Pandemic Emergency Unemployment Compensation

What is Pandemic Emergency Unemployment Compensation ?

PEUC is a federal Continued Assistance Act program that extends benefits to those who have exhausted state unemployment benefits.;This benefit is set to end September 4, 2021.

What does it mean to exhaust state unemployment benefits?

A person exhausts state unemployment benefits when he or she either draws all available benefits that could be paid, or reaches the end of the benefit year and is not monetarily eligible for a new benefit year. Also, the individual cannot be eligible to file a claim in any other state.

How long does PEUC run?

Under the March 2020 CARES Act, the PEUC extension program allowed an additional 13 weeks of benefits and the program expired on December 26, 2020. The Continued Assistance Act extended this program to expire the week ending March 13, 2021. Under the new American Rescue Plan Act of 2021 , the PEUC program is now set to expire the week ending September 4, 2021.

How do I apply for PEUC?

Once your state unemployment claim has a zero balance, you can apply for PEUC on our website at www.GetKansasBenefits.gov.

PEUC applications can only be filed online at this time.

Do I have to apply for the extension provided under the new ARP Act?

No. If you were previously filing for PEUC benefits, you do not have to file a new application for the additional weeks. You just need to continue filing weekly claims each week you are unemployed.

How much does PEUC pay each week?

New Exclusion Of Up To $10200 Of Unemployment Compensation

If your modified adjusted gross income is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you dont have to pay tax on unemployment compensation of up to $10,200. If you are married, each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you file Form 1040-NR, you cant exclude any unemployment compensation for your spouse.

The exclusion should be reported separately from your unemployment compensation. See the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure your exclusion and the amount to enter on Schedule 1, line 8. ;

When figuring the following deductions or exclusions from income, if you are asked to enter an amount from Schedule 1, line 7 enter the total amount of unemployment compensation reported on line 7 and if you are asked to enter an amount from Schedule 1, line 8, enter the amount from line 3 of the Unemployment Compensation Exclusion Worksheet. See the specific form or instructions for more information. If you file Form 1040-NR, you arent eligible for all of these deductions. See the Instructions for Form 1040-NR for details.

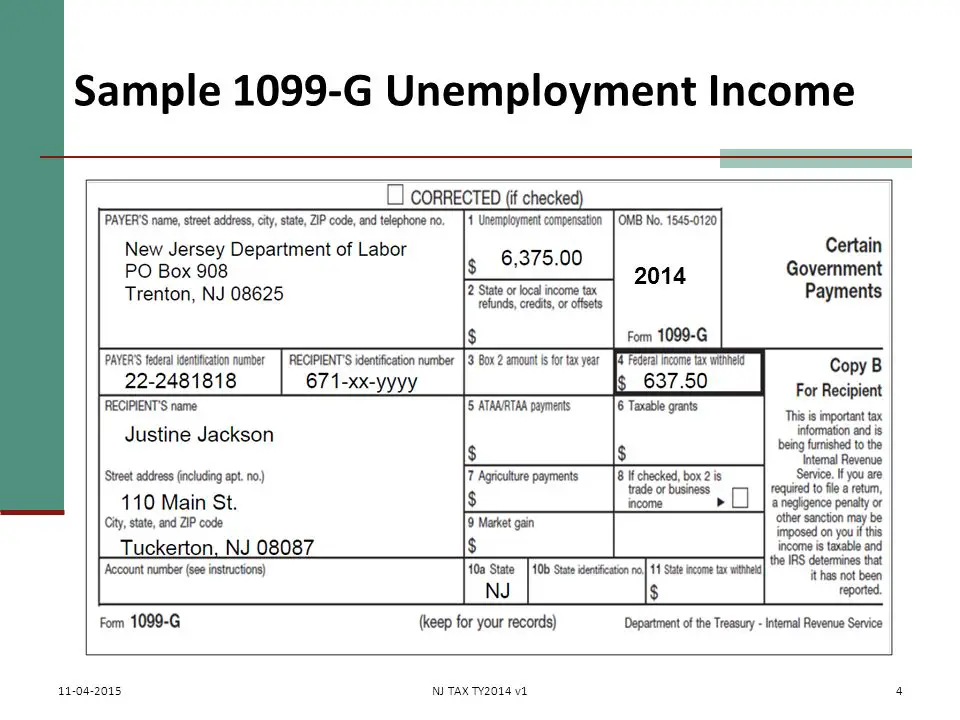

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail; then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

Also Check: How Much Does Health Insurance Cost If You Are Unemployed

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 15, 2021.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

The Benefits And Drawbacks Of Being A 1099 Employee

Pros

- You set your own schedule. Work whenever you see fit, so long as you meet your deadlines and obligations.

