When Does It Make Sense For Me

If you think you might be able to take on a part-time job that doesnât bring in more than $1,000 a month, you might want to consider applying for SSD and unemployment.

If youâre among those who can collect unemployment benefits while looking for a part-time job, you still need to research how your unemployment benefits might affect any Supplemental Security Income . If you do qualify for unemployment benefits and start receiving monthly payments, those payments can affect your eligibility for the disability program. You can be denied SSI benefits if your unemployment checks cause your monthly income to exceed the limits.

If you go the route of applying for both, you arenât saying that you can hold down a full-time job but youâre also not saying that you are unwilling to look for a job. In this situation, you state that your disability prevents you from working full-time and that you need unemployment benefits to make up for your lack of a job while you seek other options.

Note that some states require you to be willing to look for a full-time job in order to receive unemployment benefits. Youâll need to check with your state laws ahead of time.

Also Check: Is Degenerative Disc Disease Considered A Disability?

Does Disability Pay More Than Unemployment

Workers Compensation Permanent Disability BenefitsWorkers Compensation Permanent Disability Benefits Two-thirds of her $300 weekly wages would be $200, which is more than the maximum weekly payment allowed by law Modified or alternative work must pay at least 85% of the wages you were receiving at the ⦠View Doc

INCOME UNEARNED NEW YORK STATE DISABILITY INSURANCE BENEFITS â¦NEW YORK STATE DISABILITY INSURANCE BENEFITS, WORKERSâ COMPENSATION AND SICK PAY sickness and/or accident disability more than six months after the A/R stopped working because of that sickness or disability, is unearned income. Sick pay received during the first six months is earned income ⦠Fetch Doc

Disability Retirement For Federal EmployeesSecurity, workers compensation, insurance proceeds, unemployment compensation, interest, dividends, rents, inheritances, 12 The Social Security Act deems anyone who earns more than a certain monthly amount to be pay continues for the term of the disability up to a maximum of 45 days, ⦠Get Document

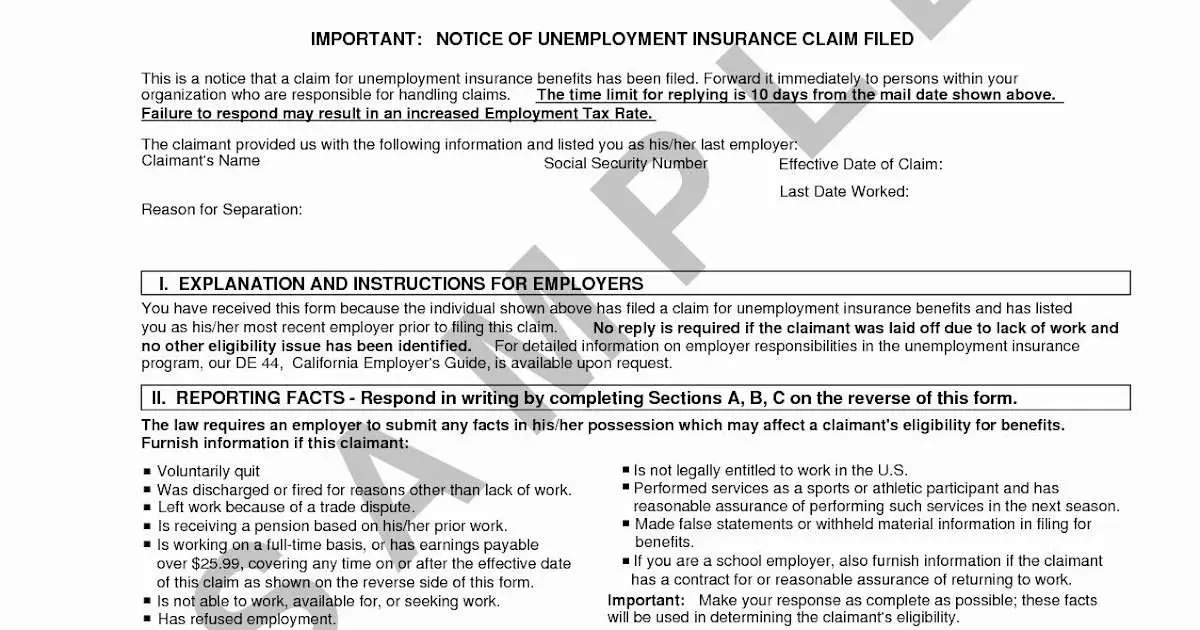

Unemployment Insurance Continued Eligibility RequirementsUnemployment Insurance Continued Eligibility Requirements REPORTING WAGES EARNED pay that you receive when your job ends does not have to be reported because you did not earn it while in case the EDD ever suspects you of lying to receive more in unemployment benefits than you are ⦠Fetch Full Source

