Penalties For Committing Fraud

Depending on the circumstances, if you knowingly make false or misleading statements, you will likely be fined. The amount of the fine varies, but you may have to pay up to 150% of any overpayment you received, or three times your benefit rate for every false statement, whichever amount is lower. The value of the overpayment is the total of any benefits that you were actually paid plus a percentage of the value of any benefits that you could have been paid because of the fraud.

In addition, we may record a violation on your EI file. If this happens, you will need to work more hours to qualify for EI benefits in the future. We will calculate the number of hours based on the following chart. The higher the value of this figure, the more hours you may need to qualify for EI benefits.

| Violation type | |

|---|---|

| More than one violation in your file |

100% more hours Example: If you usually need 420 hours, you will now need 840 hours. |

*These increases apply for five years from the date we record the violation on your file or to your next two claims, whichever comes first.

It does not matter if you apply for regular, sickness, maternity, parental, compassionate care, or family caregiver for children or adults benefitsyou will need the increased number of hours to receive any of these benefits.

Reporting Unemployment Insurance Fraud

The Virginia Employment Commission is committed to ensuring unemployment benefits go to individuals who are eligible to receive them.

However, here in Virginia and throughout the United States, fraud relating to unemployment insurance benefits does take place.

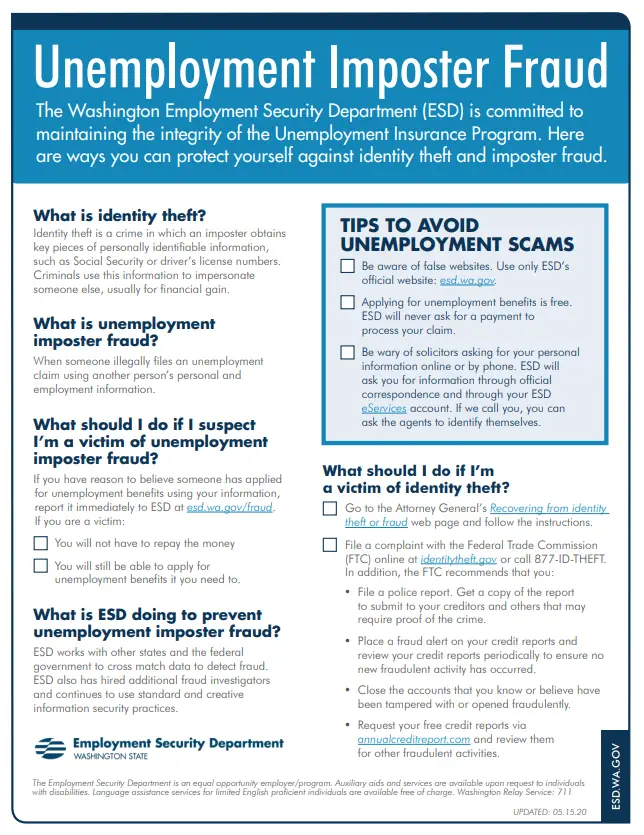

- Identity theft that is related to Unemployment Insurance, is usually not the fault of the claimant or employer, happens when you believe someone has illegally filed for unemployment benefits using your identity.

- Fraud takes place when false information is knowingly submitted to receive unemployment benefits. An example of Unemployment Insurance fraud could be a claimant who has returned to work, but repeatedly files weekly claims for benefits, without reporting wages earned.

- Overpayments can happen when a claimant receives more benefits than they are entitled to.

If you suspect fraud or identity theft related to unemployment insurance benefits, or would like to report an overpayment, please complete the Fraud/Theft/Overpayment form.

If you are unable to complete the form, an agent may assist you in completing the form by calling 1-800-782-4001. This number is only for assistance in completing the online form. With any other claim issue, please contact the Customer Contact Center at 1-866-832-2363.

Reports of overpayment, fraud or identity theft may also be reported by faxing or mailing information to:

The Virginia Employment CommissionFax: 804-692-0580

What To Expect After You Have Reported Fraud

We will help you through this difficult time.

