Protect Yourself From Scams

IWD does not ask for unemployment insurance overpayments to be paid by credit card or gift cards. Individuals who have received an unemployment insurance overpayment will be notified by mail delivered by the U.S. Postal Service.

In addition, IWD does not request sensitive account information through email communications. Individuals filing for unemployment insurance benefits will receive pertinent information regarding their account through the U.S. Postal Service.

What Is Good Cause

There are many valid reasons to quit a job, such as a lack of advancement opportunities, poor hours, or tedious responsibilities, which do not meet the legal definition of “good cause.”

In general, having good cause for resigning means there are unsolvable problems with the work, which leave an employee with no other options beyond quitting. Additionally, it needs to be documented that the employer was made aware of the situation, and made no effort to rectify it. Some examples of good cause are:

- Unsafe work conditions

Some types of family emergencies are also considered good cause.

Fraudulent Unemployment Insurance Activity

Report Fraud

With the record number of unemployment insurance claims filed during the COVID-19 pandemic, Maryland, and states across the entire country, have seen an increase in activity by bad actors and fraudsters using illegally obtained data to file fraudulent unemployment insurance claims. Please note that there has been NO breach in our BEACON unemployment system.

If you believe that your information has been used to fraudulently file an unemployment insurance claim, please contact the Division of Unemployment Insuranceâs Benefit Payment Control Unit by completing a âRequest for Investigation of Unemployment Insurance Fraudâ form and e-mailing it to .

If you received a 1099-G tax form, but did not apply for unemployment insurance benefits in Maryland in 2020, then please complete this Affidavit form and submit it along with picture ID to the Benefit Payment Control Unit by e-mailing .

If you are an employer and believe a fraudulent claim has been charged to your account, please file a benefit charge protest through your employer portal.

If you believe fraudulent transactions have been made on your Bank of America Debit Card, please contact the Debit Card Customer Service Center at 1-855-847-2029 to file a report and request a replacement card.

Avoid Scams

Avoid Scams on Social Media

Links to the Maryland Department of Laborâs official government agency social media pages can be found below:

Identity Theft Resources

Don’t Miss: Can You Draw Unemployment If You Quit A Job

Do I Need To Meet With Anyone In Person

Some states require unemployed workers to meet with the unemployment department representatives to receive help with their job search and/or re-employment assistance.

If your state happens to be among these, there’s no need to panic. In many cases, it’s a routine meeting designed to assist with your job search not to put you or your job search under a microscope. Your meeting may be an individual meeting or a group meeting with other unemployed workers. It’s important to remember to bring records of your work search if you are required to apply for a certain number of jobs each week.

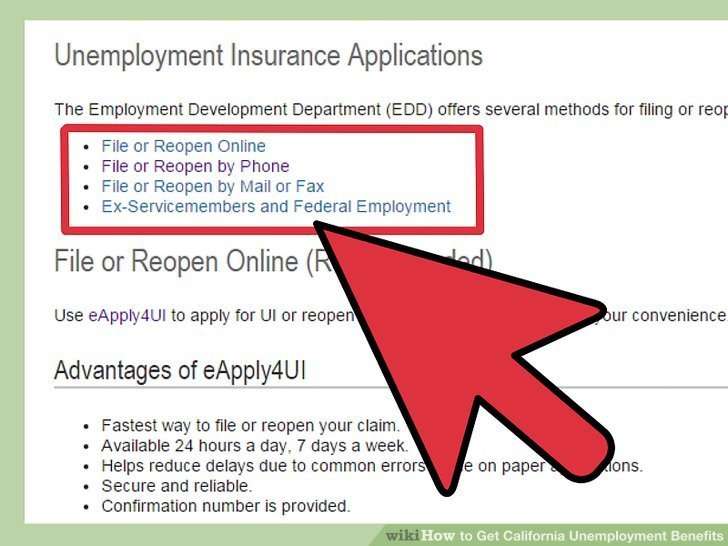

Apply Online By Phone Or Mail

- Apply online anytime between 12:00am on Sunday through 6:00pm on Friday.

