Unemployment Money Is Taxable Not Stimulus Checks

Between March 13 and April 3, about 60% of first time unemployment applicants like Schultze elected withholding state and federal taxes, according to the state Depart,ment of Labor.

So that means nearly 2 out of 5 applicants, about 400,000 New Yorkers, failed to check the withholding box.

And these recipients could be in for a rude awakening when filing their income taxes next year.

While stimulus payments are tax free $1,200 for a single person with a gross taxable income of $75,000 $2,400 for couples with an income under $150,000 and $500 for each qualifying dependent child unemployment insurance benefits are subject to income taxes.

Also Check:

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

Read Also: How Do I Check My Unemployment

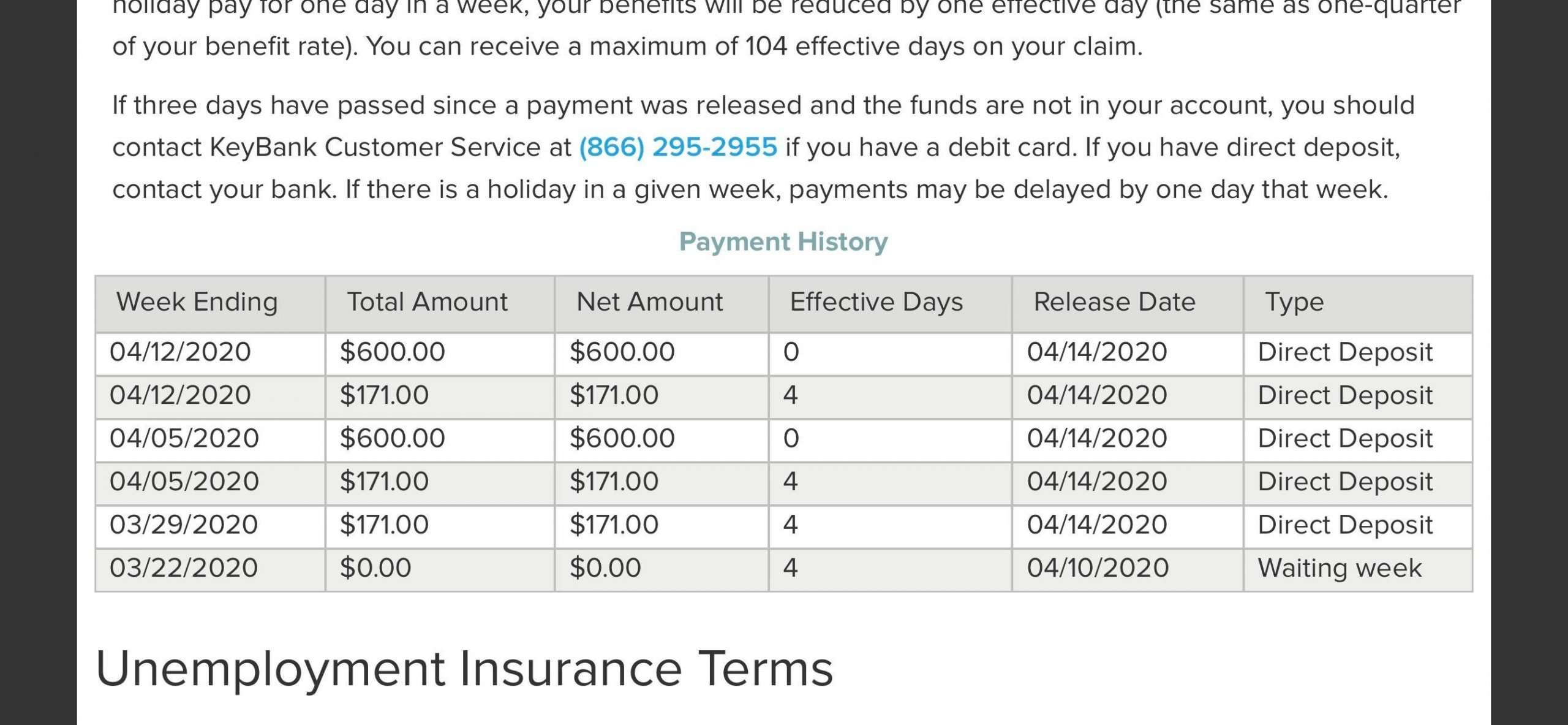

How Was The Benefit Amount Listed On My 1099

Benefit amounts listed on the 1099-G are based on the total payments issued in 2021. View an example of how UI compensation is calculated.

