How Unemployment Taxes Work

In brief, the unemployment tax system works as follows:

- Employers pay into the system, based on a percentage of total employee wages.

- You dont deduct unemployment taxes from employee wages.

- Most employers pay both federal and state unemployment taxes.

- Employers must pay federal unemployment taxes and file an annual report.

- The tax paid goes into a fund that pays unemployment benefits to employees who have been laid off.

Dont Miss: How To Apply For Va Individual Unemployability

How Unemployment Affects Your Taxes Taxact

One question that may arise in your mind is: Does unemployment get taxed?

Well yes, the unemployment benefits are taxable. Long ago, unemployment benefits were exempt from income tax. Unfortunately, thats no longer true.

You dont have to pay Social Security and Medicare taxes on your unemployment benefits, but you do have to report them on your tax return as income.

You can choose to have income tax withheld from your unemployment benefits, if necessary, to avoid an unpleasant surprise next year when you file your return. Before you do, however, make sure thats necessary.

Reporting Unemployment Income For Taxes

Your stateâs unemployment agency will report the amount of your benefits on Form 1099-G. The IRS gets a copy, and so do you. The form will also show any taxes you had withheld.

You must report these amounts on line 7 of the 2020 Schedule 1, then total all your sources of additional income in Part I of the schedule and transfer the number to line 8 of the 2020 Form 1040.

The economic impact payment or stimulus checks that you might have received are not considered to be unemployment compensation. You do not have to pay taxes on this money.

Also Check: Njuifile.net Log In

Making Estimated Tax Payments

You might be required to make payments directly to the IRS as quarterly estimated tax payments if you elect not to have taxes withheld from your unemployment benefits. This works out to a payment once every three months. You can elect to do this instead of having 10% withheld from every unemployment check, giving yourself a little bit of wiggle room when money is tight.

You might even have to make quarterly payments in addition to withholding from your benefits. You’re obligated to make estimated payments if you expect that you’ll owe at least $1,000 after accounting for all taxes withheld from all your sources of income, and if you expect that your withheld taxes plus any refundable tax credits you’re eligible for will be less than 90% of what you’ll owe, or 100% of the total taxes you paid last year.

You might want to consult with a tax professional because the whole equation can be complicated. You could accrue additional penalties if you don’t pay enough tax, either through withholding or estimated tax payments.

How To Prepare For Income Taxes

Knowing that you may have to pay income taxes on your unemployment benefits, you can choose from several options to help make the payments more manageable.

- Request tax withholdings. When you were working, your company may have withheld money for taxes and made those payments on your behalf. You can also ask your state to do the same with your weekly unemployment benefits. It will withhold 10% of your unemployment pay, which it will send to the IRS. You may also request state or local tax withholdings if they apply to you.

- Pay estimated taxes. Another option is to make estimated tax payments to the IRS and your state tax agency every quarter. Depending on how much unemployment you collect, and what other sources of income you have throughout the year, you may want to do this even if you have money withheld from your benefits. If you wind up owing more than $1,000 in income taxes, you may have to pay an additional underpayment penalty.

- Set money aside. You could choose to keep all your unemployment benefits if you dont expect to owe any taxes. Or, even if you expect to owe a little, you could still keep the money and set a portion aside in a savings account in case theres an emergency in the interim. An income tax calculator could help you estimate how much youll want to set aside.

Read Also: How To Qualify For Unemployment Louisiana

You May Like: Njuifile Net Sign In

If You Cant Pay Your Taxes On Time

If you do end up owing the government money and cant pay your taxes on time, the IRS offers several payment plan options that can help you.

But be aware that not paying the full amount you owe by the filing deadline will mean youll pay interest and possibly penalties on the unpaid amount even if you arrange a payment plan with the IRS.

Should I Wait To File My Taxes To Claim The Waver

Many out-of-work Americans rushed to complete their taxes to get a possible refund to help make ends meet. The tax break is becoming law after 55.7 million tax returns were already filed by Americans with the IRS, as of March 5.

