What To Do If You Lose Your Debit Card

What should you do if you have lost or misplaced your unemployment debit card? If your debit card is damaged, lost, or stolen, check the FAQ section of your state unemployment office for instructions on how to get a replacement card. For example, in California, there’s an 800 number to call to get a replacement card mailed to you.

Your State Is Switching Payment Providers

In Maryland, the Division of Unemployment Insurance switched from using Bank of America to Wells Fargo. Anyone who was getting their benefits deposited to a Bank of America debit card had to switch to being paid via direct deposit or check. Anyone who didnt actively choose a new payment method could experience a benefit payment delay.

Fpuc Authorization And Funding History

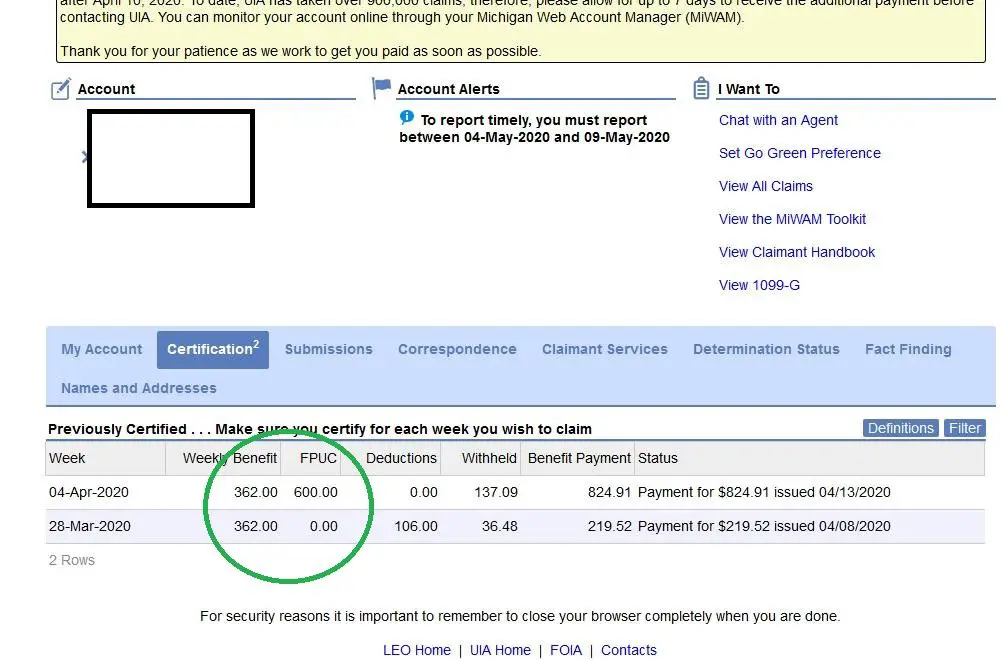

As noted, additional unemployment benefits of $600 per week were originally authorized by the CARES Act through July 31, 2021. This was followed by the Lost Wages Assistance program, authorized by an Aug. 8 presidential memo and subsequent Department of Labor guidance. LWA funds, which were expected to last from Aug. 1, 2020, to Dec. 27, 2020, were depleted by Sept. 5, 2020.

The signing of the Consolidated Appropriations Act of 2021 into law Dec. 27, 2020, restarted the FPUC program and authorized $300 FPUC payments beginning after Dec. 26, 2020, and ending on or before March 14, 2021.

Most recently, the American Rescue Plan Act of 2021, which became law March 11, 2021, extended FPUC payments through Sept. 6, 2021. ARPA also provides a waiver of federal income taxes on the first $10, 200 in unemployment benefits received in 2020.

If the state where you worked before becoming unemployed drops out of FPUC, you are not eligible for FPUC program benefits.

Recommended Reading: What Is The Unemployment Rate In Minnesota

How To Avoid Unemployment Debit Card Scams

Unemployment debit card scammers are thieves who target unemployment recipients in order to get their hands on their funds.