You May Like: Generalized Anxiety Disorder Va Rating

How Does Unemployment Affect Your Taxes

How does unemployment affect my taxes? Unemployment benefits are generally taxable. Most states do not withhold taxes from unemployment benefits voluntarily, but you can request they withhold taxes. Make sure you include the full amount of benefits received, and any withholdings, on your tax return.

Dont Miss: Can You Get Social Security Disability If You Have Copd

Don’t Miss: Can You Collect Unemployment If You Quit Your Job Because Of Stress

Disability Benefits And The Eitc

The Earned Income Tax Credit is a refundable tax credit for low-income working families and individuals. Since the IRS is clear that disability benefits are not considered earned income, these benefits cant be used to claim this credit. You must have worked and made an income to get this tax credit.

It can be difficult to navigate both Social Security administration rules in conjunction with IRS tax laws alone. It would be beneficial to hire a disability lawyer to help make sure youve received the benefits youre entitled to, as well as report the right amounts of earned and unearned income.

The Problem With Applying For Unemployment Benefits And Ltd

Long-term disability insurance carriers and plan administrators will not hesitate to use an application for unemployment benefits against you. They may interpret your application as evidence that you think you can work. They may also find that you lack credibility because you’re trying to maintain two supposedly contradictory positions at once. You’re filing a claim for disability benefits based on your inability to work while at the same time affirming to the unemployment agency that you’re ready and available to work.

Your state’s unemployment agency may make similar inferences if it discovers you’ve filed a claim for LTD benefits: namely that you’re not “ready, willing, and able” to work and therefore don’t qualify for benefits.

Also Check: How To Earn Money When Unemployed

The Ltd Offset For Unemployment Benefits

Most long-term disability policies contain LTD offsets for “other income benefits” such as Social Security disability payments, workers’ compensation, third-party settlements, and, yes, unemployment benefits. In those cases where an individual receives both LTD and unemployment benefits, LTD insurers are frequently able to deduct the monthly unemployment amount from their monthly LTD payments. Thus, if an individual receiving $1,400 per month in LTD benefits is approved for $1,000 each month in unemployment benefits, the LTD insurer would pay a reduced benefit of $400 as long as the individual is receiving $1,000 per month in unemployment benefits.

Offsets for unemployment benefits and other forms of income are common to both individual and group LTD policies, although individual policies are occasionally written to exclude certain offsets in exchange for higher monthly premiums.

What Income Is Counted For Snap

Gross income is the total, non-excluded income, before any deductions have been made. Net income is the gross income minus your allowable deductions. If your household only consists of one person, then the gross monthly income to be eligible for SNAP is $1,287 . For two people, gross is $1,726 .25 oct. 2017

Recommended Reading: Bankofamerica/kdoldebitcard

Ways Employees Can Disqualify Themselves From Sdi

In some situations, employees can lose their eligibility for SDI benefits. Benefits are not available for an employee who:

- missed the doctor’s appointment that the EDD set up

- is unable to work as the result of a felony he or she committed

- is incarcerated after being convicted of a crime

- is receiving unemployment benefits

- is receiving sick leave that equals his or her full salary or regular wages

- is receiving paid family leave benefits, or

- is receiving workers’ comp payments that are higher than what the employee would receive from SDI.

What Happens If My Employer Denies Me Workers Compensation Benefits

If your employer denies your initial claim, you are still eligible to apply for other benefits. Applying for those benefits does not prevent you from filing a workers compensation claim. Make sure you attach your employers Notice of Denial form when you file your claim.

Some of the benefits for which you can apply to help pay your bills after your employer has denied or delayed your workers compensation claim include:

- Unemployment Compensation benefits.

