When Do W2s Come Out

The IRS mandates that employers have to send out or make W2s available to their employees by January 31. Even if you switched jobs, they still have this deadline in place, yet sometimes you can expect to receive it earlier. Your former employer will also include your accumulated vacation, severance, and outstanding bonuses on your W-2 form.

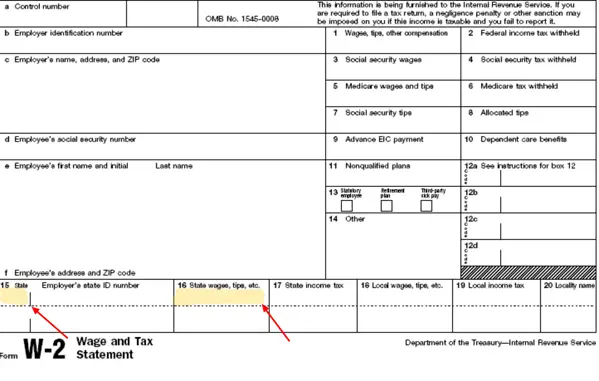

To file your income taxes and get your tax refund, you have to have your W2. This form contains all of the important information that you need for your annual income tax filing.

If you do not have your W-2 form by the end of January, confirm that your employer has your correct mailing address. If you dont receive the W-2 from your employer by Valentines Day, contact the IRS at 800-829-1040 and provide them with your details so they can find your information.

Before calling them, make sure you are prepared to provide them with your name, mailing address, phone number, social security number, employers name and address, and the dates that you were employed

The IRS will accept returns without W2s however, this could delay your refund. The IRS has to make sure that your income is accurate and matches their records before they can issue you a tax refund.

Check Back For Updates To This Page

For the latest updates on coronavirus tax relief related to this page, check IRS.gov/coronavirus. Were reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

Unemployment compensation you received under the unemployment compensation laws of the United States or of a state must be included in your income. It is taxable income. If you received unemployment compensation, you should receive Form 1099-G showing the amount you were paid and any federal income tax you elected to have withheld. Some states do not mail Form 1099-G recipients need to get the electronic version from their stateâs website. For more information, see Publication 525, Taxable and Nontaxable Income.

You May Like: Is There An Extension For Unemployment

If You Owe Tax That You Can’t Pay

If youre receiving unemployment benefits, its likely because youre out of work, and that could cause a hardship if you realize you have a lump sum of tax due when you file your return. For some taxpayers, this could mean deciding between paying the rent and buying groceries, or sending estimated tax payments to the IRS. If you find yourself in this situation, there are some options.

You can apply for a short-term or long-term installment agreement with the IRS to satisfy your tax debt in monthly payments made over a period of time, up to 72 months. Just file Form 9465 with the IRS.

You can also file Form 2210 with the IRS to ask the agency to waive any underpayment penalty thats been assessed against you if you feel it would be inequitable to require you to pay the penalty. You might also qualify for a waiver if you became disabled during the year you collected unemployment, or you retired during that year and were at least 62 years old.

Recommended Reading: Uia1020

How To Claim Unemployment Benefits

Each state has its own guidelines for how to claim unemployment benefits. There are also, typically, requirements you must follow to continue receiving the benefits.

The first thing to do is gather the documents you will need to file your claim. This is because when you file a claim, your states unemployment insurance agency will ask you for details around your former employment, such as addresses and dates. You should take the time to provide the most complete and accurate information you can, as it lessens the chances of your claim being delayed.

Second, you should contact your State Unemployment Insurance agency as soon as possible after you become unemployed. You dont always have to walk into an office because in some states it is now possible to file a claim by telephone or over the Internet.

A general tip is that you should file your claim with the state where you worked. However, if you lived in one state but worked in another or you worked in multiple states, the unemployment insurance agency of the state where you live now can help you with information on how to file your claims with the other states.

Usually, youll get your first benefit check about two to three weeks after youve filed your claim if you qualify.

How To Get A Copy Of Your W2 Online

With more than 100 million W-2s available online, finding yours may be very easy by using the TurboTax or H& R Block W2 finder to access yours.

TurboTax and H& R Block are online tax preparation companies with a free W2 search and import function, enabling you to find your W2 online quickly.

You have the option to import your W2 into your tax return instantly. This service is fast, free, easy and automatically places your information where it needs to go in your tax return.