Some filers may consider waiting to file their taxes until the IRS issues new guidance to claim the new $10,200 waiver, experts say.

To be sure, the stimulus package also offers $1,400 stimulus checks to individuals who earned up to $75,000, and married couples with incomes up to $150,000. Payments would decline for incomes above those thresholds, phasing out above $80,000 for individuals and $160,000 for married couples.

Some taxpayers may opt to file their taxes sooner to get the latest stimulus check, particularly if their 2020 income was lower than in 2019.

Also Check: Unemployment Compensation Phone Number

Reporting Unemployment Benefits At The State And Local Level

If your state, county, or city collects income tax on your unemployment benefits, keep your Form 1099-G for reference. You may have to attach it to your state, county, or local income tax return. If so, keep a copy for yourself.

Check with your states Department of Revenue and relevant county and local government tax agency for instructions on how to report your unemployment benefits at the state and local level.

You May Be Able To Deduct Job

Job-hunting expenses are deductible as miscellaneous deductions on your tax return. Youll need to have substantial job-hunting or other miscellaneous deductions before they actually reduce your income tax bill.

You can only deduct your total miscellaneous deductions to the extent that they exceed 2% of your adjusted gross income.

However, if your income is much lower this year, you may reach that amount more quickly than you expect.

Keep track of your job-hunting expenses, such as transportation to interviews , subscriptions to online job search services, admission to job fairs, and resume consultations.

Don’t Miss: How To Sign Up For Unemployment In Missouri

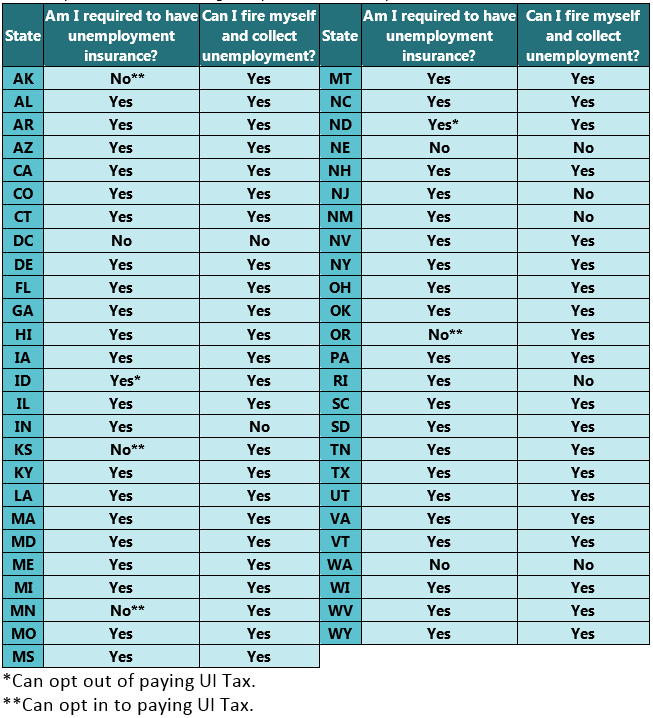

Do All People Get Unemployment Benefits

Not all people qualify to receive UI benefits. People who voluntarily leave their job, are looking for their first jobs, or are trying to get a job after leaving the workforce for a while donât usually qualify. Self-employed people, independent contractors, and students usually arenât eligible either.

How To Report Futa Tax

FUTA tax must be reported using Form 940, or the Employers Annual Federal Unemployment Tax Return. This must be completed if the following criteria are met:

- A company has paid an employee $1,500 or more in any quarter of the current or previous year.

- A company has hired 1+ employees for any part of a day in 20+ weeks of the current or previous year.

Form 940 must be filed by January 31st of the respective year. For the 2021 tax year, for example, the form should be completed by January 31st 2022.

