You Can File Sooner With Online W

Fortunately, many people can get their W2 online, and they can simply import it into their tax returns. Various companies provide it online, even the military, Walmart, and McDonalds.

The W2 online distribution process has been simplified and automated by third-party companies. These payroll or W-2 distribution firms often make the form available for free on the Internet.

Employees, therefore, do not have to wait on the mail and can file their taxes sooner. Also, the process reduces a significant amount of paper waste across the country.

You May Like: Can You Get Unemployment If You Are Fired

These Are The States That Will Not Mail You Form 1099

Missouri

- To access your Form 1099-G, log into your account through at uinteract.labor.mo.gov. From the UInteract home screen, click View and Print 1099 tab and select the year to view and print that years 1099-G tax form.

- The Missouri Division of Employment Security will mail a postcard no later than January 31, 2021, notifying anyone who has not accessed their Form 1099-G online about the availability of the form and how to access it.

New Jersey

- To access your Form 1099-G, check your email. You will receive your Form 1099-G by email. You can also use the Check Claim Status tool to get your Form 1099-G.

- If you prefer to have your Form 1099-G mailed, you may request a copy from your Reemployment Call Center. It may take 10 business days to receive a copy of your Form 1099-G.

New York

- To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

- If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

Wisconsin

You May Like: Can You Have An Llc And Collect Unemployment

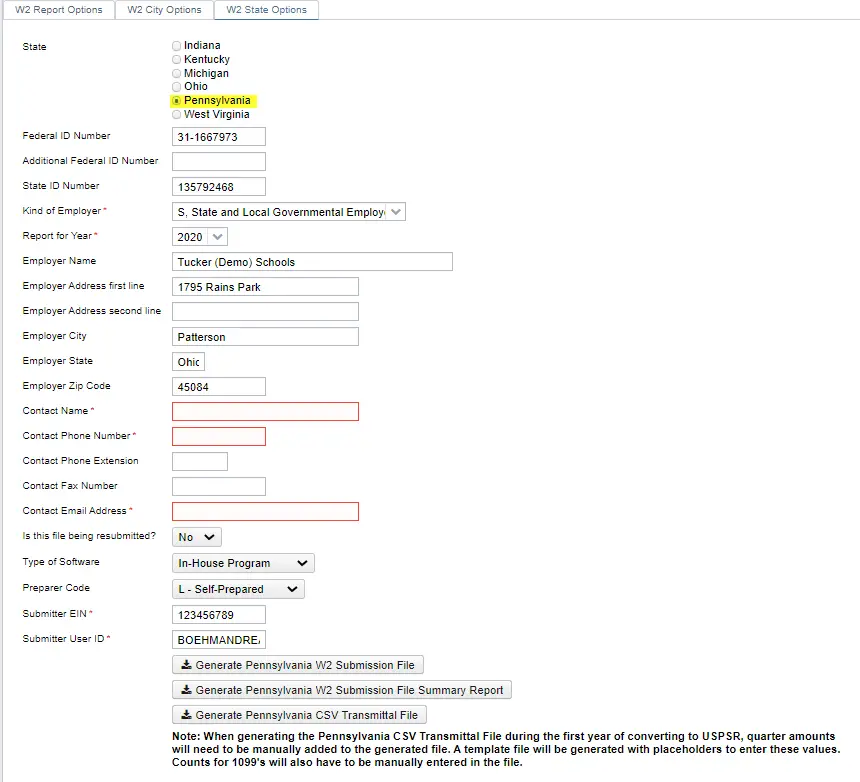

Pa Unemployment W2 Form Online

Pa Unemployment W2 Form Online If youre one from the millions of people that filed your earnings taxes using the US government this year, youre probably heading to need to know what a W2 Form is and whether or not or not you need to file one. In this short post, I am heading to briefly explain what a W2 Form is, and then Im heading to tell you what to do with it as soon as you get it in the mail.

First of all, a W2 Form is really a type of tax return thats submitted by a taxpayer. Its used to provide information on just how much income the taxpayer has, just how much income she or he has paid out, and what deductions and credits have been claimed on a tax return. Most taxpayers file a W2 Form once a year nevertheless, you can select to file a more comprehensive one every year, up to four.

