Unemployment Insurance Is A Federal

Program parameters come from both federal statute and guidance and state statute and rules.

The federal government paid for many unemployment programs used during the pandemic in 2020 and 2021 including:

- Pandemic Unemployment Assistance

Every state has a UI trust fund

States deposit employer tax dollars in individual UI trust funds for paying future benefits.

- ESD produces Washingtons UI trust fund forecast report three times per year.

- Find current and archived reports on ESDs labor market page for the trust fund.

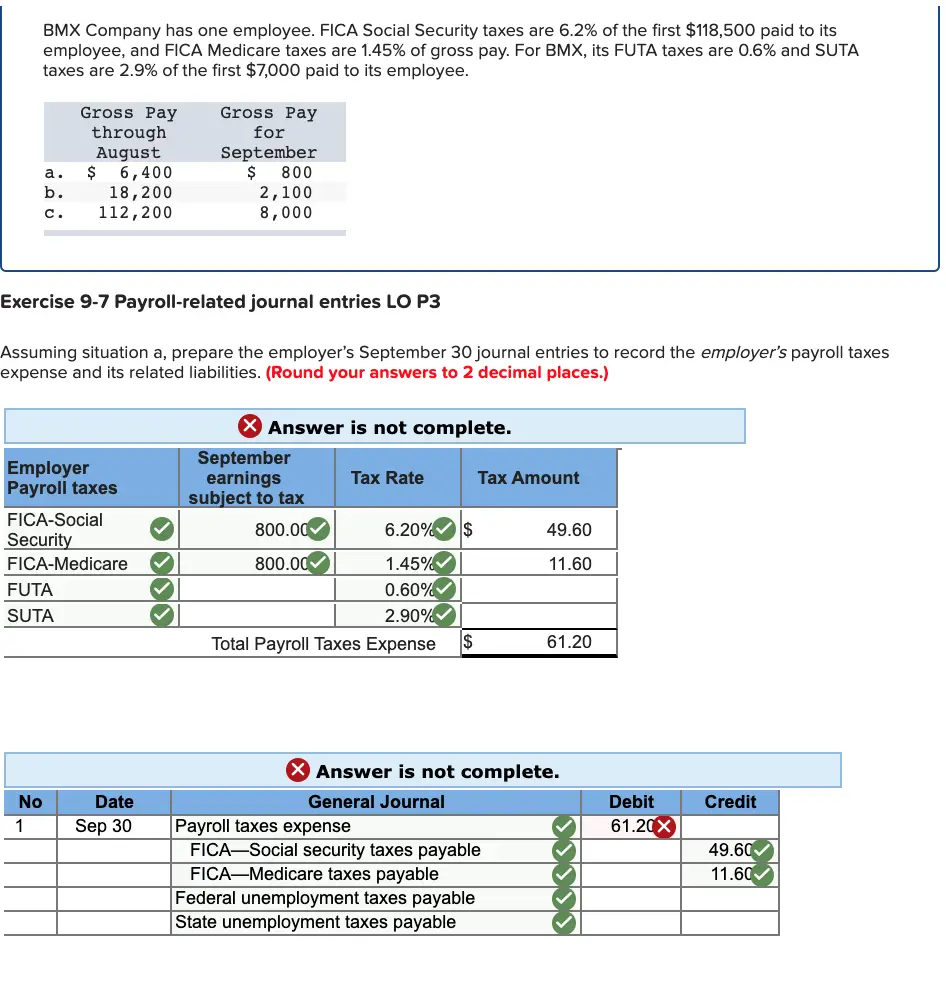

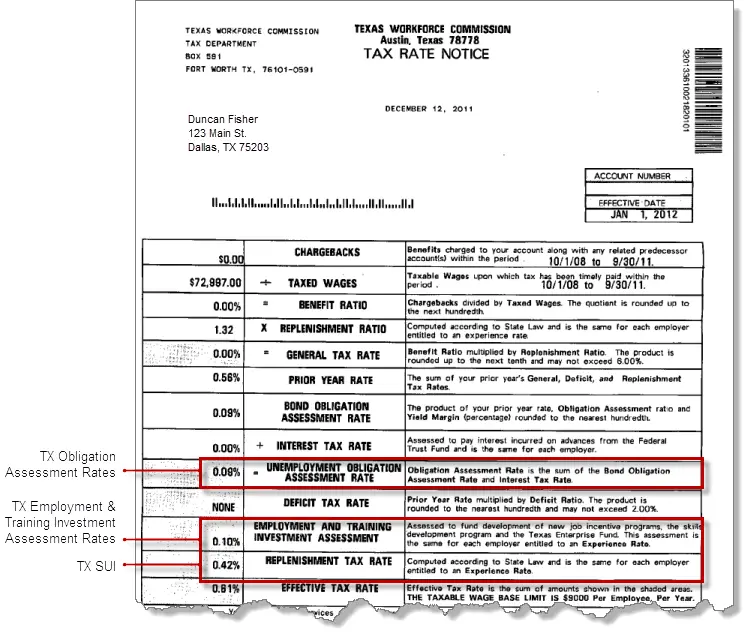

Employers pay two types of taxes: state and federal

- SUTA taxes fund benefit payments for claimants. Theyre deposited in the states UI trust fund.

- FUTA taxes are administered at the federal level. Theyre used for oversight of state unemployment programs. During times of high unemployment, states may borrow from FUTA funds, helping provide benefits to locally unemployed people.

State Unemployment Taxes

An employees wages are taxable up to an amount called the taxable wage base, authorized in RCW 50.24.010. This taxable wage base is $62,500 in 2022, increasing from $56,500 in 2021.

Experience tax currently capped at 5.4% )

Flat social tax currently capped at 0.50%

The total of the experience tax and the social tax cant exceed 6%.

Solvency tax currently capped is waived

Federal Unemployment Taxes

These Are The States That Will Either Mail Or Electronically Deliver Yourform 1099

Florida

You can access your Form 1099-G through your Reemployment Assistance account inbox. The fastest way to receive your 1099-G Form is by selecting electronic as your preferred method for correspondence. Go to My 1099-G in the main menu to view Form 1099-G from the last five years.

Illinois

Access yourForm 1099-Gonline by logging into your account atides.illinois.gov. If you havent already, you will need to create an .

Indiana

Access yourForm 1099-Gonline by logging into your account atin.gov. Go to your Correspondence page in your Uplink account.

To reduce your wait time and receive your 1099G via email, or using the MD Unemployment for Claimants mobile app.

Michigan

If you did not select electronic as your delivery preference by January 9th, 2021, you will automatically be mailed a paper copy of your Form 1099-G.

