Preparing Your Tax Return Now

If you are preparing you own tax return, you must determine if you are eligible for the exclusion by considering whether your AGI is less than $150,000. Filing electronically is the easiest way to calculate the correct amount. The IRS has worked with the tax return preparation software industry to reflect these updates so people who choose to file electronically simply need to respond to the related questions when electronically preparing their tax returns. See New Exclusion of up to $10,200 of Unemployment Compensation for for information and examples. For others, instructions and an updated worksheet about the exclusion were available in March and posted to IRS.gov/form1040. These instructions can assist taxpayers who have not yet filed to prepare returns correctly.

Will I Owe Taxes On Stimulus Checks

No, stimulus checks aren’t considered income by the IRS. They are prepaid tax credits for your 2020 tax return, authorized by two relief bills passed last year that aimed at stabilizing the struggling U.S. economy in the wake of the pandemic. Because the stimulus payments arent considered income by the tax agency, it wont impact your refund by increasing your adjusted gross income or putting you in a higher tax bracket, for instance.

When it comes to getting paperwork ready, you’ll want to dig up the IRS Notice 1444 for the stimulus payment amount you were issued in 2020. And the second round of payments would be outlined in Notice 1444-B.

Jessica Menton and Aimee Picchi

Follow Jessica on Twitter @JessicaMenton and Aimee @aimeepicchi

How Do I File Unemployment On Taxes

Unemployment compensation is taxable on your federal return.

You will have to enter a 1099G that is issued by your state.

Some states will mail out the 1099G. Or you might need to go to your states unemployment website and use the password, etc. that you have been using to certify for weekly benefits to get your 1099G from the states site.

Enter your 1099G in Federal> Wages & Income> Unemployment

Go through the screens very carefully, making sure to enter any federal/state tax you had withheld from the unemployment.

STATES THAT TAX UNEMPLOYMENT BENEFITS

AZ, AR, CO, CT, DE, DC, GA, HI, ID, IL, IN, IA, KS, KY, LA, MA, ME, MD, MI, MN, MS, MO, NB, NM, NY,NC, ND, OH, OK, OR, RI, SC, UT, VT, WV, WI

STATES THAT DO NOT TAX UNEMPLOYMENT BENEFITS on the state return

AK, CA, FL, MT, NH, NJ, NV ,PA, SD, TN, TX, VA, WA, WY

You May Like: What States Are Cutting Unemployment

How To Report Unemployment Benefits On Your Taxes

With your unemployment benefits, youll receive Form 1099-G . This form should show exactly how much you received. That total amount must be entered on your tax return.

The IRS already knows you received this money, so dont try to hide it or you could face an audit as well as penalties and interest.

When you file your return, report your unemployment income on line 19 of Form 1040 , line 13 of Form 1040A , or line 3 of Form 1040EZ , depending on which tax return you decide to file.

Rather than going to the hassle of filling out these forms and calculating your taxes, youll be able to just enter your unemployment income and any other tax information on the PriorTax tax application. From there, well look for any way to boost your total refund!

