Federal Income Taxes & Your Unemployment Benefits Twc

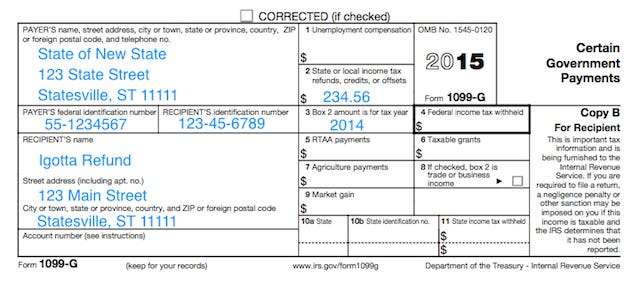

Posted: Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS.

How To Get Your 1099 Form

Posted: To quickly get a copy of your 1099-G or 1099-INT, simply go to our secure online portal, MyTaxes, at https://mytaxes.wvtax.gov/ and click the Retrieve Electronic 1099 link. This is the fastest option to get your form. To request a copy of your 1099-G or 1099-INT by phone, please call 558-3333. If you choose this option, it could take

Why Is My Overpayment Which I Repaid Not Reported On My Form 1099g

The amount in the Benefits Repaid box of Table A or Table B is based on payments processed between January 1 and December 31 of the tax year.

Only cash repayments are reported on Form 1099G. Benefits taken from your claim to repay an overpayment are not cash repayments, and are not included in this box. Penalties and other collection costs are not repayments of a benefit overpayment, and are not reported on Form 1099G.

For more information, visit Benefit Overpayment Services. To speak with a representative, call 1-866-401-2849, Monday through Friday, between 8 a.m. and 5 p.m. , except on state holidays.

Donât Miss: How To Get Unemployment In Tn

You May Like: How Can You Get Health Insurance If You Are Unemployed

How Many Weeks Of Unemployment Can You Get In New York

Pandemic Emergency Unemployment Benefit: New Yorkers can now receive up to 53 weeks of extended unemployment benefits. UI: If you havent worked for an employer since your first application, or earned ten times your weekly benefit percentage, you can also prove your current eligibility at the end of the work year.

What Is The Irs Form 1099

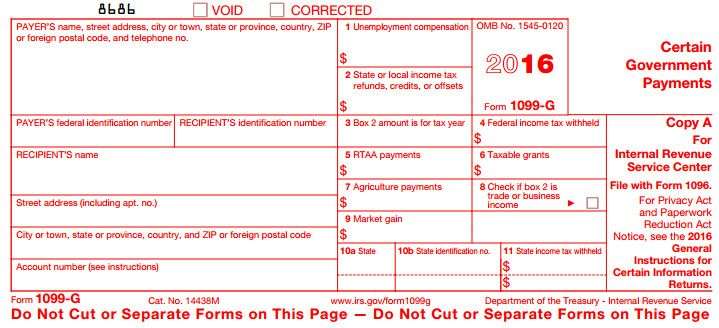

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

You May Like: How Do You Sign Up For Unemployment Benefits

How Taxes On Unemployment Benefits Work

Unemployment benefits are income, just like money you would have earned in a paycheck. Youll receive a Form 1099-G after the end of the year, which will report in Box 1 how much youve received in the way of benefits. The IRS will receive a copy as well.

You would have paid taxes on the full amount of your unemployment benefits if you filed your taxes before the ARPA was passed. The IRS issued a statement on March 31, 2021, urging taxpayers who had already filed not to file an amended return related to the new legislation. The IRS will recalculate and adjust all tax returns received prior to the ARPA that report unemployment income during the spring and summer of 2021 and will issue any resulting refunds.

Youll have to pay taxes on the remaining amount if you received more than $10,200 in unemployment compensation. Your 1099-G will have the information youll need to transfer to your tax return.

Unemployment compensation has its own line on Schedule 1, which accompanies your 1040 tax return. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1, and then the withholding amount in Box 4 of the 1099-G goes directly onto your 1040 tax return on Line 25b.