You will receive:

You do not owe us any money as a result of the fraudulent claim You might have received a letter from us stating that you must repay benefits that we paid on the fraudulent claim in your name. You can ignore that letter! Our computer system automatically generates the letter when we deny an unemployment application. Were sorry for the anxiety it may have caused.

Don’t Miss: Apply For Unemployment Chicago

Protecting The Ei Program

We are all responsible for helping to detect and deter EI fraud.

At Service Canada, we are determined to protect the EI program. Our powerful computer tracking and linked data systems now mean it is almost impossible for fraudulent activity to remain undetected for long.

You also have an important role to play in helping to protect the EI program. If you are aware that someone has committed fraud, please let us know.

Prosecution For Ei Fraud

EI fraud is a serious offence that can result in prosecution. All parties involved can be prosecutedincluding EI claimants, employers, and third parties. Prosecutions take place under either the Employment Insurance Act or the Criminal Code of Canada, as determined by Employment and Social Development Canada.

Recommended Reading: Can You Get Unemployment If You Are Fired

How To Report Unemployment Fraud

IMPORTANT NOTE:IT IS NOT ILLEGAL TO WORK WHILE YOU ARE COLLECTING UNEMPLOYMENT BENEFITS

When you apply for unemployment you may be informed that you are legally allowed to work at a job and make a certain amount of money while still collecting unemployment benefits. When you initially apply for unemployment, this amount will be calculated, and how this process works will be explained to you by your unemployment counselor.

If you do work while you are collecting unemployment benefits, it is VERY important that you follow the rules given to you by your unemployment counselor, which includes reporting where you work, how much you make every week, etc.

If you suspect someone of committing unemployment fraud, you can contact the unemployment office to report them. You may be able to remain anonymous, or you may have to give your name and contact information to report them.

When you make your report, be sure to give as much detailed information as possible, including the following:

- Their name

Email Text Messages & Social Media

NYS DOL uses emails, text messages and social media to communicate with claimants throughout the application process and benefit period. Some fraudsters are posing as NYS DOL through fraudulent emails, text messages, and social media accounts to prey on New Yorkers who need assistance. Refer to the following tips about communication from NYS DOL.

NYS DOL uses email to provide updates, allow claimants to certify for backdated benefits, provide reemployment services, and more. To avoid becoming a victim of fraud, double-check the email address from all emails you receive. If an email appears fraudulent, it may be look out for misspellings, suspicious links and unusual messaging. If you are unsure if an email is from us, reach out to NYS DOL to confirm.

Find out more about DocuSign emails from NYS DOL.

Text Messages

NYS DOL uses text messages to provide updates and allow claimants to certify for backdated benefits.

Text messages from NYS DOL will only come via DocuSign or from the numbers 468-311 or 22751.

Watch out for SMShing attempts where fraudsters use text messages to lure you into calling back a fraudulent phone number, visiting fraudulent websites, or downloading malicious content via phone or web.

Find out more about DocuSign text messages from NYS DOL.

Social MediaNYS DOL uses social media to provide updates and answer questions.

The only verified social media accounts associated with NYS DOL are the following:

Continue

Also Check: Can An Llc Owner Collect Unemployment

How To Prove A Phone Harassment Offense In Virginia

One of the most critical elements in proving a phone harassment offense is showing the defendant made the calls or contacted the other person through an electronic device. An electronic device, in this case, will include smartphones, cell phones, fax machines, computers, video recorders, or a pager.

What Is Unemployment Insurance Fraud

Employers and claimants can both commit fraud under state unemployment insurance laws.

Employer fraud can include certain actions to avoid tax liability or establishing a fictitious employer account to enable fraudulent claims against that account. Claimant fraud can include knowingly submitting false information continuing to collect benefits when knowing oneself to be ineligible not being able and available to work while certifying for benefits under state law or intentionally not reporting wages or income while collecting full benefits. Additionally, identity theft may result in unemployment insurance fraud that is not the fault of the employer or the identity theft victim.

