Where To Get A Form 1099

If you didn’t receive payments from the government that could count as taxable income, you shouldn’t receive a 1099-G. But most taxpayers who received such payments can expect to receive Form 1099-G in the mail. You may also be able to view and download the form online, depending on the state or agency. Forms are usually sent out by the end of January.

If you receive a 1099-G form for unemployment benefits you didn’t receive, you could be the victim of identity theft. Report the potential fraud to the state agency that paid the benefits and follow its instructions.

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

You May Like: Can An Llc Owner Collect Unemployment

How Can You Determine If You Have Fallen Victim To A Fraudulent Unemployment Claim

Some indicators are:

- You received a notice from your employer indicating that a request for information about an unemployment claim in your name was received while you were still employed

- You received mail from a government agency about an unemployment insurance claim or payment that you didnt submit or received

- You received a Form 1099-G reporting in Box 1 unemployment insurance benefits that you never received or an amount greater than what you actually received during the year.

Make sure you double-check your Form 1099-G, even if you did claim and receive unemployment insurance benefits. The amount showing in Box 1 might be overstated if your identity was stolen and someone submitted a fraudulent claim on your behalf.

If you were a victim of unemployment benefits fraud, its important that you take immediate steps to report unemployment identity theft to the state where it occurred and correct any tax forms you may have received due to a fraudulent claim. The US Department of Labor has a website for victims of unemployment fraud that provides key steps to help victims of unemployment fraud.

If youve confirmed you are a victim of unemployment fraud, you might be wondering how to file your taxes if you have a tax form showing income that you never received, but that you know was also reported to the IRS.

Also Check: How Can I Draw Unemployment

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 15, 2021.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

Recommended Reading: Unemployment Compensation Phone Number

These Are The States That Will Either Mail Or Electronically Deliver Your Form 1099

California

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at and select 1099G at the top of the menu bar on the home page.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by: logging into your account at selecting 1099G at the top of the menu bar > View next to the desired year > Print or Request Paper Copy.

You can also request a paper copy by calling 1-866-333-4606.

Florida

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at myflorida.com and go to My 1099-G & 49Ts in the main menu.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed at 1099grequest.myflorida.com.

Illinois

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at ides.illinois.gov. Illinois Department of Employment Security will send an email notification with instructions to access the document from the Illinois Department of Employment Security website.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by calling 338-4337.

Indiana

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at in.gov. You will find your Form 1099-G on your Correspondence page.

If you opted into electronic delivery:

Michigan

Recommended Reading:

Also Check: When Will Extra 300 Unemployment Start

How To Get My 1099 From Unemployment To File Taxes

Many taxpayers are unaware that the unemployment income they received is taxable, just like earned income. The key difference is that unemployment income is taxed at a lower rate. Also, thanks to the American Recovery and Reinvestment Act , the first $2,400 of unemployment income is untaxed. In any event, you should list your unemployment income should on your return. Your state unemployment office should send you the 1099-G form listing that amount, but there are ways to request the form in the mail.

Tips

-

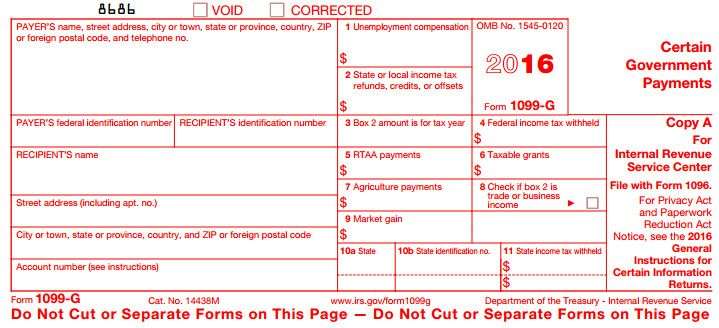

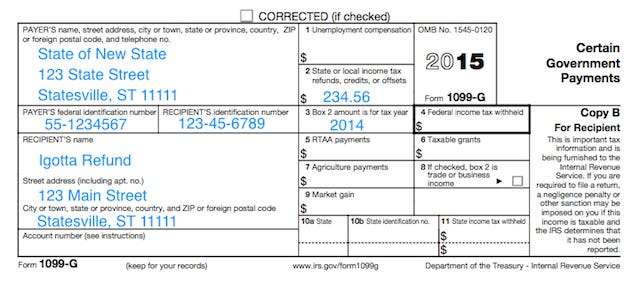

If you have received unemployment income at any point during the year, you will be required to complete and return IRS Form 1099-G. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly.