- Apply by phone, Monday through Friday, 7 a.m. – 6 p.m.1 600-2722

- Submit a claim by mail. Download the Arizona Initial Claim for Unemployment InsuranceUB-105).

- Attention PEUC claimants: The American Rescue Plan Act was signed on March 11, 2021, increasing the maximum benefit amount for PEUC to 53 times an individual’s average weekly benefit amount. PEUC claimants should continue filing weekly certifications if they remain unemployed. No applications for Extended Benefits should be filed at this time.

NOTES:

- If you are participating in the Address Confidentiality Program , you must list your own phone number when filing an Unemployment Insurance claim so DES can contact you directly. Please do not use the ACP phone number.

DES is analyzing changing state and federal guidance and updating its eligibility requirements accordingly. These requirements may continue to change as the government response to COVID-19 evolves.

Applicants are also automatically registered with Arizonas largest jobs database, Arizona Job Connection . By completing their registration, job seekers can create a digital resume, search for jobs, and get matched with hiring employers.

Read Also: Can You File Bankruptcy On Unemployment Overpayment

Chat With A Live Agent

Claimants can conveniently chat online with a live agent to receive help with their unemployment insurance inquiries. To chat with a live agent, please select the blue âChat with usâ button at the bottom right of the homepage and then type “speak with an agent.” Agents are available Monday to Friday from 7:00 a.m. to 6:00 p.m., Saturday from 8:00 a.m. to 12:00 p.m., Sunday from 12:00 p.m. to 4:00 p.m.

Claimants can also chat with Laborâs Virtual Assistant Dayne, which can provide immediate answers to common inquiries or direct claimants to relevant resources about filing a new claim, extending benefits, receiving benefit payments, and more. The Virtual Assistant is available 24/7. Since May 2020, the Virtual Assistant has handled more than 18.8 million messages and 3.1 million conversations, with an average of 10,400 conversations daily.

Are You Unemployed File For Your Unemployment Benefits Now

Did you recently just get out of work and are in dire need of assistance? You may be able to apply for benefits the same week you become unemployed or your hours are greatly reduced.

Unemployment insurance benefits provide temporary financial assistance to workers unemployed through no fault of their own who meet the states eligibility requirements. Need assistance? See if you qualify for unemployment benefits by visiting UnemploymentResources.com!

- You are fully or partially unemployed because of a layoff, furlough, reduced wages, or reduced hours.

- You and your family are impacted by school closures.

- Your unemployment claim expired.

- You are not able to work due to a non-work-related illness, injury, or pregnancy.

- You are not able to perform your normal work duties because you are sick or quarantined due to COVID-19.

- You paid into the State Disability Insurance program , via taxes.

You may be eligible for Paid Family Leave benefits if:

- You will qualify if you are unemployed through no fault of your own.

- You will qualify if you meet work and wage requirements.

- You will qualify if you meet the states requirements.

Read Also: How Do I Change My Address For Unemployment Online

Is There An Unemployment Waiting Period

Unemployment insurance waiting periods are 100% state-driven. Many states have what is known as a “waiting period,” otherwise referred to as a “waiting week” as part of their unemployment insurance laws.

For example, in New York State, you must serve an unpaid waiting period equivalent to one full week of unemployment benefits before you receive payments. Minnesota has a non-payable waiting week before benefits can be collected. In some locations, the waiting week benefits will be paid, but you will have to wait until the end of the claim period in order to collect those funds.

Based on the state-by-state differential, it’s best to check with your state unemployment office website as soon as you lose your job for information regarding the unemployment waiting period in your location.

What Is Unemployment Insurance

Unemployment insurance is compensation provided to workers who lose their jobs through no fault of their own, providing monetary payments for a specific period of time or until the worker finds a new job.

Benefits are provided by state unemployment insurance programs within guidelines established by federal law. Eligibility for unemployment insurance, benefit amounts, and the length of time benefits are available are determined by laws in your state.

