Where To Enter 1099 G

You will have to enter a 1099G that is issued by your state. Some states will mail out the 1099G. Or you might need to go to your states unemployment website and use the password, etc. that you have been using to certify for weekly benefits to get your 1099G from the states site. Enter your 1099G in Federal> Wages & Income> Unemployment

Also Check: Www Njuifile Net 1099 Form

What About Form 1099

The 1099-G form is a tax form that shows how much someone received in unemployment benefits.

The New Jersey Department of Labor said if it has your email address on file, you should have received your 2020 form 1099-G. If you haven’t received it, you can also use the state’s “Claim Status Tool” at , and use the “Self Service Options” to show the 1099-G information or request another copy via email.

If you received a 1099-G form but did not file for unemployment, you may be a victim of tax fraud. Report the suspected fraud by calling the labor department’s fraud hotline at 609-777-4304 or online at .

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Name

- Date of birth

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters weve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

- Name

Also Check: Can You Collect Unemployment And Social Security

You May Be A Victim Of Unemployment Identity Theft If You Received:

- Mail from a government agency about an unemployment claim or payment and you did not recently file for unemployment benefits. This includes unexpected payments or debit cards and could be from any state.

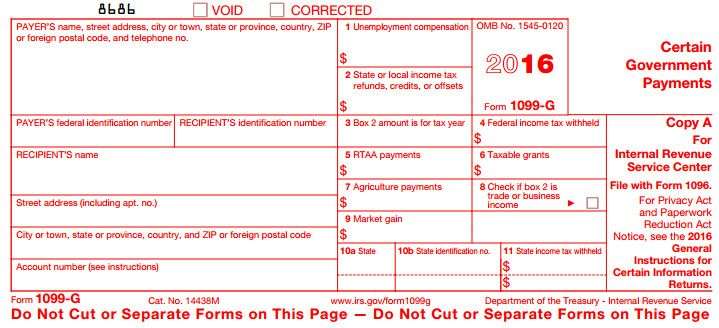

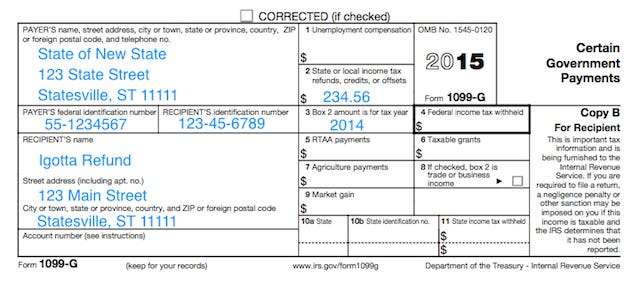

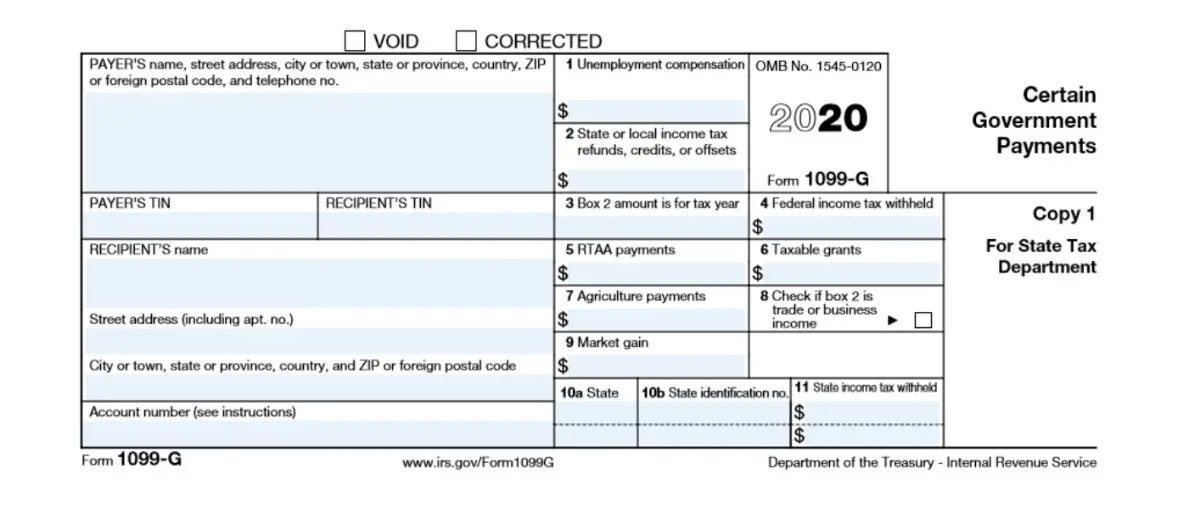

- A 1099-G tax form reflecting unemployment benefits you weren’t expecting. Box 1 on this form may show unemployment benefits you did not receive or an amount that exceeds your records for the unemployment benefits you did receive. The form itself may be from a state in which you do not live or did not file for benefits.

- While you are still employed, a notice from your employer indicating that your employer received a request for information about an unemployment claim in your name.

