Talk To The Irs And Set Up A Payment Plan

If the amount seems impossible for you to cover, contact the IRS directly. Despite its reputation, the IRS actually works with individual taxpayers who are having difficulty paying their taxes. It offers extensions, waive fees and sometimes even compromise in difficult situations.

Start by calling the IRS at 18008291040. Try to avoid doing this too close to the filing deadline of April 15, as the IRS tends to get very busy around that date. Call as early as possible. Discuss your situation with them and ask what options are available.

Heres How The $10200 Unemployment Tax Break Works

- President Joe Biden signed the American Rescue Plan Act of 2021 on Thursday.

- The $1.9 trillion Covid relief bill gives a tax break on unemployment benefits received last year. The measure allows each person to exclude up to $10,200 in aid from federal tax.

- The IRS issued instructions Friday for workers who haven’t yet filed their taxes. Americans who got jobless benefits in 2020 and already filed their taxes shouldn’t yet file an amended return.

In this article

Millions of Americans who collected unemployment benefits last year got a new tax break from the American Rescue Plan.

Here’s how it works.

What If I Received A Disqualification That Led To An Overpayment And/or I Have Repaid Some Of The Overpayment Do I Need To Have A Corrected 1099

The Louisiana Workforce Commission is required by the IRS to put all benefit payments, including overpaid amounts on your 1099-G form. These benefits were paid out to you by the Agency and they will not issue a corrected 1099 if:

- You were disqualified and received an overpayment amount and/or

- If you have made any repayments to the Agency for an overpayment made against you.

Recommended Reading: Maximum Unemployment In Mn

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.

What To Do If You Have Not Filed Taxes

If you havent already filed your 2020 tax return, you can claim the exemption allowed by the American Rescue Plan when you file.

You can find all the information about what benefits you were paid and how much was withheld using Form 1099-G, which you should have received from your state unemployment office by mail or electronically. You may receive separate forms for state unemployment compensation and any federal benefits you received, but you should report all benefits you were paid on your return, according to the IRS.

If you qualify, youll report your total benefits from Form 1099-G separately from the exclusion. Heres how:

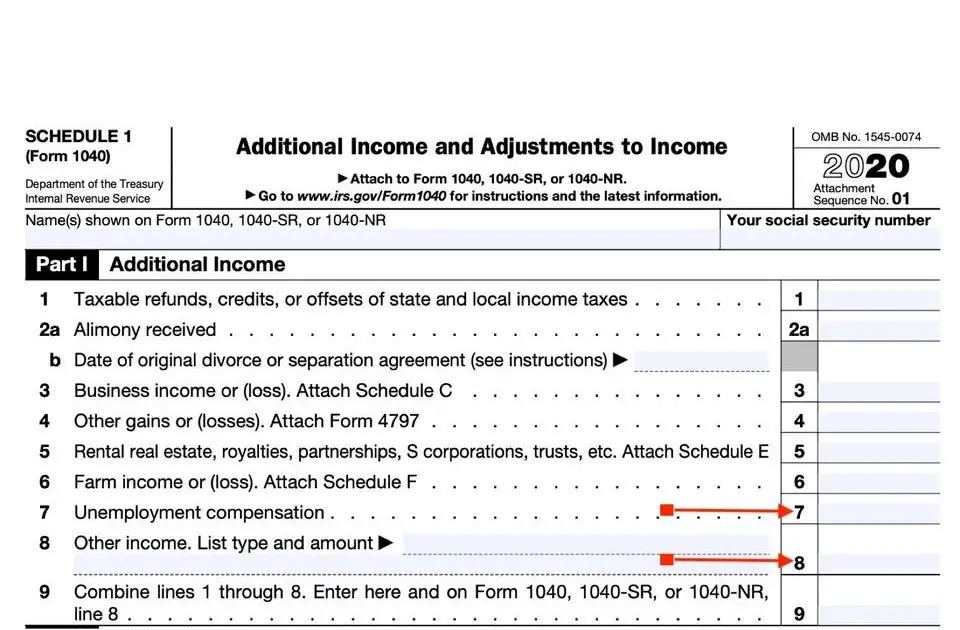

Generally, you report your taxes using Form 1040. But when you claim unemployment insurance, you must also complete a Schedule 1 form to report this additional income. Under the new exemption, you should report the total amount of unemployment compensation you received on line 7 of Schedule 1. Then, use the Unemployment Compensation Exclusion Worksheet to determine the exclusion amount youre eligible for, which youll report on line 8 of Schedule 1.

