Eligibility Requirements For Unemployment Insurance Benefits

To be eligible for UI benefits the claimant must:

- be totally or partially unemployed

- have worked and earned a minimum amount of wages in work covered by UI in the last 15 to 18 months

- have lost his or her job through no fault of their own

- be able and available for work

- NEW!;Verify your identity through online verification or provide required documents

- be actively seeking work

- be registered for work .

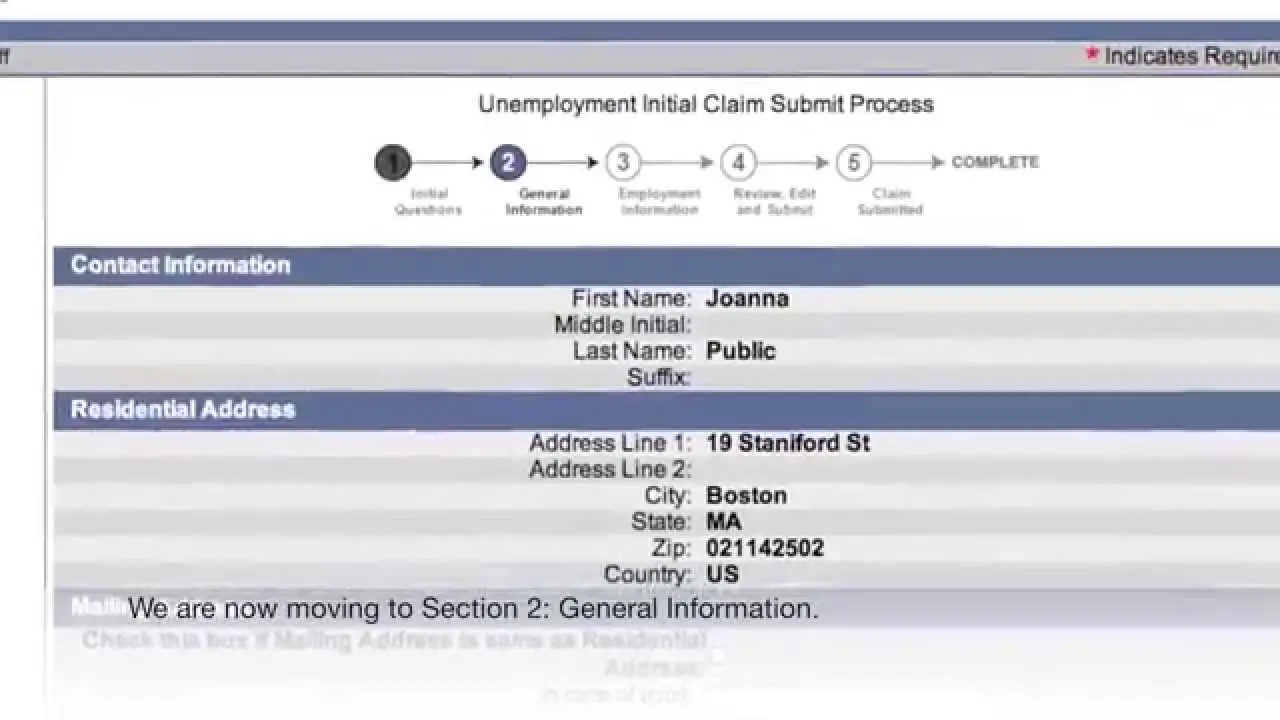

S To Create An Online Account

IMPORTANT: USE A VALID EMAIL ADDRESS WHEN YOU CREATE YOUR ACCOUNT.

1. Click on Create an Online Account on the DES homepage, des.nc.gov.;

2. Enter your Social Security Number twice.;

3. Select Next. On the User Account Creation page:;

- Create a User Name .;

- Enter a valid email address twice.;

- Create a PIN number .;

- Enter your contact phone number.;

- Create a Password .

4.Select Create Account.;

5.You can now Sign In at des.nc.gov. Use the User Name and Password you entered when creating your Online Account in Step 3.;

Creating an Online Account for Claimants

Before You Apply: Gather Your Documents And Information

For regular unemployment insurance benefits, you will need:

- Your name, Social Security number, birthdate and contact information.

