Tax Deductions And Credits When Youre Unemployed

You may be required to file a tax return when youre unemployed, depending on your situation and doing so can have benefits. If youre eligible for any refundable tax credits, the only way to get them is to file a tax return. And itemizing deductions may allow you to recoup certain expenses incurred while you were unemployed.

Do I Have To Pay Unemployment Back

No. Unemployment benefits are yours to keep, except for the amount you may owe in taxes. But make sure youre getting the right amount.

In a few cases that ProPublica found, simple mistakes have led states to overpay unemployment recipients and then demand huge sums of money back. A new bill would shield unemployment recipients from having to repay overpayments made by mistake, but it would only apply to unemployment aid that came directly from the federal government. As of April 2021, the bill is still in committee.

About this guide: ProPublica has reported extensively about taxes, the IRS Free File program and the IRS. Specifically, weve covered the ways in which the for-profit tax preparation industry companies like Intuit , H&R Block and Tax Slayer has lobbied for the Free File program, then systematicallyundermined it with evasive search tactics and confusing design. These companies also work to fill search engine results with tax guides that sometimes route users to paid products. ProPublicas guide is not personalized tax advice, and you should speak to a tax professional about your specific tax situation.

New Exclusion Of Up To $10200 Of Unemployment Compensation

If your modified adjusted gross income is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you dont have to pay tax on unemployment compensation of up to $10,200. If you are married, each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you file Form 1040-NR, you cant exclude any unemployment compensation for your spouse.

The exclusion should be reported separately from your unemployment compensation. See the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure your exclusion and the amount to enter on Schedule 1, line 8. ;

When figuring the following deductions or exclusions from income, if you are asked to enter an amount from Schedule 1, line 7 enter the total amount of unemployment compensation reported on line 7 and if you are asked to enter an amount from Schedule 1, line 8, enter the amount from line 3 of the Unemployment Compensation Exclusion Worksheet. See the specific form or instructions for more information. If you file Form 1040-NR, you arent eligible for all of these deductions. See the Instructions for Form 1040-NR for details.

Read Also: How Do I Sign Up For Unemployment In Washington State

How Do You Claim Unemployment Benefits

Unemployment benefits are offered at the state level. You’ll need to contact your state’s unemployment insurance program and follow its instructions for applying. In general, you’ll need to complete an application that explains your situation and details where you worked, how long you worked there, how much you made, and why you’re no longer employed. Your state’s unemployment program will review your application and approve it, request additional information or an interview, or deny it. You can appeal if your claim is denied.

Tax Returns And Third Stimulus Payment

The bills mid-tax season passage may have caused a lot of confusion for unemployed taxpayers trying to determine the best time to file.;

But the good news, says , senior fellow at the Urban-Brookings Tax Policy Center, is that you will receive the full amount youre owed, even if there is a delay.

For taxpayers whose stimulus eligibility was processed based on 2019 returns, at some point possibly later this year, but definitely when they file a tax return next year the IRS will bump up the money and send an additional amount or what they would have received based on 2020 income.;

In other words, you may have to reconcile your payment using a similar claim to the Recovery Rebate Credit for the previous two stimulus payments.;;

Recommended Reading: How Do I Get My Unemployment Back Pay

What Should I Do If I Can’t Pay My Tax Bill

Even if you can’t afford to fully pay your tax bill by April 15, you need to file your return by that day. The IRS charges a stiff penalty for failing to file on time that is ten times worse than the penalty they’ll hit you with for failing to pay, says H&R Block’s Pickering.

The failure-to-file penalty equals 5 percent of the amount of unpaid taxes for each month your return is late, up to 25 percent of the total. The failure-to-pay penalty is only 0.5 percent of the unpaid taxes you owe for each month you carry a balance, again up to 25 percent.

“If you think you owe, don’t freak out, that’s when a lot of bad decisions get made,” says Pickering. “There are so many options for paying if you have a balance due. And the most important thing is to file your taxes.”