Read Also: Www Njuifile Net Tax

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: How To Sign Up For Unemployment Massachusetts

Des: Tax Information And 1099

Posted: What is the IRS Form 1099-G for unemployment benefits? By Jan. 31, 2021, all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account.

Check Back For Updates To This Page

For the latest updates on coronavirus tax relief related to this page, check IRS.gov/coronavirus. Were reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. Unemployment compensation includes amounts received under the laws of the United States or of a state, such as:

- State unemployment insurance benefits

- Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund

- Railroad unemployment compensation benefits

- Disability benefits paid as a substitute for unemployment compensation

- Trade readjustment allowances under the Trade Act of 1974

- Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and

- Unemployment assistance under the Airline Deregulation Act of 1978 Program

- Federal Pandemic Unemployment Compensation provided under the Coronavirus Aid, Relief, and Economic Security Act of 2020

- Benefits from a private fund if you voluntarily gave money to the fund and you get more money than what you gave to the fund.

If you received unemployment compensation during the year, you must include it in gross income. To determine if your unemployment is taxable, see Are Payments I Receive for Being Unemployed Taxable?

You May Like: Missouri Edd Unemployment

Recommended Reading: Can Self Employed People Get Unemployment

What To Do If You Don’t Receive A Form 1099

If you received unemployment benefits or other income that would be reported on a 1099-G but haven’t received the form, contact the agency that made the payment. You may be able to access your form online, or the agency may provide other instructions.

However, if you were unable to access the information by the May 17 tax deadline, you’re still responsible for filing a tax return. You can estimate the payments made to you, as well as any taxes that were withheld. If you receive the missing information after you’ve filed and discover a discrepancy, you’ll need to file an amended tax return.

Can I Get My 1099

In most cases youll get a hard copy on your mailing address. Government agencies wont send you online version on your email due to information security requirements. So, how do I get my 1099-G from unemployment, if I dont have one?

If you havent received the documents hard copy, you can request it in the department of taxation. Moreover, some states like California and New York allow you to get all the appropriate information electronically. It is possible to print 1099-G unemployment NY statement on the Department of Labor official website. Note that youll need your income tax return in this case.

Recommended Reading: How Much Is Unemployment In Missouri

How To Prepare For Your 2020 Tax Bill

Contact your unemployment office immediately if you do owe tax on your unemployment benefits and are concerned about being able to pay. You can start having income tax withheld from your payments if you havent already done so and if youre still collecting.

If youre still collecting unemployment benefits, see if you can opt in to having federal and state taxes withheld, Capelli said.

It probably wont solve your whole problem with the 10% withholding cap in place, but it will somewhat defray the impact of those benefits being included in your income. Ask for Form W-4V, fill it out, and file it with your unemployment office.

Consult With A Tax Advisor For Federal And State Tax Credits And Deductions Available

Lisa Greene-Lewis, a CPA at tax-prep software firm TurboTax, said income-based tax incentives and deductions are available to New Yorkers this tax season.

From federal and state earned income tax credits to child and dependent care tax credits, Lewis says low income earners in New York with outstanding tax bills and collecting unemployment should consult with a tax accountant to examine all options currently available.

New Yorkers should also be mindful of specific local tax credits like the child and dependent care, and earned income tax for New York City residents, she said.

Credits are dollar for dollar taking off the taxes you owe, she said. Theres a state specific earned income tax credit that is 30% of the federal earned income tax credit theres also specific credits for New York City.

Above all, Lewis says the last thing New Yorkers should do is to wait until April 15 to look into tax credits and deductions available.

Lewis and Ricky Wolbrom of Great Neck-based accounting firm Malc & Company said stimulus checks, known as Economic Impact Payments, are not taxable.

GOVERNMENT: When parkland expands, who pays the taxes? Ask Westchester and Rockland

Wolbrom, a partner at Malc & Co, also noted that this year taxpayers can claim a deduction of up to $300 for cash donations made to charity in 2020.

However, all unemployment benefit claimants, including New Yorkers on temporary furlough, must pay income taxes on their benefits, he said.

Also Check: What Does Mba Mean On Unemployment

What Is Reported On My 1099

DES reports the total amount of unemployment benefits paid to you in the previous calendar year on your 1099-G. This amount is based upon the actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

Recommended Reading: Pa Apply For Unemployment

The Way To Generate An Electronic Signature For A Pdf On Android

In order to add an electronic signature to a 1099 unemployment ny, follow the step-by-step instructions below:

If you want to share the 1099 ui form with other people, you can easily send the file by e-mail. With signNow, you are able to eSign as many papers daily as you need at a reasonable cost. Begin automating your eSignature workflows right now.