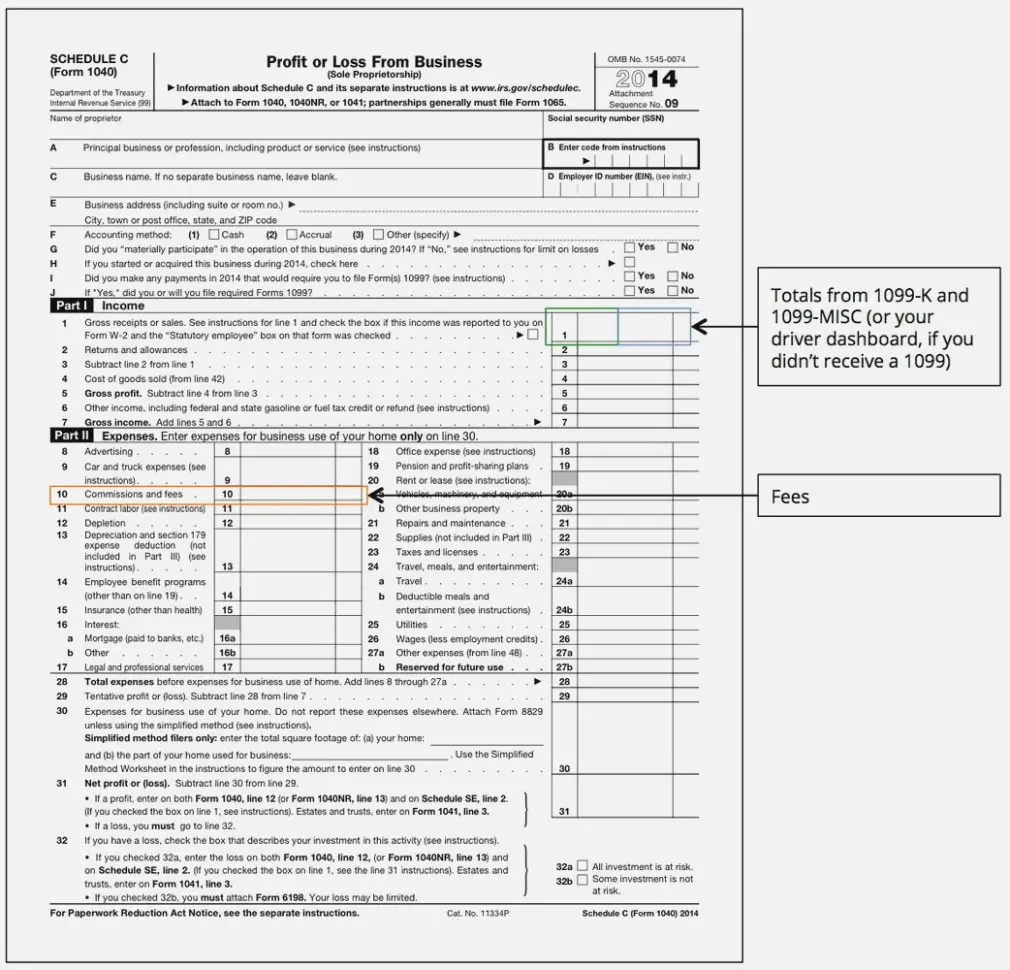

If youre a self-employed individual, or are planning on becoming one, you can choose to file your taxes each year. However, its not suggested that you do so, because the IRS has rules about self-employed taxpayers that you must adhere to. If you select to file your taxes each year, its crucial to consider a glance at what your tax form contains in order to make sure that youre complying with all the guidelines and regulations. Put simply, dont just presume that youre compliant.

Don’t Miss: How Do I File An Appeal For Unemployment

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2021 New York State Form 1099-G statement is the same as the 2020 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

Also Check: Where Can I Get My Unemployment Tax Form

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Next Section

Read Also: Do You Need To Report Unemployment On Your Taxes

You May Like: Who To Call For Unemployment

Everything Employers Need To Know About Paying Unemployment Insurance Taxes In Texas

By David M. Steingold, Contributing Author

If your small business has employees working in Texas, youll need to pay Texas unemployment insurance tax. The UI tax funds unemployment compensation programs for eligible employees. In Texas, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, Texas does not have state withholding taxes. However, other important employer taxes, not covered here, include federal UI and withholding taxes.

Different states have different rules and rates for UI taxes. Here are the basic rules for Texass UI tax.

Note: Texas often refers simply to unemployment tax rather than unemployment insurance tax.

Note On Taxable Income

The American Rescue Plan Act of 2021 contains provisions regarding taxable unemployment compensation. Please direct all tax filing questions to the IRS, and visit their website for the most recent guidance.

Image source: /content/dam/soi/en/web/ides/icons_used_on_contentpages/IDES_icon_blue_warning_67px.png

Recommended Reading: Pa Unemployment Ticket Number Status

Recommended Reading: Can You Draw Unemployment If You Get Fired

Work Search Requirement Reinstated

On Sunday, July 4, Maryland LABOR reinstated the standard active search for work requirement for all claimants receiving regular unemployment insurance benefits. Claimants receiving benefits under the Pandemic Unemployment Assistance and Pandemic Emergency Unemployment Compensation federal programs must meet the active search for work requirement beginning Sunday, July 18, 2021.