If you work with a tax preparer to file, they should be able to assist you in working out what to report on these forms using IRS guidance. If you file using a tax software, the IRS says these changes should now be reflected in the software you use to prepare electronically.

Recommended Reading: Www.njuifile.net Tax

How Does Unemployment Insurance Usually Work

In the United States, federal and state unemployment insurance programs have existed in some form since the 1930s. Unemployment programs are administered at the state level. Still, the system is funded by businesses paying Federal Unemployment Tax Act taxes and State Unemployment Tax Act taxes.

These programs are designed to temporarily provide financial assistance when a worker loses their job and is currently looking for a new one. Workers who are laid off, have lost seasonal work or have been furloughed are allowed to apply for unemployment insurance.

In most U.S. states, laid-off workers are typically able to receive 26 weeks of unemployment benefits and a percentage of their average annual pay. How much a worker can receive depends on how much money they made in their last job and in what state they reside.

Once a worker has been laid off, they can then submit an unemployment claim to their state government. This claim formally notifies the government and the former employer that the worker is seeking unemployment insurance. In some cases such as the worker being fired for cause the former employer may deny the unemployment claim.

How Long You Could Receive Ei Regular Benefits

You can receive EI from 14 weeks up to a maximum of 45 weeks, depending on the unemployment rate in your region at the time of filing your claim and the amount of insurable hours you’ve accumulated in the last 52 weeks or since your last claim, whichever is shorter.

Seasonal workers

If youre a seasonal worker, you may be eligible for 5 additional weeks of benefits up to a maximum of 45 weeks.

Until September 24, 2022: Number of weeks of EI regular benefits payable

| Number of hours of insurable employment in the qualifying period | < 6% |

|---|

| 14 |

To find out the rate of unemployment in your region, visit EI Program Characteristics.

Once the weekly benefit rate is established, it will remain unchanged over the life of your claim.

Don’t Miss: Njuifile.net Sign In

Reporting Unemployment On 1099

When you receive unemployment compensation, you will get issued a 1099-G at the end of the year. This is how the IRS keeps track of any income received from governmental sources. You are required to report this as income, and failing to do so might be one of the biggest tax mistakes you can make.

If you fail to report your unemployment benefits as income, its unlikely youre going to end up federal prison for tax evasion. But the fees and penalties associated with lying on your taxes are significant. And if you get audited the process will be time-consuming and potentially expensive. When it comes to paying taxes, honesty is always the best policy.

Reporting unemployment income on your taxes is easy. There are lines on your tax forms that are specifically for any 1099-G income.

Irs: Unemployment Compensation Is Taxable Have Tax Withheld Now And Avoid A Tax

IR-2020-185, August 18, 2020

WASHINGTON With millions of Americans now receiving taxable unemployment compensation, many of them for the first time, the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year.

Withholding is voluntary. Federal law allows any recipient to choose to have a flat 10% withheld from their benefits to cover part or all of their tax liability. To do that, fill out Form W-4V, Voluntary Withholding Request PDF, and give it to the agency paying the benefits. Don’t send it to the IRS. If the payor has its own withholding request form, use it instead.

If a recipient doesn’t choose withholding, or if withholding is not enough, they can make quarterly estimated tax payments instead. The payment for the first two quarters of 2020 was due on July 15. Third and fourth quarter payments are due on September 15, 2020, and January 15, 2021, respectively. For more information, including some helpful worksheets, see Form 1040-ES and Publication 505, available on IRS.gov.