- Unemployment Insurance is taxable, and while some claimants elected to have taxes deducted from weekly benefits payments, the amount shown on the 1099-G will be the pre-tax amount.

You May Like: How Many Hours Can I Work And Still Get Unemployment

Note On Taxable Income

The American Rescue Plan Act of 2021 contains provisions regarding taxable unemployment compensation. Please direct all tax filing questions to the IRS, and visit their website for the most recent guidance.

Image source: /content/dam/soi/en/web/ides/icons_used_on_contentpages/IDES_icon_blue_warning_67px.png

Recommended Reading: Pa Unemployment Ticket Number Status

These Are The States That Will Either Mail Or Electronically Deliver Yourform 1099

Florida

You can access your Form 1099-G through your Reemployment Assistance account inbox. The fastest way to receive your 1099-G Form is by selecting electronic as your preferred method for correspondence. Go to My 1099-G in the main menu to view Form 1099-G from the last five years.

Illinois

Access yourForm 1099-Gonline by logging into your account atides.illinois.gov. If you havent already, you will need to create an .

Indiana

Access yourForm 1099-Gonline by logging into your account atin.gov. Go to your Correspondence page in your Uplink account.

To reduce your wait time and receive your 1099G via email, or using the MD Unemployment for Claimants mobile app.

Michigan

If you did not select electronic as your delivery preference by January 9th, 2021, you will automatically be mailed a paper copy of your Form 1099-G.

To view or download your Form 1099-G,

o sign into your MiWAM account ando click on I Want To, theno 1099-G then choose the tax year.

To change your preference, log into MiWAM.

o Under Account Alerts, click Request a delivery preference for Form 1099-G and thenselect the tax year.

Mississippi

To access yourForm 1099-Gonline, log into your account and follow the instructions sent by email on where you can view and print yourForm 1099-G.

North Carolina

Division of Employment SecurityP.O. Box 25903Raleigh, NC 27611-5903

Utah

Recommended Reading: How To Apply For Unemployment In Ma

Can U Get My W2 From My Unemployment

You do not get a W-2 for unemployment benefits. You get a 1099G, and no, TurboTax cannot get it for you. You have to get it yourself. Usually you need to go to the stateâs unemployment web site to get it and print it out. To enter it on your tax return, go to Federal> Wages & Income> Unemployment /Government benefits on Form 1099G

There are some employers who make W-2âs available for import to TurboTax, but not all do this. And it is late in the year, so it might not even still be available for import at this time. You might have to ask your employer for a copy of the W-2 that was issued in January.

Recommended Reading: How To File For Unemployment In California Online

Why & How Is It Used

Document can be filed by your employer to report the amount of tax that was withheld from your paycheck. 1099 g form online is used to report the amount that employer has withheld from paycheck for federal taxes. 1099 G form is a document that is used to report the amount of state and local general sales fees for a given year. It is important to note that these are not federal fees like what are used to report on a 1040 tax.

State and local governments use this 1099-G unemployment to report the amount of taxes that were assessed and paid. This way, the IRS has a way to determine how much, if any, is owed in taxes to the federal government.

First part is a summary of the federal taxes that you have paid. It is the beginning of federal Form 1099 G that details the amount that you have paid in taxes. It is the sum of your personal information, such as social security number, the amount of gross income you received, and the amount of fees that were withheld from pay. Amount of taxes withheld may be different from the amount of federal taxes that you owe to the government. This is because the information on the document is reported by the employer, and employer may not have withheld the correct amount of fees . Second part is the state and local tax information.

Don’t Miss: How To Apply For Jobs For Unemployment

Individual Income Tax Information For Unemployment Insurance Recipients

- Current: 2020 Individual Income Tax Information for Unemployment Insurance Recipients

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return.

Total taxable unemployment compensation includes the new federal programs implemented in 2020 due to COVID-19:

- Federal Pandemic Unemployment Compensation

For additional information, visit IRS Taxable Unemployment Compensation.

Note: Benefits are taxed based on the date the payment was issued.