Last year, a third of taxpayers who couldn’t pay their full tax bill didn’t file their return by the deadline, according to a survey conducted by LendEDU. And with 53 percent of Americans worried about having to go into debt over their taxes for this year, it seems likely a few more may be scared into making the same mistake.

The good news: it’s easy to avoid that failure-to-file penalty. You can even file electronically for free if your income was less than $72,000 using the IRS Free File program.

Related Articles

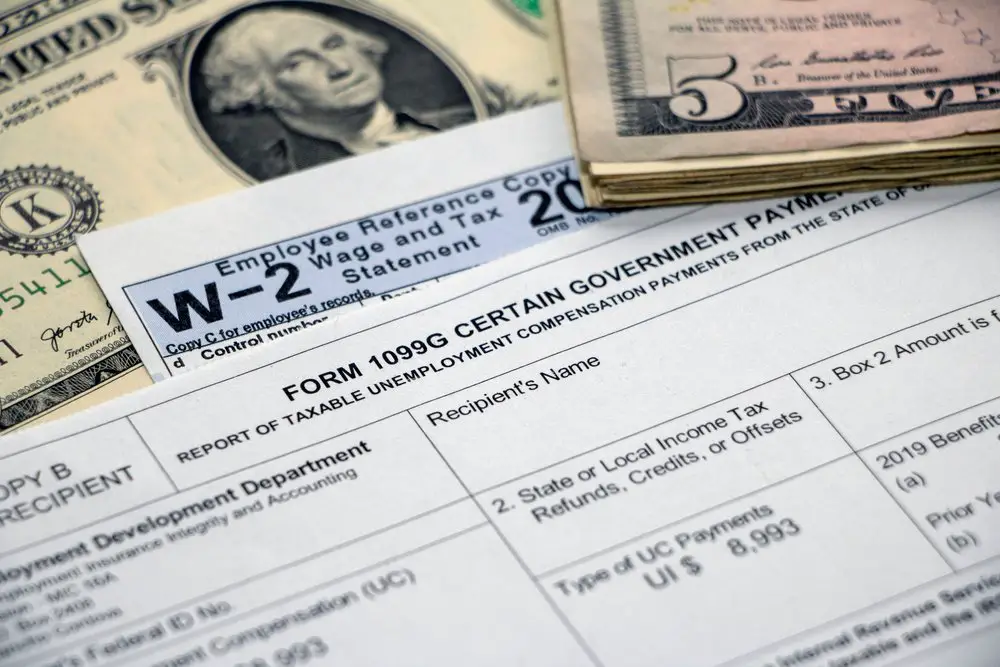

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return; the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Don’t Miss: What Is The Unemployment Rate In Minnesota

What Can Disqualify You From Receiving Unemployment Benefits

Each state has its own unemployment criteria and rules. Unemployment programs typically require you to be unemployed through no fault of your own and meet work and wage requirements. If you quit or were fired for cause, you usually don’t qualify for unemployment. Self-employed people and contract workers usually aren’t eligible for unemployment benefits, but the CARES Act allowed states to extend unemployment benefits to these individuals.

Paying Unemployment Taxes At The State And Local Level

At the local and state level, the options to pay for your state and local taxes may differ depending on where you live. Contact your state, county, or local unemployment office to learn about the different options to pay your taxes. These options may include:

1. Requesting to have state and/or local taxes withheld. The steps to request state and local tax withholding differ.

2. Making quarterly estimated payments. The due dates for estimated payments at the state and local level may differ from federal due dates.

3. Paying your taxes in full. If you need your full amount of your unemployment benefits and cannot make quarterly estimated payments, you can pay your taxes all at once when they are due. However, you may receive an underpayment penalty for not paying enough taxes throughout the year.

Read Also: What Do You Need To Sign Up For Unemployment

Despite Federal Exemption On Unemployment Benefits Some Jobless Might Owe Taxes To Irs And Ny

As we have been reporting the IRS is allowing folks on unemployment to keep the first $10,000 without paying taxes. However, the State of New York is not so generous you have to pay taxes on every dollar of your jobless benefits and more.