The state is required and expected to enforce its own unemployment insurance laws.

Also Check: How Do I Change My Address For Unemployment Online

Is There Any Unemployment Insurance Fraud In Virginia

However, here in Virginia and throughout the United States, fraud relating to unemployment insurance benefits does take place. Identity theft that is related to Unemployment Insurance, is usually not the fault of the claimant or employer, happens when you believe someone has illegally filed for unemployment benefits using your identity.

Information On Ui Fraud

Unemployment Insurance fraud and abuse is a crime. It drives up UI taxes for businesses, and causes frustration for law-abiding workers. Individuals who commit fraud are subject to penalties and/or criminal prosecution. You may be guilty of fraud if you hold back information from or provide false information to the Unemployment Insurance Division. Any incorrect information about your work status or details in your application can be construed as misrepresentation of facts to commit unemployment fraud. Individuals who knowingly collect unemployment benefits based on false or inaccurate information provided by them when filing their claim or while receiving benefits, are committing fraud!

Fraud Prevention

The UI Division also verifies that telephone numbers and/or internet IP addresses used to file claims remotely are received from the area in which the claim is assigned.

Types of Fraud and Abuse:

Individuals who commit UI fraud could face a variety of serious penalties including:

- Repaying the UI benefits collected, plus penalties

- Prosecution

- Possible jail or prison sentences

- Garnishment of future wages

Also Check: Ways To Make Money When Unemployed

Consequences Of Committing Fraud

Collecting unemployment under false pretenses is a crime. The Georgia Department of Labor actively pursues collections of all overpayments and is committed to maintaining the integrity of the UI program. Under Georgia’s Employment Security Law, individuals who knowingly make false statements, misrepresent or omit material facts, or knowingly accept benefits to which they are not entitled lose the right to future unemployment benefits for up to 15 months and are subject to criminal and civil legal actions and fines.

Individuals who commit fraud are liable for the total amount of improperly paid benefits plus penalties and interest. A penalty of 15 percent will be added to, and become part of, the overpayment amount. Interest of one percent per month shall accrue until the overpayment is repaid. Penalty amounts will not be waived.

The GDOL is also empowered to intercept state and federal income tax refunds to recover UI overpayments.

False Information Identification Or Identity Theft

Some workers try to obtain unemployment insurance payments by submitting applications that contain false or misleading information. For example, an applicant who uses a false name, or who uses the personal identifying information of someone else to obtain unemployment benefits, commits unemployment insurance fraud. Similarly, submitting false information about employment status, income, and other related issues can also result in fraud charges.

Also Check: What Ticket Number Is Pa Unemployment On

If You Believe You Are A Victim Of Fraud

If you believe your identity has been stolen and a fraudulent unemployment claim has been filed on your behalf, here’s some steps you can take to protect yourself:

Is It A Crime To Threaten Someone On The Phone In Virginia

Criminal Threats as Found Under Virginia Code 18.2-60 This statute states that any person that communicates electronically or through the phone by issuing threats to harm or kill another is guilty of a crime. When a person accuses you of threatening to cause harm or kill them or a member of their family, the offense is severely prosecuted.

Read Also: How Do I Change My Address For Unemployment Online

Justice Department Warns On Fake Unemployment Benefit Websites

The Department of Justice recently warned that fraudsters are creating websites mimicking unemployment benefit websites, including state workforce agency websites, for the purpose of unlawfully capturing consumers personal information.To lure consumers to these fake websites, fraudsters send spam text messages and emails purporting to be from an SWA and containing a link. The fake websites are designed to trick consumers into thinking they are applying for unemployment benefits and disclosing personally identifiable information and other sensitive data. That information can then be used by fraudsters to commit identity theft.

Help stop these scams by reporting them and using the list of state contacts at DOL.gov/fraud.

