Why Is My Unemployment Claim Pending

If your claim status is pending, we may need to confirm your identity or eligibility before we can process payment.

If we need to confirm your eligibility, we will schedule a phone interview with you. For more information, visit Claim Status: Pending Payment.

Many people receiving unemployment are reaching the end of their benefit year. If your unemployment claim expired because your benefit year ended, you must apply for a new claim. If you do not, we will not be able to determine your eligibility or process payments, which can lead to a Pending claim status. To learn more, visit Benefit Year End.

Note: If you have an existing Pandemic Unemployment Assistance claim, you do not need to submit a new application.

What Happens If I Get Approved For Unemployment Benefits

Once your claim has been accepted, a check should come in the mail or through a direct deposit you set up. If everything goes smoothly, you should start receiving benefits in two to three weeks, Woodbury said.

In most states, receiving unemployment insurance comes with the condition that you continually verify that you are ready, able and willing to work immediately, and that you are actively looking for work. Under the CARES Act, you still need to be actively seeking work to receive unemployment benefits, but the bill gives states flexibility on how applicants who cant look for work because of quarantine, illness or restricted movement should meet that requirement.

States are starting to loosen that job search requirement in these extraordinary times. Wisconsin, Nevada, South Dakota, Pennsylvania, and Texas, for example, are no longer requiring claimants to submit work search actions if they are applying for UI because of COVID-19.

A HuffPost Guide To Coronavirus

- Stay up to date with our live blog as we cover the COVID-19 pandemic

How Unemployment Works In Michigan

It is important to apply for Michigan unemployment as soon as you lose your job so that your benefits can begin as soon as possible. You can file a Michigan unemployment application online, over the phone, or at a Michigan unemployment office.

If you meet Michigan unemployment benefits eligibility, you will be approved for up to 20 weeks of unemployment compensation. The minimum amount you will receive is $81, with a maximum of $362.

The Michigan unemployment department requires all benefits recipients to file a weekly claim with MARVIN, the online reporting system. This is proof that you are searching for new work and is required to receive your weekly benefits.

If you have found a new job and are being paid, regardless of how quickly, your benefits will end. Or, after reaching 20 weeks, your benefits will expire. In most situations, the state will reject a Michigan unemployment extension request.

Recommended Reading: Can You Draw Unemployment If You Quit Your Job

How Do I Get A Chip Debit Card

Bank of America is sending chip cards to new claimants starting July 25, 2021. If you already have a debit card, it will be replaced with a chip card when it expires.

If your card has been lost or stolen, you must contact Bank of America at 1-866-692-9374 .

If your card is damaged, you can order a replacement card online by visiting the Bank of America debit card website.

What Do I Need To Know About Unemployment Benefits

If you are unemployed due to COVID-19, your experience will be similar to anyone else who needs to apply for unemployment benefits.

If you have become unemployed or had your hours greatly reduced, you should:

If you have questions, our UI Customer Service Representatives are here to help.

Recommended Reading: How Do I Sign Up For Unemployment In Tn

Unemployment Eligibility From Previous Employment

If your business is not set up as a W-2 employer, all may not be lost.

Roberts explains, “If you only recently started working for yourself, your previous employment would actually be examined to determine eligibility. There’s a minimum base period of a year in almost every state. This means that the earliest four of the last five complete quarters of the calendar year will be examined to determine both eligibility and benefit amount.”

If you don’t have enough work history to use under this rule, your state may have exceptions where you can qualify with less work history, so be sure to check your state laws and requirements.

Is It Quicker To Apply By Phone Or Online

Woodbury said most claims are made online, but theres no hard and fast rule on which path is easier or quicker.

Some states let you apply both on the phone and online others dont. You can check the options for your state on this Department of Labor website. Oregon highlighted its phone option after online crashes.

Anyone experiencing difficulty using the online claim system can also call the agencys contact centers, where Employment Department staff can help with starting a claim for unemployment benefits: 1-877-FILE-4-UI #COVID19#UIbenefits

Oregon Employment Department

Also Check: How Do I Change My Address For Unemployment Online

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Premium Subsidy. The page links to information about COBRA including:

How To Apply For Unemployment As A Business Owner

To be able to apply, “you must confirm you are eligible to work and are actively looking for work,” says Behren. The U.S. Department of Labor web site will point you to your state’s official site, where you can apply online.