The good news is, you can protect yourself. Unemployment offices do not ask for your personal information once your claim is set up. Therefore, most likely you’re dealing with a scammer if you receive a phone call, email, or text message requesting the following information:

- Bank card/direct payment card number

- Direct deposit account number

- PIN

What Are Issues And Why Are There Issues On My Claim

An issue can be associated with your claim if circumstances occur such as being terminated from your last employer or you were eligible for severance or vacation pay at the time of separation. Other issues may occur due to how you answered the questions on your voucher. These issues must be resolved before payments can be released.

Recommended Reading: How Do I Change My Address For Unemployment Online

My Debit Card Is Set To Expire How Do I Get A New Card

A new debit card will automatically be issued to you when your card is set to expire if there has been financial activity in the last 90 days or you have a card balance of $20 or more. New cards will be mailed on the first business day of the month that the card is due to expire. You should receive a new card within 7 to 10 days after the mail date.

Why Havent I Received My Unemployment Benefits

With no help in sight, people like Harris are turning to elected officials, lawyers, and even social media for help. Harris is part of the Unofficial California Unemployment Help Facebook group, which has drawn more than 56,000 members since it was started in March.;

When asked via email what is causing the delays, the California EDD cited unprecedented demand for unemployment benefits. The EDD says it has processed 11.9 million combined claims for the regular unemployment insurance program, as well as the Pandemic Unemployment Assistance program.

Many states operate unemployment systems that are sorely out of date or didnt have the staff to handle this deluge of applications. The states are catching up, but if there is anything wrong with your application, you could get lost in the mix, says Andrew Stettner, a senior fellow at the progressive, independent think tank The Century Foundation.;

If your application gets flagged and your states unemployment agency lacks the resources to resolve your issue, you could get stuck, says Stettner, who has over 20 years of experience as an unemployment insurance policy advocate.

This is what happened to Mikaelah Pagan, who found her way to the same Facebook group as Harris. She says she filed for unemployment with the EDD the day she lost her food service job and waited four months to receive benefits.;

Read Also: How To File For Unemployment In California Online

What Is The Process And Timeline For Reviewing My Unemployment Claim

Once your claim is filed, OESC must first determine if you are monetarily eligible for benefits.; We may need to request wages from other states, complete investigations on missing wages, request federal agency or military wages, or adjust your claims base period to accurately determine monetary eligibility.;

Once determined monetarily eligible, we will review your claim to determine if you are allowed benefits under the Oklahoma Employment Security Act. The U.S. Department of Labor has established that this eligibility determination should be issued within 21 days of a claim becoming monetarily eligible. After a determination is met, you will be mailed a letter detailing the decision and further information.

What Can You Do To Ensure Youre Getting What Youre Owed

The huge influx of recent unemployment claims were partly caused by the number of people who qualify under this years unique circumstances but who wouldnt under normal circumstances.

The Coronavirus Aid, Relief, and Economic Security Act extends unemployment benefits to many who didnt previously qualify. Independent contractors, freelancers, gig workers, and the self-employed may be eligible for payments through the Pandemic Unemployment Assistance program, established by the CARES Act. Since these types of workers dont pay state unemployment insurance taxes and they dont have employers who pay into the unemployment system, they arent normally eligible for unemployment benefits.

But how you apply for PUA benefits isnt the same across the board. Different states have different procedures and rules on who qualifies for benefits, says Daniel Kalish, managing partner at the national employment law firm HKM Employment Attorneys. The stimulus package included language saying states should be more lenient with who gets extra benefits, but didnt spell out exactly how, says Kalish.;

Because there is so much confusion right now surrounding qualification, Kalish has this straightforward advice: If you have had any reduction of your take-home compensation at all, you should apply for unemployment benefits, even if youre unsure whether you qualify. As long as you are honest in your application, there is no negative repercussion for applying. All they can say is no, he says.

Recommended Reading: What Do You Need To Sign Up For Unemployment

Unemployment Benefits And 2020 Tax Returns

Without this new tax exemption, many people who claimed unemployment benefits in 2020 could have faced an unwelcome tax bill.

Generally, unemployment benefits are taxable income. That includes standard state unemployment benefits as well as 2020 federal benefits expansions, like PUA, PEUC, and other federal relief measures.