- Control the projects you take. Choose what you want to work on. If you arent happy with a client, you arent obligated to continue working with them.

- Work from anywhere. As an independent contractor, you can work wherever you can render your services at home, at a friends house, from the cafe down the road or halfway around the world.

Cons

- More tax obligations. With a 1099-MISC, you may have to deal with additional tax payments throughout the year or lump-sum prepayments on top of your usual filing.

- No benefits or protections. Health care and retirement arent built into your services like they are with more traditional employers. With mandatory health insurance regulations in place, youll need to cover your bases to avoid paying the individual mandate penalty.

Recommended Reading: How To Get My Unemployment

Benefit Year End Date

A regular unemployment insurance benefit year ends 12 months after the claim started.

You must reapply for a new claim if you earned enough wages; in the last 18 months and are still unemployed or working part time. We will notify you when your new claim is processed. This usually takes two to three weeks.

- If youre unsure if you have enough wages as reported by an employer, log in to UI OnlineSM and select File New Claim. We will do one of the following:

- Immediately tell you that you do not have enough wages to establish a new claim.

- Provide instructions on how to submit a new application.

For more information, refer to the unemployment benefit calculator.

If you served in the military, worked for a federal government agency, or worked in a state outside of California within the last 18 months, you must reapply for a new claim by phone, mail, or fax.

You do not need to reapply if you did not earn enough wages in the last 18 months to establish a new claim, regardless of whether you are on a regular claim, a federal extension, or Pandemic Unemployment Assistance . Continue to certify for benefits, and we will notify you when your benefit weeks are processed.

To find your benefit year end date, log in to UI OnlineSMand view your Claim Summary. Your benefit year end date is 12 months after the start of your Benefit Year.

For more information, refer to your Notice of Unemployment Insurance Award for your claim ending date or review Benefit Year End.

What Is A 1099 Form

The 1099 form is a document that the Internal Revenue Service calls an information return.” There are a variety of 1099 forms, but theres one thing that they all have in common: They are all used to report the different kinds of non-salary income that you earn in a tax year.

In this article, well be talking about the 1099-MISC form specifically, which lists all of the income that a person gets from non-employee or non-salary compensations such as commissions, bonuses, contractual payments, royalties and more. 1099s are also filed by business owners who make rent payments, with the exception of businesses that rent via a property manager.

Don’t Miss: Who Do I Call To Get Unemployment

How To Get My 1099 From Unemployment To File Taxes

Many taxpayers are unaware that the unemployment income they received is taxable, just like earned income. The key difference is that unemployment income is taxed at a lower rate. Also, thanks to the American Recovery and Reinvestment Act , the first $2,400 of unemployment income is untaxed. In any event, you should list your unemployment income should on your return. Your state unemployment office should send you the 1099-G form listing that amount, but there are ways to request the form in the mail.

Tips

-

If you have received unemployment income at any point during the year, you will be required to complete and return IRS Form 1099-G. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly.

What Is Unemployment Compensation

Unemployment is a joint program administered by the state and federal government. Businesses with employees pay for unemployment insurance, and a few states even require employees to do so. The money is used to cover unemployment insurance claims. When you file a claim, you have to show that you were terminated through no fault of your own. If approved for the claim, you’ll receive a specific amount of money for a certain number of months based on a percentage of your pay over a specific period of employment. Every state is different with respect to how long you can receive unemployment and the maximum benefit you can receive.

Read More:How to Check the Status of My Unemployment Debit Card

Recommended Reading: How Do I Receive My Unemployment Money

How To Claim Unemployment Benefits

Each state has its own guidelines for how to claim unemployment benefits. There are also, typically, requirements you must follow to continue receiving the benefits.

The first thing to do is gather the documents you will need to file your claim. This is because when you file a claim, your states unemployment insurance agency will ask you for details around your former employment, such as addresses and dates. You should take the time to provide the most complete and accurate information you can, as it lessens the chances of your claim being delayed.

Second, you should;contact your State Unemployment Insurance agency;as soon as possible after you become unemployed. You dont always have to walk into an office because in some states it is now possible to file a claim by telephone or over the Internet.

A general tip is that you should file your claim with the state where you worked. However, if you lived in one state but worked in another or you worked in multiple states, the unemployment insurance agency of the state where you live now can help you with information on how to file your claims with the other states.

Usually, youll get your first benefit check about two to three weeks after youve filed your claim if you qualify.