- Your complete work history for the past 18 months including:

- employer name

- start and end dates of employment for each employer

Also Check: How To Get 1099 Form For Unemployment

Who Is Eligible To Receive Unemployment Compensation

Your state establishes;eligibility requirements for unemployment insurance coverage, with primary requirements including having worked for a certain period of time and your job having been lost through circumstances beyond your control, typically a layoff or a furlough.

Typically, you must be considered an;employeeas opposed to an;independent contractorat a company that pays into the unemployment insurance fund for your state. However, benefit guidelines have changed due to the coronavirus.

Self-employed workers may be eligible for unemployment benefits. Check with your state department of labor for information on qualifying.

If you meet the eligibility requirements established by your state, you are entitled to receive temporary compensation, generally half your earnings up to a maximum amount.

Wrongful termination;can result in eligibility for unemployment benefits, as well as possibly some company benefits.

Where To File When You Worked In A Different State

If you live in one state and worked in another, or if you have moved, you should generally file your unemployment claim with the state where you worked.

If you worked in a state other than the one where you live or if you worked in multiple states, the state unemployment office where you now live can provide information about how to file your claim with other states.

Don’t Miss: How Long Does Unemployment Debit Card Take To Arrive

For Pandemic Unemployment Assistance Benefits:

There are two ways to apply:

PUA income documentation guideIMPORTANT: Be sure you enter your information correctly on your application. Your money will be delayed by days or even weeks if you make a mistake. Be extra careful with your Social Security Number and your address.

Need help filing your claim?

Filing a claim wrong can delay your benefits. And during COVID-19, the right answers to the questions on the claim form are different than you might think.

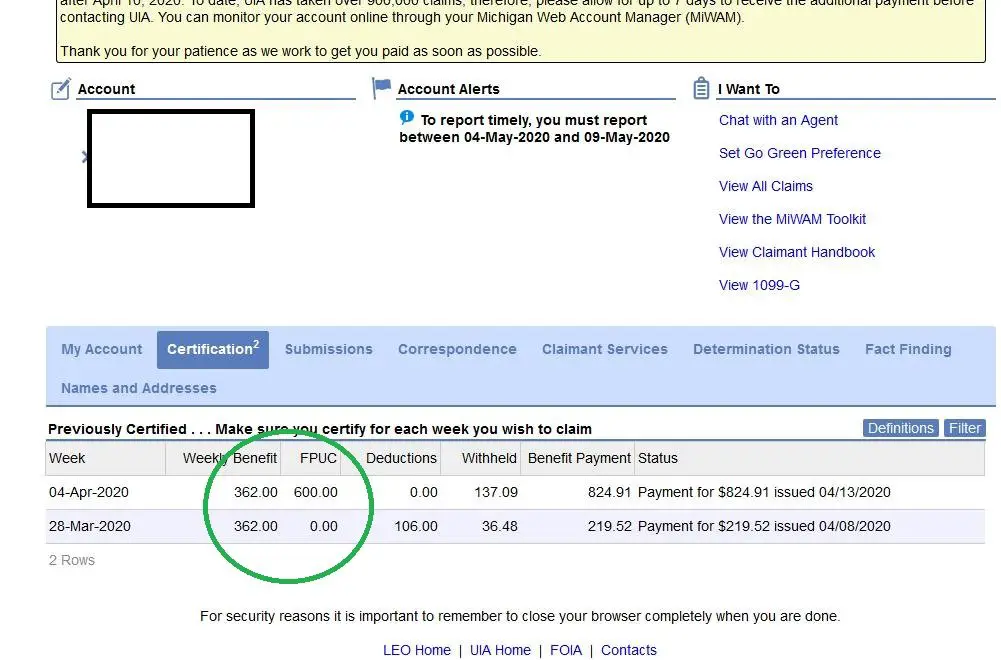

Unemployment Insurance Taxes And 1099

Unemployment insurance benefits are subject to federal and state income tax. If you collected unemployment insurance benefits in 2020, you will need the I.R.S. 1099-G tax form to complete your 2020 federal and state tax returns. Please note that when you completed your initial claim application, you chose whether to have any taxes withheld from your weekly benefit amount. If you chose not to withhold any taxes, then you will be required to pay the appropriate taxes on the total benefits received when you pay your taxes.

