Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Reporting Unemployment Benefits At The State And Local Level

If your state, county, or city collects income tax on your unemployment benefits, keep your Form 1099-G for reference. You may have to attach it to your state, county, or local income tax return. If so, keep a copy for yourself.

Check with your states Department of Revenue and relevant county and local government tax agency for instructions on how to report your unemployment benefits at the state and local level.

Calculating Your Futa Tax Liability

You must pay unemployment taxes if:

- You paid wages of $1,500 or more to employees in any calendar quarter of a year, or

- You had one or more employees for at least some part of a day in 20 or more different weeks during the year.

You must count all employees, including full-time, part-time, and temporary workers. Dont count partners in a partnership, and dont count wages paid to independent contractors and other non-employees,

You must pay federal unemployment tax based on employee wages or salaries. The FUTA tax is 6% on the first $7,000 of income for each employee. Most employers receive a maximum credit of up to 5.4% against this FUTA tax for allowable state unemployment tax. Consequently, the effective rate works out to 0.6% .

Read Also: What Long Term Care Expenses Are Tax Deductible

Recommended Reading: Can You Receive Unemployment And Disability At The Same Time

These Are The States That Willnotmail Youform 1099

Connecticut

Access your Form 1099-G on-line using the Connecticut Department of Revenues Taxpayer Service Center .

Georgia

You can access your Form 1099-G on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Detailed instructions here: How to Request an Electronic 1099-Gand 1099-G and 1099-INT Search

Louisiana

Access your Form 1099-G by logging into your HiRE account then clicking on Unemployment Services and then Form 1099-G Information.

Missouri

Access your Form 1099-G online at or by calling the Missouri Department of Revenue at 573-526-8299. You will need your social security number, zip code and filing status on your most recently filed tax return. Taxpayers living outside of the United States will need to enter 00000 in place of a zip code.

New Jersey

Access your Form 1099-G by visiting New Jerseys Department of Treasury website.

New York

To access yourForm 1099-G, log into your account atlabor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Wisconsin

Log on, then select Get your 1099-G from My UI Home to access your 1099-G tax forms.

Problems With The Irs

- Low-Income Taxpayer Clinics : LITCs are programs at law schools, accounting schools, or legal services offices that provide assistance and legal representation to lower-income taxpayers who are in disputes with the IRS.

- Taxpayer Advocate Service : TAS is an independent organization within the IRS that can help people navigate through their tax problems and find solutions. Contact your local office.

- Community Legal Aid: Local legal aid services can provide free or low-cost legal help for people with tax problems.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

Also Check: What Is The Federal Unemployment Rate

How Do You Claim Unemployment Benefits

Unemployment benefits are offered at the state level. Youll need to contact your states unemployment insurance program and follow its instructions for applying. In general, youll need to complete an application that explains your situation and details where you worked, how long you worked there, how much you made, and why youre no longer employed. Your states unemployment program will review your application and approve it, request additional information or an interview, or deny it. You can appeal if your claim is denied.

If You Cant Pay Your Taxes On Time

If you do end up owing the government money and cant pay your taxes on time, the IRS offers several payment plan options that can help you.

But be aware that not paying the full amount you owe by the filing deadline will mean youll pay interest and possibly penalties on the unpaid amount even if you arrange a payment plan with the IRS.

IR-2020-185, August 18, 2020

WASHINGTON With millions of Americans now receiving taxable unemployment compensation, many of them for the first time, the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year.

Withholding is voluntary. Federal law allows any recipient to choose to have a flat 10% withheld from their benefits to cover part or all of their tax liability. To do that, fill out Form W-4V, Voluntary Withholding Request, and give it to the agency paying the benefits. Dont send it to the IRS. If the payor has its own withholding request form, use it instead.

Don’t Miss: How To Get 1099 G From Unemployment

Paying Unemployment Taxes At The State And Local Level

At the local and state level, the options to pay for your state and local taxes may differ depending on where you live. Contact your state, county, or local unemployment office to learn about the different options to pay your taxes. These options may include:

1. Requesting to have state and/or local taxes withheld. The steps to request state and local tax withholding differ.

2. Making quarterly estimated payments. The due dates for estimated payments at the state and local level may differ from federal due dates.

3. Paying your taxes in full. If you need your full amount of your unemployment benefits and cannot make quarterly estimated payments, you can pay your taxes all at once when they are due. However, you may receive an underpayment penalty for not paying enough taxes throughout the year.

