When Do W2s Come Out

The IRS mandates that employers have to send out or make W2s available to their employees by January 31. Even if you switched jobs, they still have this deadline in place, yet sometimes you can expect to receive it earlier. Your former employer will also include your accumulated vacation, severance, and outstanding bonuses on your W-2 form.

To file your income taxes and get your tax refund, you have to have your W2. This form contains all of the important information that you need for your annual income tax filing.

If you do not have your W-2 form by the end of January, confirm that your employer has your correct mailing address. If you dont receive the W-2 from your employer by Valentines Day, contact the IRS at 800-829-1040 and provide them with your details so they can find your information.

Before calling them, make sure you are prepared to provide them with your name, mailing address, phone number, social security number, employers name and address, and the dates that you were employed

The IRS will accept returns without W2s however, this could delay your refund. The IRS has to make sure that your income is accurate and matches their records before they can issue you a tax refund.

The Best Free W2 Finders Online

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Donât Miss: Can I Get Obamacare If I Am Unemployed

Recommended Reading: What Is Needed For Unemployment

What Is A W

A W2 is a tax form that documents money paid to you, and money withheld from your paycheck. It includes your commissions, tips, wages, and the taxes that were withheld from your income for federal, state, and social security purposes.

This document has all of the information that you will need to fill out the financial information for your personal taxes. If you have worked, the IRS requires that you use your W-2 to file, and then they determine the amount of taxes that you should pay the federal and state governments.

Donât Miss: Can You Get Medicaid If Unemployed

How Can I Download My 1099

If you were out of work for some or all of the previous year, you arenât off the hook with the IRS. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Youâll also need this form if you received payments as part of a governmental paid family leave program. But you donât have to wait for your copy of the form to arrive in the mail. In many states, you can download your 1099-G directly from the Department of Revenue.

Also Check: How To Get Tax Info From Unemployment

Will I Have To Complete Identity Verification To Access My Form Online

If you have not already completed identity verification and you are only accessing your 2021 1099-G, you will not be required to complete ID.me verification. If you need to take additional actions with your claim, you may be required to complete ID.me verification. Identity verification is one of the fraud prevention tools implemented by DES to stop bad actors from using stolen identities to claim unemployment benefits.

If I Repaid An Overpayment Will It Be Reflected On My 1099

No. DES reports the total amount of benefits paid to you in the previous calendar year on your 1099-G, regardless of whether you repaid any overpayment. If you repaid part or all of an overpayment during the previous calendar year, you may be able to deduct the repaid amounts on your income tax return. The repaid amount should be reported on the tax return submitted for the year the repayment was made.

Also Check: How Can I Receive Unemployment

These Are The States That Will Either Mail Or Electronically Deliver Yourform 1099

Florida

You can access your Form 1099-G through your Reemployment Assistance account inbox. The fastest way to receive your 1099-G Form is by selecting electronic as your preferred method for correspondence. Go to My 1099-G in the main menu to view Form 1099-G from the last five years.

Illinois

Access yourForm 1099-Gonline by logging into your account atides.illinois.gov. If you havent already, you will need to create an .

Indiana

Access yourForm 1099-Gonline by logging into your account atin.gov. Go to your Correspondence page in your Uplink account.

To reduce your wait time and receive your 1099G via email, or using the MD Unemployment for Claimants mobile app.

Michigan

If you did not select electronic as your delivery preference by January 9th, 2021, you will automatically be mailed a paper copy of your Form 1099-G.

To view or download your Form 1099-G,

o sign into your MiWAM account ando click on I Want To, theno 1099-G then choose the tax year.

To change your preference, log into MiWAM.

o Under Account Alerts, click Request a delivery preference for Form 1099-G and thenselect the tax year.

Mississippi

To access yourForm 1099-Gonline, log into your account and follow the instructions sent by email on where you can view and print yourForm 1099-G.

North Carolina

Division of Employment SecurityP.O. Box 25903Raleigh, NC 27611-5903

Utah

Pandemic Emergency Unemployment Compensation

What is Pandemic Emergency Unemployment Compensation ?

PEUC is a federal Continued Assistance Act program that extends benefits to those who have exhausted state unemployment benefits. This benefit ended September 4, 2021.

What does it mean to exhaust state unemployment benefits?

A person exhausts state unemployment benefits when he or she either draws all available benefits that could be paid, or reaches the end of the benefit year and is not monetarily eligible for a new benefit year. Also, the individual cannot be eligible to file a claim in any other state.

How long does PEUC run?