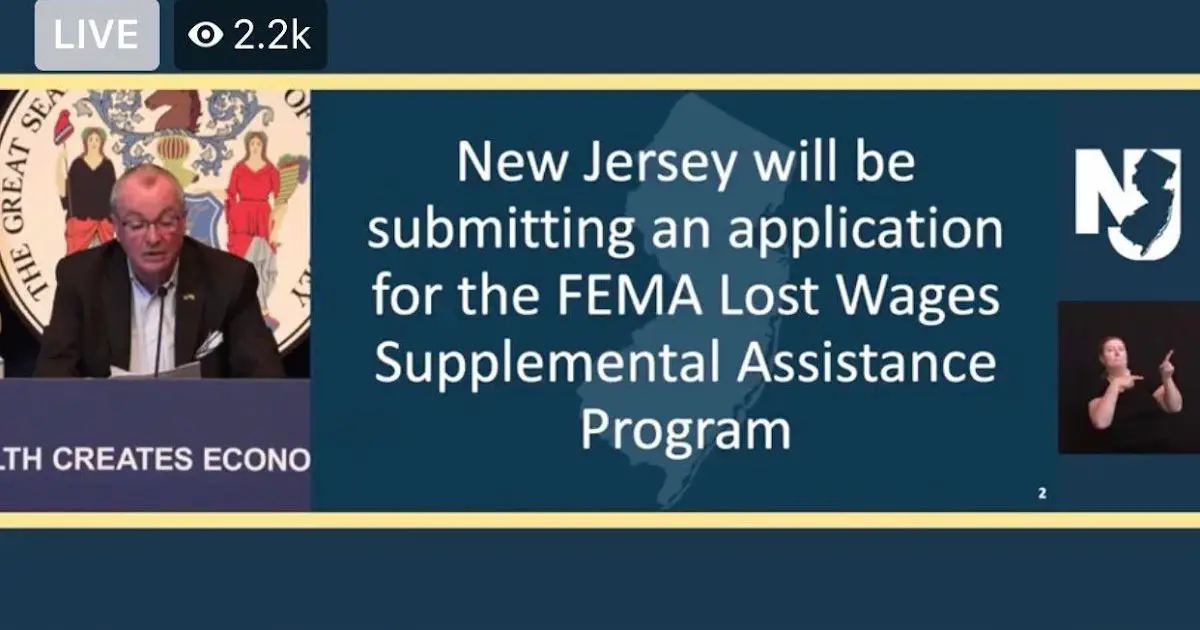

The Feds Passed A New Bill That Extends Benefits

Because of the pandemic, the length of time someone can receive benefits has been extended multiple times. And its happened again: With the new federal stimulus package, benefits can now continue until Sept. 6.

The main points:

- An extra $300 a week will be added to weekly benefits until Sept 6.

- The first $10,200 you received from unemployment in 2020 will not be taxed by the federal government as long as your household income is less than $150,000. You will still have to pay state and city taxes on your benefits, because the New York state and city governments measure income separately from the feds.

We outlined the changes in this explainer, and The New York Times answered a bunch of questions about how the stimulus package will impact unemployment here.

If youve already filed your taxes or opted to have your taxes automatically withheld, you should get a refund. The IRS is still figuring out the process for how to make that happen. If you havent filed your taxes, some experts are advising that people wait until the details are ironed out. Well let you know when we know more.

Also Check: When Will Ga Get The 300 Unemployment Benefits

What Is A W

A W2 is a tax form that documents money paid to you, and money withheld from your paycheck. It includes your commissions, tips, wages, and the taxes that were withheld from your income for federal, state, and social security purposes.

This document has all of the information that you will need to fill out the financial information for your personal taxes. If you have worked, the IRS requires that you use your W-2 to file, and then they determine the amount of taxes that you should pay the federal and state governments.

Donât Miss: Can You Get Medicaid If Unemployed

How Much Tax Is Taken Out Of Unemployment Compensation

If you collect unemployment benefits, you can choose whether or not to withhold federal taxes at a rate of 10%. Some states may allow you to withhold 5%. If you do not have taxes taken out of your unemployment checks, you may have to pay quarterly estimated payments or pay taxes when you file your annual tax return. Either way, your unemployment income is considered taxable income just like any other wages or salaries you receive.

Recommended Reading: Do You Qualify For Medicaid If You Are On Unemployment

How Can I Download My 1099

If you were out of work for some or all of the previous year, you arenât off the hook with the IRS. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Youâll also need this form if you received payments as part of a governmental paid family leave program. But you donât have to wait for your copy of the form to arrive in the mail. In many states, you can download your 1099-G directly from the Department of Revenue.

Can Turbotax Find My W

TurboTax does not have your W-2. They would only have a local form for data that you either entered from your W-2 or downloaded from your employer. You would need to get a copy from your employer. You can get a wage and income transcript from the IRS which shows data from Forms W-2 and other information returns.