But millions of claimants did not have federal taxes withheld from their benefits last year, whether because they didnt know they were taxable or because they couldnt afford to have some amount of benefits withheld, according to analysis by the Century Foundation.;

To further complicate things, while state unemployment offices are supposed to offer standard 10% federal tax withholding, not all states offered withholding consistently across different CARES Act programs.;

Researchers estimate fewer than 40% of unemployment insurance payments issued in 2020 had taxes withheld.

The average unemployed worker received $14,000 in unemployment benefits in 2020, the Century Foundation estimates. Now, with $10,200 of that income tax-exempt, the average claimant will owe taxes on just $3,800 of the money they took in.

Letter #1 Monetary Determination

This is;not;an approval, but rather tells you how much you;could;receive if you are approved. This document tells you how many weeks you will receive unemployment. Do not confuse the benefit year with how many weeks you will be eligible. The maximum number of weeks you can draw unemployment in Tennessee is 26 weeks .Not the correct amount or is an employer missing during the past 18 months?

If you believe that the wages on the Wage Transcript and Monetary Determination are incorrect, you may file a;Wage Protest;.

You May Like: What Day Does Unemployment Get Deposited In Nc

How Will I Be Paid

When you apply, you choose how you want to receive your benefit payments:

- Direct deposit to your checking or savings account, or

You can change your payment method by logging in to your account online or by calling customer service.

It is your responsibility to monitor the balance in your account to avoid overdrafts.

Tax Returns And Third Stimulus Payment

The bills mid-tax season passage may have caused a lot of confusion for unemployed taxpayers trying to determine the best time to file.;

But the good news, says , senior fellow at the Urban-Brookings Tax Policy Center, is that you will receive the full amount youre owed, even if there is a delay.

For taxpayers whose stimulus eligibility was processed based on 2019 returns, at some point possibly later this year, but definitely when they file a tax return next year the IRS will bump up the money and send an additional amount or what they would have received based on 2020 income.;

In other words, you may have to reconcile your payment using a similar claim to the Recovery Rebate Credit for the previous two stimulus payments.;;

You May Like: How Do I Get My Unemployment Back Pay

Do I Have To Pay Taxes On Unemployment Compensation

Normally yes. Unemployment benefits are considered taxable income by the Internal Revenue Service . That means unemployment benefits are always subject to federal taxes, but state taxes on the benefits vary depending on the state where you live.;

However, as part of the stimulus package, the federal government is forgiving taxes on up to $10,200 of unemployment benefits earned in 2020 for individuals earning less than $150,000.;

If you already filed your 2020 taxes, you dont need to amend your return. The IRS is adjusting qualifying returns automatically in two phases. Nearly three million refunds were sent the week of June 7, and another batch of refunds is expected to be distributed later in June. The IRS will send a mailed letter to anyone whose return has been adjusted.

If you havent yet filed your 2020 tax return, If you filed for benefits in 2020, your state should mail you Form 1099-G, Certain Government Payment, which will include your total unemployment compensation received during the year. Youll use this form to determine how much to adjust your tax return calculations in order to get the tax break.;;

How Do I Get A Chip Debit Card

Bank of America is sending chip cards to new claimants starting July 25, 2021. If you already have a debit card, it will be replaced with a chip card when it expires.

If your card has been lost or stolen, you must contact Bank of America at 1-866-692-9374 .

If your card is damaged, you can order a replacement card online by visiting the Bank of America debit card website.

Recommended Reading: How Do I Sign Up For Unemployment In Washington State

How To Apply For Federal Pandemic Unemployment Compensation

To apply for Federal Pandemic Unemployment Compensation, you must file a claim for regular benefits with the UI program in the state where you worked. Depending on the state, you can file a claim in person, online, or over the phone; most states recommend filing online. When you file a claim, you must provide your Social Security number, contact information, and details about your former employment. To find out the rules in your state, check with your state’s unemployment insurance program.

Under the current FPUC program, states administer an extra $300 weekly payment to eligible people who receive regular unemployment benefits , as well those collecting benefits from the following programs:

- Pandemic Emergency Unemployment Compensation

- Payments under the Self-Employment Assistance program

When states provide the extra payment, eligible people will receive retroactive payments.