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

You can opt to have federal income tax withheld when you first apply for benefits. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development, Unemployment Insurance, PO Box 908, Trenton, NJ 08625-0908. for the Request for Change in Withholding Status form.

After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. This information is also sent to the IRS.

Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2020, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

IMPORTANT INFORMATION FOR TAX YEAR 2020:

Also Check: How To Claim Unemployment On Taxes

What If I Believe The Information On My Form Is Incorrect

Information provided on your 1099-G form is based on the records of the Unemployment Insurance Division of the Vermont Department of Labor. If you believe your form to be incorrect, please contact us.

Information for victims of unemployment fraud

In 2020 and 2021, an international crime ring used previously stolen personal information to fraudulently claim unemployment benefits in states across the country. If you believe youre a fraud victim, or if youve already reported fraud to us but received a 1099-G for fraudulently paid benefits, please see the tax information for fraud victims page: .

Taxes On Unemployment Income

Due to the pandemic, Ohioans who earned less than $150,000 do no have to pay state or federal income tax on the first $10,200 in unemployment income they received in 2020. Heres how to get these tax benefits:

Federal income tax

If you havent filed your taxes yet:

- On the standard federal 1040 form, you will list the full amount of unemployment benefits you received on line 7 titled capital gain or ,according to the IRS.

- This total is listed on a 1099-G form you received. Because of potential unemployment fraud, you should check that that number matches what you actually got.

- Then, you list the amount you can exclude on line 8 titled other income as a negative amount . For example, if you received $12,000 in unemployment, you would list here, because that is the maximum amount you can exclude from income taxes.

If you have already filed your taxes:

State income tax

If you havent filed your taxes yet:

- You do not need to list unemployment benefits on state tax forms because they will be accounted for in your federal adjusted gross income.

If you have already filed your taxes:

- You do need to file an amended return for state income tax and school district income tax. Make sure you check the box for an amended return and provide a reason: your federal adjusted gross income decreased.

Also Check: Unemployment Tennessee Apply

Don’t Miss: How Do I Check My Unemployment

Des: Tax Information And 1099

Posted: What is the IRS Form 1099-G for unemployment benefits? By Jan. 31, 2021, all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account.

Read Also: How To Enroll In Unemployment

How Are Wages Reported And Taxes Paid

The Employers Quarterly Tax and Wage Report is used to report wage and tax information. Liable employers will need to file the report online, download a blank Employers Quarterly Tax and Wage Report from our website, or contact the Employer Call Center at 919-707-1150 to request that a blank form be mailed to them. The Employers Quarterly Tax and Wage Report data can also be submitted on magnetic media.

Employers are required to file a report for each quarter, beginning with the quarter in which employment begins. Tax must be paid on each employees wages up to the taxable wage base for each calendar year. Quarterly wages must be reported for each employee by name and social security number. Correct and complete social security numbers are required to properly record wages.

Both tax and reported wages are due by the last day of the month following the end of each quarter. NOTE: Failure to receive a report form from DES does not relieve employers of the responsibility to file. If the form is lost or damaged or if additional forms are needed, contact the Employer Call Center at 919-707-1150.

|

Quarter |

Read Also: How To Fill Unemployment Form

You May Like: How Does Unemployment Work In Illinois

Respond To Dua With Information In A Timely Manner

If an employee who worked for you within the past 15 months files a claim, you are considered a base period employer and you may receive a request from DUA to provide information regarding the employee. You will be able to complete these requests through your UI Online account.

Any employer for whom the employee worked during the last 8 weeks of work is considered an interested party to the claim, and has the right to protest an employees eligibility for unemployment benefits.

If an employee is approved for benefits by DUA, protesting interested party employers receive notice of the approved claim and have the right to request a hearing within 10 business days . A disqualified employee can also request a hearing.

If you do not respond timely or adequately to requests for information, you may:

- Lose your right to be notified of the eligibility determination and your right to appeal that determination

- Lose your right to a hearing. If a disqualified former employee files an appeal, you will be invited to attend the hearing as a witness only, with no right to introduce evidence or testimony, question the former employee, or examine other witnesses.

- Lose your right to protest benefit charges to your account

How Do I Get A Copy Of My 1099 R Form Nj

When you receive your Form 1099-R, please check the information carefully. If there are any errors, contact the NJDPB Office of Client Services at 292-7524. If you need a duplicate form, you can request one using the Duplicate 1099-R application on the Member Benefits Online System .

You May Like: Do I Have To File Taxes If I Was Unemployed

Individual Income Tax Information For Unemployment Insurance Recipients

- Current: 2020 Individual Income Tax Information for Unemployment Insurance Recipients

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return.

Total taxable unemployment compensation includes the new federal programs implemented in 2020 due to COVID-19:

- Federal Pandemic Unemployment Compensation

For additional information, visit IRS Taxable Unemployment Compensation.

Note: Benefits are taxed based on the date the payment was issued.

Can You Get A Tax Return On A 1099

It is possible to receive a tax refund even if you received a 1099 without paying in any estimated taxes. The 1099-MISC reports income received as an independent contractor or self-employed taxpayer rather than as an employee. Three payments of $200 each should result in a 1099-MISC being issued to you.

