How To Apply For Unemployment In Illinois

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.There are 7 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 83% of readers who voted found the article helpful, earning it our reader-approved status. This article has been viewed 276,213 times.Learn more…

Losing a job is a scary experience, but Illinois fortunately offers unemployment benefits to those who’ve lost a job through no fault of their own. You can apply online, by phone, or at an office during the first week you become unemployed. Remember to recertify your eligibility for benefits every two weeks, up to a maximum of 26 weeks in a one-year period.XResearch source

Contact Your Former Employer

If by the end of January you have not received your W-2, first contact your previous employer. If the company you worked for has a human resources department, call or email the HR representative to ask about the status of your W-2 and to confirm they have your correct mailing address. They might have mailed the form, but it got lost in the mail or went to the wrong address. If the company does not have an HR department, call your former manager. Offer to pick up your W-2 in person to save time.

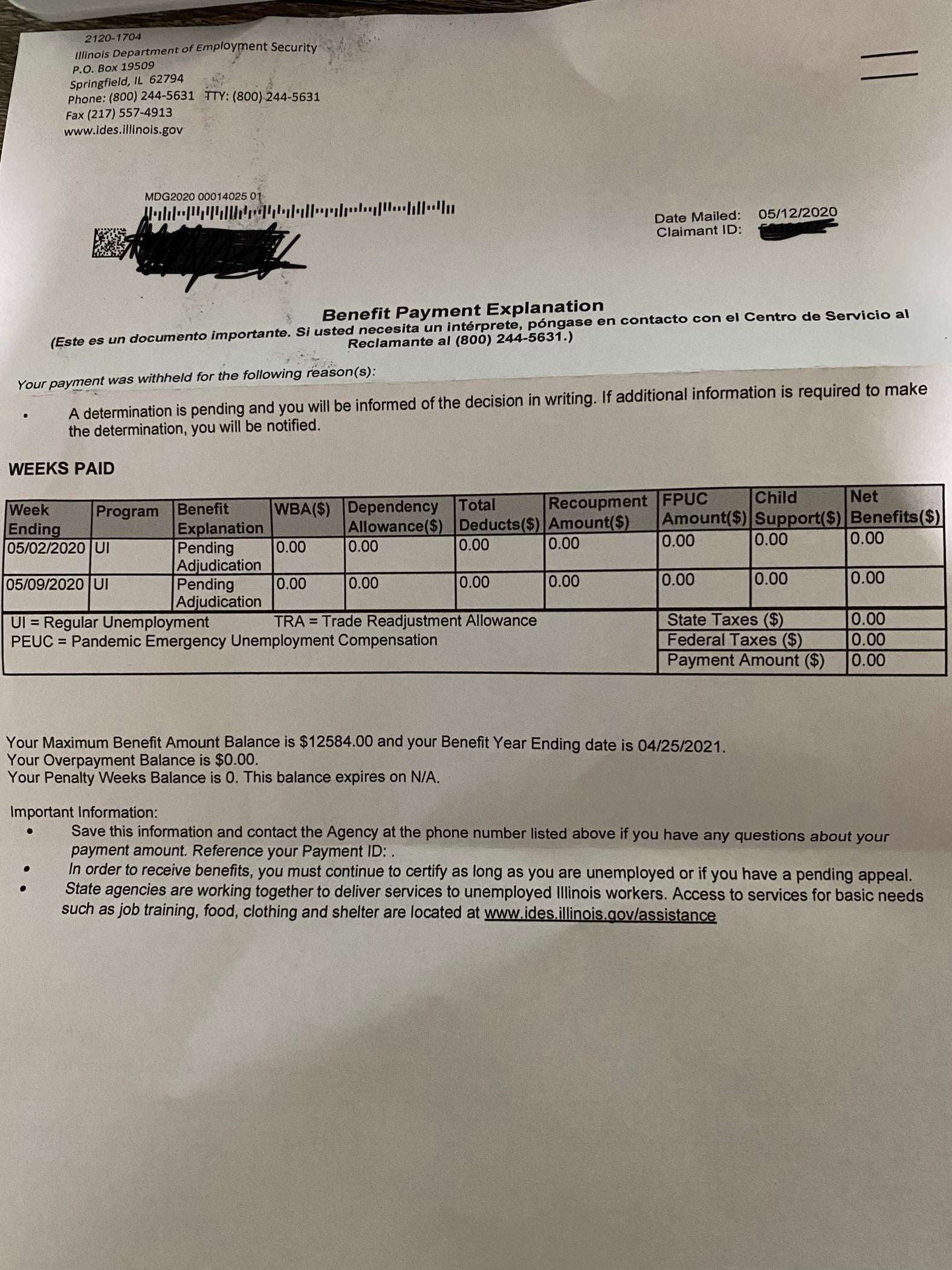

C Claims Adjudicators Determination As To Eligibility

For each week for which a claim for benefits is made, a claims adjudicator makes a determination as to the claimants eligibility.