Read Also: Www Tn Gov Workforce Howtofileui

How Do I Get Paid Edd

Receive Your Benefit Payments It takes at least three weeks to process a claim for unemployment benefits and issue payment to most eligible workers. When your first benefit payment is available, you will receive a debit card in the mail. Once you activate the card you can track, use, and transfer your benefit payments.

Make Sure You’re Properly Covered: Get Professional Legal Help Today

If your case is especially complex, or you have additional questions about disability and unemployment, you may benefit from a consultation with a Social Security Disability Insurance lawyer. An attorney will understand how to navigate the system and ensure everything is filed correctly. Contact an experienced SSDI attorney today.

Thank you for subscribing!

Read Also: How Do I Change My Address For Unemployment Online

Can You Lose Your Disability Benefits

Social Security disability benefits are rarely terminated due to medical improvement, but SSI recipients can lose their benefits if they have too much income or assets. Although it is rare, there are circumstances under which the Social Security Administration can end a persons disability benefits.

When Can You Get Unemployment And Disability

Because unemployment requires a claim that you are able to work and disability generally requires a claim that you cannot work, it is very rare to be able to get both at the same time. Situations where you may get both at the same time include the following:

- You are able to do some work that is not similar to previous work you have done.

- Your work does not rise to the level of substantial gainful activity.

A long term disability attorney can help you determine whether you meet these eligibility requirements.

Don’t Miss: How Do I Sign Up For Unemployment In Indiana

Are Government Workers Eligible For Disability Benefits

Some government workers, including school employees, may be eligible for Disability Insurance benefits. To find out, review your collective bargaining contract. If you have wages from another employer in your base period, you may be eligible even though your current employer doesnât participate in State Disability Insurance. If you arenât sure if youâre eligible, file a claim anyway.

Can I Receive Both Workers Comp And Ssdi Benefits At The Same Time

Yes. If you suffered an injury on the job that leaves you permanently disabled, you could receive both workers comp and SSDI, but only up to 80 percent of the total the SSA estimates your current wage to be. If the combined benefits from workers comp and SSDI add up to more than that 80 percent total, your SSDI benefits will be reduced until you reach the 80 percent threshold.

Read Also: Can You File Bankruptcy On Unemployment Overpayment

Can You Be Fired While On Disability In Ca

California provides broad protection to employees with a physical or mental disability. Sometimes an individuals disability necessitates a temporary leave of absence. If the employee and employer meet certain criteria, the employer is not permitted to fire the employee while he or she is on a disability leave.

When Do Va Benefits Not Count As Income

The IRS defines Gross Income in Section 61 as: Compensation for services, including fees, commissions, and similar items.

According to the IRS, disability benefits received from the VA should not be included in your reported gross income and are not taxable at the federal level.

Payments that are considered disability benefits include:

- Disability compensation and pension payments for disabilities paid either to veterans or their families

- Grants for homes designed for wheelchair living

- Grants for motor vehicles for veterans who lost their sight or the use of their limbs

- Benefits under a dependent-care assistance program

- Education, training, and subsistence allowances

- Veterans insurance proceeds and dividends paid either to veterans or their beneficiaries, including the proceeds of a veterans endowment policy paid before death

- Interest on insurance dividends left on deposit with the VA

- Benefits under a dependent-care assistance program

- The death gratuity paid to a survivor of a member of the Armed Forces who died after September 10, 2001

- Payments made under the compensated work therapy program

- Any bonus payment by a state or political subdivision because of service in a combat zone

Currently, VA disability payments also are tax-free in all states, although its always a good idea to double-check your state income tax code.

Also Check: How To Increase Your Va Disability Rating

Recommended Reading: How Do I Sign Up For Unemployment In Tn

Not Having Paid Into Sdi Or Not Having Earned Enough In Your Base Period

In addition to having a non-work-related injury or illness, to get SDI benefits:

- If you’re an employee, you must have had California SDI taxes taken out of your paychecks, and you must have earned at least $300 in your base period .

- If you’re an independent contractor or business owner, you must have paid into Elective Coverage for at least 6 months.

If you have not paid California SDI taxes during the base period, you do not qualify for SDI.

Example: For the last three years, you’ve been working for a company in Phoenix, Arizona. Three months ago, you got a promotion and were transferred to their office in San Diego. Since working in the San Diego office, 1.2% of your pay has gone to SDI. However, you don’t qualify for SDI yet, because during your base period, you lived in Arizona and weren’t paying into SDI.