When the government passed the American Rescue Plan back in March, Congress approved an exemption on the first $10,200 of unemployment benefits retroactive to January of 2020.

For couples filing jointly, the exemption is $20,400. But the State of New York is forgiving nothing, which can be tough for folks that have already filed their taxes.

Tim Eliason of EG Tax Service says it gets worse. Even for those who had taxes withheld from their unemployment checks, it was not enough.

The federal income tax was under-withheld, but the exemption would erase most of that. However, New Yorks withholding on unemployment is 2.5%, while the actual income tax owed would be 4%.

How Does State Unemployment Tax Affect My Payments As An Employer

The IRS has an Unemployment Tax Trust Fund to pay the costs of administering the federal and state unemployment taxes. Generally, your business gets a credit for amounts you pay to a state unemployment fund.

Some states borrow from this trust fund, and some of those states don’t repay the loans. If a state doesn’t repay within two years, employers in the state may be required to pay additional unemployment tax.;

Read Also: How To File For Unemployment In California Online

Do I Have To Pay Taxes On Unemployment Benefits

If youve lost your job because of the coronavirus pandemic, you might be new to collecting unemployment benefits.; Our Consumer Action Center is getting a lot of questions right now about unemployment checks and taxes.

Specifically, people want to know whether those unemployment benefits are taxable.

Effect On Other Tax Benefits

Taxable unemployment benefits include the extra $600 per week that was provided by the federal government in response to the coronavirus pandemic, accountant Chip Capelli, of Provincetown, Massachusetts, told The Balance.

Not only is unemployment compensation taxable, but receiving it can also affect some tax credits you might be eligible for and are counting on to defray those 2020 taxes that will be due.

Something else to consider is if you usually get the Earned Income Credit each year, Capelli said. While unemployment benefits arent considered earned income, they do influence your adjusted gross income , which is used to calculate the EIC.

The American Rescue Plan Act also expanded eligibility for the EIC to include more households, including childless households, as well as increasing the maximum credit from $543 to $1,502.

Don’t Miss: What Day Does Unemployment Get Deposited In Nc

Making Estimated Tax Payments

You might be required to make payments directly to the IRS as quarterly estimated tax payments if you elect not to have taxes withheld from your unemployment benefits. This works out to a payment once every three months. You can elect to do this instead of having 10% withheld from every unemployment check, giving yourself a little bit of wiggle room when money is tight.

You might even have to make quarterly payments in addition to withholding from your benefits. You’re obligated to make estimated payments if you expect that you’ll owe at least $1,000 after accounting for all taxes withheld from all your sources of income, and if you expect that your withheld taxes plus any refundable tax credits you’re eligible for will be less than 90% of what you’ll owe, or 100% of the total taxes you paid last year.

You might want to consult with a tax professional because the whole equation can be complicated. You could accrue additional penalties if you don’t pay enough tax, either through withholding or estimated tax payments.

Do I Have To Pay Taxes On The Extra $600

The Coronavirus Aid, Relief, and Economic Security Act provided for the Federal Pandemic Unemployment Compensation program when President Trump signed it into law on March 27, 2020. It provided an additional $600 per week in unemployment compensation per recipient through July 2020. That money is also taxable after the first $10,200.;;

You might be paid up if you arranged to have income tax withheld from your benefits, but federal law caps withholding on benefits at 10%. That might not be enough to offset all taxes owed if you had additional income during the year.

Not all states were technologically prepared to withhold anything from that extra $600 portion. Their unemployment systems simply werent up to the task, and many initially collapsed during the first weeks of increased visits to their sites.

You’ll still have to pay tax on benefits you received over $10,200 if you asked for withholding and it didn’t happen.

This 10% withholding cap prevents you from having extra money withheld now to try to compensate for not having anything withheld earlier in the year. You can ask for extra withholding from your paychecks, however, if you return to work.

Recommended Reading: How Do I Change My Address For Unemployment Online

Look For This Form In The Mail

Keep an eye out for a 1099-G in your mailbox by the end of January.