FPUC was extended by the American Rescue Plan to go until September 6, 2021, however, a number of states have chosen to end their enrollment in the program earlyâmeaning your $300 supplement may run out before then. Check with your state’s unemployment office to determine the duration of your benefits.

Under the CARES Act, states that waive their usual one-week “waiting period” for benefits will be fully reimbursed by the federal government for benefits paid that week, plus any associated administrative expenses.

What To Watch Out For

- You may pay a fee to cash your check if you dont do so at your bank

- Once deposited, it might take a few days before all your money is available for use

Remember, checks can take a few days to arrive so this may not be the best option if you need funds quickly. If you have your own bank or credit union account or prepaid card, you may be able to use a mobile banking app to capture an image of the check and have it deposited into these personal accounts. Otherwise, you may need to make a trip to a financial institution to cash or deposit it, but be aware that it may take a few days until all the money appears in your account and is available for you to use.

You May Like: Do You Have To Pay Federal Taxes On Unemployment

Look For Important Documents From The Edd

You will receive these documents in the mail within two weeks of submitting your unemployment application:

- Employment Development Department Customer Account Number Notification Your EDD Customer Account Number is required to register for UI Online. If you were automatically enrolled in UI Online or already have an existing UI Online account there is no need to re-register. Your EDDCAN may be used instead of your Social Security number when speaking with the EDD so it is important to keep for your records.

- Use this form to certify for continued benefits every two weeks. You can also certify through UI OnlineSM or EDD Tele-CertSM.

You Have Options For How To Receive Your Unemployment Benefits

Millions of workers have filed for unemployment insurance benefits as a result of the coronavirus pandemic. If youve lost your job or a portion of your income, you can apply for benefits through your state unemployment program, and if you qualify, you have options for how you can receive this money.

In most states, you can receive your money either on a state-issued prepaid debit card or by having it directly deposited into your own bank or credit union account or onto an existing prepaid card. In some states, receiving paper checks is also an option. While the majority of workers who are eligible for unemployment benefits have already filed as a result of COVID-19, many states will allow you to make changes to the way you receive your benefits.

How Can I Track My Unemployment Debit Card In The Mail

Your state’s unemployment website will inform you of when you can expect to receive your debit card. This can take a few weeks after you file your claim, so it’s a good idea to be careful with your budget until your card arrives. States typically use standard mail to send your card, so no tracking is available.

How Long Does It Take To Get Unemployment Money On My Debit Card

The time it takes to get your first payment via debit card depends on where you live. For example, it can take four weeks for someone in Texas to receive their first payment, while recipients in Washington state can expect to receive it about two weeks after being approved for benefits. Your state should tell you when you can expect the payment to be added to your card’s balance.

Once your benefits begin, most states send payments every two weeks after you have certified your continued eligibility for unemployment benefits. This means that you either call into a voicemail system or log in online and answer questions about whether you have been employed, any money that you have earned and whether you have made efforts to find a new job. Every state is different, but in many cases, a deposit will be made within a day or two after you certify.

What Is Pandemic Unemployment Assistance And Who Is Eligible

Pandemic Unemployment Assistance ;is a federal benefit made available to;self-employed, contract, and gig workers who are not;traditionally eligible for regular Unemployment Insurance benefits.;The CARES Act of 2020 provided thirty-nine weeks of unemployment benefits, which was available 2/2/2020 to 12/26/2020.

How Unemployment Debit Cards Work

After you sign up for benefits, your card will be mailed to you. Once it’s;received, you will need to activate it and set up a PIN in order for it to receive funds from the government. You’ll receive your;funds according to a schedule determined by your local unemployment office.

If your state unemployment office provides a debit card, it will work just like any other bank debit card. You will be able to withdraw cash at an ATM machine of;your choice and use your card for purchases at stores.

You can also pay bills with;your;debit card. For example, you may be provided with a Chase Visa card, a KeyBank debit card, a Bank of America Mastercard, or another bank-issued card. When you use your card, it wont be apparent to the department store or your dry cleaner that its an unemployment payment card. Your card will be similar to a personal debit card.

In addition, you may be able to transfer funds from your unemployment debit card directly to your bank account via a direct deposit transfer if you want to pay your monthly bills that way. Check with your;local bank to;see if they;provide this service.