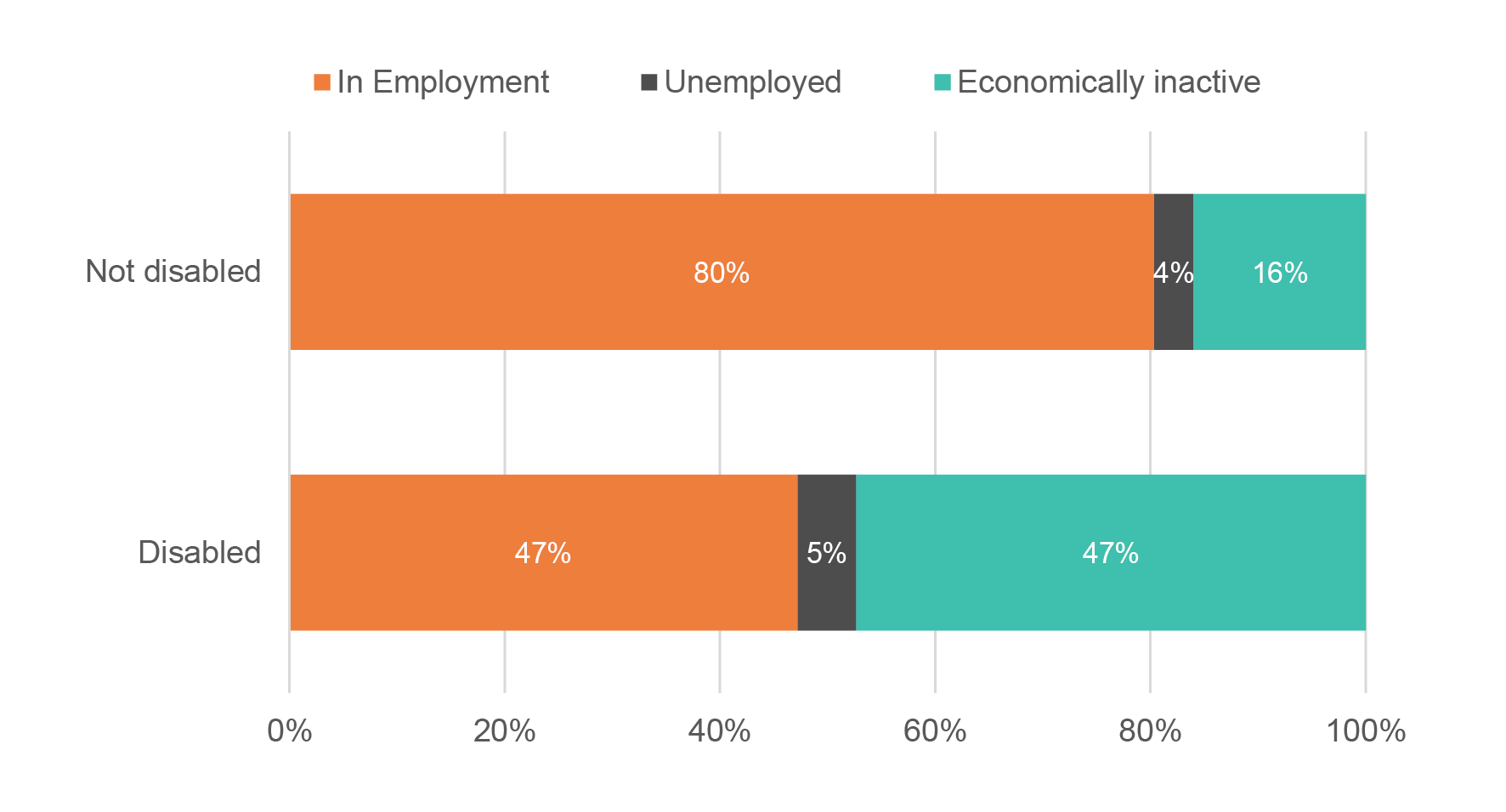

Ii A Simple Model Of Interactions Between Unemployment Insurance And Disability Insurance

model the choice between work and SSDI application for marginally disabled workers. We extend their model to include unemployment insurance, drawing as well on model of UI and job search. Each period a displaced worker can choose whether to search for work or to remain idle. Only search can lead to a new job or to UI benefits, whereas an SSDI application can be submitted only when idle.