To view or download your Form 1099-G,

o sign into your MiWAM account ando click on I Want To, theno 1099-G then choose the tax year.

To change your preference, log into MiWAM.

o Under Account Alerts, click Request a delivery preference for Form 1099-G and thenselect the tax year.

Mississippi

To access yourForm 1099-Gonline, log into your account and follow the instructions sent by email on where you can view and print yourForm 1099-G.

North Carolina

Division of Employment SecurityP.O. Box 25903Raleigh, NC 27611-5903

Utah

State Income Taxes On Unemployment Benefits

Many states tax unemployment benefits, too. There are several that do not, and some waived income tax on benefits received in 2021. For example, Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Seven states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

Read Also: Can You Qualify For Medicaid If You Are Unemployed

How To File Unemployment On Your Taxes

If youre wondering if unemployment is taxed, the answer is yes. These benefits are subject to both federal and state income taxes. The amounts you receive should be reflected on your taxes on Form 1040 .

Important tax planning notes:

- To pay less tax when you file your return, you should request withholding from your unemployment checks on the federal and state level.

- Youll receive a Form 1099-G in the mail that will report the amount of the unemployment benefits paid to you. This form will also show if you had taxes withheld.

Also Check: Can I Collect Unemployment If I Was Fired

South Carolina Unemployment Number

- Claimants are considered ineligible if:

- If you quit your job without “good cause”.

- If you are fired due to misconduct.

- If you refuse to work without “good cause” to.

- If you file when you are already employed.

- If you are not working because of a strike or type of industry/labor dispute. Exceptions can be made during a “lockout”.

- In some cases, if you suffer from a loss of work due to a strike even though you are not involved with the strike, you are ineligible.

Extended SC BenefitsRegarding Filing Mistakes: Any mistake made during the online claim process can be corrected by simply press the “back” button on your browser to correct your answer.

