Questions On Impact Of Unemployment Compensation Benefits Including Repayment And Overpayment On Your Form 1099

How will I know how much unemployment compensation I received?

If you received unemployment compensation or PUA during the year, you should receive Form 1099-G from the Delaware Division of Unemployment Insurance. The form will indicate the total amount of benefits received and the amount of federal taxes withheld. You will need to add the payment that is noted in the 1099-G form when preparing and reporting your income taxes to the Internal Revenue Service

If I repaid benefits that I had received, will I receive a 1099-G?

If you received UI benefits in the same year during which you repaid an overpayment of benefits, you will receive a 1099-G for that year. If you only repaid benefits received from prior benefit years, you will not receive a 1099-G.

What if I received an overpayment of benefits in one year and I repaid any of it in the same or subsequent calendar year?

Note: The total payment section on your 1099-G form includes all benefits paid to you during the calendar year, including benefits that were applied to an overpayment.

For more information on how to report your repayment of UC benefits on your tax return, see Unemployment Benefits and Repayments in IRS Pub. 525 or contact the IRS directly at 800-829-1040.

If I am no longer collecting unemployment benefits, how can I pay the tax due?

Can Furloughed Workers Receive Unemployment Benefits

Yes. Furloughed workers those put on mandatory unpaid leave â are encouraged to apply for Florida unemployment benefits. If your hours were reduced or you were put on a zero-hour schedule, you may be eligible for unemployment benefits.

Even if your employer says you wonât qualify, you should apply anyways. Eligibility is based on your earnings in a prior week, not the number of hours you worked. Once you apply for benefits, the Reemployment Assistance team will review your information and determine your eligibility.

How Was The Benefit Amount Listed On My 1099

Benefit amounts listed on the 1099-G are based on the total payments issued in 2021. View an example of how UI compensation is calculated.

- Unemployment Insurance is taxable, and while some claimants elected to have taxes deducted from weekly benefits payments, the amount shown on the 1099-G will be the pre-tax amount.

Recommended Reading: Can You Get Health Insurance On Unemployment

Where To Find Your 1099

We will mail a paper copy of your 1099-G to the address we had on file for you on December 31, 2021.

We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31, 2022.

It is too late to change your address for the 1099-G mailing, but you can access your 1099-G online.

- Pandemic Unemployment Assistance payments

- Supplemental payments

- Any other kind of unemployment benefit

The total on your 1099-G includes any amounts that were withheld on your behalf, such as:

- Federal taxes

- Child support

- Overpayment offsets

Your 1099-G total does NOT include benefit payments that were processed in 2022, even if those payments were for weeks in 2021.

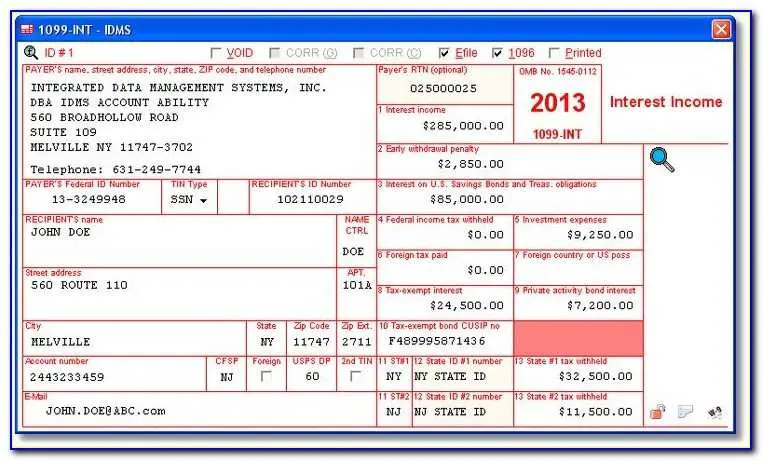

Why & How Is It Used

Document can be filed by your employer to report the amount of tax that was withheld from your paycheck. 1099 g form online is used to report the amount that employer has withheld from paycheck for federal taxes. 1099 G form is a document that is used to report the amount of state and local general sales fees for a given year. It is important to note that these are not federal fees like what are used to report on a 1040 tax.

State and local governments use this 1099-G unemployment to report the amount of taxes that were assessed and paid. This way, the IRS has a way to determine how much, if any, is owed in taxes to the federal government.