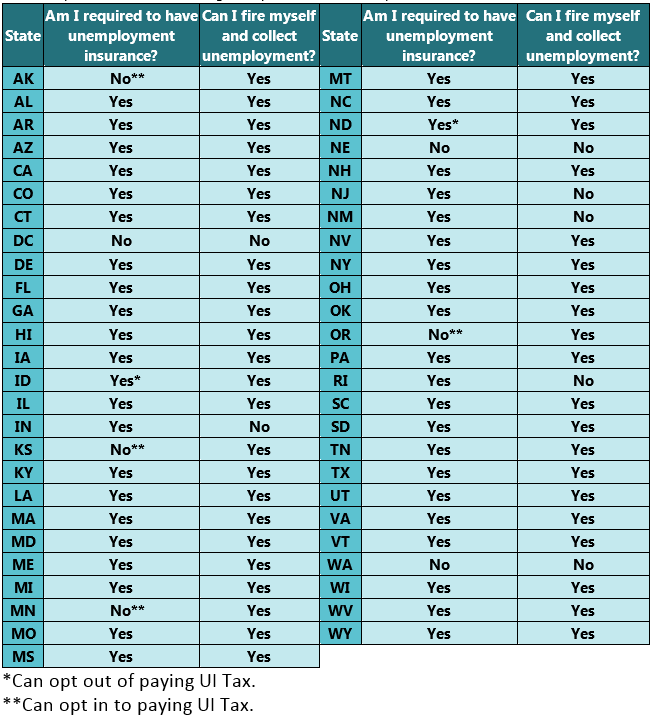

Do I Pay Taxes On My Unemployment Benefits From When I Was Out Of Work

If you go from a wage-earning position to unemployment, one of the first things you may do is file for some of your unemployment benefits. Unemployment benefits come from an insurance fund worked out between the federal, state and local governments. When you file for your unemployment benefits, you should be able to choose to have your federal taxes withheld. Generally, the withholding is about 10 percent of the total payment.

The benefit is paid to the governments by most employers and it is called a FUTA tax. It is not taken out of an employees regular wages.

Because our state governments all have different rules governing the insurance benefit, some are taxed like fully taxable wages. The rules governing taxation of these benefits vary widely by state. The first place you should look for details considering your benefit is on your states or local governments website. However, if your benefits come from a private fund that you contribute to on a voluntary basis, the taxable amount of this income is not considered unemployment compensation, but rather it may be considered as other income on your Form 1040.

If you received unemployment benefits you may receive a form 1099-G. This is typically filed by federal, state and local governments if they made unemployment compensation payments to individuals. This form is also used for other government payouts including agricultural payments, tax refunds, credits or taxable grants to name a few.

Also Check: How To Find Unemployment 1099

Filing Your Taxes If You Claimed Unemployment Benefits: What To Know Where To Find Help

The 2021 IRS deadline for filing your taxes has been pushed to May 17 to give people more time to get organized in the wake of the COVID-19 pandemic.

Even with this extra time, your situation is likely to be even more complicated if youve been unemployed during the course of the pandemic since you have to pay taxes on federal unemployment if you earned above a certain amount in benefits.

With the new IRS tax filing deadline now less than a month away, heres what you need to know about filing your taxes if youve claimed unemployment benefits this year and where you can find free or low-cost tax help, even after many such support services closed up shop on the original IRS deadline of April 15.