Read Also: Unemployment Mn Maximum Benefits

Taxes On Unemployment Benefits

All benefits are considered gross income for federal income tax purposes. This includes benefits paid under the federal CARES Act, Federal Pandemic Unemployment Compensation , state Extended Benefits , Trade Adjustment Assistance , Pandemic Unemployment Assistance , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance . DES reports these benefits to the Internal Revenue Service for the calendar year in which the benefits were paid.

You may choose to have federal income tax withheld from your unemployment benefit payments at the rate of 10% of your gross weekly benefit rate , plus the allowance for dependents .

The amount deducted for state income tax will be 10% of the amount deducted for federal taxes, which is currently calculated as 1% of the gross weekly benefit amount. Please Note: State income tax cannot be withheld from the $300 additional weekly benefit in Lost Wages Assistance and the $600 additional weekly FPUC benefit for regular UI claims. Claimants who received FPUC and/or LWA in regular UI will be responsible for paying any tax due on those amounts when filing state income taxes for calendar year 2020.

After selecting your tax withholding on the initial Unemployment Insurance application, you can change your withholding preferences by completing the Voluntary Election for Federal/State Income Tax Withholding form . After completing the form, submit it to DES by mail or fax.

Reporting Unemployment Benefits On Your Tax Return

You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The amount will be carried to the main Form 1040. Remember to keep all of your forms, including any 1099-G form you receive, with your tax records.

If you use TurboTax to file your taxes, well ask about your unemployment income and put the information in all the right tax forms for you.

TurboTax is here to help with our Unemployment Benefits Center. Learn more about unemployment benefits, insurance, eligibility and get your tax and financial questions answered.

Recommended Reading: Pa Unemployment Ticket Number Lookup

Will I Owe Taxes Because Of My Unemployment Compensation

- Generally, states dont withhold taxes on unemployment benefits unless asked.

- However, if you qualify for EITC, or the child tax credits, your taxes could be covered.

- You can do a year-end tax checkup to see if you have enough credits and withholding to cover your taxes. You may still have time to make adjustments to lower your shortfall.

- If you are still unemployed come 2021 tax time, you can set up a payment plan with the IRS or work out other delayed payment options.

- The IRS assesses penalties on the balance owed when you file and when you pay late they also compound interest on the full bill daily. The IRS has programs that may forgive your tax penalties. If you qualify, this will also help reduce your interest and lower your overall tax bill.

- Make sure you file your tax return on-time, even if you cant pay. In the short-term, the penalties for filing late are higher than the penalties for paying late.

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

You May Like: Unemployment Tn Application

How Do You Claim Unemployment Benefits

Navigating unemployment can be confusing and frustrating at any time. With the recent changes from the CARES Act and other legislation, you may be even more unsure about eligibility and how to claim unemployment benefits.

This post will outline the normal rules for eligibility for unemployment benefits. Well also cover how to apply and how to file unemployment income on your taxes.

Looking for details on the latest coronavirus unemployment relief? Visit our coronavirus resource center.

Have other tax-related unemployment questions? Be sure to visit our Unemployment Resource Center.

Do You Have To Pay Taxes On Unemployment Benefits

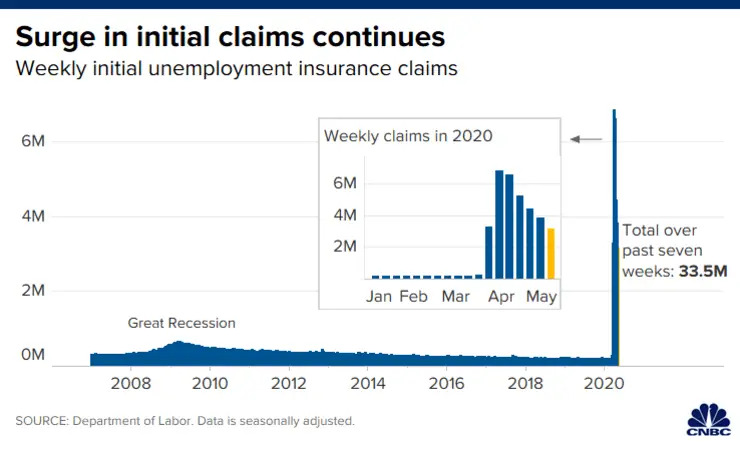

With more than 48 million Americans filing for unemployment insurance over the past 15 weeks and millions getting an additional $600 weekly benefits under the CARES Act on top of their base state benefits, many will have to consider how those payments could affect their taxes.

