Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return.; Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers.; Free File is available in English and Spanish.; To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

If I Repaid An Overpayment Will It Be Reflected On My 1099

No. DES reports the total amount of benefits paid to you in the previous calendar year on your 1099-G, regardless of whether you repaid any overpayment. If you repaid part or all of an overpayment during the previous calendar year, you may be able to deduct the repaid amounts on your income tax return. The repaid amount should be reported on the tax return submitted for the year the repayment was made.

What Is Reported On My 1099

DES reports the;total;amount of unemployment benefits;paid;to you in the previous calendar year on your 1099-G. This amount is based upon the;actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

Read Also: How Do I Get My Unemployment Card

What We Still Don’t Know About Unemployment Refunds

The IRS has only provided limited information on its website about;taxes and unemployment compensation. We’re still unclear on the future timeline for payments during the coming months, which banks get direct deposits first or who to contact at the IRS if there’s a problem with your tax break refund.;

Also, since some states fully tax unemployment benefits and others don’t, you might have to do some digging to see if the unemployment tax break will apply to your state income taxes. This chart by the tax preparation service;H&R Block;could give some clues, along with this state-by-state guide by Kiplinger.;

Here’s how to;track your tax return status and refund online;and what we know about contacting the IRS for;stimulus check problems. For more on stimulus payments and relief aid, here is information about the child tax credit for up to $3,600 per child and details on;who qualifies.

If You Owe Tax You Cant Pay

Many Americans find themselves in a position where they still need every cent of those unemployment checks for living expenses, in which case theres no money left to send to the IRS for quarterly estimated tax payments. You might still have options if this is the case.

The IRS suggests paying what you can and reaching out to take advantage of one of its payment options to deal with the balance. You can ask for an installment agreement and pay off your tax debt on balances of up to $50,000 over 72 months, according to Capelli.

Making the request is a simple matter of filing Form 9465 with the IRS. This will at least cut the 0.5% per month late-payment penalty to 0.25%, although the effective interest rate will continue at 3% .

You might also look into an offer in compromise to settle your tax debt for less than the full amount you owe, or ask the IRS for a temporary delay in collecting if your financial situation is particularly difficult. But youll almost certainly need the help of a tax professional to exercise either of these options.;

Capelli strongly recommended against taking out a loan to pay your tax bill except as a last resort.

Do not, under any circumstances, borrow money unless its interest-free, Capelli said. Dont use a credit card to pay your taxes. The IRS interest rate is lower than most credit cards, and the IRS payment plan doesnt appear on your credit report.

Read Also: Are Unemployment Benefits Delayed On Holidays 2020

Do You Get Tax Documents For Unemployment

If you have received unemployment insurance payments last year you will need to report the total amount as found on your 1099-G on your federal taxes. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online.

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Tax Refund Calculator

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: How To Report Unemployment On Taxes

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 15, 2021.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

What To Do If Youre Still Waiting On Your Unemployment Refund

Its best to locate your tax transcript or try to track your refund using the Wheres My Refund tool . The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax return. The IRS makes it clear not to file a second return: You should call if its been more than three weeks since your last update.

Keep in mind that the IRS has limited live assistance because the agency is juggling the tax return backlog, delayed stimulus checks and child tax credit payments. Even though the chances of speaking with someone are slim, you can still call. Heres the best number to call: 1-800-829-1040.;

Don’t Miss: Can You Get Medicaid If Unemployed

Unemployment Tax Refund Update: 10 Key Facts About Your Irs Money

Still waiting on your 2020 unemployment tax refund? Here’s how to view your tax transcript to get some clues about your money.

The IRS has sent 8.7 million unemployment compensation refunds so far.

If you paid taxes on your unemployment benefits from 2020 and filed your return before the American Rescue Plan was passed in March, you could be getting a refund this September. Here’s why: The;first $10,200 of 2020 jobless benefits, or $20,400 for married couples filing jointly, is considered nontaxable income. Since May, the IRS has been making adjustments on tax returns and issuing refunds averaging $1,686 to those who can claim that tax break.;

The frustrating thing is that those remaining payment dates are unclear. The last batch of refunds, which;went out to some 1.5 million taxpayers, was over a month ago. The IRS has not issued any news about a timeline for this month, except to say “summer,” which officially ends Sept. 22. While some have reported on social media that they have pending dates on their IRS tax transcripts,;many other taxpayers;say they’re fed up because they haven’t received any money or updates at all.;

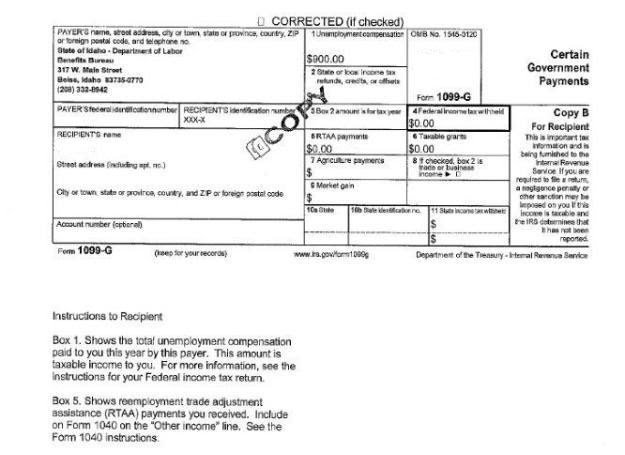

If You Received Unemployment Your Tax Statement Is Called Form 1099

Do you get tax documents for unemployment. The IRS will receive a copy as well. It contains information about. Report the amount shown in Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF and attach this to the Form 1040 or Form 1040-SR.