If you received unemployment benefits in 2020, your state should send you a Form 1099-G that shows how much you received in unemployment. Box 1 tells you how much income you received, while Box 4 tells you how much federal income taxes were withheld. Boxes 10a11 reports state income tax withholding.

You should receive this form via snail mail by Jan. 31, 2021. If you dont receive one for some reason, you still need to report the income. Head to your states official website and look for the department that handles taxes. Check for an option to request a new form online, or call the unemployment agency. Youll need to provide your personal information or the username and password you use to log in to your online account.

State Vs Federal Taxation

Youll get even more relief if you live in a state that doesnt tax unemployment benefits. Otherwise, youll owe tax on your benefits to both the IRS and your state government.

As of 2020, the states that dont tax unemployment benefits are:;

- Alabama

- Washington

- Wyoming;

New Hampshire has an income tax, but only on investment income, so youll pay less tax if you live in that state, too. And two more statesIndiana and Wisconsinmay tax only a portion of your benefits, Capelli said, but he warned that some cities and counties have local income taxes that will apply to unemployment compensation as well.

How Much Are Unemployment Taxes

Both federal and state unemployment taxes are based on employee wages.

The FUTA tax rate is 6% . Most employers qualify for a tax credit of 5.4% . This lowers the FUTA tax rate to 0.6% .

Some employers might not receive the full FUTA tax credit. This will happen if a state borrows money from the federal government to cover unemployment benefits, but cannot pay the loan back within two years. The state becomes a . When this happens, your FUTA tax credit is reduced, meaning your total FUTA tax liability increases.

You only owe FUTA tax on the first $7,000 per year that you pay each employee. Wages you pay an employee beyond $7,000 per year are not taxed by FUTA.

If you receive the full FUTA tax credit, your maximum FUTA tax liability is $42 per employee for the year .

To learn more about FUTA tax and credits, see the Instructions for Form 940 and Schedule A .

SUTA taxes do not have a standard rate. Each state sets its own rates.

When you become an employer, you must register for an account with the state unemployment agency. There is often a rate for new employers. The state will send you an updated rate every year. The state will typically base your rate on your industry, experience, and number of unemployment claims made by former employees.

Every state also sets its own wage base. This is the maximum amount of wages per employee per year that you owe SUTA tax on.

Proactively Set Aside 10%

If for some reason, you dont want to have your taxes withheld directly from your benefits payments, you can always choose to save a chunk of money on your own to cover the responsibility. For example, you could consider stashing 10% of your weekly benefit into a sinking fund, which is a savings account thats separate from your emergency savings. Sinking funds are designed to be used to save for a specific expense. In this case, its your tax bill. Having a separate fund allows you to know exactly how much money youve saved to specifically cover your tax bill and help to ensure you dont tap it for other purchases.

Of course, you can simply save 10% of each payment in your regular savings account. But you have to be extra careful not to withdraw too much from that account for other expenses so that you dont risk using up all the money you set aside to cover your tax liability.

How The $10200 Tax Break Works

As were in the middle of tax season, the rollout of this tax break is unfortunately a little complicated, and will be challenging for the IRS to administerand for ordinary Americans to take advantage of. But if you qualify, persist: You could potentially save thousands of dollars.

If you received unemployment benefits in 2020, you should have received a mailed statement or an online version of the Form 1099-G, Certain Government Payments from your state unemployment insurance agency, which shows how much in unemployment payments you received in 2020. It also shows how much you paid in federal taxes .

The IRS requires your state unemployment insurance agency to provide this form before Jan. 31. If you did not receive a form before this due date, check with your state agencyyou may have to log in your states unemployment portal to obtain it.

While the total benefits are reported in Box 1 of the Form 1099-G, you will only need to report a partial amount on your Schedule 1 of the Form 1040 tax return if you qualify for the new tax break.

First, you report the full amount of unemployment benefits on Line 7 of Schedule 1. Next, you would include the amount of benefits you qualify to exclude on Line 8 of Schedule 1.

- Where you enter your unemployment compensation on your Schedule 1. This image is for informational purposes only.