The Best Free W2 Finders Online

How To Get Another W

The Internal Revenue Service Form W-2 is the wage and tax statement you receive from your employer at the end of the year. This form is sent to the employee, federal, state and local governments.

The deadline for your employer to send your W-2 form to you is January 31. Allow a few extra days for it to reach you in the mail.

The W-2 form will show your annual earnings, taxable fringe benefits, income taxes withheld, 401 contributions and other vital tax information.

If you do not receive Form W-2 by early February or misplace it before filing your tax return, the first thing to do is ask your employer for another copy. There may be a fee for this, especially if your employer uses a payroll tax service.

Some employers have their Form W-2s posted on a secure webpage accessible on the internet. If this is the case in your situation, you can log onto the website and print another copy of your W-2.

If you do not receive your Form W-2 from your employer before the April 15 tax filing deadline, you may complete IRS Form 4852 with the year-to-date information from your last paystub of the tax year. File the Form 4852 with your income tax return.

References

My Ilogin Account Is Locked What Should I Do

If your account has been locked, it will automatically unlock after 60 minutes. To unlock your account before 60 minutes, when signing into , expand the “Need Help?” and click on the “Unlock account?” link to initiate the account unlock. You will be asked to enter in your current email address or username, and select a security option to verify your identity . You will be required to provide your security question answer during the reset password process. Once you have unlocked your account, you may then need to initiate the Forgot Your Password process.

Read Also: Can I Collect Unemployment If Terminated While On Disability

Contact Your Former Employer

If by the end of January you have not received your W-2, first contact your previous employer. If the company you worked for has a human resources department, call or email the HR representative to ask about the status of your W-2 and to confirm they have your correct mailing address. They might have mailed the form, but it got lost in the mail or went to the wrong address. If the company does not have an HR department, call your former manager. Offer to pick up your W-2 in person to save time.

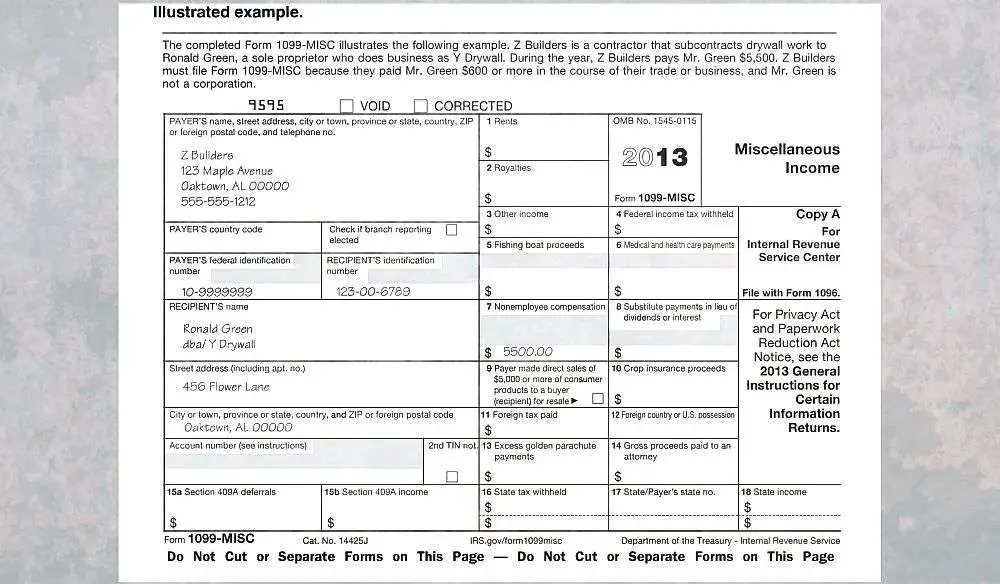

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

Form 1099-G also reports any amount of federal and state income tax withheld.