Yes you need the 1099-G. The Form 1099-G reports the total taxable unemployment benefits paid to you from the Tennessee Department of Labor Workforce. This information is also sent to the IRS.

You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly. PUA will be reported on a separate form from any UC including PEUC EB TRA that you may have received. You will need to add the payments from all forms.

Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year. Youll receive a Form 1099-G after the end of the year reporting in Box 1 how much in the way of benefits you received. After each calendar year during which you get Unemployment Insurance benefits we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld.

Unemployment benefits are income just like money you would have earned in a paycheck. The 1099-G is a tax form for Certain Government PaymentsESD sends 1099-G forms for two main types of benefits. Unemployment and family leave.

This form shows the income you earned for the year and the taxes withheld from those earnings.

Don’t Miss: How To Sign Up For Unemployment In Ms

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is;an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript;. There are two ways you can get your transcript: ;

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password. ;

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. ;The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS.; You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

Also Check: How Can I Be Eligible For Unemployment

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, ;2021. ;We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may;be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

Meaning Of Irs Tax Transcript Codes: 971 846 And 776

Some taxpayers whove accessed their transcripts report seeing different tax codes, including 971 , 846 and 776 . Others are seeing code;290;along with Additional Tax Assessed and a $0.00 amount. Since these codes could be issued in a variety of instances, including for stimulus checks and other tax refunds or adjustments, its best to consult the IRS or a tax professional about your personalized transcript.;

You May Like: How To Appeal Unemployment Overpayment

Unemployment Tax Refunds: Key Things To Know

In late May, the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the provision in the American Rescue Plan waived taxes on up to $10,200 in unemployment insurance benefits for individuals earning less than $150,000 a year. With the latest batch of payments in July, the IRS has now issued more than 8.7 million unemployment compensation refunds totaling over $10 billion.;

The first batch of these supplemental refunds went to those with the least complicated returns , and batches are supposed to continue throughout the summer for more complicated returns. On July 13, the IRS said it sent out 4 million more payments via direct deposit and paper check, and another 1.5 million went out starting July 28.;

According to an igotmyrefund.com forum and another discussion on;, some taxpayers who filed as head of household or as married with dependents started receiving their IRS money in July or getting updates on their transcript with dates in August and September.;

Heres a quick recap of what we know:

Now playing: Your tax questions answered in 3 minutes

3:26

What To Do If You Have Not Filed Taxes

If you havent already filed your 2020 tax return, you can claim the exemption allowed by the American Rescue Plan when you file.

You can find all the information about what benefits you were paid and how much was withheld using Form 1099-G, which you should have received from your state unemployment office by mail or electronically. You may receive separate forms for state unemployment compensation and any federal benefits you received, but you should report all benefits you were paid on your return, according to the IRS.;

If you qualify, youll report your total benefits from Form 1099-G separately from the exclusion. Heres how:

Generally, you report your taxes using Form 1040. But when you claim unemployment insurance, you must also complete a Schedule 1 form to report this additional income. Under the new exemption, you should report the total amount of unemployment compensation you received on line 7 of Schedule 1. Then, use the Unemployment Compensation Exclusion Worksheet to determine the exclusion amount youre eligible for, which youll report on line 8 of Schedule 1.;

If you work with a tax preparer to file, they should be able to assist you in working out what to report on these forms using IRS guidance. If you file using a tax software, the IRS says these changes should now be reflected in the software you use to prepare electronically.;

Read Also: How To File Taxes On Unemployment Benefits

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes.;The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Income Taxes Vs Fica Taxes

Unemployment compensation is not subject to FICA taxes, the flat-percentage Social Security and Medicare taxes that would normally be withheld from your paycheck if you were working.

You’ll still pay significantly less in FICA taxes than you would have had you been working if you collected unemployment through a significant part of the year.

Read Also: Is There An Extension For Unemployment

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Name

- Claim ID, also referred to as Claimant ID in letters

- Current mailing address

- Date of birth

- Phone number, including area code.

Do not include your Social Security number in an email. Email;may not be secure.;Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters we’ve sent you.

Be sure you include the email address where you want us to send the copy.;Email us at;;.

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

- Name

Effect On Other Tax Benefits

Taxable unemployment benefits include the extra $600 per week that was provided by the federal government in response to the coronavirus pandemic, accountant Chip Capelli, of Provincetown, Massachusetts, told The Balance.

Not only is unemployment compensation taxable, but receiving it can also affect some tax credits you might be eligible for and are counting on to defray those 2020 taxes that will be due.

Something else to consider is if you usually get the Earned Income Credit each year, Capelli said. While unemployment benefits arent considered earned income, they do influence your adjusted gross income , which is used to calculate the EIC.

The American Rescue Plan Act also expanded eligibility for the EIC to include more households, including childless households, as well as increasing the maximum credit from $543 to $1,502.

You May Like: Can I Get Obamacare If I Am Unemployed