Read Also: How To Pay Retail Sales Tax Online

Taxes Deductions And Tax Forms For Unemployment Benefits

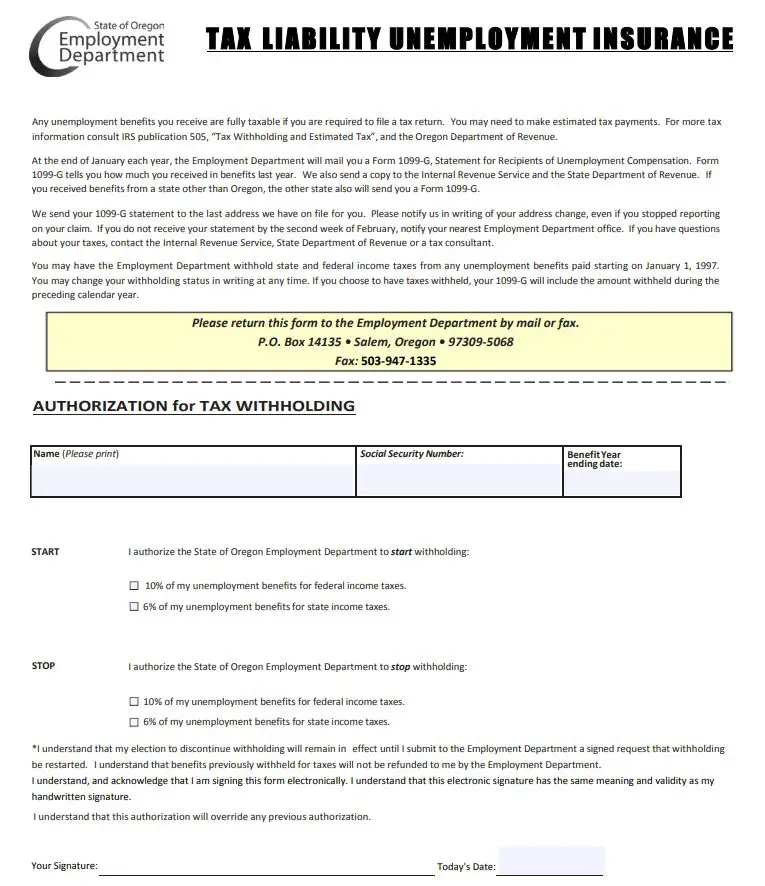

Youre responsible for paying federal and state income taxes on the unemployment benefits you receive. The Department of Unemployment Assistance does not automatically withhold taxes, but you may request that taxes be withheld from your weekly benefits when you file your claim.

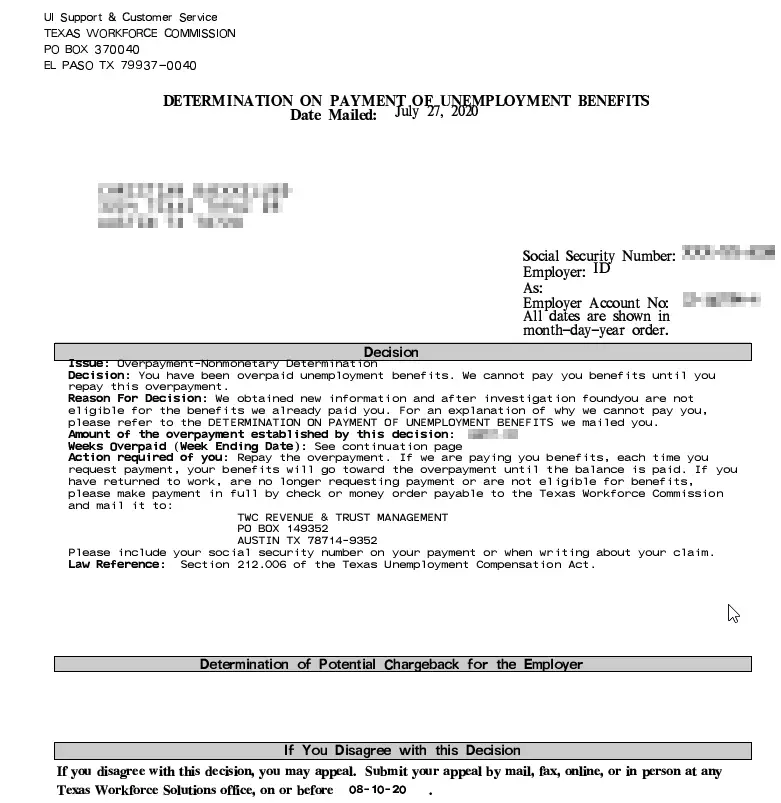

Your weekly benefits may also be reduced if you have a child support order or if you receive an overpayment on your weekly benefit.

You May Like: How To Sign Up For Unemployment In California

Will I Owe Taxes Because Of My Unemployment Compensation

- Generally, states dont withhold taxes on unemployment benefits unless asked.

- However, if you qualify for EITC, or the child tax credits, your taxes could be covered.

- You can do a year-end tax checkup to see if you have enough credits and withholding to cover your taxes. You may still have time to make adjustments to lower your shortfall.

- If you are still unemployed come 2021 tax time, you can set up a payment plan with the IRS or work out other delayed payment options.

- The IRS assesses penalties on the balance owed when you file and when you pay late they also compound interest on the full bill daily. The IRS has programs that may forgive your tax penalties. If you qualify, this will also help reduce your interest and lower your overall tax bill.

- Make sure you file your tax return on-time, even if you cant pay. In the short-term, the penalties for filing late are higher than the penalties for paying late.