You May Like: Do You Claim Unemployment Income On Taxes

Add Your Unemployment Contribution Rate To Square Payroll

You must provide your UI Contribution Rate when signing up for Square Payroll so we can accurately compute this tax. To locate your UI Contribution Rate:

-

If you are a new employer, you will receive your Unemployment Contribution Rate after you complete registration on MyTax Illinois. The UI Contribution Rate includes the Fund Building Rate.

-

If you are an existing employer switching to Square Payroll, you can look your rate up online by logging in to your MyTax Illinois Account or locate it on the Notice of Contribution Rate that IDES mails each December. The UI Contribution Rate includes the Fund Building Rate.

-

If you cant find your UI Contribution Rate, call IDES at 800-247-4984.

You are responsible for ensuring Square Payroll has the correct UI Contribution Rate for your business. If you need to update your rate, you can do so from the Tax Info tab in your online Square Dashboard.

Other Payments Covered By Form 1099

The other reasons you may receive Form 1099-G include the following types of payments:

- Reemployment trade adjustment assistance payments. These are shown in Box 5.

- Taxable grants received from federal, state and local governments. These are shown in Box 6.

- Taxable payments from the Department of Agriculture. These are shown in Box 7.

Read Also: Can You Claim Unemployment If You Quit

Request A Corrected 1099

If your 1099-G has an incorrect amount in “total payment” or “tax withheld,” you can request a revised form.To request a corrected form: Complete Form UIA 1920, Request to Correct Form 1099-G, and submit it to UIA. Mail completed forms to: Unemployment Insurance Agency, 1099-G, P.O. Box 169, Grand Rapids, MI 49501-0169.

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

Also Check: How Many People Are On Unemployment

When Do W2s Come Out

The IRS mandates that employers have to send out or make W2s available to their employees by January 31. Even if you switched jobs, they still have this deadline in place, yet sometimes you can expect to receive it earlier. Your former employer will also include your accumulated vacation, severance, and outstanding bonuses on your W-2 form.

To file your income taxes and get your tax refund, you have to have your W2. This form contains all of the important information that you need for your annual income tax filing.

If you do not have your W-2 form by the end of January, confirm that your employer has your correct mailing address. If you dont receive the W-2 from your employer by Valentines Day, contact the IRS at 800-829-1040 and provide them with your details so they can find your information.

Before calling them, make sure you are prepared to provide them with your name, mailing address, phone number, social security number, employers name and address, and the dates that you were employed

The IRS will accept returns without W2s however, this could delay your refund. The IRS has to make sure that your income is accurate and matches their records before they can issue you a tax refund.

What To Do If You Lost Your W

The W-2 form is a vital piece of info for most tax filers as it confirms the income you earned for that tax year. Sometimes known as the Wage and Tax Statement, this is sent out by employers at the beginning of every calendar year.

These businesses, by law, have to mail the W-2 forms by January 31 so that filers have sufficient time to submit their taxes by the April 15 deadline for filing taxes. Your Employer also has to send a copy of your W-2 straight to the IRS.

What if you dont have your W-2 form, what should you do next? As per the IRS, you have a few options to think about:

You May Like: Do You File Unemployment On Taxes

Recommended Reading: Can I Get Unemployment And Social Security

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Name

- Claim ID, also referred to as Claimant ID in letters

- Current mailing address

- Date of birth

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters weâve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

- Name

Read Also: How Do I Sign Up For Unemployment In Tn

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Can I Get Unemployment And Workers Comp

How We Make Money

We are an independent publisher. Our advertisers do not direct our editorial content. Any opinions, analyses, reviews, or recommendations expressed in editorial content are those of the authors alone, and have not been reviewed, approved, or otherwise endorsed by the advertiser.

To support our work, we are paid in different ways for providing advertising services. For example, some advertisers pay us to display ads, others pay us when you click on certain links, and others pay us when you submit your information to request a quote or other offer details. CNETs compensation is never tied to whether you purchase an insurance product. We dont charge you for our services. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear.