Read Also: Why Does Unemployment Take So Long

How Do You Calculate Taxes Taken From Your Paycheck

Add the accumulated taxes together to find the total taxes withheld on the employees check. Divide the result by the gross salary to find the percentage of the salary that is spent on taxes. To find the total percentage of tax withheld for all employees, add the withheld tax to each employees check and add the result.

Employer Payment Deferment Under Relief Act Ended For Calendar Year 2021

Payment deferment under the RELIEF Act ended on December 31, 2021, for calendar year 2021. Under the state RELIEF Act, contributory and reimbursable employers could elect to defer their unemployment insurance payments for the first three quarters of calendar year 2021. Contributory and reimbursable employers who deferred payments for calendar year 2021 are required to pay the outstanding payments by the due dates described below.

For Contributory Employers :

- Deferment of payments for Quarter 1, Quarter 2, and Quarter 3 of calendar year 2021 ended on December 31, 2021.

- All outstanding payments for Quarter 1, Quarter 2, and Quarter 3 of calendar year 2021 which were deferred under the RELIEF Act are due by January 31, 2022.

- Failure to pay outstanding contributions/taxes by January 31, 2022, will impact and reduce a contributory employers FUTA tax credit. This will result in an increase in the amount owed in federal unemployment insurance tax.

- Note : Under the RELIEF Act, contributory employers with fewer than 50 employees can defer payments for Quarter 1, Quarter 2, and Quarter 3 of calendar year 2022 until January 31, 2023.

For Reimbursable Employers :

Read Also: Do You Have To Pay Taxes On Disability

Read Also: Can I Get Unemployment While Waiting For Disability

Are There Tax Breaks For Unemployment

The Earned Income Tax Credit is one tax benefit that many people may overlook. It is intended to help taxpayers with low to moderate income. The amount of credit you can receive depends on your filing status, total income, and how many qualifying children you have.

If you are paying for childcare while you look for work, you could receive a tax credit to offset those costs. The amount you can claim for the Child and Dependent Care Credit depends on your income.

For the EITC and the childcare credit, you must have earned income to report on your return. Your unemployment compensation does not count toward these since it is not earned. But if you lost your job during the year, you can still qualify based on what you earned while you were still employed.

If you have dependents under age 17, you may be able to claim theChild Tax Credit. You do not need to have earned income to qualify for this credit, but your dependents will have to meet certain requirements to be eligible. If you claim anyone over the age of 17, they may qualify for a separate dependent credit worth $500.

Have you picked up a side gig, like driving for Uber, tutoring, or selling a product as an independent consultant? If so, you may be considered self-employed for tax purposes. To learn more, read: Different Types of Self-Employment.

Recommended Reading: Tn Unemployment Application

Do You Owe Taxes On Unemployment Benefits

Yes, unemployment checks are taxable income. If you received unemployment benefits in 2021, you will owe income taxes on that amount. Your benefits may even raise you into a higher income tax bracket, though you shouldn’t worry too much about getting into a higher tax bracket.

People who file for unemployment have the option to have income taxes withheld from their unemployment checks, and many do. If you elected to do this, you have little to worry about.

What if you didn’t choose to have income taxes withheld from your unemployment checks? Don’t panic. If you were employed during much of the year, you may simply see a reduced tax return or a very small tax bill when you file.

Don’t Miss: How Do I File For Unemployment If I Am Self-employed

What To Do If You Owe Taxes On Unemployment Benefits

After going through these steps, you may find that you owe taxes to the IRS. If you do, don’t panic. You have options.

However, not paying that tax bill is not one of those options. You should make every effort to pay as much of your tax bill as possible. Not paying your tax bill means that you’ll immediately face additional penalties for late payment, as well as interest that accrues on your unpaid taxes. If you continue to not file your taxes, the IRS may seek legal remedy against you.

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

Don’t Miss: When Will Ga Get The 300 Unemployment Benefits

How To Prepare For Your 2021 Tax Bill

You can have income tax withheld from your unemployment benefits, so you dont have to pay it all at once when you file your tax returnbut it wont happen automatically. You must complete and submit Form W-4V to the authority paying your benefits. Withheld amounts appear in box 4 of your Form 1099-G.

You can have federal taxes withheld from your benefits, but it is limited to 10% of each payment. This may not be enough to adequately cover taxes on the benefits you received. If youve returned to work, you can opt to have extra tax withheld from your paychecks through the end of the year to help cover taxes owed on your unemployment benefits as well as your regular pay.