All claimants must actively search for work by completing at least three valid reemployment activities each week, which must include at least one job contact. Claimants must satisfy the active search for work requirement to maintain their eligibility for UI benefits.

Valid reemployment activities are intended to help a claimant become reemployed and remove potential barriers to employment. Qualifying activities include, but are not limited to: activities completed through the Maryland Workforce Exchange , such as setting up a virtual recruiter or completing a skills self-assessment attending networking events creating a résumé in MWE and attending employment events held by the Maryland Division of Workforce Development and Adult Learning . For a full list, see .

Job contacts refer to actions a claimant takes to contact employers in an attempt to secure employment. Acceptable job contacts include: submitting a job application to an employer interviewing for a job or completing a pre-screening for a job interview among other actions.

Extra $300 Per Week Ended June 26

Everyone who was eligible for unemployment benefits will no longer receive an extra $300 per week, which was availableunder the Federal Pandemic Unemployment Compensation program.

The $300 supplement expired June 26. The federal legislation extended the supplement through Sept. 4, but Abbott said Texans would stop receiving the money in June.

NOTE: A previous $300 boost authorized by the Lost Wages Assistance program last year was not available to people receiving less than $100 per week in unemployment benefits. This new supplement was authorized by a different program, and the same rules do not apply.

Also Check: How Do I Sign Up For Unemployment In Tn

You May Like: Where Do I Find My Unemployment 1099

Will I Have To Complete Identity Verification To Access My Form Online

If you have not already completed identity verification and you are only accessing your 2021 1099-G, you will not be required to complete ID.me verification. If you need to take additional actions with your claim, you may be required to complete ID.me verification. Identity verification is one of the fraud prevention tools implemented by DES to stop bad actors from using stolen identities to claim unemployment benefits.

Who Can Get Their W2 Online

Many companies, including the military, have their employees W-2s available online for free. In addition, the documents can be downloaded via a variety of outsourcing companies, so the distribution process of the W-2s is automated. Your employer should alert you as to whether or not you will be able to access your W2 online.

Suppose they do allow you to access it online. In that case, you will get the benefit of being able to file your taxes earlier, in addition to not waiting for paper copies and eliminating the security risks that come along with having that information sitting around on paper.

Read Also: Filing Taxes If You Received Unemployment

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

The Quickest Way To Obtain A Copy Of Your Current Year Form W

How to get my w2 from unemployment nj. Unemployment benefits including Federal Pandemic Unemployment Compensation FPUC Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Lost Wages Assistance LWA and Extended Benefits EB are taxable income. You have reached Indianas one stop shop for Unemployment Insurance needs â for Individuals who are Unemployed and for Employers. Can I Get My 2009 Michigan Unemployment W2 Online.

How to Get an Online Statement From Unemployment in New Jersey. When Do I Get My Nj Unemployment W2. Pacific time except on state holidays.

They arrive at the end of the month. 14 of the W-2 Statement to provide its employees with information regarding items that may or may not impact the calculation of taxable wages appearing in Boxes 1 3 5 and 16. You can opt to have federal income tax withheld when you first apply for benefits.

Can I Get My Kentucky Unemployment W2 Online. Contact the IRS at 800-829-1040 to request a copy of your wage and income information. Click here for the Request for Change in Withholding Status form.

Mail the completed form to. To view and print your current or. Call the IRS at 1-800-829-1040 after February 23.

You may be able to locate the information online. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. You can also use Form 4506-T to request a copy of your previous years 1099-G.

Re My Nj Sdi Is Greater Then 60 What Can I Do To

Don’t Miss: Do You Have To Pay Taxes On Unemployment Income

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Unemployment Insurance Benefits Tax Form 1099

DES has mailed 1099-G tax forms to claimants who received unemployment benefits in 2021. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

You May Like: How Much Taxes Do You Pay On Unemployment In California

These Are The States That Will Either Mail Or Electronically Deliver Your Form 1099

California

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at and select 1099G at the top of the menu bar on the home page.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by: logging into your account at selecting 1099G at the top of the menu bar > View next to the desired year > Print or Request Paper Copy.

You can also request a paper copy by calling 1-866-333-4606.

Florida

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at myflorida.com and go to My 1099-G & 49Ts in the main menu.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed at 1099grequest.myflorida.com.