Our insurance content may include references to or advertisements by our corporate affiliate HomeInsurance.com LLC, a licensed insurance producer . And HomeInsurance.com LLC may receive compensation from third parties if you choose to visit and transact on their website. However, all CNET editorial content is independently researched and developed without regard to our corporate relationship to HomeInsurance.com LLC or its advertiser relationships.

Also Check: Njuifile Home Page

What If I Believe The Information On My Form Is Incorrect

Please know that we are aware of a mailing and printing processing issue that will impact the delivery and mailing of 1099-G information. Further updates will be provided at

Information for victims of unemployment fraud

In 2020, an international crime ring used previously stolen personal information to fraudulently claim unemployment benefits in states across the country. If you believe youre a fraud victim, or if youve already reported fraud to us but received a 1099-G for fraudulently paid benefits, please see the tax information for fraud victims page: .

Recommended Reading: Can You Apply For Obamacare If You Are Unemployed

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

Here Are 2 Good Places To Get A Copy Of Your W2 Online:

TurboTax W2 Finder will find and retrieve your W2,which allows you to file your taxes as soon as you are ready. This year you can lookup your W2 easier than ever before! Just follow the TurboTax screens as it guides you to find your W2 online.

Millions of employers and financial institutions participate, so the odds are good your W2 will be available to download. You save time by doing so, and it ensures that your information is delivered accurately.

H& R Block W2 Finder will also find and access your W2. When using an online-based company like H& R Block, you will have the capability to get your W2 data online. You wont have to wait for your forms to come in the mail.

The H& R Block search page can find your W2 in 3 easy steps. You can then import your W2 data into your tax return for free so that you can get your refund as soon as possible!

Read Also: File For Unemployment Tennessee

Also Check: Can I Get An Auto Loan While On Unemployment

Cant Locate Your Illinois Unemployment Account Number And/or Taxpayer Id Number

To locate your Unemployment Account Number:

-

Locate your Unemployment Account Number on any previously filed Employers Contribution & Wage Report .

-

Locate your Unemployment Account Number on the Notice of Contribution Rate sent by IDES in December each year.

To locate your Taxpayer ID Number:

-

Locate your Taxpayer ID Number on any previous Illinois Withholding Income Tax Return .

Illinois Employer Tax Information

To sign up for online payroll through Square in Illinois, you must be registered as an employer with the Illinois Department of Revenue and Department of Employment Security , and provide us with your Illinois Unemployment Account Number and Unemployment Insurance Contribution Rate.

Read Also: When Will Unemployment Start Back Up

Tips If You Cant Get Your W

If you have completed the steps above and believe you will not get your W-2 by the April 15 deadline, you still need to file your taxes. You have a few options to avoid IRS fines:

-

Request an extension: Submit Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, to ask the IRS to give you more time to file your taxes. If accepted, you have six more months to file your income tax returns but must still pay your taxes on time. Include with the form your best estimate of how much tax you owe and payment for that amount.

-

File without a W-2: If you do not expect to receive a W-2 from your previous employer â if, for instance, they are no longer in business â you can submit Form 4852, Substitute for Form W-2, Wage and Tax Statement, with your tax return in place of a W-2. Use the information on your last pay stub from that company to estimate your earnings and withholdings and complete the 4852. If you receive your W-2 after submitting a 4852, confirm your estimates, and file Form 1040x to correct any inaccuracies.

You can find and download these forms on the IRS website and must submit them by the April tax filing deadline. Getting an extension or filing a substitute form can slow processing of your return and delay your refund, but prevents the IRS from penalizing you for overdue or unfiled taxes.

Also Check: How Do I Sign Up For Unemployment In Washington State

These Are The States That Will Either Mail Or Electronically Deliver Your Form 1099

California

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at and select 1099G at the top of the menu bar on the home page.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by: logging into your account at selecting 1099G at the top of the menu bar > View next to the desired year > Print or Request Paper Copy.

You can also request a paper copy by calling 1-866-333-4606.