An employer that has filed a sufficient Notice of Possible Ineligibility within the 10-day time limit is a party to such determination and is entitled to a notice of the determination and has the right to appeal it. The General Assembly, with the approval of the Governor, has allocated one million dollars to provide free legal assistance to small employers at Departmental hearings. To implement this provision, the Department contracted with a private law firm to provide this assistance. A contact telephone number is printed on determinations, decisions, etc., the appeals of which are covered by this program.

If no Notice of Possible Ineligibility or letter has been filed within the time limit, the employing unit is not a party to the determination.

An employer that has filed a sufficient and timely Notice of Possible Ineligibility alleging an issue of availability, disqualifying income, refusal of work or not unemployed becomes a party to any determination made with respect to the week for which the

Notice is received. Such employer will have appeal rights to the determination.

You May Like: How To Draw Unemployment In Texas

How Much Money Will I Receive In Unemployment Benefits

Your weekly benefit is calculated by adding your earnings during your two highest-paid quarters of your base period, taking 47% of that total, and then dividing it by 26. Lets say you earned $15,000 combined during your two most profitable quarters. Youd be eligible to get $272 a week. The maximum weekly benefit you can receive is $471, and you may be eligible for an additional allowance if you have a non-working spouse or dependent child.

For a non-working spouse, you get 9% of your total wages during your two highest-paid base period quarters divided by 26, or $52 a week in our example. For a dependent child, you get 17.4% of your total wages during your two highest-paid base period quarters divided by 26, or $100 in our example. You may claim either a non-working spouse or a child allowance, but not both . The maximum allowance for a non-working spouse is $91 a week, while the maximum for a dependent child is $175 a week.

In addition, anyone who files an unemployment claim now is entitled to an extra $600 a week as part of the recently approved economic stimulus package. That $600 applies to dates of unemployment from March 27 through July 31. After that, your weekly benefit reverts back to its original amount â meaning, the amount youâre entitled to based on the above calculations.

Unemployment Insurance In Illinois: Funding Benefits And Eligibility

| Index of articles about unemployment insurance |

|---|

| Click here for more coverage of unemployment insurance on Ballotpedia |

Unemployment insurance is a term that refers to a joint federal and state program that provides temporary monetary benefits to eligible laid-off workers who are actively seeking new employment. Qualifying individuals receive unemployment compensation as a percentage of their lost wages in the form of weekly cash benefits while they search for new employment.

The federal government oversees the general administration of state unemployment insurance programs. The states control the specific features of their unemployment insurance programs, such as eligibility requirements and length of benefits.

Although the word insurance is in the term, a few key differences distinguish unemployment insurance from private insurance plans such as home insurance, car insurance, or health insurance. In most states, employersrather than individuals themselvespay unemployment taxes that fund state unemployment insurance programs. When an individual loses their employment , state-administered unemployment insurance programs provide temporary monetary benefits to the former employee. Unemployment insurance compensation is not intended to replace lost wages it is designed to replace a portion of the individual’s lost wages with the goal of providing financial support as an individual searches for a new job.

Also Check: Can You Collect Unemployment While On Unpaid Medical Leave

Make Changes To Your Ui Account

Complete the changes online at the MyTax Illinois website or the Notice of Change form UI-50 for:

- Phone Number Change/Name Change/Address Change/Miscellaneous Changes

- Business Name change without change in legal entity

- Reorganization, Sale or Other Organizational Change

- Request to Close UI Account

Complete the forms below for Wage/Name/Social Security Corrections

Report Entity Changes

Did you acquire your Illinois business or any portion of it by purchase, reorganization or a change in entity, for example, a change from sole proprietor to corporation? If yes, report the changes online at the MyTax Illinois website or complete the forms below:

Power of Attorney, Third Party Agent Grant Power of Attorney to a Third Party Agent and Register as a Third Party Agent for Multi-account Filers

Combined Power of Attorney LE-10 and Special Mailing UI-1M These forms are used to represent an employer before the director in any and all matters, to act in the Employers stead with the same consequences as the Employer. The special mailing form is to notify the Department of a request to have correspondence sent to an address other than your business address or to terminate a preexisting address.