The cost of search is cU and the probability of finding employment is f. If a job is found, it yields continuation value VE. Job searchers can draw up to N periods of unemployment benefits, worth bUI per period. Idle individuals do not pay search costs but have probability 0 of finding employment and cannot draw UI benefits.

In a period that an individual does not search, he may apply for SSDI benefits at application cost cA and with probability of success p. We assume that SSDI eligibility decisions are perfectly correlated over time, so that a worker who is rejected once will not reapply. A worker whose application is successful receives per-period benefits bDI in perpetuity.

where VU, VI, and VA represent, respectively, the values associated with choosing to search for a job, to remain idle, or to apply for benefits. These are

Read Also: How Do I Change My Address For Unemployment Online

Will Unemployment Compensation Affect My Social Security Disability Insurance Benefits

By Shelley W. Elovitz, Esquire

There are cases where you can work and receive Social Security Disability Insurance Benefits But what if you lose your job? Are you eligible for Unemployment Compensation?

If you are enrolled in the Social Security Ticket to Work program and you worked for at least six months before you were laid off, you are eligible to collect unemployment benefits and disability benefits at the same time.

Social Security uses Grid Rules based on age, RFC level , education level, and work history and skills to determine disability. If you are over 50 years old and can only do sedentary work, and if you have been seeking sedentary work while collecting unemployment, you may remain eligible for both unemployment and disability. If you are over 55 years old and can only do light work, and you have been seeking light work while collecting unemployment, you may remain eligible for both unemployment and disability.

Unemployment benefits do not affect or reduce retirement and disability benefits. State unemployment compensation payments are not wages because they are paid due to unemployment rather than employment. However, income from Social Security may reduce your unemployment compensation.

You May Like: How Much Does Sdi Pay In California

There Are A Few Situations Where You Can Receive Both Long

By Aaron Hotfelder, J.D., University of Missouri School of Law

Individuals rarely receive long-term disability and unemployment benefits at the same time because of the way these programs are typically designed. Unemployment benefits, generally administered by a state agency, are intended for individuals who are ready, willing, and able to work, but have lost a job through no fault of their own. Those collecting unemployment benefits are required to certify that they’re capable of working either full-time or part-time, depending on the state, and that they’re actively seeking employment. Long-term disability benefits, on the other hand, are provided by a private insurer and meant for individuals who aren’t able to work due to illness or injury.

However, the eligibility requirements for LTD and unemployment benefits do occasionally overlap and in limited circumstances, as we’ll see below, a person may collect both.

If you’re looking for information on Social Security disability, see our article on applying for SSDI while on unemployment.

Also Check: Bankofamerica Com Kdoldebitcard

Va Ask A Queseion For The Veterans Affairs

There are some circumstances under which VA benefits do count as income. This is not an exhaustive list, and you should always check your states laws and regulations, but some common examples include:

Calculating income for child support and alimony. VA disability payments count as income for purposes of calculating child support and maintenance. The fact that theyre tax-free payments means theyre invisible to the IRS, but theyre not invisible to other agencies or for other purposes.

Calculating income for food stamps . Under federal law, all income is counted to determine eligibility for SNAP unless its explicitly excluded. For SNAP purposes, income includes both earned income such as wages, and unearned income such as Supplemental Security Income and veteran disability and death benefits. Because veteran disability benefits are not explicitly excluded, they are counted when determining a households eligibility for SNAP.

Obtaining a mortgage. VA lenders can count disability income when calculating income toward a mortgage. Borrowers with a service-connected disability are exempt from paying the VA Funding Fee, a mandatory cost the VA applies to every purchase and refinance loan to help cover losses and ensure the programs continued success.

Veterans who dont want to complete the financial worksheet must agree to pay a copayment to the VA for services.

Disability Benefits For Veterans

You may be eligible for disability benefits if you’re on disability from your service in the Canadian Armed Forces or Merchant Navy.

You may get social assistance payments from:

- your province or territory

- your First Nation

These payments will depend on your household income, savings and investments.

You may also be eligible for health-related benefits from your province or territory. These benefits may include benefits that help cover the cost of:

- medications

- medical aids or devices

You May Like: How Do I Sign Up For Unemployment In Indiana