How To Get 1099 From Indiana Unemployment

Posted: Call your local unemployment office to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Delaware Income Tax 1099g Information

Posted: 1099-Gs were mailed during the week of January 25th. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G will NOT be forwarded by the United States Postal Service. The Delaware Division of Unemployment Insurance cannot update your mailing address for this 1099 cycle.

What To Do If Your Debit Card Has Expired Social Security

If they sent you a card and you didnt receive it and your current card has expired, you should call them and ask them to cancel the card that never arrived and leave you. Remember, they wont write you a check in the meantime, because the government has stopped issuing checks for Social Security benefits.

Dont Miss: How Long Does Unemployment Take To Direct Deposit

Don’t Miss: Pa Unemployment Ticket Number

How To Get Your 1099 Form

Posted: To quickly get a copy of your 1099-G or 1099-INT, simply go to our secure online portal, MyTaxes, at https://mytaxes.wvtax.gov/ and click the Retrieve Electronic 1099 link. This is the fastest option to get your form. To request a copy of your 1099-G or 1099-INT by phone, please call 558-3333. If you choose this option, it could take

Does A 1099 Get Reported To Unemployment

Freelancer, independent contractor, gig worker whatever you call it, entrepreneurial work is an advantageous work arrangement. You can set your own schedule and work on your terms. But working as an independent contractor isnt all daisies in fact, sometimes it can be a thorny rose.

In times of hardship, unemployment benefits are a nice safety net. However, for contractors, this adds a new layer of complexity to their finances.

How much can you make on unemployment? Does your 1099 get reported to unemployment if you qualify? Can you even file for unemployment if you are a 1099 worker?

These are all valid questions, and were going to answer them for you. Read on to learn the answers to these questions and more.

You May Like: Unclaimed Unemployment Benefits

How To File Form 1099

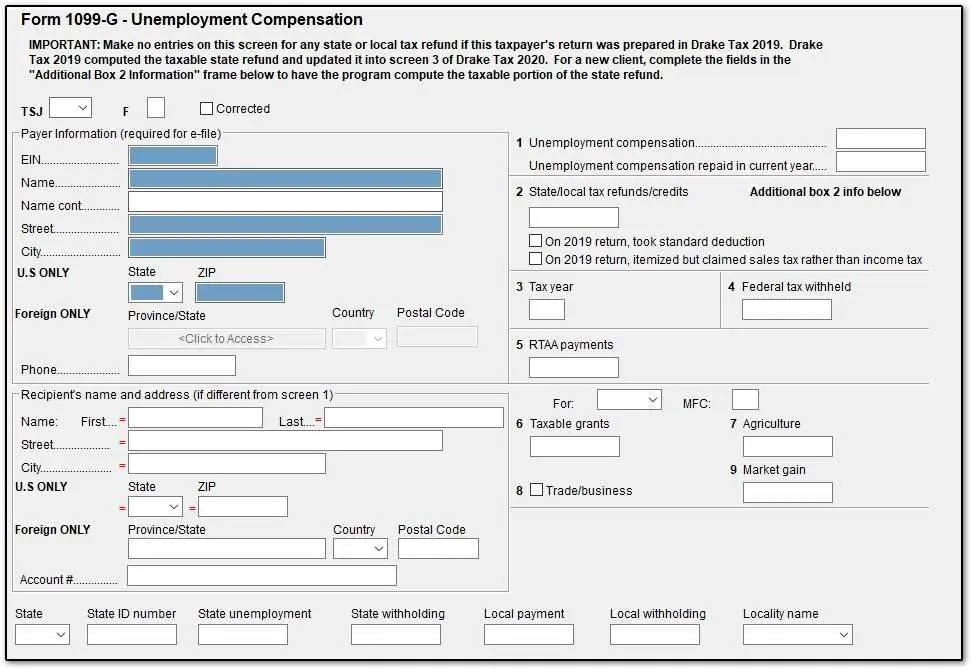

Posted: If you received a Form 1099-G for unemployment compensation that you received during the year, you can enter this in your account go to: Federal Section. Income Select My Forms. Form 1099-G Box 1 Unemployment Compensation. Add or Edit a 1099-G. The exclusion will be applied automatically based on the entries in the program.

You May Like: Where Do I Get My W2 From Unemployment

What Happens When I Run Out Of My Unemployment

When your original application for unemployment benefits expires, you will no longer receive unemployment benefits, unless you can request an extension of your unemployment benefits. If you submit a new unemployment benefit application after your first unemployment benefit application, your benefit year will not start again.

