The Eligibility Criteria For Receiving Stimulus Checks

- Having a Social Security number.

- A Single filers earning has to be less than $99000 while for the head of the household it must be below $136,500 to qualify for the criteria. For married couples, it has to be less than $198,000 for the most recently filed tax returns.

- A person who is not claimed by someone as a dependent is eligible to receive a stimulus check.

- Those who have filed their tax in 2018 or 2019 a well as those who dont earn the needed amount to file for a tax but they are receiving other federal benefits like Social Security, disability or retirement benefits are also eligible.

Looking for a free consultation? We are just a call away. Contact us at MI Tax CPA, and our tax consultants are ready to guide you through all your tax related queries.

The Real Cost Of Unemployment Claims: Increased Tax Rates

The cost of an individual UI claim depends on how much the employee made, how long they remain on unemployment, and the states maximum benefit amount. The average amount paid out on an unemployment claim is $4200, but can cost up to $12,000 or even more.

State governments get the money to pay claims by debiting the employers UI account or by raising the employers UI taxes. A deduction in the account balance may also cause a rate increase, as the ratio between taxable payroll and the account balance changes. Each claim assessed to an employers account can result in a tax rate increase in future years.

So the real story isnt the cost of an individual claim . Its the higher tax rate that will have a long-term impact.

The state formulas generally use a three-year moving period to assign a tax rate. Each awarded unemployment claim can affect three years of UI tax rates. Employers often dont realize the real cost of a claim since its spread out over a long period.

The average claim can increase an employers state tax premium $4,000 to $7,000 over the course of three years. However, it can be far more, eclipsing the cost of the claim itself. Not winning claims can easily cost employers tens of thousands of dollars annually, if not more.

Charges To Accounts Of Contributing Employers

A contributing employer’s account is charged with the unemployment benefits paid out based on the percentage of base period wages paid by the employer that were used to establish a claim. Charges for contributing employers are not amounts the employer must pay instead, the DES tracks these charges and uses them when figuring an employer’s tax rate.

Also Check: Sign Up For Unemployment In Tennessee

The Payment Is Taxed But You Will Not Face A Lump Sum Of A Tax Bill

If there is any tax owing at the end of the year, Revenue will collect this by adjusting your tax credits.

Your Web Browser may be out of date. If you are using Internet Explorer 9, 10 or 11 our Audio player will not work properly. For a better experience use , Firefox or Microsoft Edge.

Who is entitled to the Pandemic Unemployment Payment?

The payment, which is a flat rate lump sum of 350 a week, is paid to anyone who has lost their job as a result of the coronavirus shutdown. It applies both to employees and the self-employed. You need to be aged between 18 and 66 and resident in the State.

Unlike other welfare payments, you do not need a public services card to apply although using one will give you online access to the application process which will deliver payments more quickly.

According to the most recent figures, 579,400 people are in receipt of the payment, though 33,400 of them have now returned to work and will not receive the payment from next week.

Ive heard this might be taxable. Is that the case and, if so, why?

It is taxable as in subject to income tax. This has come as a revelation to the many people who now find themselves claiming social welfare for the first time in their working lives.

Other taxable welfare payments include maternity benefit. For those of a certain age, the State pension is also taxable if a person has other sources of income.

So when is tax collected?

Dont Miss: Where Do I Go To Get Unemployment Benefits

Will I Get An Approval Letter From Unemployment

Youll usually receive a monetary determination letter soon after filing and a decision letter within two weeks unless some dispute occurs and slows down the process. These documents often come through the regular mail, but states can also offer electronic versions through their unemployment websites.

Recommended Reading: Njuifile.net Sign In

What Else To Know About Unemployment Tax Refunds

The IRS has provided some information on its website about taxes and unemployment compensation. But were still unclear on the exact timeline for payments, which banks get direct deposits first or who to contact at the IRS if theres a problem with your refund.