Marylandâs Division of Unemployment Insurance has issued a 1099-G tax form to all claimants that received unemployment insurance benefits during the calendar year 2020 based on the delivery preference chosen in their BEACON portal.

All claimants will be able to immediately access their 1099-G tax form by visiting their BEACON portal and selecting Correspondences from âYour Options.â Select âSearchâ to display all Correspondences and select â1099â to view. If you selected the U.S. Mail as your preferred method of delivery, then you will also receive a 1099-G tax form in the mail.

To learn about the Earned Income Tax Credit, find locations offering FREE tax preparation through the CASH Campaign of Maryland, get financial help with the cost of health coverage through the Maryland Health Connection, and more, please visit our website. To learn more about the 1099-G tax form, please read our Frequently Asked Questions.

Also Check: How Do I File For My Unemployment

How To Apply For Unemployment Benefits

The best and fastest way to apply is online. You can apply by phone, but wait times are very long because of COVID-19. At this time, you cannot apply in person. The steps below will guide you through the process.

Get ready to apply

Before applying, gather information youll need. See Page 1 of the Unemployed Worker Handbook or visit the;Have this information ready page.

Reasonable accommodation.;Information on reasonable accommodation;is available for unemployment-benefits customers with disabilities.

File An Initial Or Weekly / Continued Claim

Welcome to the Virginia Employment Commission Workforce Services Unemployment Insurance claim filing system. In order to file for Unemployment Insurance you must have been separated from your employer or have had your hours reduced.

You should not attempt to file a Virginia claim if:

- Your last employer was a federal civilian employer in a state other than Virginia .;;;The only exception is if you worked as a federal civilian overseas.

- Your employment within the last 18 months was performed in;a state or states;other than Virginia.

You will need the following information to file your claim:

- Your Social Security Number

- The accurate employer names, addresses, telephone numbers and dates of employment within the last 18 months.

- The name and local number of your local union hall, if you obtain work through a union.

- Your Alien Registration Number if you are not a US citizen.

- If you have any Non-Virginia employers you must have an accurate mailing address, phone number, and dates of employment for them.

- You will be asked to select a method of payment:;VA Debit Card;or;Direct Deposit. If you select Direct Deposit, you will need to have your Routing Number and your Account Number .

If you do not have this information available, please gather it before you begin to file your claim. This site is available seven days a week. The filing process takes approximately 45 minutes to complete. Please allow enough time to complete this process.

INCOMPLETE APPLICATIONS WILL NOT BE PROCESSED!

Recommended Reading: How Do I Sign Up For Unemployment In Tn

File An Unemployment Claim

To apply for regular unemployment insurance, click the button below. You’ll be taken to the 10 Things You Should Know page to start the application process.

Pandemic Unemployment Assistance applications are being accepted until October 6th, 2021. However, PUA benefits are only payable retroactively through the week ending September 4th, 2021. Learn more and file a PUA claim online.

Once you have filed a claim for regular unemployment benefits, return to this page and click:

How To Reopen An Unemployment Insurance Claim In California

1 Access your UI Online account. Log in to Benefit Programs Online and select UI Online. 2 Select Reopen Your Claim. Select Reopen Your Claim from the Notifications section of your UI Online home page. 3 Answer all questions. 4 Review and submit your answers. 5 Check your status.

Your unemployment claim expired. Use the UI Benefit Calculator to estimate how much you may receive in unemployment. Once you file for unemployment, we will verify your eligibility and wage information to determine your unemployment compensation and benefits.

Recommended Reading: How Can I Be Eligible For Unemployment

Benefit Year End Date

A regular unemployment insurance benefit year ends 12 months after the claim started.

You must reapply for a new claim if you earned enough wages; in the last 18 months and are still unemployed or working part time. We will notify you when your new claim is processed. This usually takes two to three weeks.