You’ll set up an account and provide your identifying information. Roberts offers these tips:

- Have your employer’s information , as well as the most current address, and your pay stubs going back at least a year.

- Keep your previous tax returns on hand for easy access.

- Complete the required information on the formâthe request is then sent to the employer to verify the information.” Since you are the employer, you’ll then have to respond and complete that part of the application as well,” Behren says.

Don’t Miss: Can You Get Unemployment If You Are Fired

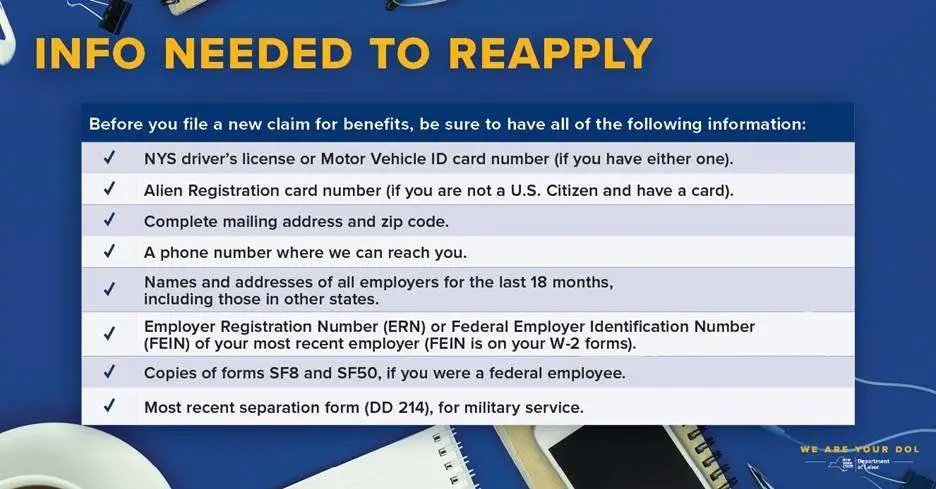

What Do You Need To File A Claim

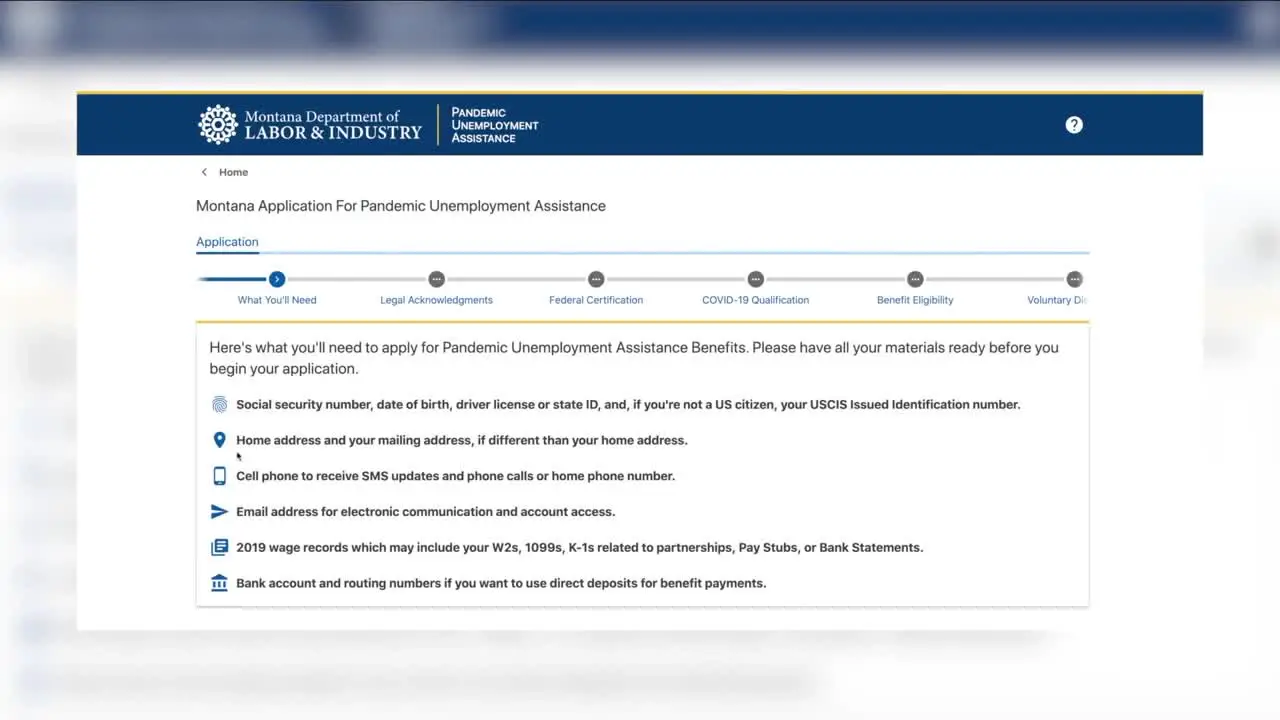

In most states, self-employed or 1099 workers will need to provide the following information when applying for unemployment benefits:

- Name, full mailing address, and phone number.

- Driver’s license or state ID number.

- Social Security or Alien Registration number and drivers license number.

- Proof of income, which can include 1099 tax forms, 1099 pay stubs, Form 1040 tax returns and tax returns.

- Bank account number and routing number for direct deposit of benefits.

Keep in mind that each state will have specific requirements, so do your research and collect all relevant documents before starting the unemployment application process.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

for more expert tips & business owners stories.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

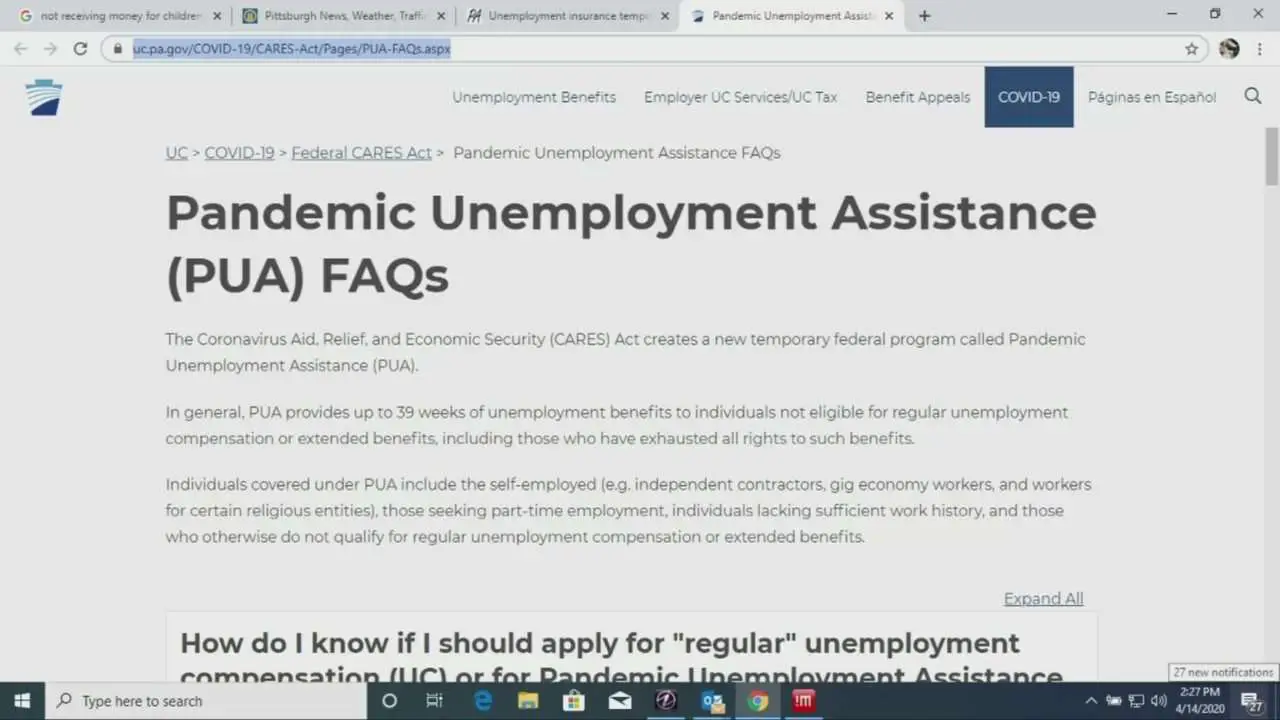

I Am An Independent Contractor Am I Eligible For Unemployment Benefits Under The Cares Act