The amount that was withheld will appear in Box 4 if you asked to have income tax withheld from your benefits.

You must still report your unemployment compensation on your tax return, even if you dont receive a Form 1099-G for some reason.

What To Know When You File Your Taxes Next Year

If a recipient prefers to continue receiving the benefit without taking a chunk for taxes, the other method suggested is to increase your W-2 withholding to cover the amount owed on benefits when you return to work.

That means instead of being deducted from the benefit check immediately, youll have your take home pay reduced for the balance of the year when your regular job resumes.

If opting out of benefit withholding, a third method may be useful.

Determine the amount owed and file an estimated federal and state tax payments in three installments: July 15 September 15, and January 15, 2021.

Forms are available on the IRS and state tax web sites.

Calculating the amount due will depend on your tax bracket.

But as a general rule, be prepared to set aside at least 10% of your total jobless benefits for the federal hit and 2.5% for the state portion.

The worst case scenario that unemployed New Yorkers should look to avoid next year is owing a four-figure sum between federal and state taxes, with little or no savings to cover the bill, experts said

If they decide not to withhold, they may have a balance due and then theyre stuck and they dont have money for the balance due, Anderson said.

Don’t Miss: How Long Can You Receive Unemployment Benefits

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2021 New York State Form 1099-G statement is the same as the 2020 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

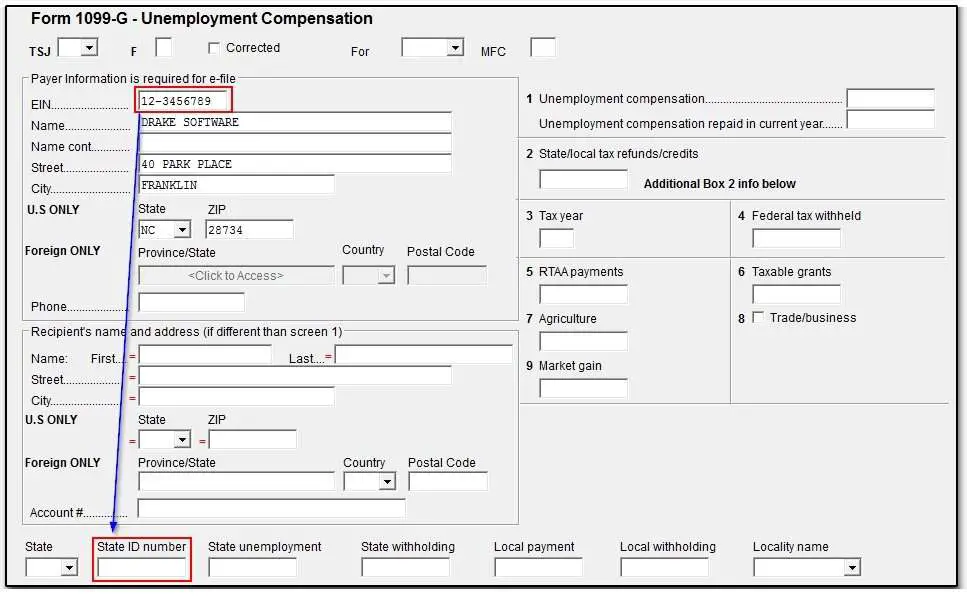

Where You Can Find The Tax Account Numbers Needed

If you are an existing employer who has previously run payroll in New York, you likely already have the IDs and online accounts needed for OnPay to process your tax filings.

If you are a new employer in New York, you will need to register your business with the New York Department of Taxation & Finance and the New York Department of Labor. This must be completed for OnPay to be able to file and pay your NY taxes.

Read Also: Va Unemployability Process

You May Like: When Will 300 Unemployment Start In Nj

What If Youre Collecting Unemployment From Ny But Live In Nj

New Jersey doesnt tax unemployment compensation, but you will need to pay non-resident New York State taxes on this income, says Engel. In addition, while the American Rescue Plan Act exempts a certain portion of your unemployment compensation, New York has not adopted this tax exemption. Therefore, unemployment is fully taxable at the federal level.