Don’t Miss: How To Apply For Unemployment In Tennessee

Are Unemployment Insurance Benefits Taxed By States And The Federal Government

Yes. Unemployment insurance benefits are subject to both federal and state taxes. Before 2021, unemployment benefits counted toward your income and were taxed at rates according to the IRSs tax brackets. The American Rescue Plan Act of 2021 exempted some of that money from federal income taxes for tax year 2020.

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

Recommended Reading: Tennessee Unemployment Qualifications

State Income Taxes On Unemployment Benefits

It may not be just the IRS you have to worry about. Many states tax unemployment benefits, too. There are several that do not, though California, Montana, New Jersey, Pennsylvania, and Virginia do not charge taxes on unemployment benefits. Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Eight states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

Why Is New York Still Taxing Unemployment Benefits

Unemployed New Yorkers are receiving surprise tax bills. Republican legislators joined with progressive Democrats to move to waive taxes on benefits, following the lead of most other states and the federal government.

Before the pandemic shut down live events in New York City and wiped out two-thirds of the citys arts, entertainment and recreation jobs, Stephanie Freed worked 14-hour days as an electrician for concerts, theaters and galas. Unemployment payments have helped her afford bills through the past year, though she hasnt been able to pay rent in five months.

When she filed taxes for 2020, Freed discovered she owed New York State $1,200 for income taxes on unemployment benefits.

The benefit at $504 dollars is already low, especially for those of us living in New York City, so taxing on top of that is just cruel, frankly, said Freed, the Executive Director of ExtendPUA, an advocacy organization created during the pandemic.

New York, which has the second highest unemployment rate in the country, is one of just 11 states that is fully taxing unemployment benefits, according to H& R Block.

In a rare show of bipartisanship, sixteen of New Yorks 20 Republican state senators have joined with progressive Democrats to support legislation to waive taxes for the first $10,200 of benefits. Legislators from both parties described the taxes to New York Focus as a penalty on the states most vulnerable.

All this money went to rent

Recommended Reading: How To Get Unemployment In Tn

What Kind Of Unemployment Documentation Do I Need For Filing My Taxes

If you received unemployment benefits in 2020, EDD should have already sent you your 1099G form, which is a record of the total taxable income EDD has issued to you in a calendar year.

If you havent gotten this form for some reason, you can print one or request a paper copy through your UI Online account on EDDs website.

EDD recommends that if your 1099G form shows a $0 amount, you should call 1-866-401-2849 You can also report form problems online.

Read Also: Www.1040paytax

Do I Have To Claim My Severance Pay On My Tax Return If I Already Paid Taxes

- Severance pay is a lump-sum payment received from a company when you are terminated due to job closings, company reductions, or even company closures. These payments are typically based on time in service and/or job performance, and as such are taxable as wages. This payment will have the usually Social Security, Medicare, federal and state taxes withheld, which will be reflected on your W-2.

Read Also: How Do I Apply For Unemployment In Tn

How Did Coronavirus Relief Legislation Change Benefits For 1099 Earners

The Coronavirus Aid, Relief and Economic Security Act, which was passed in March 2020, allocated funds for expanded unemployment benefits during COVID-19. This included the creation of the Pandemic Unemployment Assistance program, Pandemic Unemployment Compensation , and Pandemic Emergency Unemployment Compensation .

Since the passage of the CARES Act, self-employed people have typically been eligible for unemployment benefits. Eligibility has varied from state to state, so its important to check with your local labor office to see how it has implemented the CARES Act.

States can provide PUA benefits to individuals who are self-employed. However, to qualify, you should not be able to apply for regular state unemployment benefits and be unemployed or unable to work due to circumstances related to the COVID-19 pandemic. The PUA program provides up to 39 weeks of benefits, but the benefits are only authorized through December 31, 2020. Notably, U.S. legislators could still extend PUA benefits in the future so people can use it for longer as the pandemic persists.

If at any point, a self-employed individual that is receiving PUA benefits is able to restart their business or take on new work, they must report that income to their state unemployment office. The benefit amount they receive may decline, but workers do not want to run into legal trouble for receiving benefits while also being back to work.

