Will I Get A Tax Refund From Unemployment

Will I get a tax refund from unemployment? What Are the Unemployment Refunds? In a nutshell, if you received unemployment benefits in 2020 and paid taxes on that money, youll be getting some or all of those taxes back via direct deposit or the mail.

Hereof, How long is unemployment on Covid?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation program.

Similarly How much taxes do you pay on unemployment? If you had taxes withheld on jobless benefits, the federal taxes are withheld at a 10% rate. On $10,200 in jobless benefits, were talking about $1,020 in federal taxes that would have been withheld. Thats money that could go to cover what income taxes you owe or possibly lead to a bigger federal income tax refund.

Are Unemployment Insurance Benefits Taxed By States And The Federal Government

Yes. Unemployment insurance benefits are subject to both federal and state taxes. Before 2021, unemployment benefits counted toward your income and were taxed at rates according to the IRSs tax brackets. The American Rescue Plan Act of 2021 exempted some of that money from federal income taxes for tax year 2020.

You May Like: How To Make Money Unemployed

Reporting Unemployment Benefits On Your Tax Return

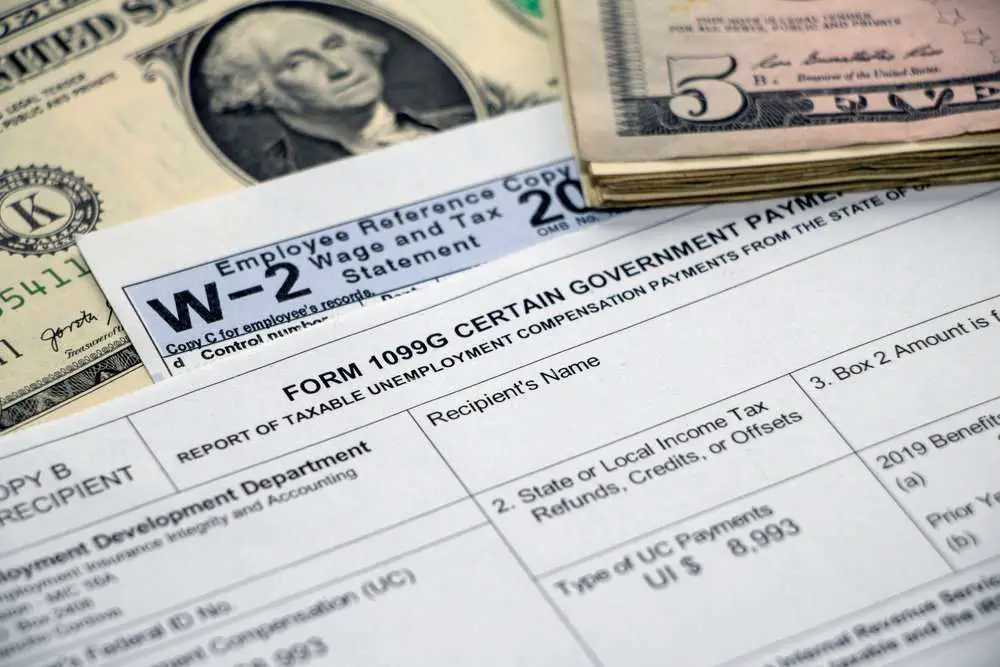

You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The amount will be carried to the main Form 1040. Remember to keep all of your forms, including any 1099-G form you receive, with your tax records.

If you use TurboTax to file your taxes, well ask about your unemployment income and put the information in all the right tax forms for you.

TurboTax is here to help with our Unemployment Benefits Center. Learn more about unemployment benefits, insurance, eligibility and get your tax and financial questions answered.

Read Also:

You May Like: Are Unemployment Overpayments Dischargeable

If You Owe Tax That You Can’t Pay

If youre receiving unemployment benefits, its likely because youre out of work, and that could cause a hardship if you realize you have a lump sum of tax due when you file your return. For some taxpayers, this could mean deciding between paying the rent and buying groceries, or sending estimated tax payments to the IRS. If you find yourself in this situation, there are some options.

You can apply for a short-term or long-term installment agreement with the IRS to satisfy your tax debt in monthly payments made over a period of time, up to 72 months. Just file Form 9465 with the IRS.

You can also file Form 2210 with the IRS to ask the agency to waive any underpayment penalty thats been assessed against you if you feel it would be inequitable to require you to pay the penalty. You might also qualify for a waiver if you became disabled during the year you collected unemployment, or you retired during that year and were at least 62 years old.

Do You Owe Taxes On Unemployment Benefits

Yes, unemployment checks are taxable income. If you received unemployment benefits in 2021, you will owe income taxes on that amount. Your benefits may even raise you into a higher income tax bracket, though you shouldn’t worry too much about getting into a higher tax bracket.

People who file for unemployment have the option to have income taxes withheld from their unemployment checks, and many do. If you elected to do this, you have little to worry about.