Engel notes that its important to deduct both federal and New York state taxes from unemployment income to avoid any surprises on your 2021 tax return.

You May Like: What Happens To Unclaimed Unemployment Benefits

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

Read Also: Can Llc Owner Collect Unemployment

Also Check: Can You Get An Advance On Unemployment

The Way To Generate An Electronic Signature For A Pdf On Android

In order to add an electronic signature to a 1099 unemployment ny, follow the step-by-step instructions below:

If you want to share the 1099 ui form with other people, you can easily send the file by e-mail. With signNow, you are able to eSign as many papers daily as you need at a reasonable cost. Begin automating your eSignature workflows right now.

Recommended Reading: How To Apply For Unemployment In Missouri

What Happens When I Run Out Of My Unemployment

When your original application for unemployment benefits expires, you will no longer receive unemployment benefits, unless you can request an extension of your unemployment benefits. If you submit a new unemployment benefit application after your first unemployment benefit application, your benefit year will not start again.

Recommended Reading: How To Sign Up For Unemployment In Missouri

Know The Signs Of Identity Theft

Taxpayers do not need to file a Form 14039, Identity Theft Affidavit, with the IRS regarding an incorrect Form 1099-G. The identity theft affidavit should be filed only if the taxpayers e-filed return is rejected because a return using the same Social Security number already has been filed.

See Identity Theft Central for more information about the signs of identity theft and general steps that should be taken.

Additionally, if taxpayers are concerned that their personal information has been stolen and they want to protect their identity when filing their federal tax return, they can request an Identity Protection Pin from the IRS.

An Identity Protection PIN is a six-digit number that prevents someone else from filing a tax return using a taxpayers Social Security number. The IP PIN is known only to the taxpayer and the IRS, and this step helps the IRS verify the taxpayers identity when they file their electronic or paper tax return.

How Do I Get A Copy Of My 1099g

If you have a Paid Family Leave claim or you are unable to access your information online, you can request a copy of your Form 1099G by calling the EDDs Interactive Voice Response system at 1-866-333-4606. The IVR system is available 24 hours a day, 7 days a week. A copy of your Form 1099G will be mailed to you.

Also Check: How Do Unemployment Taxes Work

Individual Income Tax Information For Unemployment Insurance Recipients

- Current: 2020 Individual Income Tax Information for Unemployment Insurance Recipients

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return.

Total taxable unemployment compensation includes the new federal programs implemented in 2020 due to COVID-19:

- Federal Pandemic Unemployment Compensation

For additional information, visit IRS Taxable Unemployment Compensation.

Note: Benefits are taxed based on the date the payment was issued.

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Recommended Reading: How To Collect Unemployment In Nj

Dont Get Hit With Unexpected Tax Bill From Unemployment Insurance Payments New York State Tax Department Shares Money

For Release: Immediate, Tuesday, September 22, 2020

For press inquiries only, contact: James Gazzale, 518-457-7377

The New York State Department of Taxation and Finance today encouraged New Yorkers to review their current tax situation. By taking a closer look at your tax records now, you can ensure you dont end up owing unpaid taxes, and you may be able to claim valuable tax credits when you file your income tax return next year.

We understand many New York taxpayers are facing challenges this year, which is why were reminding them of all the money-saving tax programs and refundable tax credits available, said New York State Commissioner of Taxation and Finance Mike Schmidt. We also want taxpayers to understand that unemployment insurance payments are taxable. As a result, some taxpayers may need to adjust their withholding to prevent a tax bill in 2021.

Unemployment benefits are taxable benefits

If you are receiving unemployment benefits, consider having tax withheld from these payments to avoid owing taxes when you file your federal and New York State income tax return next year. New York State unemployment insurance benefits and any of the special unemployment compensation authorized under the Coronavirus Relief Act are considered taxable income. By law, the New York State Department of Labor must report these benefits to the IRS and to the New York State Tax Department.

