required by law to be mailed by January 31st for the prior calendar year. The Division has mailed the 1099-Gs for Calendar Year 2020.

1099-Gs were mailed during the week of January 25th. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G will NOT be forwarded by the United States Postal Service.

How Can I Download My 1099

If you were out of work for some or all of the previous year, you aren’t off the hook with the IRS. Those who received unemployment benefits for some or all of the year will need a 1099-G form. You’ll also need this form if you received payments as part of a governmental paid family leave program. But you don’t have to wait for your copy of the form to arrive in the mail. In many states, you can download your 1099-G directly from the Department of Revenue.

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Next Section

Continue

Read Also: How Do I Change My Address For Unemployment Online

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

- Disability Insurance benefits received as a substitute for UI benefits

- Disaster Unemployment Assistance benefits

- Paid Family Leave benefits

Form 1099-G also reports any amount of federal and state income tax withheld.

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

Read Also: Nc Unemployment Benefits Estimator

What Do You Need To File A Claim

In most states, self-employed or 1099 workers will need to provide the following information when applying for unemployment benefits:

- Name, full mailing address, and phone number.

- Drivers license or state ID number.

- Social Security or Alien Registration number and drivers license number.

- Proof of income, which can include 1099 tax forms, 1099 pay stubs, Form 1040 tax returns and tax returns.

- Bank account number and routing number for direct deposit of benefits.

Keep in mind that each state will have specific requirements, so do your research and collect all relevant documents before starting the unemployment application process.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

for more expert tips & business owners stories.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

Recommended Reading: How Do I Sign Up For Unemployment In Sc

How To Get Unemployment Tax Form Florida

Posted: Sep 14, 2021 · Of the 1040 tax form she adds. In Florida the Unemployment Compensation Program is known as the Reemployment Assistance Program. 10 Things You Should Know About Form 1099 . But when you claim unemployment insurance you must also complete a Schedule 1 form to. How to get unemployment tax form florida. The Florida Reemployment Tax is a tax paid

Recommended Reading: Can You Have An Llc And Collect Unemployment

Also Check: Washington State Unimployment Insurance

How Does A 1099 Employee Work

1099 employees are self-employed independent contractors. They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return. The employer withholds income taxes from the employees paycheck and has a significant degree of control over the employees work.

Look Up Your 1099g/1099int

To look up your 1099G/INT, youll need your adjusted gross income from your most recently filed Virginia income tax return .

Please note: This 1099-G does not include any information on unemployment benefits received last year. If youre looking for your unemployment information, please visit the VECs website.

Note: We will not mail paper 1099G/1099INT forms to taxpayers who chose to receive them electronically unless we receive a request for paper copies of these forms from the taxpayer. We will automatically mail paper forms to taxpayers who did not opt to receive them electronically.

You May Like: File For Unemployment California Online

What If I Believe The Information On My Form Is Incorrect

Please know that we are aware of a mailing and printing processing issue that will impact the delivery and mailing of 1099-G information. Further updates will be provided at

Information for victims of unemployment fraud

In 2020, an international crime ring used previously stolen personal information to fraudulently claim unemployment benefits in states across the country. If you believe youre a fraud victim, or if youve already reported fraud to us but received a 1099-G for fraudulently paid benefits, please see the tax information for fraud victims page: .

Dont Miss: Unemployment Address Change

Reporting Unemployment Benefits On Your Tax Return

You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The amount will be carried to the main Form 1040. Remember to keep all of your forms, including any 1099-G form you receive, with your tax records.

If you use TurboTax to file your taxes, well ask about your unemployment income and put the information in all the right tax forms for you.

TurboTax is here to help with our Unemployment Benefits Center. Learn more about unemployment benefits, insurance, eligibility and get your tax and financial questions answered.

You May Like: How Do I Sign Up For Unemployment In Tn

These Are The States That Will Not Mail You Form 1099

Missouri

- To access your Form 1099-G, log into your account through at uinteract.labor.mo.gov. From the UInteract home screen, click View and Print 1099 tab and select the year to view and print that years 1099-G tax form.

- The Missouri Division of Employment Security will mail a postcard no later than January 31, 2021, notifying anyone who has not accessed their Form 1099-G online about the availability of the form and how to access it.

New Jersey

- To access your Form 1099-G, check your email. You will receive your Form 1099-G by email. You can also use the Check Claim Status tool to get your Form 1099-G.

- If you prefer to have your Form 1099-G mailed, you may request a copy from your Reemployment Call Center. It may take 10 business days to receive a copy of your Form 1099-G.

New York

- To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

- If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

Wisconsin

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2020 New York State Form 1099-G statement is the same as the 2019 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

Also Check: How To Earn Money When Unemployed

Don’t Miss: Njuifile 1099

How Do I Get A Copy Of My 1099 C

requestrequest

. Similarly, how do I find my 1099 C?