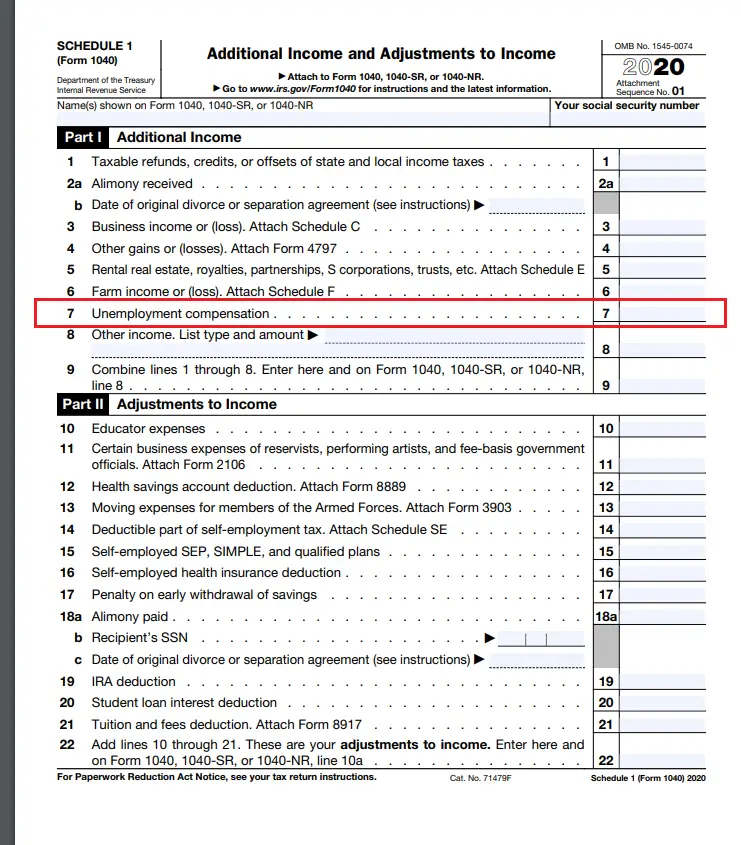

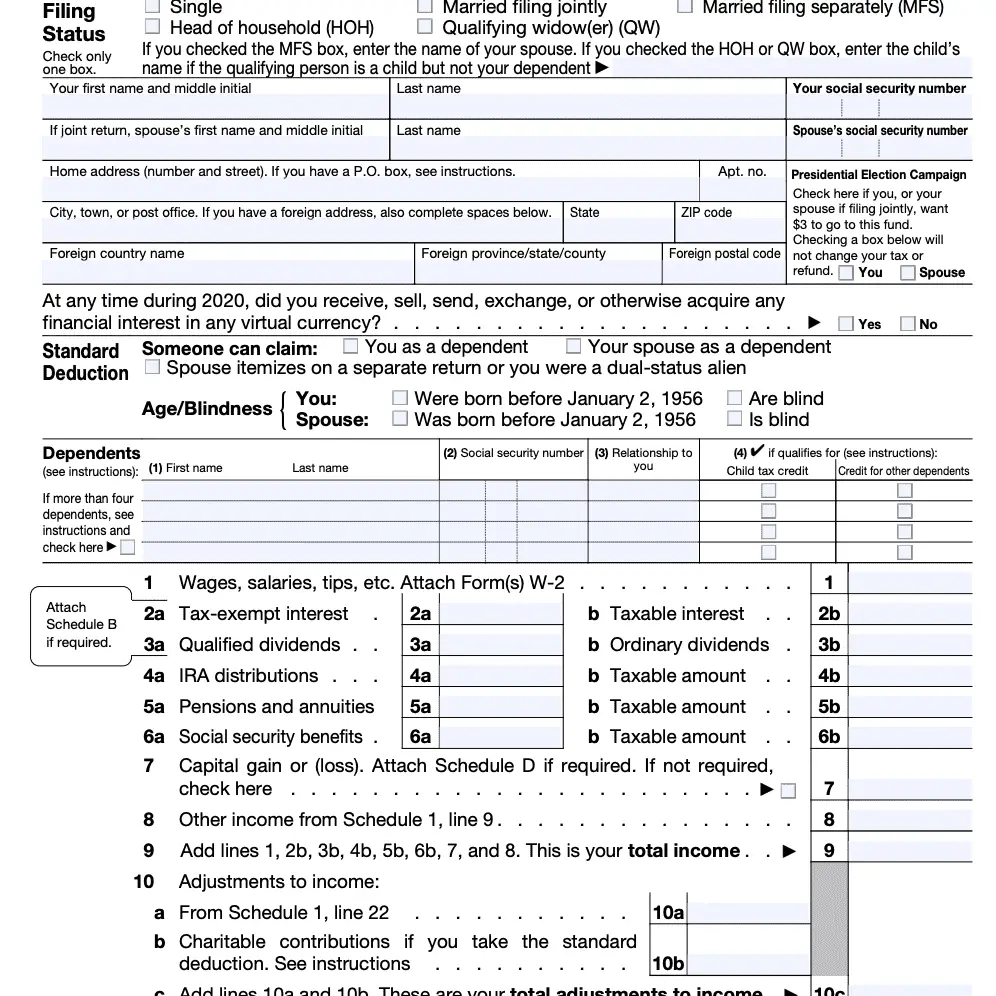

Unemployment Benefits At Tax Time

People who become unemployed for the first time are often shocked to learn that they must report their unemployment benefits more than $10,200 on their 2020 tax return. You should receive a Form 1099-G showing total unemployment compensation paid to you in 2020. If you move and don’t receive a 1099G from your state’s unemployment office, you might even forget you received this income altogether. But if you omit unemployment income from your tax return, the IRS will take noticeand expect you to pay what’s owed.

It’s important to be proactive so you don’t get caught short of funds at tax time. When you file for unemployment, consider having federal and state taxes withheld from your benefits. It may be difficult to lose that money from your unemployment check when funds are so tight, but you’ll be glad when it comes time to file your taxes in May.

Note: The Internal Revenue Service pushed back the federal income tax filing due date for the 2020 tax year from April 15, 2021, to May 17, 2021. This extended deadline gives you an extra month to file your returns.

If you havent been withholding taxes from your unemployment benefits, talk to a tax professional or use your favorite online tax software to project your federal and state tax liabilities. Be sure to include all sources of income, both taxable and tax-free, and any amounts that were withheld from wages, investment accounts and early retirement withdrawals.

Don’t Miss: How To Find My Unemployment 1099

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

How Much Are Unemployment Benefits Taxed

At the federal level, unemployment benefits are treated the same as other types of ordinary income. The federal income tax brackets, which range from 10% to 37%, will determine how much you pay.

Which bracket you fall into depends on your total income minus deductions and credits, with the rate you’ll pay being determined on a per-dollar basisyou won’t pay the same rate for every dollar you made during the year.

It works something like this: If you file as single in 2020, you can automatically receive a $12,400 standard deduction, which reduces your taxable income. As a result, you won’t have to pay any federal income taxes on the first $12,400 you makeyou might not even have to file a federal tax return. The next $9,875 you make falls into the 10% tax bracket, with the 12% bracket after that covering income from $9,876 to $40,125, and so on .