You May Like: How Do I Sign Up For Unemployment In Washington State

Read Also: Pa Unemployment Ticket Number Lookup

How Do I Get My 1099 2020

Online

Recommended Reading: Can You Get Unemployment If You Are Fired

Look Up Your 1099g/1099int

To look up your 1099G/INT, youll need your adjusted gross income from your most recently filed Virginia income tax return .

Please note: This 1099-G does not include any information on unemployment benefits received last year. If youre looking for your unemployment information, please visit the VECs website.

Note: We will not mail paper 1099G/1099INT forms to taxpayers who chose to receive them electronically unless we receive a request for paper copies of these forms from the taxpayer. We will automatically mail paper forms to taxpayers who did not opt to receive them electronically.

You May Like: Is There An Extension For Unemployment

Recommended Reading: Maximum Unemployment Benefits Mn

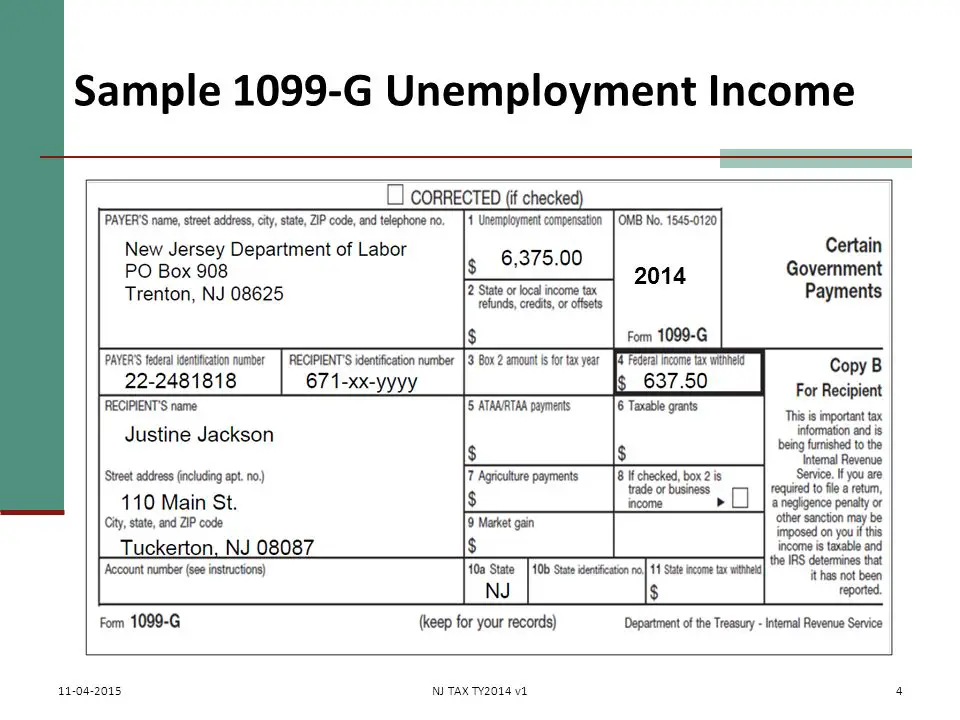

What Is Reported On My 1099

DES reports the total amount of unemployment benefits paid to you in the previous calendar year on your 1099-G. This amount is based upon the actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

Also Check: How Much Does Unemployment Pay In Texas

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

Also Check: Minnesota Unemployment Maximum

Individual Income Tax Information For Unemployment Insurance Recipients

- Current: 2020 Individual Income Tax Information for Unemployment Insurance Recipients

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return.

Total taxable unemployment compensation includes the new federal programs implemented in 2020 due to COVID-19:

- Federal Pandemic Unemployment Compensation

For additional information, visit IRS Taxable Unemployment Compensation.

Note: Benefits are taxed based on the date the payment was issued.

These Are The States That Will Not Mail You Form 1099

Missouri

- To access your Form 1099-G, log into your account through at uinteract.labor.mo.gov. From the UInteract home screen, click View and Print 1099 tab and select the year to view and print that years 1099-G tax form.

- The Missouri Division of Employment Security will mail a postcard no later than January 31, 2021, notifying anyone who has not accessed their Form 1099-G online about the availability of the form and how to access it.