What Determines If Im Able To Work Available For Work And Actively Seeking Work

To be considered able to work, an individual must be mentally and physically capable of performing a job in an occupation where jobs exist.

To be considered available for work, an individual cannot impose conditions on the acceptance of work if those conditions essentially leave them with no reasonable prospect of work.

To be considered actively seeking work, an individual must reasonably try to return to work. An individual cannot refuse a suitable job offer or they could lose eligibility for benefits.

Also Check: Tax Return For Unemployment Benefits

How Does Illinois Unemployment Insurance Work

Unemployment Insurance supplies funding for the Illinois Department of Employment Security , which pays benefits to the unemployed. The wage base is $12,960 for 2021, and rates range from 0.525% to 6.925%. If youre a new employer, your rate is 3.175%.

Newly registered businesses must register with IDES within 30 days of starting up. You can register electronically through the MyTax Illinois website.

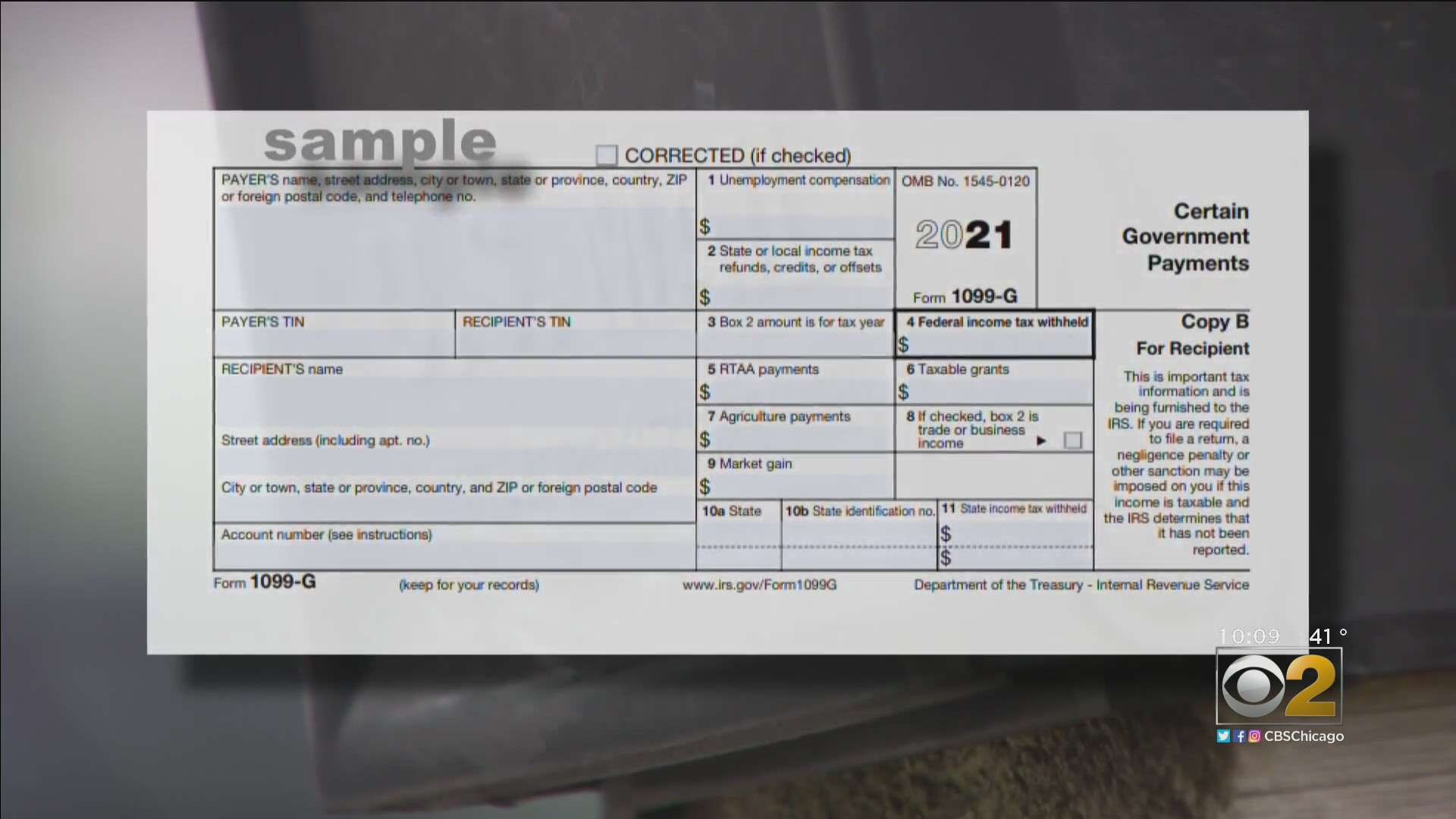

Request A Corrected 1099

If your 1099-G has an incorrect amount in total payment or tax withheld, you can request a revised form.To request a corrected form: Complete Form UIA 1920, Request to Correct Form 1099-G, and submit it to UIA. Mail completed forms to: Unemployment Insurance Agency, 1099-G, P.O. Box 169, Grand Rapids, MI 49501-0169.

Don’t Miss: What Line Of The 1040 Is Unemployment Compensation Reported On

Reporting Unemployment Benefits At The State And Local Level

If your state, county, or city collects income tax on your unemployment benefits, keep your Form 1099-G for reference. You may have to attach it to your state, county, or local income tax return. If so, keep a copy for yourself.

Check with your states Department of Revenue and relevant county and local government tax agency for instructions on how to report your unemployment benefits at the state and local level.

How Is The State Unemployment Tax Calculated

Like other payroll taxes, you pay SUTA taxes on a percentage of each employees earnings, up to a certain amount.

Your SUTA tax rate falls somewhere in a state-determined range. States assign your business a SUTA tax rate based on industry and history of former employees filing for unemployment benefits. New companies usually face a standard rate.

Each state decides on its SUTA tax rate range. The ranges are wide: Kentuckys range, for example, is 0.3% to 9%.