As the amount you earn climbs, new earnings are pushed into new brackets, but the rate that applies on lower-dollar earnings stays the same. Even if you make $1 million in a year, you still receive the standard deduction, pay 10% on the first $9,875, 12% on the next portion, on up to the top tax rate of 37% for income above $518,400.

As a result, your unemployment benefits may be taxed federally anywhere from 0% to 37%.

Recommended Reading: How To Fight An Unemployment Claim

Do I Have To Pay Unemployment Back

No. Unemployment benefits are yours to keep, except for the amount you may owe in taxes. But make sure youre getting the right amount.

In a few cases that ProPublica found, simple mistakes have led states to overpay unemployment recipients and then demand huge sums of money back. A new bill would shield unemployment recipients from having to repay overpayments made by mistake, but it would only apply to unemployment aid that came directly from the federal government. As of April 2021, the bill is still in committee.

About this guide: ProPublica has reported extensively about taxes, the IRS Free File program and the IRS. Specifically, weve covered the ways in which the for-profit tax preparation industry companies like Intuit , H& R Block and Tax Slayer has lobbied for the Free File program, then systematicallyundermined it with evasive search tactics and confusing design. These companies also work to fill search engine results with tax guides that sometimes route users to paid products. ProPublicas guide is not personalized tax advice, and you should speak to a tax professional about your specific tax situation.

You May Like: What Percentage Of Taxes Do The Rich Pay

State Income Taxes On Unemployment Benefits

Many states tax unemployment benefits, too. There are several that do not, and some waived income tax on benefits received in 2021. For example, Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Seven states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

Don’t Miss: How Do I Get My Unemployment Tax Form Online

Where To Find Your 1099

We will mail a paper copy of your 1099-G to the address we had on file for you on December 31, 2021.