Also Check: Il Unemployment Office Near Me

You May Like: How Do I Get My 1099g Form From Unemployment

What Happens If Someone Filed For Unemployment Under Your Name

If you are a victim, reach out to your state unemployment office to report the fraud. If there were false claims in multiple states, reach out to each state individually. If you need to make a legitimate benefits claim but have a fraudulent claim made in your name, you need to work with this department.

What Should I Do If I Dont Agree With The Amount Listed On My Form 1099g

If you received Unemployment Insurance benefits, became disabled, and began receiving Disability Insurance benefits, you can confirm the amount on your Form 1099G by viewing your Payment History in UI Online.

If you still dont agree with the amount, call 1-866-401-2849 to speak to a representative, Monday through Friday, between 8 a.m. and 5 p.m. , except on state holidays.

If you have a Paid Family Leave claim, call us at 1-866-401-2849 to get your Form 1099G information.

If your question about the amount listed on your Form 1099G cannot be answered during the call, we will look into this further, and a written response will be mailed to you. Be sure to provide your current address and telephone number when you speak with one of our representatives.

For more DI or PFL questions, call:

- DI: 1-800-480-3287

Don’t Miss: File Taxes For Free With Unemployment

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Where Can I Get My Nj 1099

The New Jersey Division of Taxation will now provide Form 1099-G information online at the divisions website. The division is no longer mailing Form 1099-G, Certain Government Payments, to report the amount of a New Jersey income tax refund a taxpayer received.

Read Also: How Can I Find Out My Pin Number For Unemployment

How To Register For An Ein In New Jersey

Overview

One of several steps most businesses will need to take when starting a business in New Jersey is to register for an Employer Identification Number and New Jersey state tax ID numbers. These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes, payroll taxes, and withhold taxes from employee wages.

Lets review in more detail what this number is used for when it is required, the cost, and how to register.

You May Like: How Much Taxes Do They Take Out Of Unemployment

How Do I Get My 1099g From Unemployment

Online

Also Check: Pa Unemployment Ticket Number Tracker

Recommended Reading: When Does The Extra Unemployment End

How To Get My 1099 From Unemployment To File Taxes

Many taxpayers are unaware that the unemployment income they received is taxable, just like earned income. The key difference is that unemployment income is taxed at a lower rate. Also, thanks to the American Recovery and Reinvestment Act , the first $2,400 of unemployment income is untaxed. In any event, you should list your unemployment income should on your return. Your state unemployment office should send you the 1099-G form listing that amount, but there are ways to request the form in the mail.

Tips

-

If you have received unemployment income at any point during the year, you will be required to complete and return IRS Form 1099-G. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly.

If You Owe Tax You Cant Pay

Many Americans find themselves in a position where they still need every cent of those unemployment checks for living expenses, in which case theres no money left to send to the IRS for quarterly estimated tax payments. You might still have options if this is the case.

The IRS suggests paying what you can and reaching out to take advantage of one of its payment options to deal with the balance. You can ask for an installment agreement and pay off your tax debt on balances of up to $50,000 over 72 months, according to Capelli.

Making the request is a simple matter of filing Form 9465 with the IRS. This will at least cut the 0.5% per month late-payment penalty to 0.25%, although the effective interest rate will continue at 3% .

You might also look into an offer in compromise to settle your tax debt for less than the full amount you owe, or ask the IRS for a temporary delay in collecting if your financial situation is particularly difficult. But youll almost certainly need the help of a tax professional to exercise either of these options.

Capelli strongly recommended against taking out a loan to pay your tax bill except as a last resort.

Do not, under any circumstances, borrow money unless its interest-free, Capelli said. Dont use a credit card to pay your taxes. The IRS interest rate is lower than most credit cards, and the IRS payment plan doesnt appear on your credit report.

You May Like: Do You Have To Pay Federal Taxes On Unemployment

How Taxes On Unemployment Benefits Work

Unemployment benefits are income, just like money you would have earned in a paycheck. Youll receive a Form 1099-G after the end of the year, which will report in Box 1 how much youve received in the way of benefits. The IRS will receive a copy as well.

You would have paid taxes on the full amount of your unemployment benefits if you filed your taxes before the ARPA was passed. The IRS issued a statement on March 31, 2021, urging taxpayers who had already filed not to file an amended return related to the new legislation. The IRS will recalculate and adjust all tax returns received prior to the ARPA that report unemployment income during the spring and summer of 2021 and will issue any resulting refunds.

Youll have to pay taxes on the remaining amount if you received more than $10,200 in unemployment compensation. Your 1099-G will have the information youll need to transfer to your tax return.

Unemployment compensation has its own line on Schedule 1, which accompanies your 1040 tax return. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1, and then the withholding amount in Box 4 of the 1099-G goes directly onto your 1040 tax return on Line 25b.

The amount that was withheld will appear in Box 4 if you asked to have income tax withheld from your benefits.

You must still report your unemployment compensation on your tax return, even if you dont receive a Form 1099-G for some reason.