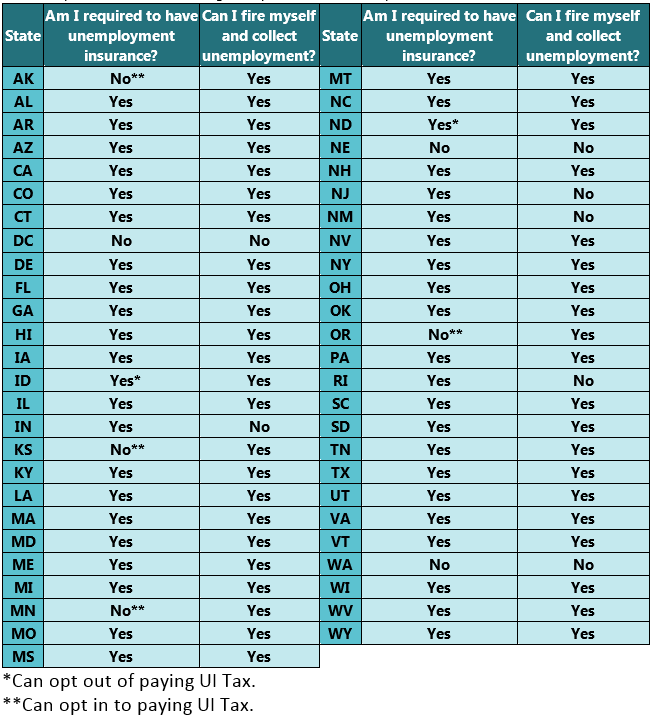

Some states, but not all, are adopting the unemployment exemption for 2020 state income tax returns. Because some get full tax unemployment benefits and others dont, you might have to do some digging to see if the unemployment tax break will apply to your state income taxes. This chart by the tax preparation service H& R Block could give some clues, along with this state-by-state guide by Kiplinger.

Learn smart gadget and internet tips and tricks with our entertaining and ingenious how-tos.

Here is information about the child tax credit for up to $3,600 per child and details on who qualifies.

Do You Have To Pay Taxes On Unemployment Benefits

The American Rescue Plan Act of 2021 changed federal tax requirements on 2020 unemployment benefits. For the latest information, see How Unemployment Benefits Are Changing in 2021.

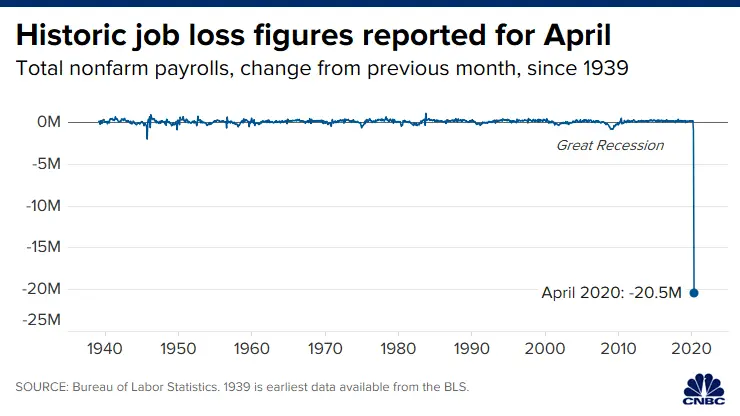

Over 45 million new unemployment claims were filed in the 13 weeks following the declaration of a state of emergency due to COVID-19 in mid-March. For many, especially those filing for benefits for the first time, the fact that unemployment benefits are taxed at the federal, state and potentially even local levels might come as a bit of a shock.

How much youâll pay depends on your overall income for the year and several other factors. When you pay can also depend, as you can either have taxes withheld from your benefit payments like you would a regular paycheck, pay when you file your taxes or pay a quarterly estimated tax.

Also Check: How To Contact Unemployment Office

You May Like: Njuifile Extension

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

Read Also: How To Correct State Tax Return

Reporting Unemployment Benefits On Your Tax Return

You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The amount will be carried to the main Form 1040. Remember to keep all of your forms, including any 1099-G form you receive, with your tax records.

If you use TurboTax to file your taxes, well ask about your unemployment income and put the information in all the right tax forms for you.