Paying Unemployment Taxes At The Federal Level

There are 3 options to pay your federal income taxes on your unemployment benefits. If you dont expect your benefits to add much to any tax you owe, it may be easiest to pay the full amount at tax time. The following options can help you avoid having a large bill at tax time.

1. Request your state employment agency to withhold your federal taxes. Withholding your taxes means that a flat 10 percent of each of your unemployment checks will be used to pay federal taxes, similar to withholding taxes on a regular paycheck.

Usually, you can choose to have your taxes withheld when you first register for unemployment benefits. You can also complete and give Form W-4V, Voluntary Withholding Request to the agency that is disbursing your unemployment benefits to start withholding your taxes. Request Form W-4V, Voluntary Withholding Request from your unemployment office or find it on the IRS website. If your agency has its own withholding form, use that one instead.

Use the Estimated Tax Payments Calculator to make sure that you are withholding enough taxes from your unemployment benefits. If too little tax is withheld, you may also have to make quarterly estimated tax payments to avoid an underpayment penalty.

Depending on the amount of your unemployment benefits and your other sources of income, you may choose to make quarterly estimated payments and withhold your taxes if your total tax withholding does not cover enough of the income taxes you will owe.

| Income from: |

Recommended Reading: Unemployment Benefits Tennessee Eligibility

How Do Unemployment Benefits Work

Unemployment is a benefit paid by state or federal governments to help people who have lost their jobs through no fault of their own. It doesn’t apply if you quit or were fired for cause.

You would contact your state’s unemployment insurance program to apply for unemployment benefits. Certain limitations apply as to the amount you’re eligible to receive, and they can vary by state. For example, New Jersey provides benefits of up to 60% of your average pay, capping out at $713 a week as of 2020, not including the extra $600 provided for under the Coronavirus Aid, Relief, and Economic Security Act or the $300 provided for under the American Rescue Plan Act.

Unemployment taxes are paid by employers and these taxes go into a state fund to aid workers who have lost their jobs. The U.S. Department of Labor monitors the system.

How Much You Could Receive

We cant tell you exactly how much youll receive before we process your application. For most people, the basic rate for calculating Employment Insurance benefits is 55% of their average insurable weekly earnings, up to a maximum amount. As of January 1, 2021, the maximum yearly insurable earnings amount is $56,300. This means that you can receive a maximum amount of $595 per week.

Read Also: Pa Unemployment Ticket Number

Problems With The Irs

- Low-Income Taxpayer Clinics : LITCs are programs at law schools, accounting schools, or legal services offices that provide assistance and legal representation to lower-income taxpayers who are in disputes with the IRS.

- Taxpayer Advocate Service : TAS is an independent organization within the IRS that can help people navigate through their tax problems and find solutions. Contact your local office.

- Community Legal Aid: Local legal aid services can provide free or low-cost legal help for people with tax problems.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

Still No Unemployment Tax Refund What To Know About Your Irs Money

Millions of taxpayers are still waiting for their tax refund on 2020 unemployment benefits, with no updated timeline from the tax agency.

The IRS has sent 8.7 million unemployment compensation refunds so far.

Since May, the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around $1,600 to those who can claim an unemployment tax break. Heres why: The first $10,200 of 2020 jobless benefits, or $20,400 for married couples filing jointly, was made nontaxable income by the American Rescue Plan in March. Taxpayers who filed their returns before the legislation and paid taxes on those benefits are entitled to a refund.

However, the last batch of refunds, which went out to some 1.5 million taxpayers, was over a month ago, and the remaining payment dates are unclear. The IRS hasnt issued a timeline for this month, except to say summer, which officially ends Sept. 22. Some have reported on social media that their IRS tax transcripts show pending deposit dates. But many other taxpayers are frustrated because they havent received any money or updates at all. Some dont know if they should file an amended return or how to check the status of their refund online.

Recommended Reading: How Do I Sign Up For Unemployment In Washington State

Recommended Reading: How To Contact Unemployment Office