Read Also: Www Tn Gov Workforce Howtofileui

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2021 New York State Form 1099-G statement is the same as the 2020 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

Read Also: Pa Apply For Unemployment

How Much Tax Is Taken Out Of Unemployment Compensation

If you collect unemployment benefits, you can choose whether or not to withhold federal taxes at a rate of 10%. Some states may allow you to withhold 5%. If you do not have taxes taken out of your unemployment checks, you may have to pay quarterly estimated payments or pay taxes when you file your annual tax return. Either way, your unemployment income is considered taxable income just like any other wages or salaries you receive.

Individual Income Tax Information For Unemployment Insurance Recipients

- Current: 2020 Individual Income Tax Information for Unemployment Insurance Recipients

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return.

Total taxable unemployment compensation includes the new federal programs implemented in 2020 due to COVID-19:

- Federal Pandemic Unemployment Compensation

- Pandemic Emergency Unemployment Compensation

- Pandemic Unemployment Assistance

For additional information, visit IRS Taxable Unemployment Compensation.

Note: Benefits are taxed based on the date the payment was issued.

Also Check: How To Apply For Unemployment In Tennessee

Request Your Unemployment Benefit Statement Online

-

Because unemployment benefits are taxable, any unemployment compensation received during the year must be reported on your federal tax return. If you received unemployment benefits in 2020, you will receive Form 1099-G Certain Government Payments .

The statements, called 1099-G or âCertain Government Payments,â are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

You can choose to receive your 1099-G, electronically through MiWAM or by U.S. mail.

To receive your 1099-G electronically, you must request your delivery preference by January 9, 2021. Your statement will be available to view or download by mid-January. If you do not select electronic, you will automatically receive a paper copy by mail.

To receive your 1099-G online:

1 Log into MiWAM

2 Under Account Alerts, click Please select a delivery preference for your 1099 Form

3 Under Delivery Preference for Form 1099-G, click Electronic. Your email address will be displayed.

4 â Review and Submit. You will receive an email acknowledging your delivery preference.

To receive your copy by mail, follow the steps above and select paper as your delivery preference.

Can Turbotax Find My W

TurboTax does not have your W-2. They would only have a local form for data that you either entered from your W-2 or downloaded from your employer. You would need to get a copy from your employer. You can get a wage and income transcript from the IRS which shows data from Forms W-2 and other information returns.

Recommended Reading: Va Unemployability Benefits

You May Like: How To Sign Up For Unemployment In Missouri

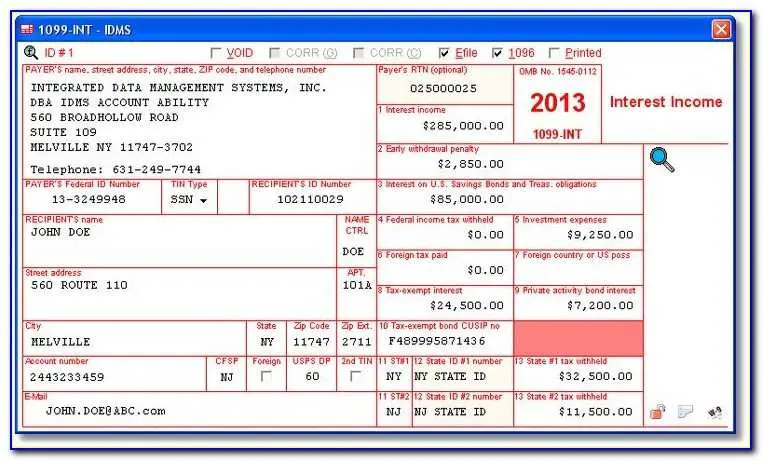

What Is Reported On My 1099

DES reports the total amount of unemployment benefits paid to you in the previous calendar year on your 1099-G. This amount is based upon the actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

Can U Get My W2 From My Unemployment

You do not get a W-2 for unemployment benefits. You get a 1099G, and no, TurboTax cannot get it for you. You have to get it yourself. Usually you need to go to the stateâs unemployment web site to get it and print it out. To enter it on your tax return, go to Federal> Wages & Income> Unemployment /Government benefits on Form 1099G

There are some employers who make W-2âs available for import to TurboTax, but not all do this. And it is late in the year, so it might not even still be available for import at this time. You might have to ask your employer for a copy of the W-2 that was issued in January.