What Amount Do I Need To Report From My 1099

- Individuals who are required to file a tax return must report the total show in Box 1 on the 1099-G form as income.

- However, the first $10,200 of the unemployment benefit you received is not taxable income to the IRS and does not need to be reported if you have not opted into having your taxes withdrawn from your weekly benefit payments.

Read Also: Should I Charge Tax On Shopify

You May Like: How Much Is Unemployment In Washington State

Know That Your Nanny Should Be Classified As A Household Employee

The IRS has ruled that, with very few exceptions, nannies are employees of the families for whom they work not independent contractors. This is regardless of the amount of hours worked, wages paid or whats written in an employment contract. This means your nanny should be given a W-2 form, rather than a 1099 form, to file their taxes. Worker misclassification is considered a form of tax evasion and is a risk you should not be willing to take.

Recommended Reading: How Are Social Security Retirement Benefits Calculated

If You Cant Pay Your Taxes On Time

If you do end up owing the government money and cant pay your taxes on time, the IRS offers several payment plan options that can help you.

But be aware that not paying the full amount you owe by the filing deadline will mean youll pay interest and possibly penalties on the unpaid amount even if you arrange a payment plan with the IRS.

IR-2020-185, August 18, 2020

WASHINGTON With millions of Americans now receiving taxable unemployment compensation, many of them for the first time, the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year.

Withholding is voluntary. Federal law allows any recipient to choose to have a flat 10% withheld from their benefits to cover part or all of their tax liability. To do that, fill out Form W-4V, Voluntary Withholding Request, and give it to the agency paying the benefits. Dont send it to the IRS. If the payor has its own withholding request form, use it instead.

You May Like: What Are The Benefits Of Corporate Social Responsibility

Don’t Miss: Can I Collect Unemployment And Social Security

What If I Cant Leave My Home Because I Must Care For My Child During The Pandemic Or Because I Have Covid

An individual in any of those situations would be unemployed through no fault of theirown and might be eligible for UI benefits. However, to qualify for UI, theywould still need to meet all other eligibility requirements. For example, the individual must be able and available for work, and show that they are seeking work from home. Individuals can be considered able and available to work if there is some work that they could perform from home .This individual also must prove that they left their job due to their employer. However, there is an exception to the requirement that the reason for leaving is due to the employer. That exception is when an individual quits a job because a licensed and practicing physician deems them unable to perform the work or when their employer is unable to accommodate the individuals need to care for a family member who has been verified to be in poor health or to have a disability.

New Exclusion Of Up To $10200 Of Unemployment Compensation

If your modified adjusted gross income is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you dont have to pay tax on unemployment compensation of up to $10,200. If you are married, each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you file Form 1040-NR, you cant exclude any unemployment compensation for your spouse.

The exclusion should be reported separately from your unemployment compensation. See the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure your exclusion and the amount to enter on Schedule 1, line 8.

When figuring the following deductions or exclusions from income, if you are asked to enter an amount from Schedule 1, line 7 enter the total amount of unemployment compensation reported on line 7 and if you are asked to enter an amount from Schedule 1, line 8, enter the amount from line 3 of the Unemployment Compensation Exclusion Worksheet. See the specific form or instructions for more information. If you file Form 1040-NR, you arent eligible for all of these deductions. See the Instructions for Form 1040-NR for details.

Recommended Reading: How To Get My W2 From Unemployment

Do You Owe Taxes On Unemployment Benefits

Yes, unemployment checks are taxable income. If you received unemployment benefits in 2021, you will owe income taxes on that amount. Your benefits may even raise you into a higher income tax bracket, though you shouldn’t worry too much about getting into a higher tax bracket.

People who file for unemployment have the option to have income taxes withheld from their unemployment checks, and many do. If you elected to do this, you have little to worry about.

What if you didn’t choose to have income taxes withheld from your unemployment checks? Don’t panic. If you were employed during much of the year, you may simply see a reduced tax return or a very small tax bill when you file.