Each state also decides on an annual SUTA limit so that an employees earnings after that amount are no longer taxed until the following year.

You might know that Social Security taxes stop after an employee earns $137,700 for the year. The SUTA limit, also called a SUTA wage base, is the same concept.

Don’t Miss: What Race Has The Highest Unemployment Rate

Illinois Payroll Tax Form Information

Contacting Support

Were currently experiencing service issues for contacting Support. Please use the Help & How-To Center while we work through these issues.

Select a state from the drop-down list or visit the State-specific payroll tax form information topic to view payroll tax form information for that state.

Dont Have Your Illinois Payroll Account Numbers

To get your Illinois Payroll Account Numbers, register online with MyTax Illinois. After you complete registration, you will receive your Illinois Unemployment Account Number and Taxpayer ID Number.

Square Payroll only requires the first seven digits of your Unemployment Account Number. Your Taxpayer ID Number will typically match your nine digit Federal Employment Identification Number followed by a three-digit Sequence Number.

You May Like: When Do The 300 Unemployment Start

Illinois Unemployment Benefits Attorney

If you have been denied unemployment benefits, contact an employment firm today. We have successfully represented many claimants in unemployment hearings and in front of the Board of Review, allowing them to receive their well-deserved benefits. Osborne Employment Law offers a complementary initial consultation to help determine how we can help you obtain unemployment benefits. Be advised there are strict time limitations in filing unemployment claims and appeals. Generally unemployment benefits appeals must be raised within 30 days of the underlying determination. Therefore, it is essential to contact an attorney as soon as possible.

Practice Areas

Read Also: How To Get Unemployment In Tn

Wage Base And Tax Rates

UI tax is paid on each employee’s wages up to a maximum annual amount. That amount, known as the taxable wage base, increases slightly every few years in Illinois. In recent years it has been slightly less than $13,000.

The state UI tax rate for new employers, also known as the standard beginning tax rate, also can change from one year to the next. In recent years, it generally has been somewhere between 3.5% and 4.0%. Established employers are subject to a lower or higher rate than new employers depending on an “experience rating.” This means, among other things, whether your business has ever had any employees who made claims for state unemployment benefits.