What if you didn’t choose to have income taxes withheld from your unemployment checks? Don’t panic. If you were employed during much of the year, you may simply see a reduced tax return or a very small tax bill when you file.

You May Like: Can Llc Owner Collect Unemployment

$10200 In Unemployment Benefits Wont Be Taxed Leading To Confusion Amid Tax

The $1.9 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers. The law waives federal income taxes on up to $10,200 in unemployment insurance benefits for people who earn under $150,000 a year, potentially saving workers thousands of dollars. States that currently tax unemployment benefits have yet to decide whether they will allow those state taxes to be waived as well.

The change is good news for many taxpayers, who could save as much as $25 billion, according to the Wall Street Journal. But it also affects an already complex tax season for a tax collection agency that is already behind thanks to understaffing and pandemic-fueled disruptions.

Read Also: What Do Tax Accountants Do

Fringe Benefits Tax A Fringe Benefit Is A Payment To An Employee But In A Different Form To Salary Or Wages

Due to various tax benefits put in place by the government to encourage consumers to purchase homes. Specifically, federal tax changes related to unemployment benefits in the federal american rescue plan act of 2021 will impact some individuals who have already filed or will soon be filing their 2020 ohio it 1040 and ⦠On march 31, 2021, governor dewine signed into law sub. By far, the buying of a home can be one of a consumers biggest investments. See exceptions, below, for the situations where you are not required to file form 8833. Fringe benefits tax a fringe benefit is a payment to an employee, but in a different form to salary or wages. Tax benefits of home ownership in 2021. 18, which incorporates recent federal tax changes into ohio law effective immediately. When a consumer considers purchasing or selling a home, they should consider the fact that there are many tax benefits that could potentially make owning a home quite profitable. There are also benefits available for expenses related to adoption. The tax was first imposed in 1986 and the operation of the tax is described by the fringe benefits tax assessment act 1986. For fringe benefits tax purposes, an employee includes a: There are certain tax breaks available to military members and their dependents:

How to estimate your 2021 tax refund. For fringe benefits tax purposes, an employee includes a: There are also benefits available for expenses related to adoption.

Recommended Reading: Pennsylvania Unemployment Ticket Number

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Unemployment benefits provided a much-needed lifeline for thousands of Americans dealing with pandemic furloughs and layoffs in 2020. But on April 15 an unpleasant surprise might be waiting for people who got such aid.

According to Kathy Pickering, H& R Blocks chief tax officer, many first-time unemployment recipients dont know those payments count as taxable income for both federal and state returns.

Thanks to extended benefits that stretched up to 39 weeks in some states and additional weekly federal support payments, first of $600 and then $300, unemployment benefit recipients could be facing hefty tax bills theyre unprepared for and ill-able to afford, particularly if they are still out of work.

Legislation proposed by two Democratic Senators on February 2 hopes to prevent this by waiving taxes on the first $10,200 of unemployment benefits a person received last year. However, the bill has yet to be passed and no changes have been made to the existing tax code. So for now, its best to brace for a possible hit from Uncle Sam.

If you relied on unemployment compensation last year, heres what you need to know when you file your 2020 return: how that aid will be taxed ways to reduce your tax bill and your options if you cant pay in full by the deadline.

What To Do If You Owe Taxes On Unemployment Benefits

After going through these steps, you may find that you owe taxes to the IRS. If you do, don’t panic. You have options.

However, not paying that tax bill is not one of those options. You should make every effort to pay as much of your tax bill as possible. Not paying your tax bill means that you’ll immediately face additional penalties for late payment, as well as interest that accrues on your unpaid taxes. If you continue to not file your taxes, the IRS may seek legal remedy against you.

Recommended Reading: Sign Up For Unemployment In Tn

What Kind Of Unemployment Documentation Do I Need For Filing My Taxes

If you received unemployment benefits in 2020, EDD should have already sent you your 1099G form, which is a record of the total taxable income EDD has issued to you in a calendar year.

If you havent gotten this form for some reason, you can print one or request a paper copy through your UI Online account on EDDs website.

EDD recommends that if your 1099G form shows a $0 amount, you should call 1-866-401-2849 You can also report form problems online.

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

You can opt to have federal income tax withheld when you first apply for benefits. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development, Unemployment Insurance, PO Box 908, Trenton, NJ 08625-0908. for the “Request for Change in Withholding Status” form.

After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. This information is also sent to the IRS.

Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2020, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

IMPORTANT INFORMATION FOR TAX YEAR 2020:

Recommended Reading: Njuifile Home Page

You May Need To Adjust Your Spouses Income Tax Withholding

One way you can increase your current after-tax income, if you and your spouse were both working, is to have your spouse adjust his or her income tax withholding.

If your spouses withholding is based on the assumption you both earned an income, he or she is almost certainly having too much withheld for your current circumstances.

The working spouse should file a new Form W-4 with his or her employer to adjust the amount of income tax withheld.