Unemployment insurance is a joint state-federal program and those Americans who have benefited from it will have to pay federal and state taxes on it because those benefits are considered income by the Internal Revenue Service.

While you might not need to include unemployment benefits in this years tax return unless you claimed the benefits in 2019 experts advise its better to start thinking about it now even if you have to do it next year.

When they go to file next year, a lot of people will be surprised that they either get a smaller refund than they expected or that they’ll have a balance that they normally don’t have, said Nathan Rigney, lead tax research analyst at H& R Block. And it’ll come at a time when people are in a no better position to pay out-of-pocket expenses than they are today.

Read Also: File Unemployment In Tennessee

How Do I Know If The Amount Listed On My 1099

If you have access to your HIRE account, you may want to look at your Claim Summary page to see the benefits you have been paid out throughout the weeks you have filed. Both your weekly benefit amount and your additional Loss Wage Assistance, , and Federal Pandemic Unemployment Compensation, , are counted as benefits paid to you.

However, this option may not be helpful if you have received benefits under several unemployment programs in 2020. This is because Claimants often have their claim summary page refreshed, for example, when filing a new claim for an extension of benefits or consideration of another benefit program.

Payments To Employees Exempt From Futa Tax

Some of the payments you make to employees are not included in the calculation for the federal unemployment tax. These payments include:

- Fringe benefits, such as meals and lodging, contributions to employee health plans, and reimbursements for qualified moving expenses,

- Group term life insurance benefits,

- Employer contributions to employee retirement accounts accounts), and

- Dependent care payments to employees.

You can find the complete list of payments exempt from FUTA Tax in the instructions for Form 940. The type of payments to employees that are exempt from state unemployment tax may be different. Check with your state’s employment department for details.

If you pay employee moving expenses and bicycle commuting reimbursements to employees, you must include the amount of these payments in the FUTA tax calculation.

In some states, wages paid to corporate officers, certain payments of sick pay by unions, and certain fringe benefits are also excluded from state unemployment tax. If wages subject to FUTA aren’t subject to state unemployment tax, you may be liable for FUTA tax at the maximum rate of 6%.

Read Also: How To Qualify For Unemployment In Tn

Where Do I Find My 1099

What Exactly Is The Tax Break For Those Who Received Unemployment Compensation In 2020

The $1.9 trillion American Rescue Plan allows those who received unemployment benefits to deduct $10,200 in payments from their 2020 income.

The benefit only applies to those whose modified adjusted gross income is less than $150,000, according to the IRSs website.

If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you are married and both spouses received unemployment, then both are exempt from paying taxes on the first $10,200 they each received. So combined, that totals $20,400.

Amounts over $10,200 for each individual are still taxable.

Also Check: Tn Unemployment Qualifications

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, 2021. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

Taxes Deductions And Tax Forms For Unemployment Benefits

Youre responsible for paying federal and state income taxes on the unemployment benefits you receive. The Department of Unemployment Assistance does not automatically withhold taxes, but you may request that taxes be withheld from your weekly benefits when you file your claim.

Your weekly benefits may also be reduced if you have a child support order or if you receive an overpayment on your weekly benefit.

Don’t Miss: Unemployment Compensation Phone Number

How Unemployment Overpayments Happen

The most common reason for overpayment is attributed to clerical errors that qualify an applicant for regular payment when that person would normally not have qualified for unemployment benefits. That includes people who quit their jobs, were fired for negligence, who arent actively looking for work, or who have found another job.

The overpayment amounts are significant, especially when viewed through the lens of strained state budgets: Colorado once overpaid by $128 million in a single year, while Indiana paid out more incorrect benefits than correct ones.