I Want To Report A Fraudulent Claim Or Identity Theft Against My Company And/or My Employee What Should I Do

If you have found your company or employee is a victim of UI fraud or Identity Theft, there are several ways to report to UI:

Also Check: Il Unemployment Office Near Me

How To Report Someone Abusing Unemployment Anonymously

how big are hotdogs, answer this or you get a dunce cap

there was no passage listed but using the process of elimination i’d say it was d. the high economy would do the opposite. i don’t see how low prices would affect it. high unemployment is possible but i feel d is the better answer.

b. condominum i think

answer organizational

Failure To Report Employment

Some people who apply for unemployment insurance later go on to find a job. When this happens, people receiving unemployment payments have a duty to report their employment, and how much they make, to the state unemployment office. Failing to do so, and continuing to receive payments while being employed is unemployment insurance fraud.

Also Check: How Do I Change My Address For Unemployment Online

Definitions And Examples Of Reportable Violations

The Texas Workforce Commission is authorized by the Texas Labor Code to investigate allegations of fraud, waste and program abuse involving TWC programs.

Fraud is a willful act or course of deception, or an intentional concealment, omission, or perversion of truth, with the intent to obtain a material benefit or service for that person or another person, for which the person may not be eligible.

Waste is any practice that a reasonably prudent person would deem careless or that would allow inefficient use of resources, items or services. Waste includes incurring unnecessary costs because of inefficient or ineffective practices, systems, or controls.

Abuse is the intentional, wrongful or improper use or destruction of state resources, or a seriously improper practice that does not involve prosecutable fraud. Abuse may include misapplication or misuse of public resources.

Theft is the unlawful appropriation of property with the intent to deprive the owner of that property.

Reportable violations include, but are not limited to, the following examples:

The Commission may refer investigative results to the appropriate district or county attorney. The Commission may also provide this information to the United States Department of Labor and the United States Department of Justice or other federal or state agencies.

Find A Lawyer In Your Area

Even though unemployment insurance fraud might not seem like a significant crime, you always need to speak to an experienced criminal defense lawyer if you are facing charges. A conviction for unemployment insurance fraud can lead to serious penalties. Even if you are not convicted, being investigated for a crime and being subject to the criminal justice process is not something you want to do without the aid and advice of a criminal defense attorney from your area.

Also Check: Can You Refinance A Car Loan While On Unemployment

Identity Theft And Unemployment Benefits

States have experienced a surge in fraudulent unemployment claims filed by organized crime rings using stolen identities. Criminals are using these stolen identities to fraudulently collect benefits across multiple states.

Because unemployment benefits are taxable income, states issue Form 1099-G, Certain Government Payments, to recipients and to the IRS to report the amount of taxable compensation received and any withholding. Box 1 on the form shows “Unemployment Compensation.” You should report fraud to the issuing state agency and request a corrected Form 1099-G.

For details on how to report fraud to state workforce agencies, how to obtain a corrected Form 1099-G, a list of state contacts and other steps you should take if you are a victim, see the U.S. Department of Labors DOL.gov/fraud page. Please follow Department of Labor guidance on reporting fraud and protecting yourself from additional scams.

How And Where To Report Fraud

If you do not want your name, address and telephone disclosed, then you need to make an anonymous report on the Fraud Hotline at 252-3642.

If you would prefer to submit your information via email you may do so to .

WARNING: Once you send your email message and the Texas Workforce Commission receives it, the message becomes an official state record. Included as part of the message is the identifier that is inserted by your internet service provider, which cannot be removed from the record pursuant to Texas Penal Code Chapter 37. The accused has a special right of access under the Public Information Act to review the official record and/or obtain copies of the record. Therefore, if you wish to remain anonymous, DO NOT contact TWC via email. Instead, you may report any allegations by calling the TWC Fraud Hotline at 800-252-3642. For Telecommunications Devices for the Deaf , call Relay Texas at: 711 .

You may also report suspected fraud, waste and abuse involving state resources directly to the State Auditor’s Office . You may contact the SAO through the SAO Hotline website or by calling the SAO Hotline at 800-TX-AUDIT 892-8348.

Don’t Miss: 18883137284