Under the March 2020 CARES Act, the PEUC extension program allowed an additional 13 weeks of benefits and the program expired on December 26, 2020. The Continued Assistance Act extended this program to expire the week ending March 13, 2021. Under the new American Rescue Plan Act of 2021 , the PEUC program expired the week ending September 4, 2021.

How do I apply for PEUC?

Once your state unemployment claim has a zero balance, you can apply for PEUC on our website at www.GetKansasBenefits.gov.

PEUC applications can only be filed online at this time.

Do I have to apply for the extension provided under the new ARP Act?

No. If you were previously filing for PEUC benefits, you do not have to file a new application for the additional weeks. You just need to continue filing weekly claims each week you are unemployed.

How much does PEUC pay each week?

PEUC is available for the following periods:

You May Like: What Number Do I Call For Florida Unemployment

These Are The States That Willnotmail Youform 1099

Connecticut

Access your Form 1099-G on-line using the Connecticut Department of Revenues Taxpayer Service Center .

Georgia

You can access your Form 1099-G on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Detailed instructions here: How to Request an Electronic 1099-Gand 1099-G and 1099-INT Search

Louisiana

Access your Form 1099-G by logging into your HiRE account then clicking on Unemployment Services and then Form 1099-G Information.

Missouri

Access your Form 1099-G online at or by calling the Missouri Department of Revenue at 573-526-8299. You will need your social security number, zip code and filing status on your most recently filed tax return. Taxpayers living outside of the United States will need to enter 00000 in place of a zip code.

New Jersey

Access your Form 1099-G by visiting New Jerseys Department of Treasury website.

New York

To access yourForm 1099-G, log into your account atlabor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Wisconsin

Log on, then select Get your 1099-G from My UI Home to access your 1099-G tax forms.

How Will I Recieve My 1099

1099-G forms will be sent via United States Postal Service. 1099-G forms cannot be sent by email, fax or any other electronic method. 1099-G forms are mailed to the address on record as of January 1, 2022. The USPS will not forward 1099-G tax forms unless it has a change of address on file.

- PUA Claimants: If you filed for benefits in PUA, your 1099-G has been mailed to you. The Department is also currently working to upload 1099-G forms for PUA claimants to the PUA online portal. We will notify you as soon as PUA 1099-G forms are available online..

- If you filed in the regular unemployment insurance system, we are unable to upload your 1099-G to your online claimant portal due to system limitations.

Recommended Reading: Is The $600 Unemployment Taxed

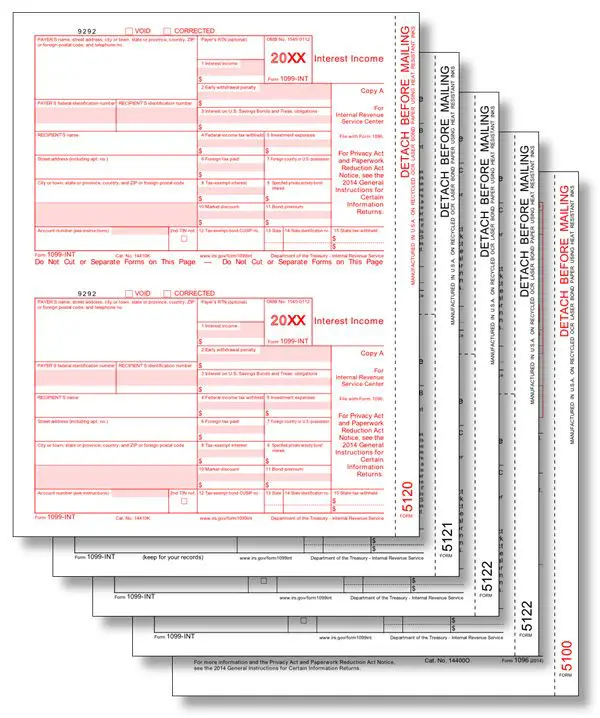

Will I Receive Multiple 1099

Most claimants will receive one 1099-G document for 2021. However, some claimants may receive multiple documents if they were reissued Lost Wages Assistance program payments or filed in both regular UI and Pandemic Unemployment Assistance in 2021. To identify which program your 1099-G is for, look for the program code printed in the Account Number box in the bottom left corner of your 1099-G.