Read Also: Can You Refinance While Unemployed

File An Initial Or Weekly / Continued Claim

Welcome to the Virginia Employment Commission Workforce Services Unemployment Insurance claim filing system. In order to file for Unemployment Insurance you must have been separated from your employer or have had your hours reduced.

You should not attempt to file a Virginia claim if:

- Your last employer was a federal civilian employer in a state other than Virginia . The only exception is if you worked as a federal civilian overseas.

- Your employment within the last 18 months was performed in a state or states other than Virginia.

You will need the following information to file your claim:

- Your Social Security Number

- The accurate employer names, addresses, telephone numbers and dates of employment within the last 18 months.

- The name and local number of your local union hall, if you obtain work through a union.

- Your Alien Registration Number if you are not a US citizen.

- If you have any Non-Virginia employers you must have an accurate mailing address, phone number, and dates of employment for them.

- You will be asked to select a method of payment: VA Debit Card or Direct Deposit. If you select Direct Deposit, you will need to have your Routing Number and your Account Number .

If you do not have this information available, please gather it before you begin to file your claim. This site is available seven days a week. The filing process takes approximately 45 minutes to complete. Please allow enough time to complete this process.

INCOMPLETE APPLICATIONS WILL NOT BE PROCESSED!

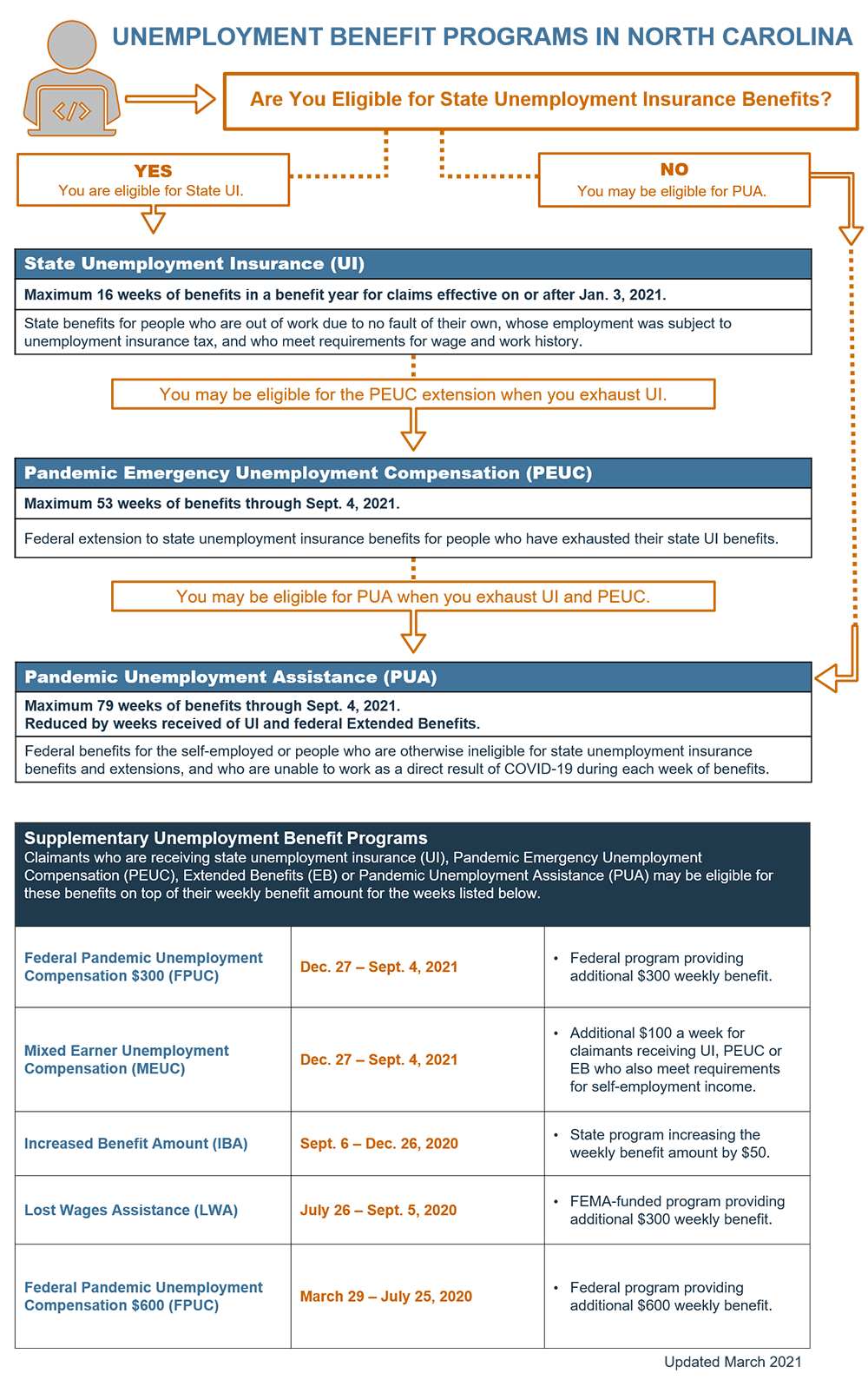

Temporary Federal Pandemic Ui Programs End On September 4 2021

The temporary, federal unemployment insurance programs , Federal Pandemic Unemployment Compensation , Pandemic Emergency Unemployment Compensation , and Mixed Earner Unemployment Compensation Program will expire the week ending Saturday, September 4, 2021. No payments of PUA, FPUC, PEUC, or MEUC benefits will be made for any weeks of unemployment ending after September 4, 2021, even if you have a PUA or PEUC balance in your BEACON portal.

Processing of Claims for Weeks Ending on or Before September 4 Claims that include weeks of eligibility that end on or before September 4 will be processed even after the federal programs expire. Claimants will receive benefits for all weeks they are determined to be eligible for, even if a determination of eligibility occurs after September 4. If you are waiting to receive an eligibility determination for any of these four federal programs, the Department will ensure that you receive all payments owed to you for those weeks.