You may be eligible for unemployment benefits, depending on your personal circumstances and how your state chooses to implement the CARES Act. States are permitted to provide Pandemic Unemployment Assistance to individuals who are self-employed, seeking part-time employment, or who otherwise would not qualify for regular unemployment compensation. To qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic.

The PUA program provides up to 39 weeks of benefits, which are available retroactively starting with weeks of unemployment beginning on or after January 27, 2020, and ending on or before December 31, 2020. The amount of benefits paid out will vary by state and are calculated based on the weekly benefit amounts provided under a states unemployment insurance laws. Under the CARES Act, the WBA may be supplemented by the additional unemployment assistance provided under the Act.

Also Check: How Do I Sign Up For Unemployment In Indiana

Other Options For Struggling Business Owners

If you didn’t hire yourself as an employee in your own business, there are some other ways to get financial assistance at this time:

- FEMA disaster relief

- Borrowing against your retirement accounts

Roberts suggests you think proactively now. “If you aren’t out of business, but see your business struggling, consider applying for a type of federal or state business loan now. The process is long, and the forms can be confusing. It’s better to have your application in than wait until you are completely out of business to apply. Remember, the programs are designed for businesses that have been economically impacted by COVID-19, not only for those that have been put out of business.”

One Of My Workers Quit Because He Said He Would Prefer To Receive The Unemployment Compensation Benefits Under The Cares Act Is He Eligible For Unemployment If Not What Can I Do

No, typically that employee would not be eligible for regular unemployment compensation or PUA. Eligibility for regular unemployment compensation varies by state but generally does not include those who voluntarily leave employment. Similarly, to receive PUA, an individual must be ineligible for regular unemployment compensation or extended benefits under state or federal law, or pandemic emergency unemployment compensation, and satisfy one of the eligibility criteria enumerated in the CARES Act, as explained in Unemployment Insurance Program Letter 16-20. There are multiple qualifying circumstances related to COVID-19 that can make an individual eligible for PUA, including if the individual quits his or her job as a direct result of COVID-19. Quitting to access unemployment benefits is not one of them. Individuals who quit their jobs to access higher benefits, and are untruthful in their UI application about their reason for quitting, will be considered to have committed fraud.

If desired, employers can contest unemployment insurance claims through their state unemployment insurance agencys process.

You May Like: Can You File Bankruptcy On Unemployment Overpayment

Federal Funding Of First Week

The federal government will fully fund the first week of unemployment compensation without a waiting period. Typically with unemployment, you have to wait one week before you start receiving payments because the state wants to allow you to find a job. The expansion has the federal government paying for the first week temporarily.

What You Should Know About Filing For Unemployment Benefits

Each state will have its own requirements to determine the amount of unemployment benefit youll receive but expect that amount to be reduced by taxes. The unemployment money you receive is taxable income for federal and some states. You want to make sure you have enough money withheld, or you will end up owing money at the end of the year.

If youre in immediate need of cash, unemployment benefits might not arrive quickly enough. Payments could take weeks to receive under normal circumstances. Given the high demand, states are currently receiving, it could take longer than expected to receive money.

Filing for unemployment does not show up on your credit report. However, unemployment income is typically lower than the income you were earning. The lower-income could have negative impacts on your finances that cause late or missed payments, which will hurt your credit score.

Don’t Miss: Quitting And Unemployment Benefits

Unemployment Benefits For Contractors Gig Workers And Self

If you are an independent contractor, a gig worker, or are self-employed in Texas, and you are out of work due to COVID-19, you may qualify for unemployment benefits through Pandemic Unemployment Assistance .

Texans who fall into the above categories should use the Unemployment Benefits Services system to apply for federal unemployment benefits. You can begin the application process by following this link.