Expanded Unemployment Assistance In 2020

In addition to tremendous increases in the number of workers claiming state UI benefits, millions of workers became newly eligible for unemployment benefits, were eligible for additional weeks of benefits, and received higher benefit payments than they would under longstanding UI programs as a result of the CARES Act. The CARES Act, enacted in March 2020, established three programs targeted at jobless workers:

- Pandemic Extended Unemployment Compensation grants thirteen additional weeks of UI to workers eligible for state unemployment benefits who are still jobless when they exhaust their state benefits . The Continued Assistance for Unemployed Workers Act , passed in December 2020, increased this to twenty-four weeks, but the additional eleven weeks can only be paid out in 2021.

- Pandemic Unemployment Assistance allows traditionally ineligible workers to access up to thirty-nine weeks of unemployment benefits . This includes self-employed workers, part-time workers, and low-wage earners, as well as workers unable to work for COVID-19-related reasons .

- Federal Pandemic Unemployment Compensation added $600 per week to unemployment benefit payments for seventeen weeks between April and July 2020. The last FPUC benefits were paid out the week ending July 26, and Congress did not extend the program in 2020. The CAUW Act reinstated the FPUC program for the 11 weeks between January and mid-March 2021, but at only $300 per week.

Sign up for updates.

Don’t Miss: Unemployment Compensation Phone Number

The Case For Forgiving Taxes On Pandemic Unemployment Aid

What You Should Know

- The $580 billion in unemployment insurance benefits paid out in 2020 are currently subject to federal income taxes.

- Millions of families will face surprise tax billssome ranging into thousands of dollarsas we head into tax filing season.

- Congress and the Department of the Treasury must exempt these benefits from taxation to support families facing sustained economic hardship.

As we write, Congress and the Biden administration are debating the size of a new relief package needed to aid struggling households and right the economy. Mostly unnoticed in the negotiation, though, is that, thanks to a decision by the Trump Department of the Treasury earlier in the pandemic, many hard-hit families who received unemployment insurance benefits in 2020 are now facing unexpected tax bills that could run to the thousands of dollars per family.1 At a time when millions are unemployed,2 when families continue to face food and home insecurity,3 Congress and the Biden administration must act urgently to prevent these surprise tax bills, and to allow millions who have already paid tax on their 2020 benefits to receive a timely refund check.

Not only will this surprise tax bill hurt many workers who cant afford it right nowtheres a strong legal argument that, according to current law these benefit payments should never have been taxed in the first place.

You Could Get A Hefty Tax Refund This Year

On the other hand, if youve been having income tax withheld from your pay for a substantial portion of the year already, you may be way ahead on paying taxes for this year.

In a progressive tax system, such as we have in the U.S., higher levels of income are taxed at much higher rates.

When your employer takes taxes out of your paycheck, the payroll department calculates your income tax withholding as if you will earn the same amount all year.

When you get laid off and make far less over the year, you may get a large portion or all of your income tax withheld back as an unemployment tax refund.

You cant get that over-withheld income tax back until after the end of the year. However, you may be able to make adjustments to minimize your over-withholding, giving you more money to live on now.

Read Also: Pa Filing For Unemployment

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

What About State Taxes

More than half of states levy an income tax on jobless benefits. States will have to decide if they will also offer the tax break on state income taxes.

Its possible that some may still opt to tax the jobless aid, experts say.

Some already exempt taxes on unemployment, including California, New Jersey, Virginia, Montana and Pennsylvania. And some dont levy state income taxes at all, including Texas, Florida, Alaska, Nevada, Washington, Wyoming and South Dakota.

Read Also: Max Unemployment Benefits Mn

Reporting Unemployment Benefits At The State And Local Level

If your state, county, or city collects income tax on your unemployment benefits, keep your Form 1099-G for reference. You may have to attach it to your state, county, or local income tax return. If so, keep a copy for yourself.

Check with your states Department of Revenue and relevant county and local government tax agency for instructions on how to report your unemployment benefits at the state and local level.

Filing Your Taxes If You Claimed Unemployment Benefits: What To Know Where To Find Help

The 2021 IRS deadline for filing your taxes has been pushed to May 17 to give people more time to get organized in the wake of the COVID-19 pandemic.

Even with this extra time, your situation is likely to be even more complicated if youve been unemployed during the course of the pandemic since you have to pay taxes on federal unemployment if you earned above a certain amount in benefits.

With the new IRS tax filing deadline now less than a month away, here’s what you need to know about filing your taxes if you’ve claimed unemployment benefits this year and where you can find free or low-cost tax help, even after many such support services closed up shop on the original IRS deadline of April 15.

Read Also: File For Unemployment Pennsylvania

Talk To The Irs And Set Up A Payment Plan

If the amount seems impossible for you to cover, contact the IRS directly. Despite its reputation, the IRS actually works with individual taxpayers who are having difficulty paying their taxes. It offers extensions, waive fees, and sometimes even compromise in difficult situations.

Start by calling the IRS at 18008291040. Try to avoid doing this too close to the filing deadline of April 18, as the IRS tends to get very busy around that date. Call as early as possible. Discuss your situation with them and ask what options are available.