Those programs for which claimants would receive a 1099-G include:

- Program Code 001

- High EB – High Extended Benefits

- FPUC – Federal Pandemic Unemployment Compensation

How To Get Your W

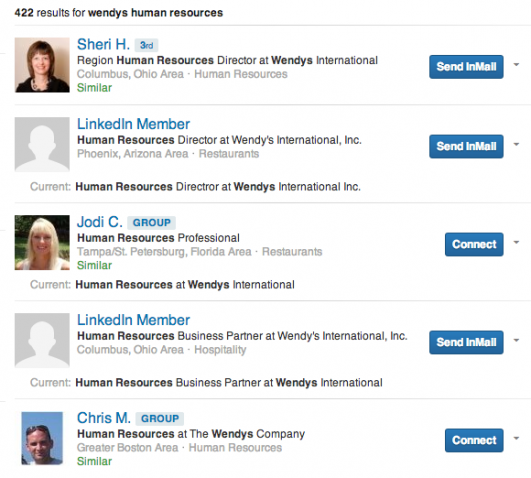

You might still be able to get your W-2 data electronically if, for whatever reason, it didnt work out with your employer or the IRS. The authorized IRS e-file providers H& R Block and TurboTax provide a free W-2 form finder.

Depending on the availability of these documents from your financial institution and employer, this feature will allow you to find and import your W-2 online.

You May Like: Workers Comp And Unemployment Insurance

Notice To Representatives Of Deceased Claimants

Q: How do I access the 1099-G tax form if I am the representative of a deceased claimant?

A: For the New York State Department of Labor to provide you with information belonging to a deceased unemployment insurance claimant, you must first show that you are legally authorized to receive this information. Authorization often comes from the New York State Surrogate Court, and may be one of the following:

- Appointment as an Executor

- Letters of Administration

- Appointment as a Voluntary Administrator

If the deceased claimant had no assets, or all property owned by the deceased claimant was owned in common with someone else, then no Executor or Administrator may have been appointed. The representative of the deceased claimant must provide proof that they are authorized to obtain the information. In this case, a surviving spouse should provide NYS DOL with:

Please submit proof that you are authorized to receive the deceased claimants information using one of the following methods:

Where Is Unemployment Tax Refund

Refunds for Unemployment Compensation If you’re entitled to a refund, the IRS will directly deposit it into your bank account if you provided the necessary bank account information on your 2020 tax return. If valid bank account information is not available, the IRS will mail a paper check to your address of record.

Don’t Miss: Where Can I Find My Unemployment 1099

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Next Section

Read Also: Do You Need To Report Unemployment On Your Taxes

What Can I Do If I Received Notice Of Dtf

If you receive note DTF-960-E but did not arrange for unemployment benefits and you think may be a victim of fraud or identity theft, follow these steps:

You May Like: Can You Collect Disability And Unemployment At The Same Time

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: 100 Percent Unemployability Va Benefits

Division Of Unemployment Insurance

“My benefits are ending. Are other resources available?”

See links to assistance with food, housing, child care, health, and more.

“How do you verify my identity?”

To reduce the risk of fraud, many unemployment claimants must verify their identity using the security vendor ID.me.

“How can I reset my PIN or password?”

We can help if you’re having trouble with your online account password and/or PIN to certify for weekly benefits.

Federal benefits created during the benefit expired September 4, 2021.

You will still be able to receive benefits for eligible weeks prior to September 4, 2021.

“What does it mean if my claim is pending, or not payable at this time?”

Many claimants see these messages and aren’t sure what, if anything, they need to do about them.

“How do I complete an application?”

Get step-by-step instructions for our application process and find out what happens after you file.

“I want to certify for and claim benefits.”

You must confirm each week that you are still eligible for benefits in order to get paid.

“I need to update my information.”

You can change your address, phone number, and other information from the online dashboard.

You May Like: What Time Will My Unemployment Benefits Be On My Card

Did You Receive A 1099

I received a 1099-G from the Ohio Department of Taxation :

If you received a 1099-G from ODT, please click here for additional information and frequently asked questions.

I received a 1099-G from the Ohio Department of Job and Family Services :

If you DID apply and/or receive unemployment benefits from ODJFS:

1. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. Unemployment benefits are taxable pursuant to federal and Ohio law.

a. Visit the IRS website here, for specific information about the IRS adjustment for tax year 2020.

b. Ohio law is in conformity with federal law, therefore the provisions applicable under federal law are also applicable under Ohio law.

If you DID NOT apply to receive unemployment benefits from ODJFS:

1. It is very important that you notify ODJFS to report identity theft and receive a corrected 1099-G.

-

Please notify ODJFS by visiting: , click on the “REPORT IDENTITY THEFT” button, and complete the form.

-

Once ODJFS verifies the ID theft claim, a corrected 1099-G will be issued. You should retain the corrected 1099-G for your records.

2. Generally, you should not include unemployment benefits you did not apply for as income on your federal and state income tax returns.