First part is a summary of the federal taxes that you have paid. It is the beginning of federal Form 1099 G that details the amount that you have paid in taxes. It is the sum of your personal information, such as social security number, the amount of gross income you received, and the amount of fees that were withheld from pay. Amount of taxes withheld may be different from the amount of federal taxes that you owe to the government. This is because the information on the document is reported by the employer, and employer may not have withheld the correct amount of fees . Second part is the state and local tax information.

Recommended Reading: How To Apply For Unemployment By Phone

Tax Impact Of Benefits

Unemployment benefits are included along with your other income such as wages, salaries, and bank interest . The total amount of income you receive, including your unemployment benefits, and your filing status will determine if you need to file a tax return.

TurboTax Tip: Use the TurboTaxUnemployment Benefits Center to learn more about unemployment benefits, insurance, and eligibility.

If Fraud Or Identity Theft Suspected Regarding Your Benefits And/or Form 1099

Will I receive a 1099G if I was a victim of identity theft?

It is the Departments goal to prevent any income that you did not receive or file for from being reported under your SSN. We are working diligently to process returned payments, debit cards, checks return a significant number of fraud calls and investigate identity theft complaints.

If you were a victim and payments were issued to you, but you returned the UC debit card, checks, or direct deposits that you received, you should NOT receive a 1099G. However, if you DO receive a 1099G and believe you shouldnt have because youve returned the funds and submitted an identity theft complaint, we ask for your patience while we work through our increased workload due to the pandemic.

If you were a victim of identity theft but no benefits were paid on the claim, you should NOT receive a 1099G. If a claim was opened and paid using your information and you did not receive the funds and therefore were unable to return them to the department, you should email the Delaware Division of Unemployment Insurance at to to file an identity theft complaint. Upon completion of the investigation, if it is found that you were a true victim of identity theft, a revised 1099G will be issued to you.

What do I do if I believe someone else filed and received UC benefit payments under my name or SSN without my permission?

You May Like: When Should You File For Unemployment

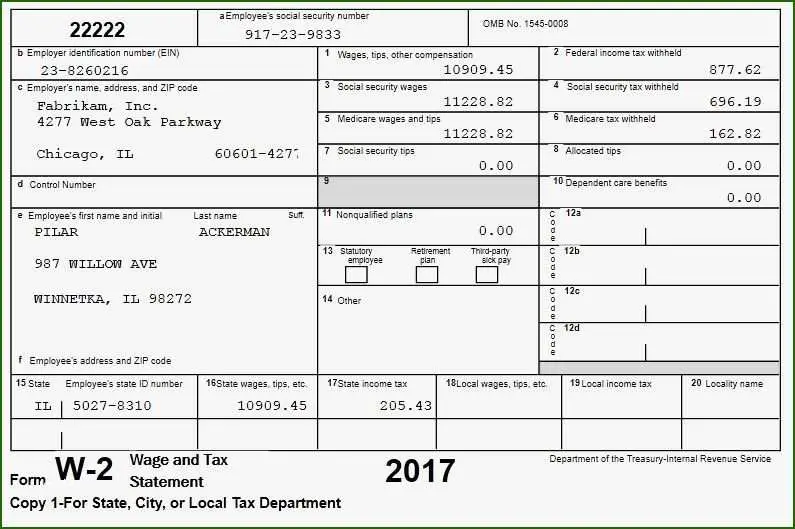

When Is A W

After the creation of a W-2 form, an employee must receive a W-2 by January 31, of the year after the tax year applicable. The Social Security Administration should also receive the W-2 by that date.

Tips

-

An employee can retrieve a copy of their W-2 by accessing their employerâs website or a payroll companyâs website. They can also request a copy from the IRS by paying a fee, filling out a form and mailing it in.

References

Also Check: What Do I Need From Unemployment To File My Taxes

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 18, 2022.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

Read Also: How To Get Taxes Taken Out Of Unemployment

Ive Started Working Again But Not Full Time Can I Continue Getting Unemployment Benefits

If you are working fewer hours than you were prior to losing employment and applying for benefits, you may still qualify for partial unemployment. Attorneys with Texas RioGrande Legal Aid tell clients in this situation to continue requesting payments like normal, including their income and hours worked.

Recommended Reading:

These Are The States That Will Not Mail You Form 1099

Missouri

- To access your Form 1099-G, log into your account through at uinteract.labor.mo.gov. From the UInteract home screen, click View and Print 1099 tab and select the year to view and print that years 1099-G tax form.

- The Missouri Division of Employment Security will mail a postcard no later than January 31, 2021, notifying anyone who has not accessed their Form 1099-G online about the availability of the form and how to access it.