Extension to File PUA Claims Until October 6, 2021, the Department will accept new initial claims for PUA benefits for weeks of unemployment ending between December 12, 2020, and September 4, 2021. Claimants are only eligible for PUA benefits for weeks they were unemployed or partially unemployed because of an approved COVID-19 related reason.

You May Like: Teleclaim Sc

How Long Does It Take To Receive Unemployment Benefits

Once you submit your claim, you should expect to wait at least three weeks before hearing whether you were approved. However, since unemployment claims have skyrocketed because of the coronavirus pandemic, it may now take even longer to receive a verdict on your application, said David Bakke, human resource specialist at DollarSanity.

In New York alone, the labor department experienced a 900% increase in web traffic and a 16,000% spike in phone calls between March 23 and March 28. As unemployment rates grow and the department continues to receive more claims than it’s used to, applicants are likely to experience delays.

What Are The Tax Implications Of Unemployment

Your unemployment insurance is considered taxable income, so you must report it on your federal tax return in the income section.

Taxes are not taken out of unemployment benefits, but when filing your federal and state taxes the following year, you must report the money you received. The IRS will send you Form 1099-G, which includes the taxable unemployment benefits you received in the previous tax year.

“One benefit, however, is not having to pay payroll taxes like Social Security and Medicare on these payments,” said Riley Adams, a certified public accountant and owner of Young and the Invested, a personal finance website. “Should you so choose, you may also elect to have taxes withheld from your unemployment benefits when filing for unemployment insurance.”

Recommended Reading: Unemployment Quit For Good Cause

American Rescue Plan Act Unemployment Insurance Programs

Overview of Programs

Pandemic Unemployment Assistance

- Provides benefits for claimants who are ineligible for regular UI and unemployed due to a COVID-19 related reason. This includes gig workers, independent contractors, the self-employed, and those with insufficient work history.