Recommended Reading: Va Unemployability Benefits

Recommended Reading: Where Is My Unemployment Card

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

Recommended Reading: How To Fill Out Unemployment Claim Form

Request Your Unemployment Benefit Statement Online

-

Because unemployment benefits are taxable, any unemployment compensation received during the year must be reported on your federal tax return. If you received unemployment benefits in 2020, you will receive Form 1099-G Certain Government Payments .

The statements, called 1099-G or âCertain Government Payments,â are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

You can choose to receive your 1099-G, electronically through MiWAM or by U.S. mail.

To receive your 1099-G electronically, you must request your delivery preference by January 9, 2021. Your statement will be available to view or download by mid-January. If you do not select electronic, you will automatically receive a paper copy by mail.

To receive your 1099-G online:

1 Log into MiWAM

2 Under Account Alerts, click Please select a delivery preference for your 1099 Form

3 Under Delivery Preference for Form 1099-G, click Electronic. Your email address will be displayed.

4 â Review and Submit. You will receive an email acknowledging your delivery preference.

To receive your copy by mail, follow the steps above and select paper as your delivery preference.

New York Unemployment Benefits

The Unemployment Insurance program in NY is handled by the Department of Labor. The department helps those who have recently lost their job for no fault of their own by providing monetary assistance and also by providing various services aimed at improving the competitiveness of the applicants.

Read more to know about the eligibility factor, documents required, methods to apply and all the other information needed to file for unemployment benefits.

Don’t Miss: How Do I Apply For Unemployability With The Va

Mixed Earner Unemployment Compensation

The Mixed Earner Unemployment Compensation benefit is designed to provide additional assistance to individuals who had both W2 employment and self-employment/freelance/gig work prior to the pandemic. These individuals technically only qualified for regular unemployment benefits and were unintentionally left out of the Federal Pandemic Unemployment Assistance program.

Eligible individuals in this category, who earned more than $5,000 in self-employment income in 2019, can receive an additional $100 per week. Keep an eye out for correspondence from TWC about the MEUC program requesting action from you to start this benefit. for more information.

You May Like: How To Make Money When Unemployed

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

You May Like: Do I Need To Amend My Tax Return For Unemployment

Des: Tax Information And 1099

Posted: What is the IRS Form 1099-G for unemployment benefits? By Jan. 31, 2021, all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account.

Read Also: How To Enroll In Unemployment

Other Payments Covered By Form 1099

The other reasons you may receive Form 1099-G include the following types of payments:

- Reemployment trade adjustment assistance payments. These are shown in Box 5.

- Taxable grants received from federal, state and local governments. These are shown in Box 6.

- Taxable payments from the Department of Agriculture. These are shown in Box 7.

Don’t Miss: How Much Is Unemployment In Arkansas

Notice To Representatives Of Deceased Claimants

Q: How do I access the 1099-G tax form if I am the representative of a deceased claimant?

A: For the New York State Department of Labor to provide you with information belonging to a deceased unemployment insurance claimant, you must first show that you are legally authorized to receive this information. Authorization often comes from the New York State Surrogate Court, and may be one of the following:

- Appointment as an Executor

- Letters of Administration

- Appointment as a Voluntary Administrator

If the deceased claimant had no assets, or all property owned by the deceased claimant was owned in common with someone else, then no Executor or Administrator may have been appointed. The representative of the deceased claimant must provide proof that they are authorized to obtain the information. In this case, a surviving spouse should provide NYS DOL with:

Please submit proof that you are authorized to receive the deceased claimants information using one of the following methods:

More New York Benefits

In addition to unemployment benefits, residents may be eligible for New York disability benefits. Those who cannot work due to a chronic medical condition may be eligible for Social Security Disability Insurance or Supplemental Security Insurance . Both programs are federally funded, but the state administers them. If you are disabled and unable to work, you can apply over the phone, in person at your local Social Security office, or online at SSA.gov.

If you receive SSI benefits, you may receive New York Medicaid. Medicaid helps with medical costs for low-income residents with certain medical conditions, disabilities, or seniors. Eligibility is dependent on income limits. You may be responsible for paying copayments which vary depending on services rendered. The good news is your responsible portion of copayments is capped at $200 per year.

New York Veterans have a variety of benefits available to them, including health care, disability, education and employment, housing, and more. New York Veterans benefits are provided through a combination of state and federal programs. Your best bet is to visit the New York State Division of Veterans Services for guidance in navigating the benefits best suited for you.

Also Check: How To Sign Up For Unemployment In Va