New Jersey

- To access your Form 1099-G, check your email. You will receive your Form 1099-G by email. You can also use the Check Claim Status tool to get your Form 1099-G.

- If you prefer to have your Form 1099-G mailed, you may request a copy from your Reemployment Call Center. It may take 10 business days to receive a copy of your Form 1099-G.

New York

- To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

- If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

Wisconsin

Also Check: Unemployment Eligibility Tn

New Exclusion Of Up To $10200 Of Unemployment Compensation

If your modified adjusted gross income is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you dont have to pay tax on unemployment compensation of up to $10,200. If you are married, each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you file Form 1040-NR, you cant exclude any unemployment compensation for your spouse.

The exclusion should be reported separately from your unemployment compensation. See the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure your exclusion and the amount to enter on Schedule 1, line 8.

When figuring the following deductions or exclusions from income, if you are asked to enter an amount from Schedule 1, line 7 enter the total amount of unemployment compensation reported on line 7 and if you are asked to enter an amount from Schedule 1, line 8, enter the amount from line 3 of the Unemployment Compensation Exclusion Worksheet. See the specific form or instructions for more information. If you file Form 1040-NR, you arent eligible for all of these deductions. See the Instructions for Form 1040-NR for details.

Unemployment Vs Gig Work

Unemployment. Gig work. There are quite a few differences between these two forms of income. And, luckily for you, you dont have to find the differences for yourself. Weve done the leg work for you. Lets take a look at the distinctions between collecting unemployment and accepting gig work shifts.

Read Also: If Im On Unemployment Can I Get Food Stamps

What If I Havent Filed A Tax Return

TAXPAYERS had until May 17 to file an extension if they needed more time to submit their returns.

If you didnt file a tax return or an extension, but should have, you need to take action â or the penalties you face may increase.

If you file your return over 60 days late, youll have to pay a $435 fine or 100% of the tax you owe â whichever is less.

However, there is no penalty for filing a late return after the tax deadline if a refund is due, said the IRS.

If you didnât file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest.

You wonât have to pay the penalties if you can show âreasonable causeâ for the failure to do so on time â we explain how in our guide.

Recommended Reading: What Can I Write Off On My Taxes For Instacart

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Recommended Reading: File For Unemployment In Tn

Note On Taxable Income

The American Rescue Plan Act of 2021 contains provisions regarding taxable unemployment compensation. Please direct all tax filing questions to the IRS, and visit their website for the most recent guidance.

Image source: /content/dam/soi/en/web/ides/icons_used_on_contentpages/IDES_icon_blue_warning_67px.png

Did You Receive A 1099

I received a 1099-G from the Ohio Department of Taxation :

If you received a 1099-G from ODT, please click here for additional information and frequently asked questions.

I received a 1099-G from the Ohio Department of Job and Family Services :

If you DID apply and/or receive unemployment benefits from ODJFS:

1. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. Unemployment benefits are taxable pursuant to federal and Ohio law.

a. Visit the IRS website here, for specific information about the IRS adjustment for tax year 2020.

b. Ohio law is in conformity with federal law, therefore the provisions applicable under federal law are also applicable under Ohio law.

If you DID NOT apply to receive unemployment benefits from ODJFS:

1. It is very important that you notify ODJFS to report identity theft and receive a corrected 1099-G.

-

Please notify ODJFS by visiting: , click on the “REPORT IDENTITY THEFT” button, and complete the form.

-

Once ODJFS verifies the ID theft claim, a corrected 1099-G will be issued. You should retain the corrected 1099-G for your records.

2. Generally, you should not include unemployment benefits you did not apply for as income on your federal and state income tax returns.

Don’t Miss: Unemployment Benefits Tennessee Eligibility

How Can I Download My 1099

Posted: Mar 30, 2018 · If you were out of work for some or all of the previous year, you arent off the hook with the IRS. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Youll also need this form if you received payments as part of a governmental paid family leave program. But you dont have to wait for your copy of the form to arrive in the mail.

Notice To Representatives Of Deceased Claimants

Q: How do I access the 1099-G tax form if I am the representative of a deceased claimant?