- If youre unsure if you have enough wages as reported by an employer, log in to UI OnlineSM and select File New Claim. We will do one of the following:

- Immediately tell you that you do not have enough wages to establish a new claim.

- Provide instructions on how to submit a new application.

For more information, refer to the unemployment benefit calculator.

If you served in the military, worked for a federal government agency, or worked in a state outside of California within the last 18 months, you must reapply for a new claim by phone, mail, or fax.

You do not need to reapply if you did not earn enough wages in the last 18 months to establish a new claim, regardless of whether you are on a regular claim, a federal extension, or Pandemic Unemployment Assistance . Continue to certify for benefits, and we will notify you when your benefit weeks are processed.

To find your benefit year end date, log in to UI OnlineSMand view your Claim Summary. Your benefit year end date is 12 months after the start of your Benefit Year.

For more information, refer to your Notice of Unemployment Insurance Award for your claim ending date or review Benefit Year End.

What Are The Rules For Applying For Unemployment

Unemployment Insurance is one of the most complex benefit programs in the state. How the rules apply to any one person often depends on a particular persons circumstances. We will continue to provide updates on federal unemployment benefits as they become available. My unemployment claim expired because my benefit year ended.

Recommended Reading: Can You Collect Ssdi And Unemployment At The Same Time

How Do I Apply

To receive unemployment insurance benefits, you need to file a claim with the unemployment insurance program in the state where you worked. Depending on the state, claims may be filed in person, by telephone, or online.

- You should contact your;state’s unemployment insurance program;as soon as possible after becoming unemployed.

- Generally, you should file your claim with the state where you worked. If you worked in a state other than the one where you now live or if you worked in multiple states, the state unemployment insurance agency where you now live can provide information about how to file your claim with other states.

- When you file a claim, you will be asked for certain information, such as addresses and dates of your former employment. To make sure your claim is not delayed, be sure to give complete and correct information.

- It generally takes two to three weeks after you file your claim to receive your first benefit check.

Filing A Weekly Claim

To maintain Unemployment Insurance benefits, you are required to file weekly claims confirming that you continue to meet the requirements to receive Unemployment Insurance.

You must file a claim every week you are unemployed, or underemployed.

The benefit week starts on a Sunday and ends on Saturday.

Learn about Arizonas work search requirements on the work search web page.

Read Also: How To Enroll In Unemployment

How Do I Know If I’m Eligible For Unemployment Insurance

Again, that can depend based on where you live, but generally speaking, most states follow the main guidelines set by the federal government. You’re eligible to file for unemployment benefits if you’ve lost your job through no fault of your own basically, if you weren’t fired for cause, but laid off or let go because your job was eliminated.

You also have to meet wage and work requirements, meaning that you were employed long enough to be eligible for unemployment benefits. States have their own formulas, but generally the base period is determined by how much you’ve made in the past year dating back to when you file your unemployment claim.

With the COVID-19 leading to a spike in unemployment, the federal government has advised states to adjust eligibility requirements so that more furloughed workers will be eligible for benefits. Specifically, federal guidelines now allow states to pay benefits when employees can’t work because an employer has temporarily ceased operations. You may also be eligible if you’ve been quarantined for COVID-19, but expect to return to work when the quarantine ends, of if you’ve left your job due to risk of exposure to coronavirus or because you’re caring for a family member.

The U.S. Department of Labor includes extensive information on eligibility for filing unemployment insurance on its website.

What You Need To Do

Make a claim for new style JSA and attend a phone interview with your local Jobcentre Plus office.

Keep to your agreement to look for work. This agreement is called a Claimant Commitment and you will create it at your phone interview.

Your JSA payments will be stopped if you do not keep to your agreement to look for work and cannot give a good reason.

Check if youre eligible for Universal Credit. If you are, you could get Universal Credit at the same time or instead of new style JSA.