TurboTax is here to help with our Unemployment Benefits Center. Learn more about unemployment benefits, insurance, eligibility and get your tax and financial questions answered.

Read Also:

Don’t Miss: Apply For Unemployment In Tn

Wait Unemployment Is Taxable

In most years, yes. The federal government considers unemployment benefits to be taxable income, although taxes are not automatically withheld from benefits payments, the way an employer might take taxes out of your paycheck. Instead, unemployment recipients must request that taxes be withheld from their benefits, and the withholding is limited to 10%.

This led to confusion and angst for the unprecedented number of workers who received jobless benefits for part of 2020 and filed their taxes for the year only to find their typical refund reduced or in some cases to be told they owe money.

Michigan resident Bridget Harwood was furloughed from her medical assistant job for three months last year when many businesses in her city closed. The unemployment benefits she received during that time also resulted in a smaller tax refund this year. Instead of the roughly $1,500 refund she typically receives, she got just $72 back.

It was definitely a shock, Harwood said.

It was even worse for Harwoods eldest daughter, who worked at a fast-food restaurant before the pandemic pushed her into unemployment. Harwood filled out her daughters tax return and found that she owed $1,000 in federal and state taxes. When Harwood explained the situation to her daughter who had been expecting a refund to put toward a new car she started to cry, Harwood said.

Read Also: Minnesota Unemployment Benefits Estimator

Unemployment Federal Tax Break

The latest COVID-19 relief bill , gives a federal tax break on unemployment benefits. This means that you dont have to pay federal tax on the first $10,200 of your unemployment benefits if your adjusted gross income is less than $150,000 in 2020. The $150,000 income limit is the same whether you are filing single or married.

For paper filers, the IRS published instructions on how to claim the unemployment tax break: New Exclusion of up to $10,200 of Unemployment Compensation. For online filers, the IRS has stated that tax software companies have updated their systems to reflect the unemployment federal tax break. If you file your taxes online and havent filed for 2020 yet, you may want to make sure your tax software is updated before filing your tax return.

If you filed your 2020 tax return before this new law change, the IRS is asking you not to file an amended return and not to take any additional steps. The IRS will automatically issue refunds starting in May and into the summer to those who qualify. If you claimed tax credits such as the Earned Income Tax Credit and Child Tax Credit , the IRS will also automatically issue refunds if you qualify for a higher amount because the tax break changed your income level.

If your state decides to give you a state tax break and you already filed your state return, you should check to see if you are newly eligible for any state tax credits.

Also Check: How Do I Apply For Unemployment Benefits In Louisiana

Unemployment Taxes At The Federal Level

At the federal level, unemployment benefits are counted as part of your income, along with your wages, salaries, bonuses, etc. and taxed according to your federal income tax bracket.

With most income, like wages, taxes are pay-as-you-go. With wages, you are expected to pay taxes on your income as you earn it. As an employee, part of your paycheck is usually automatically deducted to pay your federal income and Social Security taxes. Unlike wages, federal income taxes are not automatically withheld on unemployment benefits.

You are responsible for paying taxes on your unemployment benefits. You can request to have federal taxes withheld, make quarterly estimated tax payments, or pay the tax in full when it is due.

What If I Already Filed My Taxes

Obviously, some people already filed their taxes and now may need to see what other steps theyd have to take. Well likely hear more guidance from the IRS on that in the days ahead.

It may be necessary to file an amended return.

If you had taxes withheld on jobless benefits, the federal taxes are withheld at a 10% rate. On $10,200 in jobless benefits, were talking about $1,020 in federal taxes that would have been withheld. Thats money that could go to cover what income taxes you owe or possibly lead to a bigger federal income tax refund.

Many people didnt withhold taxes from their unemployment checks, so theyre still looking at paying whatever taxes they might owe on unemployment benefits that exceed the new $10,200 waiver for singles and for each spouse on a married filing joint return.

Those who faced lengthy unemployment in 2020, though, could have received far more in benefits and could still owe some taxes on their unemployment benefits. This is just a partial tax forgiveness measure.

In some cases, if people didnt have enough taxes withheld on jobless benefits, they could still face penalties and interest.

Recommended Reading:

Read Also: Sign Up For Unemployment In Missouri

Which Taxes Apply To Unemployment Benefits

Generally, youâll have money withheld from your paycheck for several types of taxes: income, Social Security and Medicare.

Combined, the Social Security and Medicare taxes are called Federal Insurance Contributions Act taxes, and they can be up to 7.65% of your pay. But FICA taxes donât apply to unemployment benefits.

You have to pay federal income taxes on your unemployment benefits, as well as any applicable local and state income taxes.

Similar to how you receive a W-2 or 1099-MISC tax form with your wages and income and use those to prepare your tax return, your state will send you the IRS copies of Form 1099-G with a record of how much you received in unemployment. Youâll include this amount in your income for the year when you file your taxes.

Through July 31, 2020, your taxable unemployment benefits may include an additional $600 a week as part of Coronavirus Aid, Relief and Economic Security Act stimulus. The extra benefit also counts as taxable income. The separate one-time stimulus check that was also a component of the CARES Act is not, however, subject to income taxes.

Tip #: You May Be Eligible For Tax Benefits And Credits

A lower income may help you qualify for a variety of programs, including the federal Earned Income Tax Credit, which can lower your taxes or even provide a refund, depending on your income level and the number of children you have.Other credits that may reduce your federal tax outlay include the Child Tax Credit and the Child and Dependent Care Credit. Your CPA can offer advice on the tax and other benefits that can improve your financial outlook while youre looking for work.

You May Like: Filing Unemployment In Tennessee

Read Also: Unemployment Office Fax Number

Don’t Be Surprised By An Unexpected State Tax Bill On Your Unemployment Benefits Know Where Unemployment Compensation Is Taxable And Where It Isn’t

Thanks to the COVID-19 pandemic, millions of Americans have gotten an unwanted crash course on the U.S. unemployment compensation system. There are a lot of common questions from people seeking unemployment benefits for the first time. How do I apply for benefits? How much will I get? How long will the benefits last? People need answers to these questions right away. But once you start receiving payments, another question will likely spring to mind: Will I have to pay taxes on my unemployment benefits?

When it comes to federal income taxes, the general answer is yes. Uncle Sam taxes unemployment benefits as if they were wages . However, when it comes to state income taxes, it depends on where you live. Most states fully tax unemployment benefits. However, some states don’t tax them at all , and a handful of states will only tax part of your benefits. Plus, like the federal government, some states are making special exceptions to their general rule for 2020 and/or 2021 to help people who lost their job because of the pandemic.

1 of 51

Employers Of Agricultural Employees

Employers must pay Federal unemployment taxes if: they pay wages to employees of $20,000, or more, in any calendar quarter or, in each of 20 different calendar weeks in the current or preceding calendar year, there was at least 1 day in which they had 10 or more employees performing service in agricultural labor. The 20 weeks do not have to be consecutive weeks, nor must they be the same 10 employees, nor must all employees be working at the same time of the day.

Generally, agricultural employers are also subject to state unemployment taxes, and employers should contact their state workforce agencies to learn the exact requirements.

Recommended Reading: Can You File Bankruptcy On Unemployment Overpayment

Also Check: Do You Pay Income Tax On Unemployment

What If I Cant Pay The Tax Owed On Unemployment

Paying taxes on unemployment insurance payments can seem counterintuitive, since most recipients either are out of work or recently have been. This could lead to a situation where you have a tax bill that you cant afford to pay.

In such a case, its important that you still file a return. If youre unable to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. Theres also a penalty for failure to file a tax return. So try to file on time, whether or not you can afford to pay the full balance due.

If your tax bill is too much for you to pay right now, pay as much as you can to reduce the amount of interest that will accrue. You can also apply to pay the balance in installments, allowing you to make monthly payments. You can request an installment agreement online through the IRS website, by filling out Form 9465, or for help.