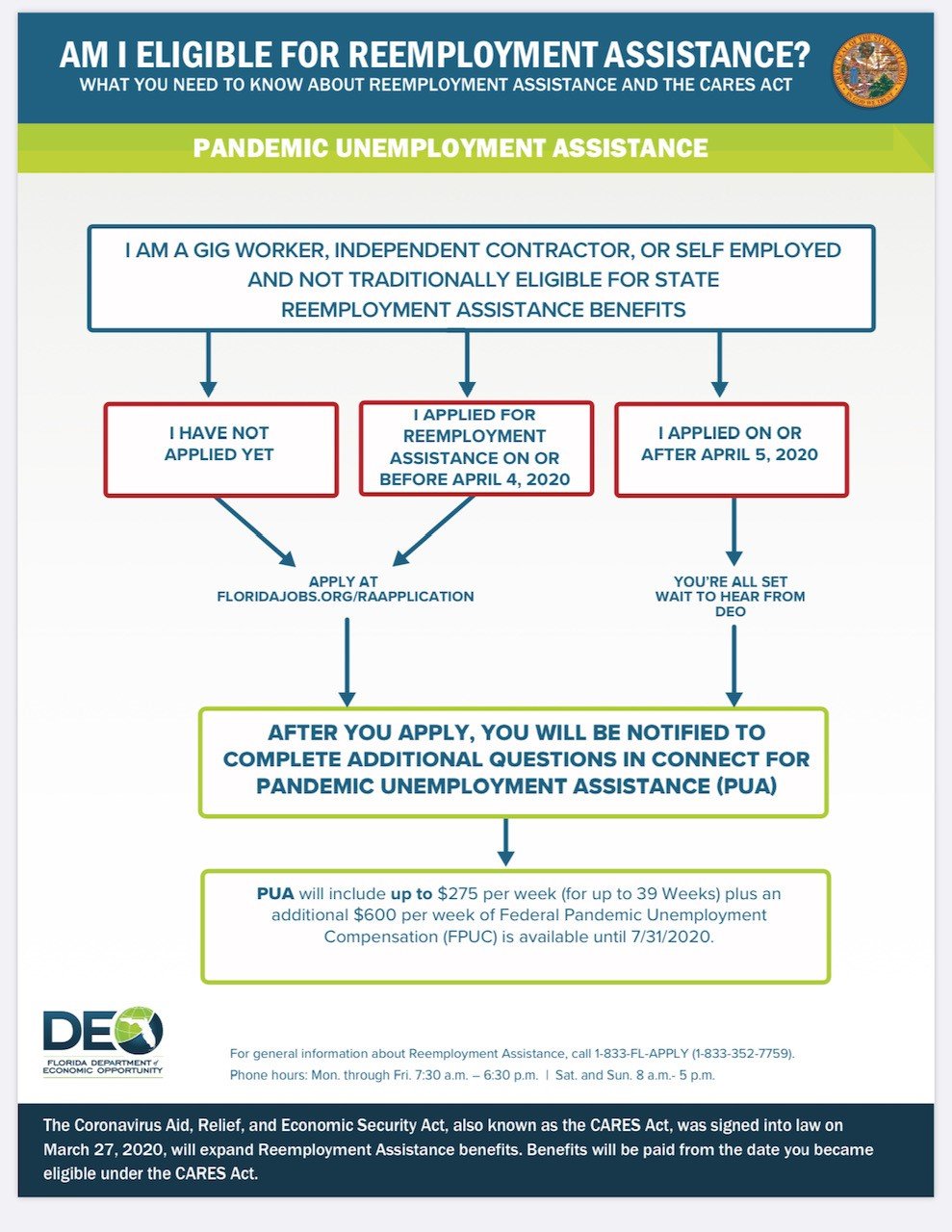

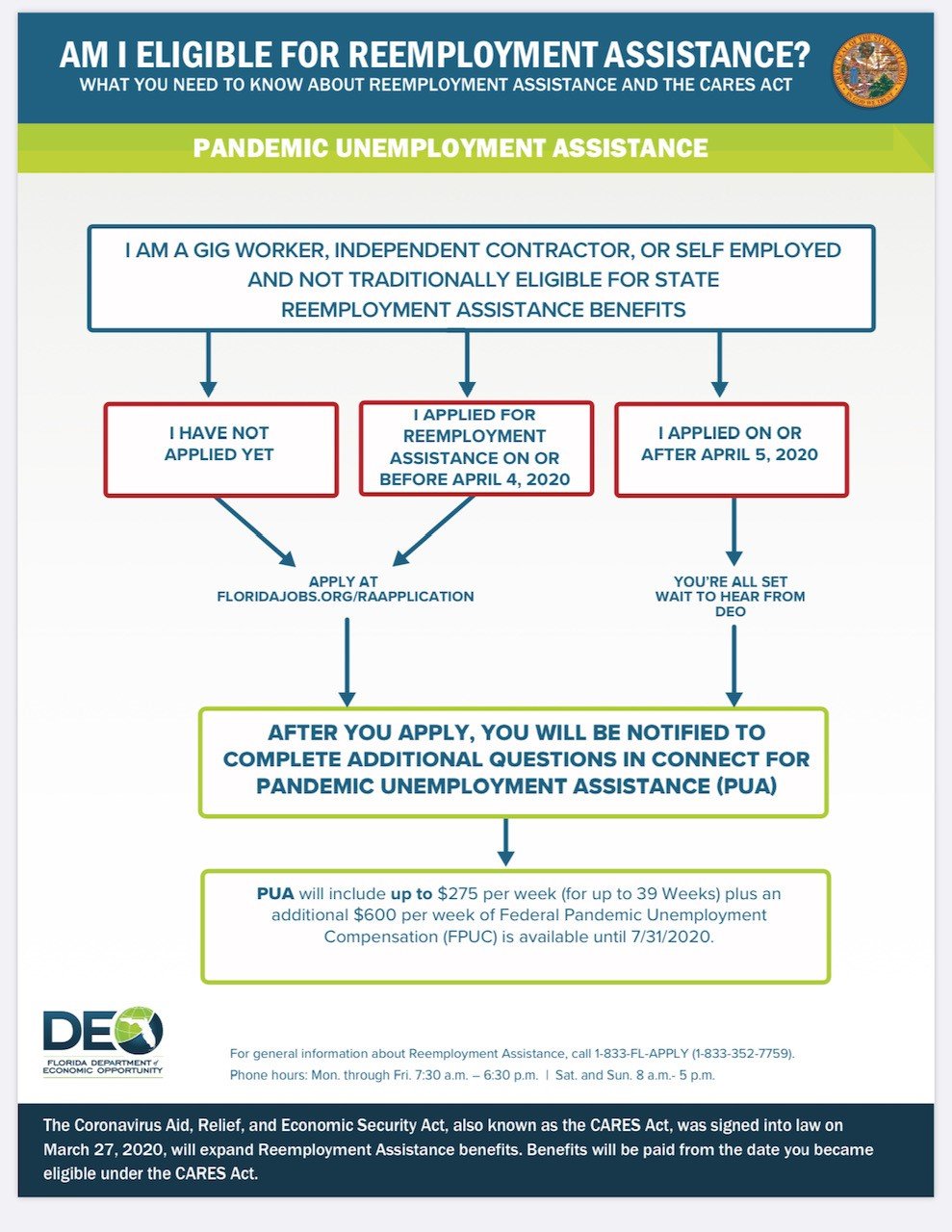

Florida

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at myflorida.com and go to My 1099-G & 49Ts in the main menu.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed at 1099grequest.myflorida.com.

Illinois

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at ides.illinois.gov. Illinois Department of Employment Security will send an email notification with instructions to access the document from the Illinois Department of Employment Security website.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by calling 338-4337.

Indiana

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at in.gov. You will find your Form 1099-G on your Correspondence page.

If you opted into electronic delivery:

Michigan

Donât Miss: Can You File Taxes If You Only Received Unemployment

Read Also: When Will The New Unemployment Benefits Start