Recommended Reading: Does Unemployment Contact Your Employer Every Week

Your Work Search Responsibilities

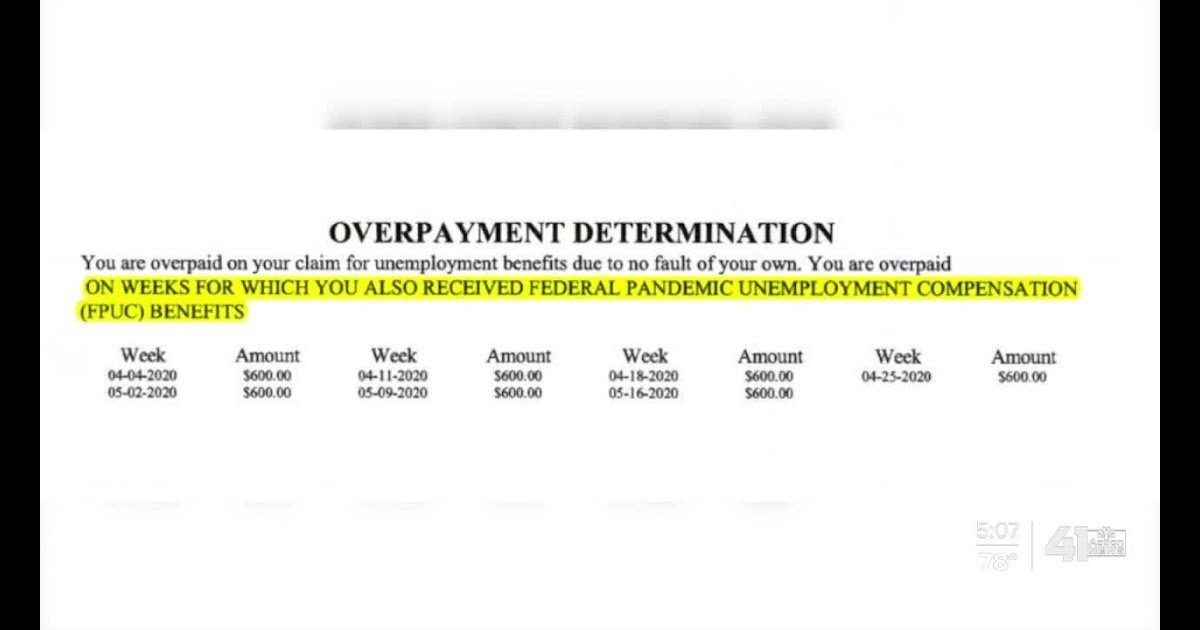

To receive unemployment insurance benefits,;;you must seek work with at least three potential employers each week and maintain a detailed and verifiable record of your work search. If you cannot prove you looked for work, you may be considered overpaid and required to repay benefits.

Submit An Application By Automated Phone

You can apply by phone on Fridays, between 8:00 a.m. to 4:30 pm.

At the end of the call, you will be transferred to a Customer Service Representative to complete your application.

Read Also: What Is The Tax Rate On Unemployment Benefits

Types Of Disability Policies

There are two types of disability policies.

-

Short-term policies may pay for up to two years. Most last for a few months to a year.

-

Long-term policies may pay benefits for a few years or until the disability ends.

Employers who offer coverage may provide short-term coverage, long-term coverage, or both.

If you plan to buy your own policy, shop around and ask:

-

How is disability defined?

-

How long do benefits last?

-

How much money will the policy pay?

Establish & Change Payment Options

When you apply for benefits, TWC offers you one of two ways to get your benefit payments:

- Direct deposit, which is direct payment into your personal checking or savings account in a United States bank or credit union

- Debit card, which is issued by the TWC-contracted bank

TWC will deposit payments to the TWC debit card account unless you sign up for direct deposit.

If you signed up for direct deposit on a prior claim, TWC will use the checking or savings account information you previously provided.

To select or change your payment option online or by phone:

- Log on to ui.texasworkforce.org and select Payment Option from the Quick Links menu.

Also Check: How Long Is Unemployment In Illinois

Important Tips To Ensure Your Application Can Be Processed Timely

Unfortunately, identity theft is a common occurrence. Identity thieves sometimes use stolen identities to apply for unemployment benefits.

To verify your identity, we review your answers to ALL questions. We also verify the information you provide using other data sources. It is very important to read each question carefully and to give an accurate, complete response. Incorrect or incomplete information will result in delays in payments .

Here are some tips: