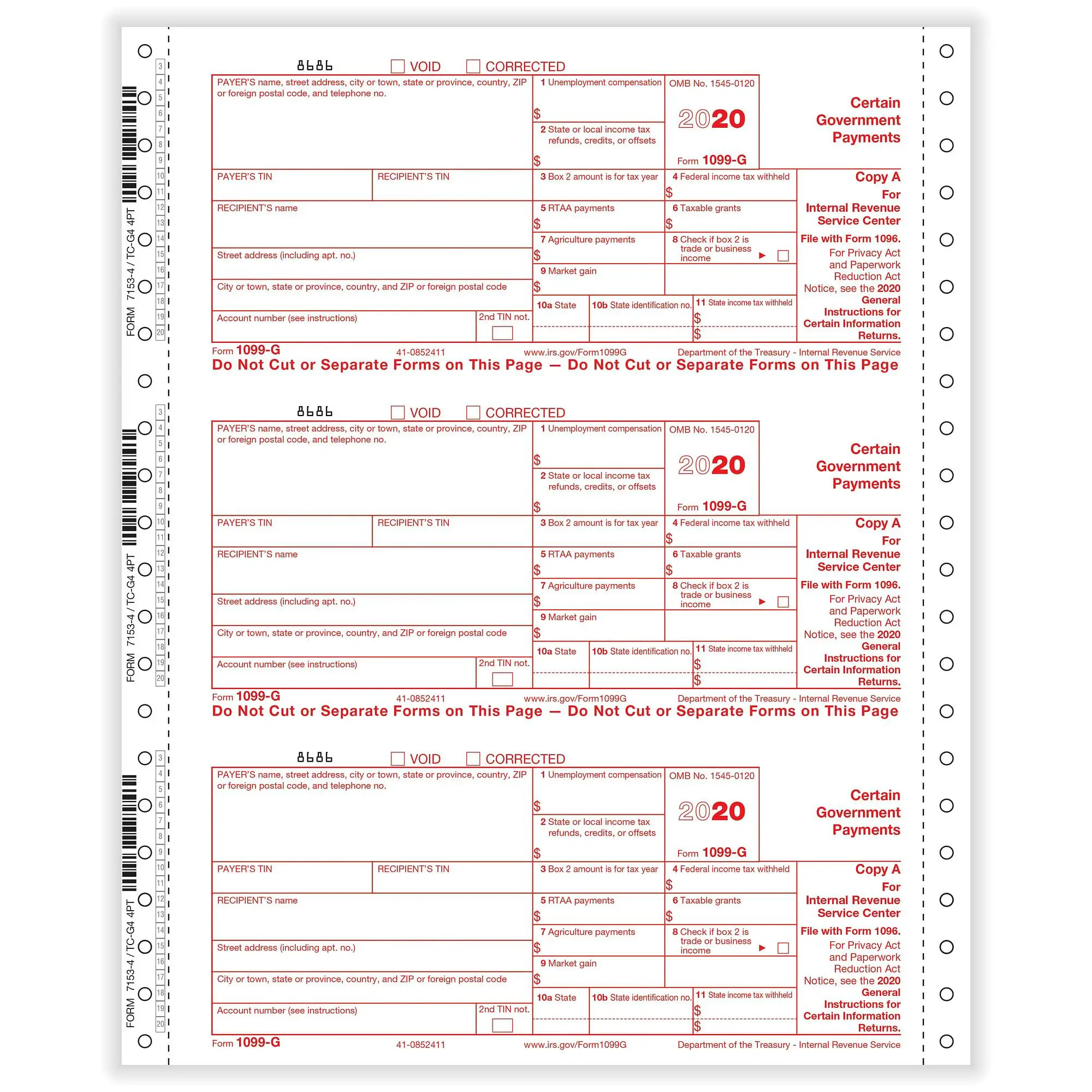

Delaware Income Tax 1099g Information

Posted: 1099-Gs were mailed during the week of January 25th. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G will NOT be forwarded by the United States Postal Service. The Delaware Division of Unemployment Insurance cannot update your mailing address for this 1099 cycle.

Recommended Reading: Pa Unemployment Ticket Status

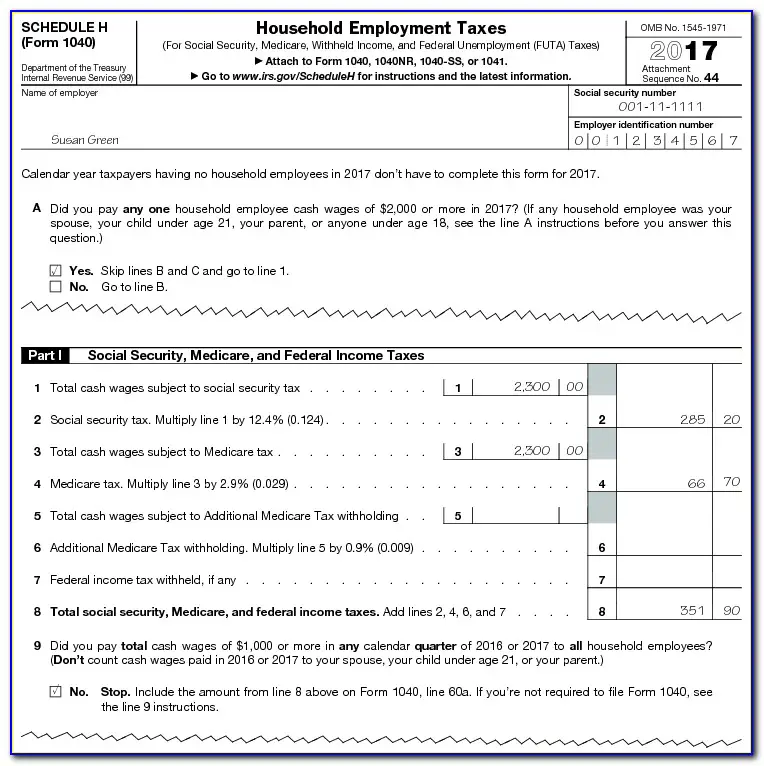

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

Gather 2022 Tax Documents

Taxpayers should develop a recordkeeping system electronic or paper that keeps important information in one place. This includes year-end income documents like Forms W-2 from employers, Forms 1099 from banks or other payers, Form 1099-K from third party payment networks, Form 1099-NEC for nonemployee compensation, Form 1099-MISC for miscellaneous income, or Form 1099-INT if you were paid interest, as well as records documenting all digital asset transactions.

Ensuring their tax records are complete before filing helps taxpayers avoid errors that lead to processing delays. When they have all their documentation, taxpayers are in the best position to file an accurate return and avoid processing or refund delays or IRS letters.

Read Also: How To File For Unemployment In Ny

These Are The States That Willnotmail Youform 1099

Connecticut

Access your Form 1099-G on-line using the Connecticut Department of Revenues Taxpayer Service Center .

Georgia

You can access your Form 1099-G on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Detailed instructions here: How to Request an Electronic 1099-Gand 1099-G and 1099-INT Search

Louisiana

Access your Form 1099-G by logging into your HiRE account then clicking on Unemployment Services and then Form 1099-G Information.

Missouri

Access your Form 1099-G online at or by calling the Missouri Department of Revenue at 573-526-8299. You will need your social security number, zip code and filing status on your most recently filed tax return. Taxpayers living outside of the United States will need to enter 00000 in place of a zip code.

New Jersey

Access your Form 1099-G by visiting New Jerseys Department of Treasury website.

New York

To access yourForm 1099-G, log into your account atlabor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Wisconsin

Log on, then select Get your 1099-G from My UI Home to access your 1099-G tax forms.

How Does A 1099 Employee Work

1099 employees are self-employed independent contractors. They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return. The employer withholds income taxes from the employees paycheck and has a significant degree of control over the employees work.

You May Like: How To Sign Up For Unemployment Massachusetts

Questions On Information In Form 1099

If I have questions concerning information on my 1099G, how do I contact someone within the Delaware Division of Unemployment Insurance?

If you have a concern about the 1099G that you received regarding the income from Unemployment Insurance or one of the CARES Act programs, please review the questions and answers above first. Perhaps we have already answered your question above. If not, please follow this link > Submit a 1099 Concern

What if I receive a Form UC-1099G with an incorrect amount in Total Payment or Tax Withheld areas of the form?

For income tax purposes, UC benefits and PUA benefits are reported in the calendar year in which they are paid, regardless of when the application or claim for benefits was filed.

If you believe the Total Payment or Tax Withheld on Form UC-1099G is incorrect, please use the link that appears on the Unemployment divisions 1099 Information Page, provided for you here Submit a 1099 Concern. All payments made to you and amounts withheld will be recalculated and compared to the amount on your Form UC-1099G. If the amount is incorrect, an amended Form UC-1099G will be issued.

Avoid Refund Delays And Understand Refund Timing

Many different factors can affect the timing of a refund after the IRS receives a return. Although the IRS issues most refunds in less than 21 days, the IRS cautions taxpayers not to rely on receiving a 2022 federal tax refund by a certain date, especially when making major purchases or paying bills. Some returns may require additional review and may take longer to process if IRS systems detect a possible error, the return is missing information or there is suspected identity theft or fraud.

Also, the IRS cannot issue refunds for people claiming the EITC or Additional Child Tax Credit before mid-February. The law requires the IRS to hold the entire refund not just the portion associated with EITC or ACTC.

Don’t Miss: How Do I Get Healthcare If I Am Unemployed

What Is Reported On My 1099

DES reports the total amount of unemployment benefits paid to you in the previous calendar year on your 1099-G. This amount is based upon the actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

Tax Reporting Requirements Associated With Form 1099

Do I need the 1099-G form to file my taxes?

Yes, you need the 1099-G form in order to complete and file your taxes.

Does UI benefit information need to be reported for Federal and State income taxes?

Yes, the Tax Reform Act of 1986 mandated that unemployment insurance benefits are taxable, and that any unemployment compensation received during the year must be reported on your federal tax return.

How will unemployment compensation affect my tax return?

If you do not have taxes withheld from your unemployment compensation, it could result in a tax liability.

Where do I find the Payers Federal Identification number?

You will find the federal identification number for the Delaware Department of Labor under the Payers name and address on the 1099-G form, immediately following the label FED EI#:.

Do I use the same Payers Identification number for Federal and State tax forms?

Yes.

What if I receive a Form UC-1099G after I have filed my federal income tax return with the IRS?

Questions concerning any adjustments that need to be made on your federal income tax return should be directed to the IRS at 800-829-1040.

Can I have federal income tax withheld from my unemployment compensation?

Don’t Miss: How Long Does It Take Unemployment To Direct Deposit

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Is A 1099 G Form Good Or Bad

Is a 1099 G taxable income? Unemployment compensation is generally taxable income to you, so Form 1099-G gives you the amount of unemployment benefits you must report on your tax return. You may opt to have federal income tax withheld on those benefits. If you do, the amount withheld will be reported in Box 4.

Recommended Reading: Applying For Unemployment In Pennsylvania

Don’t Miss: Can Self Employed People Get Unemployment

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 18, 2022.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

How Will I Recieve My 1099

1099-G forms will be sent via United States Postal Service. 1099-G forms cannot be sent by email, fax or any other electronic method. 1099-G forms are mailed to the address on record as of January 1, 2022. The USPS will not forward 1099-G tax forms unless it has a change of address on file.

- PUA Claimants: If you filed for benefits in PUA, your 1099-G has been mailed to you. The Department is also currently working to upload 1099-G forms for PUA claimants to the PUA online portal. We will notify you as soon as PUA 1099-G forms are available online..

- If you filed in the regular unemployment insurance system, we are unable to upload your 1099-G to your online claimant portal due to system limitations.

Read Also: How To Get In Touch With The Unemployment Office

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Delaware Department Of Labor

Disclaimer: These FAQs are subject to change based on new information. Additionally, due to modifications of the UI program as a result of COVID-19 responses, many of the FAQs have modified answers. Please check back frequently. This website is not intended as legal advice. Any responses to specific questions are based on the facts as we understand them and the law that was current when the responses were written. They are not intended to apply to any other situations. This communication is not an agency order. If you need legal advice, you must consult an attorney.

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Delaware Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Delawares UI benefit payment amounts that were issued within that calendar year. This may be different from the week of unemployment for which the benefits were paid.

1099-Gs were required by law to be mailed by January 31st for the prior calendar year. The Division has mailed the 1099-Gs for Calendar Year 2020.

1099-Gs were mailed during the week of January 25th. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G will NOT be forwarded by the United States Postal Service.

Don’t Miss: Is The $600 Unemployment Taxed

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters weve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

Also Check: When Will The 300 Unemployment End

Note On Taxable Income

The American Rescue Plan Act of 2021 contains provisions regarding taxable unemployment compensation. Please direct all tax filing questions to the IRS, and visit their website for the most recent guidance.

Image source: /content/dam/soi/en/web/ides/icons_used_on_contentpages/IDES_icon_blue_warning_67px.png

Notice To Representatives Of Deceased Claimants

Q: How do I access the 1099-G tax form if I am the representative of a deceased claimant?

A: For the New York State Department of Labor to provide you with information belonging to a deceased unemployment insurance claimant, you must first show that you are legally authorized to receive this information. Authorization often comes from the New York State Surrogate Court, and may be one of the following:

- Appointment as an Executor

- Letters of Administration

- Appointment as a Voluntary Administrator

If the deceased claimant had no assets, or all property owned by the deceased claimant was owned in common with someone else, then no Executor or Administrator may have been appointed. The representative of the deceased claimant must provide proof that they are authorized to obtain the information. In this case, a surviving spouse should provide NYS DOL with:

Please submit proof that you are authorized to receive the deceased claimants information using one of the following methods:

You May Like: Can I File For Unemployment While Waiting For Disability

These Are The States That Will Either Mail Or Electronically Deliver Your Form 1099

California

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at and select 1099G at the top of the menu bar on the home page.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by: logging into your account at selecting 1099G at the top of the menu bar > View next to the desired year > Print or Request Paper Copy.

You can also request a paper copy by calling 1-866-333-4606.

Florida

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at myflorida.com and go to My 1099-G & 49Ts in the main menu.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed at 1099grequest.myflorida.com.

Illinois

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at ides.illinois.gov. Illinois Department of Employment Security will send an email notification with instructions to access the document from the Illinois Department of Employment Security website.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by calling 338-4337.

Indiana

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at in.gov. You will find your Form 1099-G on your Correspondence page.

If you opted into electronic delivery:

Michigan

Utah

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

You can opt to have federal income tax withheld when you first apply for benefits. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development, Unemployment Insurance, PO Box 908, Trenton, NJ 08625-0908. for the “Request for Change in Withholding Status” form.

After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. This information is also sent to the IRS.

Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2021, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

IMPORTANT INFORMATION FOR TAX YEAR 2021:

You May Like: What Ticket Number Is Pa Unemployment On