- Per new USDOL guidelines, eligibility for PUA has been expanded to include:

- Individuals who were denied unemployment benefits because they refused to return to work or refused an offer of work at a worksite that, in either rinstance, is not in compliance with local, state, or national health and safety standards directly related to COVID-19

- Individuals who provide services to an educational institution or educational service agency and are unemployed or partially unemployed because of volatility in the work schedule that is directly caused by the COVID-19 public health emergency and

- Individuals experiencing a reduction of hours or a temporary or permanent layoff as a direct result of the Covid-19 public health emergency.

- Claimants are required to provide proof of their employment in order to be eligible for PUA.

- All PUA claimants will receive an action item in their BEACON portals. Learn more about the proof of employment requirement.

- The PUA program will end in Maryland on Saturday, September 4, 2021.

Federal Pandemic Unemployment Compensation

Pandemic Emergency Unemployment Compensation

Mixed Earner Unemployment Compensation Program

No Gap in Benefit Eligibility or Delay in Payment

Next Steps For Apply For Unemployment Benefits

Request weekly benefits

You must request weekly benefits every week that you are unemployed. You will make your first weekly benefit request the week after you file your claim for unemployment benefits.

Begin your work search

You must begin searching for work immediately . Track your search for new employment by using the Work Search Activity Log.

DUA will review your application

DUA will review your application and confirm details of your application with your former employer. If you provided an email address when you filed your claim, you will receive an email from DUA asking you to verify your email address.

DUA will send a Monetary Determination

This notice tells you how much youll potentially receive in unemployment benefits.

Respond to questionnaires from DUA

If there is a question of eligibility, you’ll receive a fact-finding questionnaire from DUA requesting information from you. You must respond to this questionnaire by the deadline specified. Failure to respond may result in a disqualification from receiving benefits.

Respond to requests for information about your unemployment claim

DUA will send a Non-Monetary Determination

This notice tells you whether youve been approved for unemployment benefits. If your application is denied, you can appeal the decision within 10 days.

Recommended Reading: Pa Unemployment Ticket Number

Am I Eligible For Unemployment

Simply being out of work doesn’t entitle you to unemployment benefits. If you were fired because of misconduct or quit your job without good reason, you may not be eligible for unemployment benefits. While each state has its own eligibility requirements, many states consider how much money you earned in your job, how many hours you worked for the year before your unemployment, and the reason you’re now jobless.

The federal government has also taken the effects of COVID-19 into consideration. Under the CARES Act, eligibility requirements have changed to accommodate workers who lost their jobs because their employers closed operations due to the virus. People who are isolating and intend to return to work, or who left their jobs to avoid infection or care for loved ones, may also be eligible for unemployment benefits. You may also be able to file if you are a gig worker or freelancer, depending on your state’s requirements.

Information Required To Apply For Unemployment

If youve been laid off from your job, the chances are high that you will qualify to file for unemployment benefits.

In most states, unemployed workers can apply online, over the phone, or, in some cases, by mailing a form. Many states provide information for applicants in numerous languages, including Spanish.

Applying online is the quickest and easiest way to file for unemployment. Claims are generally processed much more quickly, so you stand to start receiving benefits sooner than applying by phone or mail.

Recommended Reading: How Do I Change My Address For Unemployment Online

File An Unemployment Claim

To apply for regular unemployment insurance, click the button below. You’ll be taken to the 10 Things You Should Know page to start the application process.

Pandemic Unemployment Assistance applications are being accepted until October 6th, 2021. However, PUA benefits are only payable retroactively through the week ending September 4th, 2021. Learn more and file a PUA claim online.

Once you have filed a claim for regular unemployment benefits, return to this page and click:

Information You Need To Apply

You will need:

- Your last employers business name, address and phone number

- First and last dates you worked for your last employer. If you worked for your last employer on more than one occasion, provide the most recent employment dates.

- Number of hours worked and pay rate if you worked the week you apply for benefits

- Information about the normal wage for the job you are seeking

- Alien Registration number

- A valid Texas Driver License number or Texas Identification Card number

Also Check: Desncgov