To find out if a 1099–C has been filed, you can request a wage and income transcript from the IRS for the tax year or years in question. The transcript should list any 1099-Cs that were filed under your Social Security number.

Also Know, what if I never received a 1099 C? Call the IRS and have an IRS representative initiate a Form 1099 complaint. The IRS will fill out form 4598, Form W-2, 1098, or 1099 Not Received, Incorrect or Lost A letter will be sent to the creditor requesting that they furnish a corrected Form 1099 to the taxpayer within ten days.

Subsequently, one may also ask, how do I get another copy of my 1099?

The IRS has an online Get Transcript” tool on IRS.gov that lets you download or receive by email or mail transcripts of your prior return. Taxpayers can also request transcripts of prior year returns by mailing a completed copy of the paper Form 4506 to the IRS. The form can be downloaded at IRS.gov.

How do I get my 1099 C from Bank of America?

If you’re enrolled in Online Banking and you meet the IRS guidelines, you can find your 1099-INT form by signing in to Online Banking, selecting your deposit account and then selecting the Statements & Documents tab.

What Is Reported On My 1099

DES reports the total amount of unemployment benefits paid to you in the previous calendar year on your 1099-G. This amount is based upon the actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

Dont Miss: Bankofamerica.com/kdol

Also Check: Www Njuifile Net Tax

Income Tax 1099g Information

Posted: Your 1099-G will be electronically available in your BEACON portal. If, after 1099-Gs are issued in mid-January 2021, you wish to have a duplicate be mailed to your physical address, you may obtain one by sending your request via to the Maryland Department of Labor Benefit Payment Control Unit at .

Dont Miss: How Do I Sign Up For Unemployment In Sc

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Name

- Date of birth

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters weve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

- Name

Recommended Reading: Can You File Bankruptcy On Unemployment Overpayment

If Fraud Or Identity Theft Suspected Regarding Your Benefits And/or Form 1099

Will I receive a 1099G if I was a victim of identity theft?

It is the Departments goal to prevent any income that you did not receive or file for from being reported under your SSN. We are working diligently to process returned payments, debit cards, checks return a significant number of fraud calls and investigate identity theft complaints.

If you were a victim and payments were issued to you, but you returned the UC debit card, checks, or direct deposits that you received, you should NOT receive a 1099G. However, if you DO receive a 1099G and believe you shouldnt have because youve returned the funds and submitted an identity theft complaint, we ask for your patience while we work through our increased workload due to the pandemic.

If you were a victim of identity theft but no benefits were paid on the claim, you should NOT receive a 1099G. If a claim was opened and paid using your information and you did not receive the funds and therefore were unable to return them to the department, you should email the Delaware Division of Unemployment Insurance at to to file an identity theft complaint. Upon completion of the investigation, if it is found that you were a true victim of identity theft, a revised 1099G will be issued to you.

What do I do if I believe someone else filed and received UC benefit payments under my name or SSN without my permission?

Video: How To Recover A 1099 Tax Form

OVERVIEW

Are you waiting for your 1099 forms to arrive so you can start preparing your tax return? Or do you need to obtain copies of older ones for some other reason? If you answered yes to either, there are easy ways to retrieve the forms. Watch this video to find out more about recovering 1099 forms.

Also Check: Njuifile.net Sign In

Individual Income Tax Information For Unemployment Insurance Recipients

- Current: 2020 Individual Income Tax Information for Unemployment Insurance Recipients

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return.

Total taxable unemployment compensation includes the new federal programs implemented in 2020 due to COVID-19:

- Federal Pandemic Unemployment Compensation

For additional information, visit IRS Taxable Unemployment Compensation.

Note: Benefits are taxed based on the date the payment was issued.

Request Your Unemployment Benefit Statement Online

-

Because unemployment benefits are taxable, any unemployment compensation received during the year must be reported on your federal tax return. If you received unemployment benefits in 2020, you will receive Form 1099-G Certain Government Payments .

The statements, called 1099-G or Certain Government Payments, are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

You can choose to receive your 1099-G, electronically through MiWAM or by U.S. mail.

To receive your 1099-G electronically, you must request your delivery preference by January 9, 2021. Your statement will be available to view or download by mid-January. If you do not select electronic, you will automatically receive a paper copy by mail.

To receive your 1099-G online:

1 Log into MiWAM

You May Like: File For Unemployment In Kansas

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

You can opt to have federal income tax withheld when you first apply for benefits. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development, Unemployment Insurance, PO Box 908, Trenton, NJ 08625-0908. for the Request for Change in Withholding Status form.

After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. This information is also sent to the IRS.

Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2020, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

IMPORTANT INFORMATION FOR TAX YEAR 2020:

Dont Miss: How To Sign Up For Unemployment In Missouri