Your other option is to make advance estimated quarterly payments of any tax you think you might owe on your benefits. You have until Jan. 15 to make estimated tax payments on any benefits you receive between September and December of the prior tax year. In fact, you must do so if sufficient tax wasnt withheld from your unemployment benefit payments. You could be charged a tax penalty if you dont pay as you go through either additional withholding or estimated payments during the tax year.

The tax you owe on your unemployment benefits might be minimal, depending on how much you received. This is because unemployment doesn’t replace 100% of your previously earned compensation.

State Income Taxes On Unemployment Compensation

You may also need to pay state income taxes on your unemployment benefits. This is another tricky area because each state has different rules. Some states dont have a state-level income tax, and others dont tax unemployment benefits. Some tax unemployment benefits in full, and others impose taxes on only a portion of benefits.

If you live in one of the eight states that doesnt have a state income tax , you dont have to worry about paying state income taxes on your benefits. New Hampshire residents are also in the clear because the state only taxes interest and dividend income.

California, New Jersey, Pennsylvania, and Virginia dont tax unemployment benefits, so residents in those states dont have to worry about state-level withholding, either.

If you live in one of the other 37 states or the District of Columbia, check with your tax advisor or your states tax agency to find out how unemployment benefits are taxed. Those states should allow you to set up state withholding online when you apply for unemployment or at any point while you are receiving benefits.

Recommended Reading: How To File An Extension On Unemployment

Reporting On Original Tax Return

When you’re using an e-file application, you’ll be notified that you did not report your unemployment compensation, or that the amount you reported does not match our records. If you indicate that you didn’t have any compensation, the system will let you continue. However, your refund will be held up, and you’ll receive a letter requesting that you submit documentation to verify the correct amount.

- A corrected Form 1099-G – Certain Government Payments

- Documents that can prove the correct benefits

Unemployment Benefits At Tax Time

People who become unemployed for the first time are often shocked to learn that they must report their unemployment benefits more than $10,200 on their 2020 tax return. You should receive a Form 1099-G showing total unemployment compensation paid to you in 2020. If you move and don’t receive a 1099G from your state’s unemployment office, you might even forget you received this income altogether. But if you omit unemployment income from your tax return, the IRS will take noticeand expect you to pay what’s owed.

It’s important to be proactive so you don’t get caught short of funds at tax time. When you file for unemployment, consider having federal and state taxes withheld from your benefits. It may be difficult to lose that money from your unemployment check when funds are so tight, but you’ll be glad when it comes time to file your taxes in May.

Note: The Internal Revenue Service pushed back the federal income tax filing due date for the 2020 tax year from April 15, 2021, to May 17, 2021. This extended deadline gives you an extra month to file your returns.

If you havent been withholding taxes from your unemployment benefits, talk to a tax professional or use your favorite online tax software to project your federal and state tax liabilities. Be sure to include all sources of income, both taxable and tax-free, and any amounts that were withheld from wages, investment accounts and early retirement withdrawals.

Recommended Reading: When Will We Get 300 Unemployment

Unemployment Compensation Subject To Income Tax And Withholding

The Tax Withholding Estimator on IRS.gov can help determine if taxpayers need to adjust their withholding, consider additional tax payments, or submit a new Form W-4 to their employer. For more information about estimated tax payments or additional tax payments, visit payment options at IRS.gov/payments.

The Federal Unemployment Tax Act , with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax. For a list of state unemployment tax agencies, visit the U.S. Department of Labors Contacts for State UI Tax Information and Assistance. Only the employer pays FUTA tax it is not deducted from the employees wages. For more information, refer to the Instructions for Form 940.

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 18, 2022.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

Read Also: Who To Call For Unemployment

Talk To The Irs And Set Up A Payment Plan

If the amount seems impossible for you to cover, contact the IRS directly. Despite its reputation, the IRS actually works with individual taxpayers who are having difficulty paying their taxes. It offers extensions, waive fees, and sometimes even compromise in difficult situations.

Start by calling the IRS at 18008291040. Try to avoid doing this too close to the filing deadline of April 18, as the IRS tends to get very busy around that date. Call as early as possible. Discuss your situation with them and ask what options are available.

Unemployment Compensation Exclusion Worksheet Schedule 1 Line 8

Recommended Reading: How To Cancel Unemployment Benefits