Recommended Reading: How To Apply For Unemployment In Missouri

Also Check: Can I Get Free Healthcare If I Am Unemployed

Federal Income Taxes & Your Unemployment Benefits Twc

Posted: Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS.

How To Find Form 1099

In New York, the easiest way to find your 1099-G is by logging in to the state Department of Laborâs web portal. You can find it at applications.labor.ny.gov/IndividualReg.

After signing in, scroll down to the Unemployment Insurance section on the right side of the page and select âUnemployment Servicesâ.

Scroll down toward the bottom of the page and you will see a section titled Get your 1099-G.âSelect 2020.

Your browser will then automatically download the form.

Read Also: How Do I Check My Unemployment Status Online

When Should I Receive My Unemployment Tax Form

Go the website of your stateâs labor department. Navigate to the page that provides information on unemployment claims. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question. In most cases, 1099-Gs for the previous year are mailed on or before January 31. For example, if you collected unemployment in 2018, the 1099-G should have been mailed by January 31, 2019. While on your states website, copy the contact information so you can contact the office directly if necessary.

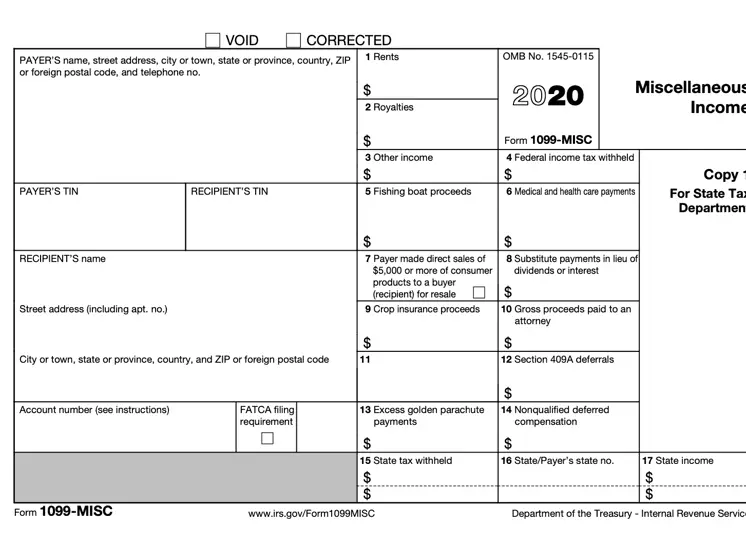

Do I Have To Report Miscellaneous Income

Yes, unless the income is considered a gift, you need to report all income that is subject to US taxation on your tax return. The $600 limit is just the IRS requirement for Form 1099-MISC to be considered necessary to file by the payer. You will report this income as other miscellaneous income on line 21 of your 1040.

Also Check: Where Do I Sign Up For Unemployment

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

You May Like: Do My Taxes Pay For Unemployment

Learn About The Forms

- The Tax Department Form 1099-G statement shows the amount of state and local taxes you overpaid through withholding or estimated tax payments. This amount includes overpayments, credits, or offsets of New York State income tax or MCTMT. You may need to report this information on your federal return. See instructions for Form 1040 for more information.

- The Department of Labor Form 1099-G statement shows the total amount of money you were paid in unemployment compensation benefits, as well as any adjustments or tax withheld. You must report this information on your 2020 income tax return.Note: New York State unemployment insurance benefits are considered taxable income. If you chose not to withhold tax from unemployment payments received in 2020, your refund this year may be negatively impacted. If you are still receiving unemployment payments, its not too late to adjust your New York State withholding for 2021 through your online account at the Department of Labor.

Read Also: How To Sign Up For Unemployment In Wv

These Are The States That Willnotmail Youform 1099

Connecticut

Access your Form 1099-G on-line using the Connecticut Department of Revenues Taxpayer Service Center .

Georgia

You can access your Form 1099-G on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Detailed instructions here: How to Request an Electronic 1099-Gand 1099-G and 1099-INT Search

Louisiana

Access your Form 1099-G by logging into your HiRE account then clicking on Unemployment Services and then Form 1099-G Information.

Missouri

Access your Form 1099-G online at or by calling the Missouri Department of Revenue at 573-526-8299. You will need your social security number, zip code and filing status on your most recently filed tax return. Taxpayers living outside of the United States will need to enter 00000 in place of a zip code.

New Jersey

Access your Form 1099-G by visiting New Jerseys Department of Treasury website.

New York

To access yourForm 1099-G, log into your account atlabor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Wisconsin

Log on, then select Get your 1099-G from My UI Home to access your 1099-G tax forms.