Recommended Reading: How To File For Unemployment In California Online

Read Also: What Ticket Number Is Unemployment On

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Should I Have Received A W2 From Nys Unemployment

Hello cbhay99,

For NYS unemployment you should have received a 1099G. If you need a copy of your 1099G, you can view and print your 1099G for calendar year 2013 on the NYSDepartment of Labor website.

Log in with your NY.GOV ID, then click on Unemployment Services and View/Print your 1099G. You can also request a copy by completing and mailing the Request for 1099G form.

Read Also: Minnesota Max Unemployment

When Should I Receive My Unemployment Tax Form

Go the website of your state’s labor department. Navigate to the page that provides information on unemployment claims. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question. In most cases, 1099-Gs for the previous year are mailed on or before January 31. For example, if you collected unemployment in 2018, the 1099-G should have been mailed by January 31, 2019. While on your states website, copy the contact information so you can contact the office directly if necessary.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: 100 Percent Unemployability Va Benefits

Read Also: Max Unemployment Benefits Mn

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Note On Taxable Income

The American Rescue Plan Act of 2021 contains provisions regarding taxable unemployment compensation. Please direct all tax filing questions to the IRS, and visit their website for the most recent guidance.

Image source: /content/dam/soi/en/web/ides/icons_used_on_contentpages/IDES_icon_blue_warning_67px.png

Recommended Reading: Pa Unemployment Ticket Number Status

You May Like: Apply For Tn Unemployment Benefits

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 15, 2021.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

Read Also: How Much Does Health Insurance Cost If You Are Unemployed

Getting Prior Years W2s

If you file a prior-year tax return, there may be complications such as missing W-2s and other forms. You can still get a copy of that form. To get a copy of a prior year W-2, there are a couple of possibilities.

Contacting the issuer is the easiest way to find that particular W2. Employer payroll departments save such important documents that contain tax information. You can contact them and ask for the form to be sent to your address. This is usually the best way.

You can also contact the IRS directly. If you cant get in touch with that employer, then you will need form 4506. Although it may take longer and cost you some money, this allows you to obtain the copy of that years W-2 rather than do nothing.

Its important to note the IRS holds past W-2s and other tax documents for 7-10 years. Theyre filed under each taxpayers social security number. You can ask for a W-2, but not until a year after it was filed, and form 4506 will be required to get a copy after that. Also note:

- The IRS charges a $57 service fee checks are paid to The United States Treasury.

- Check the second page of form 4506 for the address to send it to.

- It takes the IRS up to two months to process the request and send the W-2.

Remember, with a few clicks of the mouse, you can use the TurboTax W2 finder or the H& R Block W2 finder and get the data from your current online W2, and your tax returns are ready to start in moments.

Recommended Reading: Sign Up For Unemployment In Tennessee

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, 2021. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

Email Notification For 1099

Sign up to receive an email alert when 1099-Gs are available online mid-January.

Please enter your email address below and indicate whether you would like to be added to or deleted from the 1099-G email notification list.

IMPORTANT: Logon to my.unemployment.wisconsin.gov to view or print your current or previous year 1099-G tax forms. The signup below is ONLY to request email notification in mid-January when 1099-Gs are available online.

Recommended Reading: Apply For Unemployment Tennessee

I Misplaced Or Didnt Receive My W

For Home Healthcare Providers duplicate W-2 requests, please call the Department of Health and Human Services at 800-979-4662.

For State of Michigan Employees:

You may request duplicate W-2s for the most recent calendar year beginning February 15.

1. The DTMB-Office of Financial Management handles the duplicate W-2 and 1095-C requests. Please call the Duplicate W-2 and 1095-C Request Line at 517-241-0045, and leave a voice message providing the following information:

- Name

- Last 4 digits of your Social Security Number

- A daytime telephone number where you can be reached

- Year duplicate W-2 is needed

- Current Mailing Address

- State Government Agency

NOTE: If your need for a duplicate W-2 arises as a result of a change of address you will need to make sure that your new mailing address is correct in HRMN before requesting a duplicate W-2 . You may review and update your address in HRMN via your online employee self-service account or by contacting MI HR Service Center at 877-766-6447 .

2. Make your request via e-mail:

Submit your request to OFM at .

Include the information requested above and enter Duplicate W-2 as the subject line.

Once your request has been received, you may expect to receive your duplicate W-2 within 2 weeks.