Tax credits put money back in your pocket

When And How Will Nysdol Provide Tax Form To Claimants

Later in January. Once its available, claimants can access the 1099G immediately on our website at www.labor.ny.gov. If they dont have internet access, they can also request it be mailed to them, by calling the TCC telephone number and following directions.

Note: Once the 1099G is available, an option is added to the TCC IVR, that allows claimants to request mailing of this form through an automated system.

1099 coming soon message that is being played currently on TCC IVR

Please note Tax Form 1099G will not be mailed automatically. Soon you can view and print your 1099G for calendar year < 2020> on our website. This form shows the total amount of unemployment benefits paid during the < 2020> calendar year. If you want your 1099G to be mailed to you, call this number again once your 1099G is available and make your request.

When 1099G becomes available:

Please note tax form 1099G is only mailed upon request. However, you can immediately view and print your 1099G for the calendar year < 2020> on our website at labor.ny.gov. To have a 1099G mailed to you, press 1 now. Otherwise, press 9 to continue to the main menu.

Where to find additional information about the 1099G

Detailed information has been added to NYSDOLs website

What if claimant disagrees with information on their 1099G?

You May Like: When Will Nj Get Extra $300 Unemployment

Is The State Of New Jersey Sending Form 1099

The State of New Jersey does not mail Form 1099-G, Certain Government Payments, to report the amount of a State tax refund a taxpayer received. State Income Tax refunds may be taxable income for federal purposes for individuals who itemized their deductions on their federal tax return in the previous year.

Ny Unemployment Insurance Benefits In 2020

While the passing of the American Rescue Plan unlocked additional relief for taxpayers in New York that received unemployment benefits in 2020, the state will continue to tax unemployment benefits.

Taxpayers with an adjusted gross income of less than $150,000 will not pay federal income taxes on the first $10,200 received for unemployment benefits in 2020. Individuals filing form 1040-NR will not be eligible for the federal tax credit.

New Yorks unemployment rate is second highest in the nation after Hawaii. And despite the state Department of Labor disbursing more than $69 billion in unemployment benefits in 2020, Budget Director Robert Mujica said New York intends to continue taxing unemployment benefits doled out during the pandemic.

There has been no change to the taxable status of the unemployment benefits, Mujica said Wednesday. Those benefits have been subject to state tax for decades and that has not changed.

You May Like: How To Submit Job Search For Unemployment

What Is Form 1099

Form 1099-G is used by federal, state, or local governments to report certain types of payments to the IRS and to provide a statement with the same information to those who received those payments.

If you received either a New York State refund or unemployment compensation, you should obtain your Forms 1099-G online and save or print copies for your records. You may be required to report the information from one or both when you file your federal and state income tax returns.

What You Need To File For Unemployment Benefits

Heres whatyou need to file for unemployment benefits in your state:

Note that your state may require additional information.

However, the list below is generally what you will need to apply for benefits.

To file for Unemployment benefits, you need to provide personal information including:

- Social Security number

Furthermore, you also need information about your employment history from the last 15 months, including:

- Names of all employers, plus addresses and phone numbers

- Reasons for leaving those jobs

- Work start and end dates

- Recall date

Also, you may need additional information in certain situations:

- If you are not a U.S. citizen your Alien Registration number

- If you have children their birth dates and Social Security numbers

- For those who are members of a union your union name and local number

- If you were in the military your DD-214 Member 4 form. If you dont have it, you can request your DD-214 online.

- For those who worked for the federal government your SF8 form

Scroll down below for information on how to file for Unemployment benefits in your state

You May Like: How Do I Sign Up For Unemployment In Tn

Read Also: What Number Do I Call For Florida Unemployment

Other Payments Covered By Form 1099

The other reasons you may receive Form 1099-G include the following types of payments:

- Reemployment trade adjustment assistance payments. These are shown in Box 5.

- Taxable grants received from federal, state and local governments. These are shown in Box 6.

- Taxable payments from the Department of Agriculture. These are shown in Box 7.