New Jersey

- To access your Form 1099-G, check your email. You will receive your Form 1099-G by email. You can also use the Check Claim Status tool to get your Form 1099-G.

- If you prefer to have your Form 1099-G mailed, you may request a copy from your Reemployment Call Center. It may take 10 business days to receive a copy of your Form 1099-G.

New York

- To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

- If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

Wisconsin

You May Like: Can You Have An Llc And Collect Unemployment

Read Also: How To Provide Proof Of Income If Unemployed

What If I Am Denied Benefits How Can I Appeal A Denial Of My Claim

You could be denied benefits for a variety of reasons, including not completing paperwork in a timely manner, not having enough wages during your base period, or being disqualified because you were fired from your last position due to misconduct, among many others.

If you are denied unemployment benefits, Florida allows you to file an online appeal, by mail, or by fax. You will have 20 days to do so from the time you receive your determination notice. After receiving your appeal, the agency will schedule a telephone hearing and an appeals referee will rule on your case. A decision will then be mailed to you.

If you disagree with this decision, you can make an appeal to the Unemployment Appeals Commission, again within 20 days after you receive your notice. Commissioners will review your information and issue another written decision.

If you disagree with the Commissions findings, you can appeal that decision to the Florida District Court of Appeal.

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

You May Like: Where To Cash Unemployment Check

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2020 New York State Form 1099-G statement is the same as the 2019 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

How To Get Pua Tax Form

PUA-1099G forms must be mailed by January 31 each year. However, you can also view this form from your PUA dashboard. Only after you have tried to log into your dashboard and are unsuccessful, you can contact the department to request a duplicate form be emailed to you.

- For Pandemic Unemployment Assistance claimants, the forms will also be available online in the PUA portal. Claimants who received PUA benefits will have a separate 1099-G tax form than those claimants who received Unemployment Insurance , Pandemic Emergency Unemployment Compensation , and Extended Benefits .

Read Also: How Do I Get My Unemployment Tax Form Online

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Name

- Date of birth

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters weve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

- Name

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Donât Miss: Can I Get Obamacare If I Am Unemployed

Recommended Reading: Is Unemployment Extended New York

Mixed Earner Unemployment Compensation

The Mixed Earner Unemployment Compensation benefit is designed to provide additional assistance to individuals who had both W2 employment and self-employment/freelance/gig work prior to the pandemic. These individuals technically only qualified for regular unemployment benefits and were unintentionally left out of the Federal Pandemic Unemployment Assistance program.

Eligible individuals in this category, who earned more than $5,000 in self-employment income in 2019, can receive an additional $100 per week. Keep an eye out for correspondence from TWC about the MEUC program requesting action from you to start this benefit. for more information.

You May Like: How To Make Money When Unemployed

Requesting A Tax Return Transcript From The Irs

The IRS provides a service to request a tax return transcript from previous employers. This process can be done in one of two ways:

1) File form 4506-T and have the employer complete it, or

2) Request for the employer to electronically send the information directly to the IRS.

This service is usually used when there is a need to verify income for mortgage applications, student loans, credit card applications, etc.

After entering any other income not previously reported on a W-2 form or other tax form, submit your request online by following this link or call 1-800-908-9946.

You May Like: Is Unemployment Going To Be Extended

Can I Get My W2 From Unemployment Online

Request Your Unemployment Benefit Statement Online The statements, called 1099-G or Certain Government Payments, are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year. You can choose to receive your 1099-G, electronically through MiWAM or by U.S. mail.

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

Read Also: How Long Can You Draw Unemployment In Nc

Tax Reporting Requirements Associated With Form 1099

Do I need the 1099-G form to file my taxes?

Yes, you need the 1099-G form in order to complete and file your taxes.

Does UI benefit information need to be reported for Federal and State income taxes?

Yes, the Tax Reform Act of 1986 mandated that unemployment insurance benefits are taxable, and that any unemployment compensation received during the year must be reported on your federal tax return.

How will unemployment compensation affect my tax return?

If you do not have taxes withheld from your unemployment compensation, it could result in a tax liability.

Where do I find the Payers Federal Identification number?

You will find the federal identification number for the Delaware Department of Labor under the Payers name and address on the 1099-G form, immediately following the label FED EI#:.

Do I use the same Payers Identification number for Federal and State tax forms?

Yes.

What if I receive a Form UC-1099G after I have filed my federal income tax return with the IRS?

Questions concerning any adjustments that need to be made on your federal income tax return should be directed to the IRS at 800-829-1040.

Can I have federal income tax withheld from my unemployment compensation?