We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31, 2022.

It is too late to change your address for the 1099-G mailing, but you can access your 1099-G online.

- Pandemic Unemployment Assistance payments

- Supplemental payments

- Any other kind of unemployment benefit

The total on your 1099-G includes any amounts that were withheld on your behalf, such as:

- Overpayment offsets

Your 1099-G total does NOT include benefit payments that were processed in 2022, even if those payments were for weeks in 2021.

Special Rule For Unemployment Compensation Received In Tax Year 2020 Only

The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to $10,200 of unemployment compensation they received in tax year 2020 only. In the case of married individuals filing a joint Form 1040 or 1040-SR, this exclusion is up to $10,200 per spouse. To qualify for this exclusion, your tax year 2020 adjusted gross income must be less than $150,000. This threshold applies to all filing statuses and it doesn’t double to $300,000 if you were married and file a joint return. Any unemployment compensation in excess of $10,200 is taxable income that must be included on your 2020 tax return.

You May Like: What Is The Federal Unemployment Tax Rate

The Unemployed Still Have To Pay Taxes Even On Unemployment Benefits

Whether or not you have to file a tax return has nothing to do with your employment status. It depends entirely on how much income you received during the year.

If your income falls above the income threshold for your filing status, you have to file a tax return. Unfortunately, it doesnt matter to the IRS if you happen to be out of a job.

The unemployed should note, however, that unemployment benefits do qualify as taxable income. In other words, your unemployment payment received is considered income.

Also Check: How Do I Sign Up For Unemployment In Ohio

What Can I Do If I Cant Pay My Federal Taxes

If you owe taxes and cant pay them in full, it is important to pay what you can and make a plan. Consider using a payment plan, but note that unless you pay the amount owed in full, you will be charged interest and penalties.

To learn more about your different payment options based on your financial situation, read What to Do if I Owe Taxes but Cant Pay Them.

Don’t Miss: Do You Have To Pay Taxes On Unemployment Income

How Do I Calculate Futa Taxes

For each payroll, you must determine FUTA taxes payable based on the total gross pay paid to employees, up to $7,000 per employee each year. Then multiply this total by the FUTA tax rate .

After you calculate the total tax for all employees for the pay period, you must set aside that total in a payables account in your accounting system. Unemployment tax is a trust fund tax, meaning that it is an amount you owe that must be paid to a government agency.

How To Pay Federal Income Taxes On Unemployment Benefits

Perhaps the easiest way to pay taxes on unemployment compensation is to have federal income taxes withheld from your weekly payments. To have federal income taxes withheld, file Form W-4V with your states unemployment office to instruct them to withhold taxes.

If you request tax withholding, the state will withhold 10% of each paymentno other amounts or percentages are allowed.

Another option is to make estimated quarterly payments by mailing a check with Form 1040-ES or making a payment online via IRS Direct Pay. However, this option is fairly high maintenance compared to having tax withheld from your unemployment benefits.

First, you need to estimate the amount youll owe using your tax software or the worksheet accompanying Form 1040-ES. Then you need to make four quarterly payments, generally due April 15, June 15, September 15, and January 15 of the following year.

The final option is to wait until you file your tax return to see how much youll owe. However, this option can be risky because it can leave you with a large tax bill and underpayment penalties in April.

Read Also: What Day Does Unemployment Get Deposited In Ga

Differences In State And Federal Treatment

If you had any unemployment income last year, it is subject to taxes and needs to be reported on your 2020 income tax return. In January, those who had unemployment income should have received a Form 1099-G that spells out the amount of money paid out during the year.

Federal income taxes apply to these benefits whether its state unemployment insurance or the pandemic unemployment compensation disbursed under the CARES Act.

The catch is that withholding the appropriate amount of income tax is voluntary. You can opt to have a flat 10% of your benefits withheld to cover the tax liability.

In order to do this, youd have to file Form W-V4 with the state agency administering your unemployment.

You can also choose to make quarterly estimated tax payments to the IRS.

Uncle Sam isnt the only entity seeking a slice of your unemployment income. Most states will tax these benefits, too.

A handful of states Alabama, California, Montana, New Jersey, Pennsylvania and Virginia dont tax these payments. Indiana and Wisconsin offer a partial exclusion of unemployment income, according to Andy Phillips, director at the Tax Institute at H& R Block.

Some states have withholding, and others require it in order to alleviate surprises when tax time comes around, said Jared Walczak, vice president of state projects at the Tax Foundation.