A: For the New York State Department of Labor to provide you with information belonging to a deceased unemployment insurance claimant, you must first show that you are legally authorized to receive this information. Authorization often comes from the New York State Surrogate Court, and may be one of the following:

- Appointment as an Executor

- Appointment as a Voluntary Administrator

If the deceased claimant had no assets, or all property owned by the deceased claimant was owned in common with someone else, then no Executor or Administrator may have been appointed. The representative of the deceased claimant must provide proof that they are authorized to obtain the information. In this case, a surviving spouse should provide NYS DOL with:

Please submit proof that you are authorized to receive the deceased claimants information using one of the following methods:

Recommended Reading: Filing Unemployment In Tn

You Deducted Your State Income Taxes On Your Us

How do i get my 1099 g from unemployment online illinois. Individuals can access copies of 1099 forms by logging into the ui tax & claims system , sunday through friday from 4:00 a.m. Eligible illinois claimants will receive a $300 lwa payment retroactively starting with the benefit week ending august 1, 2020. If you have been temporarily laid off or furloughed, please see information about unemployment insurance and temporary layoffs.

The new mexico department of workforce solutions mails all unemployment insurance 1099 tax information by the last day of january each year. Payments are scheduled to begin the week of september 6th. Your illinois income tax payments for the tax year exceeded your actual tax liability .

When you are temporarily or permanently out of a job, or if you work less than full time because of lack of work. Form 1040, schedule a, for a tax year and Rtaa benefits are also reported on a separate form.

After you are logged in, you can also request or discontinue. You will need this information when you file your tax return. If you had filed an unemployment claim, returned to work, but now need to file again, please see information about filing an additional claim.

Mytax illinois if you do not have a mytax account, you must sign up for one. For additional questions, see our lost wages assistance information and faqs. The department has worked to ensure information was correct to the best of its ability.

What Bank Does Louisiana Unemployment Use

It may be 3 or 4 days after you file your weekly claim before the benefits are available through the debit card. You may inquire about the balance on the card, without charge, by contacting the customer service center listed on the card. If you have problems with the debit card, contact Chase Bank at 1- 866-795-5926.

Recommended Reading: Nc Unemployment Weekly Certification Phone Number

Note That Pursuant To The Irs Webpage The Following Now Applies To Your Federal Taxes

How to get my w2 from unemployment online. Call your local unemployment office to request a copy of your 1099-G by mail or fax. Claim ID also referred to as Claimant ID in letters. If you need a copy of your 1099G you can view and print your 1099G for calendar year 2013 on the NYS Department of Labor website.

Then you will be able to file a complete and accurate tax return. To view and print your current or previous year 1099-G tax forms online logon to the online. Include the following in your email.

Both of these companies can look-up the company you work for or they can use your Employer Identification Number to find your W2. The table below links to some of the common websites. If you got unemployment in 2020 but your 1099-G includes benefits for weeks you didnt claim.

Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. Youll also need this form if you received payments as part of a governmental paid family leave program. Your local office will be able to send a replacement copy in the mail.

Follow the instructions to report the 1099-G Fraud. To help offset your future tax liability you may voluntarily choose to have 10 percent of your weekly Unemployment Insurance benefits withheld and. Log in to your UI Online account.

SSN Pin Birthday Zip Code. If you get a 1099-G for unemployment benefits you didnt receive in 2020. Do not include your Social Security number in an email.

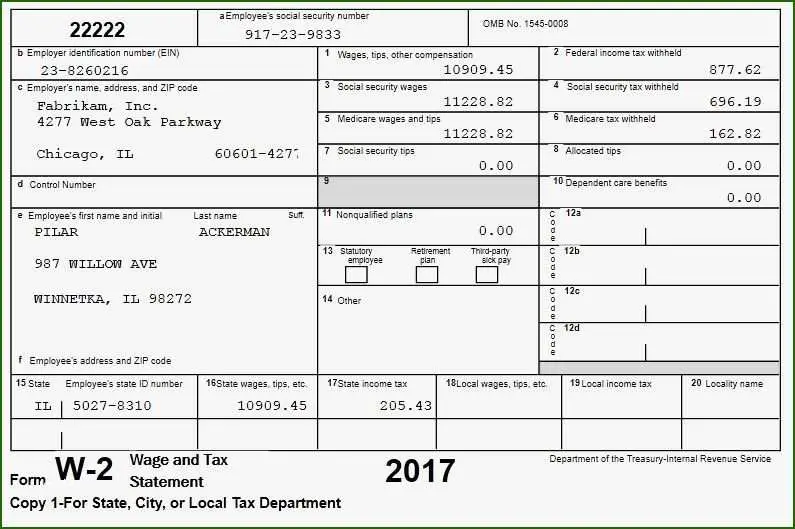

1099 G Tax Form Ides