Prepare To Make Quarterly Estimated Tax Payments

If youre not having taxes withheld from your unemployment checks, the IRS would like you to make quarterly estimated tax payments. Why? Because income taxes are a pay-as-you-go arrangement in the United States, which means that when you get your unemployment check, the IRS wants its cut as soon as possible.

-

To pay quarterly estimated taxes, basically youll need to estimate your tax liability for the whole year and then make payments on that estimated bill over the course of the year.

-

You can have tax withheld from your checks and pay estimated quarterly taxes at the same time. This combo approach might be a good idea if you think a flat 10% withholding wont be enough to cover your tax bill later.

-

If you miss a deadline to make a quarterly estimated tax payment, you can certainly âcatch upâ later and the IRS will gladly accept your money. But you may owe a penalty on that late payment.

Read Also: How To Check Unemployment Benefits

Effect On Other Tax Benefits

Taxable unemployment benefits include the extra $600 per week that was provided by the federal government in response to the coronavirus pandemic, accountant Chip Capelli, of Provincetown, Massachusetts, told The Balance.

Not only is unemployment compensation taxable, but receiving it can also affect some tax credits you might be eligible for and are counting on to defray those 2020 taxes that will be due.

Something else to consider is if you usually get the Earned Income Credit each year, Capelli said. While unemployment benefits arent considered earned income, they do influence your adjusted gross income , which is used to calculate the EIC.

The American Rescue Plan Act also expanded eligibility for the EIC to include more households, including childless households, as well as increasing the maximum credit from $543 to $1,502.

Protecting Your Credit When Youre Unemployed

While unemployment benefits can help you cover basic necessities, they wonât necessarily be enough to cover all your bills. While being unemployed doesnât impact your credit directly, it can indirectly hurt your credit if you fall behind on bills.

Many creditors recognize that you could be unemployed because of circumstances outside your control, and may work with you to temporarily waive or lower your payments. These hardship options can make it easier to manage your bills, and working with the company rather than skipping a payment without an explanation can help protect your credit.

Recommended Reading: Can An Unemployed Person File Taxes

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Unemployment Income And Taxes: Do You Need To Pay

Reading time: 3 minutes

If you or another family member who provides household income has been laid off, you probably have applied for unemployment benefits to help supplement lost pay.

The American Rescue Plan, which was enacted on March 11, 2021, includes a new exclusion of up to $10,200 of unemployment compensation. Which means you don’t have to pay tax on unemployment compensation of up to $10,200 if your modified adjusted gross income is less than $150,000.

If you are married, each spouse receiving unemployment compensation doesn’t have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you can’t exclude any unemployment compensation.

Also Check: How To Get Direct Deposit From Unemployment

What If Im Unemployed And Unable To Afford My Tax Payment

- Your annual income is less than $84,000

- The majority of your money goes to basic living expenses, including:

- Food, clothing, housekeeping supplies, and personal care products

- Housing and utilities

- Health care expenses

Are There Tax Breaks For Unemployment

The Earned Income Tax Credit is one tax benefit that many people may overlook. It is intended to help taxpayers with low to moderate income. The amount of credit you can receive depends on your filing status, total income, and how many qualifying children you have.

If you are paying for childcare while you look for work, you could receive a tax credit to offset those costs. The amount you can claim for the Child and Dependent Care Credit depends on your income.

For the EITC and the childcare credit, you must have earned income to report on your return. Your unemployment compensation does not count toward these since it is not earned. But if you lost your job during the year, you can still qualify based on what you earned while you were still employed.

If you have dependents under age 17, you may be able to claim theChild Tax Credit. You do not need to have earned income to qualify for this credit, but your dependents will have to meet certain requirements to be eligible. If you claim anyone over the age of 17, they may qualify for a separate dependent credit worth $500.

Have you picked up a side gig, like driving for Uber, tutoring, or selling a product as an independent consultant? If so, you may be considered self-employed for tax purposes. To learn more, read: Different Types of Self-Employment.

Recommended Reading: Should I Have Taxes Withheld From Unemployment Benefits