Read Also: Can I File For Unemployment While Waiting For Disability

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

How To Apply For Illinois Unemployment Online

âHow do I file a Illinois Unemployment Claim?â is a common question most recently terminated workers ask. Illinois residents can file an unemployment claim online at . Many claimants who prefer to sign up in person can visit a Illinois unemployment office and use the computers provided and get help if needed.

All applicants should learn how the Illinois unemployment system works as many of the requirements for continuing to receive benefits must be done online. Most applicants prefer to file for Illinois unemployment online as it can be done at their own pace, they can also pause the application in order to find the correct documentation.

#ADS#

You May Like: What Is Supplemental Unemployment Benefits

Illinois Mandatory Sexual Harassment Prevention Training

Every Illinois employer is required to provide employees with sexual harassment prevention training, in compliance with Section 2-109 of the Illinois Human Rights Act . Training must equal or exceed the minimum standards set forth in Section 2-109. Employers may also use the Illinois Department of Human Rights sexual harassment prevention training model.

These trainings must be complete by the end of each calendar year for every employee working in the state of Illinois. Restaurant and bar employees are required additional sexual harassment prevention training, outlined by Section 2-110 of the IHRA.

As part of our extensive payroll services, CAVU HCM offers this training course for all Illinois employees and employers.

How To Sign Up For Unemployment Insurance In Illinois

Illinois Unemployment Application Information

To apply for unemployment benefits in Illinois, the claimant can either file an application at the IDES office or online. Unemployment applicants wondering How can I sign up for unemployment? or wondering where to sign up for unemployment in their area can read through the sections below. Other information found in this section includes details about the application process, and what documents are required to file for unemployment in Illinois.

For more details on the different features of unemployment registration, review the following sections:

Donât Miss: Unemployment Ticket Checker

Recommended Reading: Do Unemployment Benefits Get Taxed

Do I Qualify For Unemployment Benefits

To qualify for unemployment benefits in Illinois, you must have lost your job through no fault of your own . You must also be able and available for work.

Under normal circumstances, to collect unemployment benefits in Illinois, youâd need to be actively seeking work, but due to the ongoing COVID-19 crisis, this requirement has been waived for now. Youâll be eligible for benefits if youâre not actively seeking work, but are prepared to return to your job as soon as your employer reopens or itâs safe to do so.

If youâre confined to your home because of COVID-19 , youâre considered unemployed for the time being through no fault of your own. The same holds true if your job canât be done from home and you need to stay home to care for your children.

Furthermore, to qualify for benefits, you must have earned at least $1,600 during your base period, as well as at least $440 outside of the base period quarter when your earnings were highest. If youâre filing an unemployment claim in April 2020, your base period is January through December 2019.

How To Calculate And Pay State Unemployment Tax

by Ryan Lasker | Updated Aug. 5, 2022 – First published on May 18, 2022

When a business finds itself in a financial bind, sometimes layoffs feel like the only option.

Unemployment benefit programs step in when employees are let go for reasons outside of their control. Employers pay unemployment tax to their state and the federal government so employees have a softer landing if theyre laid off.

Read Also: How Do I File Unemployment In Georgia

Cant Locate Your Illinois Unemployment Account Number And/or Taxpayer Id Number

To locate your Unemployment Account Number:

-

Locate your Unemployment Account Number on any previously filed Employers Contribution & Wage Report .

-

Locate your Unemployment Account Number on the Notice of Contribution Rate sent by IDES in December each year.

To locate your Taxpayer ID Number:

-

Locate your Taxpayer ID Number on any previous Illinois Withholding Income Tax Return .

Monthly Reporting And Filing Due Dates

Pursuant to Public Act 97-0689, employers with a cumulative total of 25 or more employees in the prior calendar year are required to submit monthly wage reports electronically. Employers will continue to submit quarterly contribution and wage reports, and submit eight additional monthly wage reports.

Read Also: How To Know If I Qualify For Unemployment

My Ilogin Account Is Locked What Should I Do

If your account has been locked, it will automatically unlock after 60 minutes. To unlock your account before 60 minutes, when signing into , expand the Need Help? and click on the Unlock account? link to initiate the account unlock. You will be asked to enter in your current email address or username, and select a security option to verify your identity . You will be required to provide your security question answer during the reset password process. Once you have unlocked your account, you may then need to initiate the Forgot Your Password process.

Read Also: Can I Collect Unemployment If Terminated While On Disability