Illinois

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at ides.illinois.gov. Illinois Department of Employment Security will send an email notification with instructions to access the document from the Illinois Department of Employment Security website.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by calling 338-4337.

Indiana

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at in.gov. You will find your Form 1099-G on your Correspondence page.

If you opted into electronic delivery:

Michigan

Donât Miss: Can You File Taxes If You Only Received Unemployment

How To Get Unemployment W2

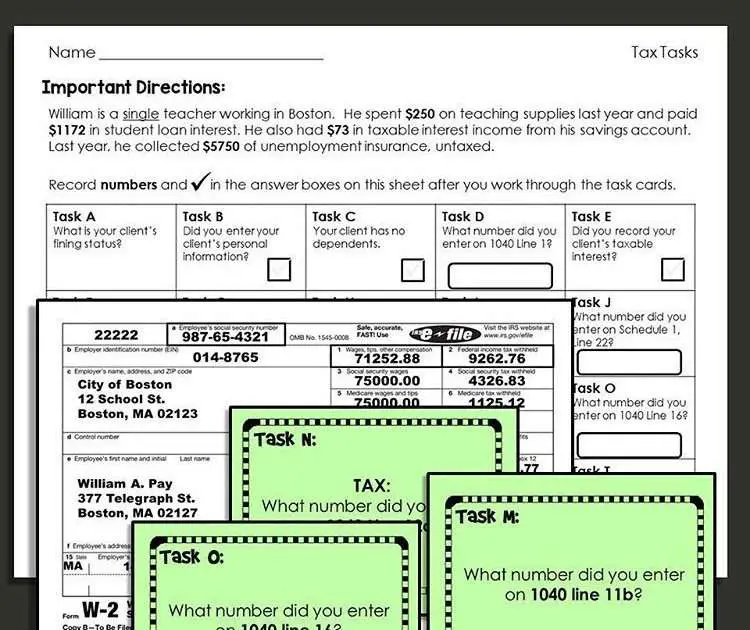

W2 is identified as a wage and tax statement. It is a form given by employers to employees. This tool accounts for employees yearly wages and the sum of taxes withheld from their paychecks. The Internal Revenue Service also utilizes the W-2 form to monitor each persons tax obligations.

The Statement for Recipients of Certain Government Payments tax forms is supposed to be available in mid-January 2022 for New Yorkers who accepted unemployment compensations in 2021. This tax form includes the total amount of money you were paid in benefits from your state in 2021, as well as any changes or tax withholding made to your benefits. Compensations paid to you are considered taxable income. You need to add this form with your tax filing for the year 2021. If you were a contractor, youd get a 1099 form instead.

Read Also: How Much Does Unemployment Pay

Also Check: Can I File For Disability While On Unemployment

How Was The Benefit Amount Listed On My 1099

Benefit amounts listed on the 1099-G are based on the total payments issued in 2021. View an example of how UI compensation is calculated.

- Unemployment Insurance is taxable, and while some claimants elected to have taxes deducted from weekly benefits payments, the amount shown on the 1099-G will be the pre-tax amount.

Ive Started Working Again But Not Full Time Can I Continue Getting Unemployment Benefits

If you are working fewer hours than you were prior to losing employment and applying for benefits, you may still qualify for partial unemployment. Attorneys with Texas RioGrande Legal Aid tell clients in this situation to continue requesting payments like normal, including their income and hours worked.

Recommended Reading:

Recommended Reading: Texas Workforce Commission Unemployment Tax Services

Unemployment Claim And Appeal Process

The Texas Workforce Commission holds responsibility for the state unemployment compensation program. Below is a brief outline of the unemployment claim and appeal process, in order of occurrence.

Initial Claim: Once an employee is no longer working, a work separation occurs and the worker may file an initial claim for unemployment benefits. If the claimant is out of work due to no fault of his own, and otherwise eligible, benefits are payable.

- Immediately after the initial filing, TWC mails a notice of the initial claim, a notice of application for unemployment benefits, to the organization or individual listed as the last employing unit where the claimant last worked for pay.

- The employer has 14 calendar days to file a timely written response to make itself a party of interest with appeal rights.Claim responses may be filed by mail, fax, telephone, or by TWCs Internet claim.

Initial Determination: TWC makes an initial determination, a determination on payment of unemployment benefits, and mails copies of the decision to all interested parties. If the employer filed a late response to the initial claim, the determination is a late protest ruling.

Appeal Tribunal: Once an appeal has been filed, the Appeals Department dismisses the appeal, issues an on-the-record decision, or sets up an appeal hearing.

Court Appeal: A Commission decision is final 14 calendar days from the date it is mailed.