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review. ;

You may send the form back to NYSDOL via your online account, by fax, or by mail. ;Follow the instructions on the bottom of the form. ;

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Next Section

Continue

Don’t Miss: How Do I Get My Unemployment Back Pay

A Brief History Of Unemployment

To fully understand the difference between standard employees and self-employed workers when it comes to unemployment compensation, it’s helpful to explore how unemployment insurance started. The roots of unemployment insurance can be traced back to the Social Security Act, which passed in 1935. The idea behind unemployment insurance is that it can limit the hardships people face due to temporary job loss.

The funds for UI benefits come from unemployment tax paid by employers. While initially employers only had to pay for unemployment insurance if they had eight or more employees, today any employer with even one employee must pay. The program is funded by the federal government but administered at the state level, which means that the exact details of weekly benefit amounts a person qualifies for or how the application process works varies from state to state.

The weekly benefits were initially limited to 16 weeks, though over time this increased to 26 weeks in any one-year period. More recently, extensions of 13 additional weeks or more have been made due to the COVID-19 pandemic.

Because unemployment is intended to partially replace wages lost, the amount paid to each claimant varies and is based upon what their previous income was. The exact calculation differs from state to state but always depends on what you made before losing your job.

How Does Unemployment Insurance Usually Work

In the United States, federal and state unemployment insurance programs have existed in some form since the 1930s. Unemployment programs are administered at the state level. Still, the system is funded by businesses paying Federal Unemployment Tax Act taxes and State Unemployment Tax Act taxes.

These programs are designed to temporarily provide financial assistance when a worker loses their job and is currently looking for a new one. Workers who are laid off, have lost seasonal work or have been furloughed are allowed to apply for unemployment insurance.

In most U.S. states, laid-off workers are typically able to receive 26 weeks of unemployment benefits and a percentage of their average annual pay. How much a worker can receive depends on how much money they made in their last job and in what state they reside.

Once a worker has been laid off, they can then submit an unemployment claim to their state government. This claim formally notifies the government and the former employer that the worker is seeking unemployment insurance. In some cases such as the worker being fired for cause the former employer may deny the unemployment claim.

Recommended Reading: Can I Draw Unemployment And Social Security

How To Claim Business Expenses As A Freelancer

You use Schedule C to calculate and claim business expenses. Heres how:

The dollar amount listed on line 31 tells you your net profit or loss for your business.

Can 1099 Employees File For Unemployment Benefits

Unemployment benefits for self-employed workers are generally not available, but the coronavirus pandemic changed this in many states.

By: Sean Ludwig, Contributor

While 1099 employees previously did not qualify for unemployment benefits, the CARES Act has since created new provisions that permit it amidst the COVID-19 pandemic.

For decades, the unemployment insurance program in the U.S. has helped provide a cushion for those who unexpectedly find themselves out of work. But what about those self-employed workers who lose their business or cant find work?

Traditionally, 1099 workers have not been eligible to receive unemployment benefits. However, the COVID-19 pandemic changed this norm, and federal coronavirus legislation opened the door for some independent workers to receive benefits. Below we answer some of the most common questions surrounding 1099 workers and unemployment benefits that can be obtained.

Recommended Reading: How To File Unemployment On Taxes

Maintaining Eligibility For Your Unemployment Benefits

At this point, youve filed your claim with your states agency and have begun receiving benefits.

The next step is to follow your states procedures to continue receiving those benefits, if any. You could have to file weekly or biweekly claims after each week has ended, and/or respond to questions about your continued eligibility for unemployment benefits. If you do have to file these claims, they generally require information about specific earnings, job offers or job refusals. Generally, these claims are filed by mail or telephone. Your state will provide filing instructions.

Finally, you must report to your local Unemployment Insurance Claims Office or Career One-Stop/Employment Service Office for any day you were scheduled to do so by the agency. If you dont attend a scheduled interview, that could cause you to lose your benefits.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return; the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

You May Like: Is The 600 Unemployment Taxable

What Is Reported On My 1099

DES reports the;total;amount of unemployment benefits;paid;to you in the previous calendar year on your 1099-G. This amount is based upon the;actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

How To File Unemployment On Your Taxes

If youre wondering if;unemployment is taxed, the answer is yes. These benefits are subject to both federal and state income taxes. The amounts you receive should be reflected on your taxes on Form 1040 .

Important tax planning notes:

- To pay less tax when you file your return, you should request withholding from your unemployment checks on the federal and state level.

- Youll receive a;Form 1099-G in the mail that will report the amount of the unemployment benefits paid to you. This form will also show if you had taxes withheld.

Recommended Reading: How Do You File For Unemployment Online