If you need help applying, consult the Unemployment Application Guide.

For more information, see Pandemic Unemployment Assistance .

How To File For Coronavirus Unemployment If Youre Self

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A new coronavirus relief package signed into law Thursday extends unemployment benefits for self-employed workers.

The American Rescue Plan breathes new life into temporary federal unemployment programs established under the CARES Act in March 2020, including the Pandemic Unemployment Assistance program, which provides benefits to gig workers, freelancers and self-employed workers who lost their income due to the coronavirus.

It also maintains the Federal Pandemic Unemployment Compensation program, which supplements state benefits with an additional $300 per week.

Heres what to know about filing.

Read Also: Can Llc Owner Collect Unemployment

How Long Will I Qualify For Mi Unemployment Benefits

Michigan allows residents to collect unemployment benefits for a maximum of 20 weeks per benefit year, regardless of wheter you find a job, stop benefits, and need to reapply later on in the year. This means there must be at least 52 weeks between Michigan unemployment claim filings to receive full benefits. For example:

- If you lose your job in March 2020 and receive unemployment benefits, you qualify for 20 weeks of payments. If you receive 15 weeks of benefits and find a new job, youll have five remaining weeks of benefits to access. If you are laid off again in January of 2021, you can utilize these five weeks, and are not entitled to any further payments because a full calendar year has not passed since you first filed.

- On the other hand, if 52 weeks has passed, you may be eligible to receive the full benefits period of 20 weeks. If you became unemployed in June 2019 and collected all 20 weeks of benefits, you are no longer eligible to receive any further payments for the year. Say you find a new job after that time and are employed. If you face another layoff after June 2020, youll be able to file a new claim and will qualify for the full 20 weeks because one whole calendar year has passed since your first claim.

In most cases, it is not possible to receive a Michigan unemployment extension. Previously, the state has only allowed extensions in times where economic downturn has created high Michigan unemployment rates.

Dont Take Your Unemployment Personal

Finding yourself without a job is a huge downer no matter how it happens even if youve lost your job because the government has forced your business to shutter. Its ok to give yourself a couple of days to wallow in self-pity but thats it!

This wont be easy especially as the weeks drag on. Some say unemployed people go through the five stages of grief: denial, anger, bargaining, depression and finally acceptance.

Dealing with the emotional pain and mental stress of unemployment is important, but you cant let it keep you down forever. Allow yourself to vent some of those frustrations every now and then.

If you keep it all bottled up youre just going to curl up in a little ball and wither away or worse yet youll self implode. Remember, youre far from alone. As of this writing, a shocking 26.4 million people have filed for unemployment since March 16th, 2020.

Recommended Reading: Apply For Unemployment Chicago

How Do I Apply For Unemployment Benefits In Michigan

Michigan residents who have recently lost their job can apply for unemployment benefits online or through the Michigan unemployment phone number. It is important to file for benefits within the first week of losing your job.

|

Monday |

|

|

Open call-in |

Open call-in |

If you are having difficulty with either system, you can also visit one of several Michigan unemployment office locations. For any questions or concerns about your Michigan unemployment, contact an unemployment insurance representative as soon as possible so that your weekly claims are not delayed or terminated.

How Do I Return Unemployment Benefits I Shouldn’t Have Received

If you received unemployment benefits you were not eligible for , we will send you a notice. It is important to repay this benefit overpayment as soon as possible to avoid collection and legal action. After receiving a notice, visit Benefit Overpayment Services to learn how to repay an existing overpayment.

If you want to repay these benefits before receiving a notice, review the following:

- Benefit check not cashed Return the original check to the EDD.

- Benefit check cashed Send a personal check, cashier’s check, or money order made payable to the EDD.

- Debit card If the funds are still on your card, transfer them to your bank account and then repay them by sending a personal check, cashierâs check, or money order made payable to the EDD.

Include a letter with the following information:

- Name.

- Social Security number or EDD Customer Account Number .

- Week or weeks that the returned payment applies to.

- Reason for returning the benefits.

- Date you returned to work .

- Gross earnings for each week of benefits being returned .

Mail the payment and letter to:

Employment Development Department Overpayment CenterPO Box 66000

Read Also: How To File Unemployment On Taxes