New Exclusion Of Up To $10200 Of Unemployment Compensation

If your modified adjusted gross income is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you dont have to pay tax on unemployment compensation of up to $10,200. If you are married, each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you file Form 1040-NR, you cant exclude any unemployment compensation for your spouse.

The exclusion should be reported separately from your unemployment compensation. See the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure your exclusion and the amount to enter on Schedule 1, line 8. ;

When figuring the following deductions or exclusions from income, if you are asked to enter an amount from Schedule 1, line 7 enter the total amount of unemployment compensation reported on line 7 and if you are asked to enter an amount from Schedule 1, line 8, enter the amount from line 3 of the Unemployment Compensation Exclusion Worksheet. See the specific form or instructions for more information. If you file Form 1040-NR, you arent eligible for all of these deductions. See the Instructions for Form 1040-NR for details.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return; the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

How Does Unemployment Insurance Usually Work

In the United States, federal and state unemployment insurance programs have existed in some form since the 1930s. Unemployment programs are administered at the state level. Still, the system is funded by businesses paying Federal Unemployment Tax Act taxes and State Unemployment Tax Act taxes.

These programs are designed to temporarily provide financial assistance when a worker loses their job and is currently looking for a new one. Workers who are laid off, have lost seasonal work or have been furloughed are allowed to apply for unemployment insurance.

In most U.S. states, laid-off workers are typically able to receive 26 weeks of unemployment benefits and a percentage of their average annual pay. How much a worker can receive depends on how much money they made in their last job and in what state they reside.

Once a worker has been laid off, they can then submit an unemployment claim to their state government. This claim formally notifies the government and the former employer that the worker is seeking unemployment insurance. In some cases such as the worker being fired for cause the former employer may deny the unemployment claim.

Read Also: Can I File Taxes With Unemployment Income

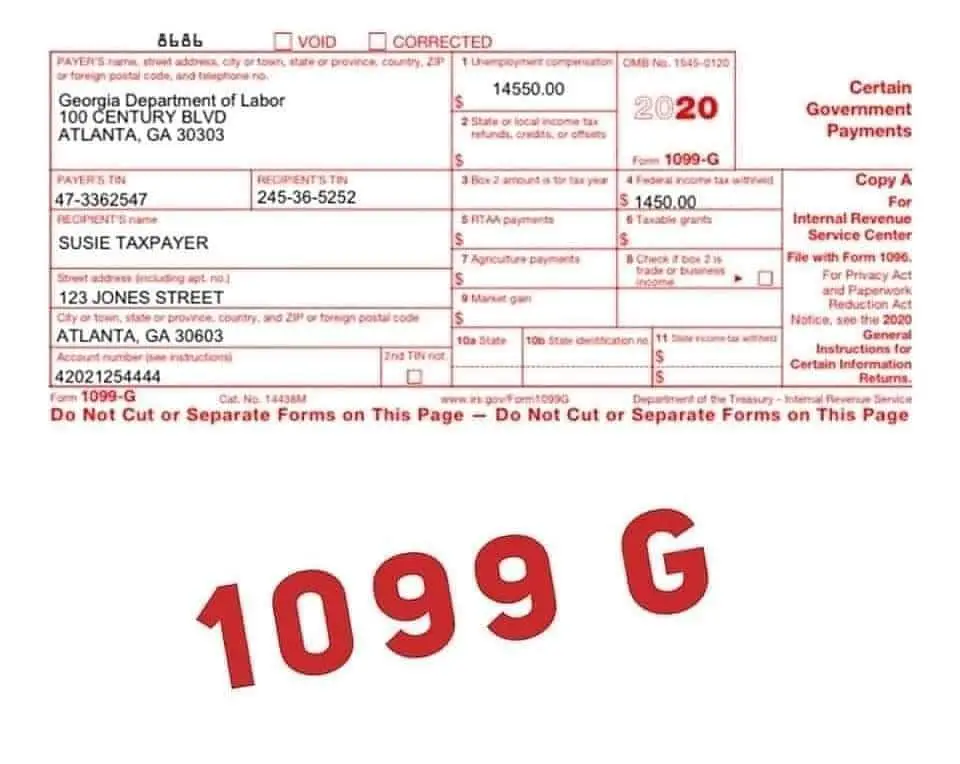

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. ;The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS.; You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return.; Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers.; Free File is available in English and Spanish.; To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Don’t Miss: How To Get 1099 Form For Unemployment

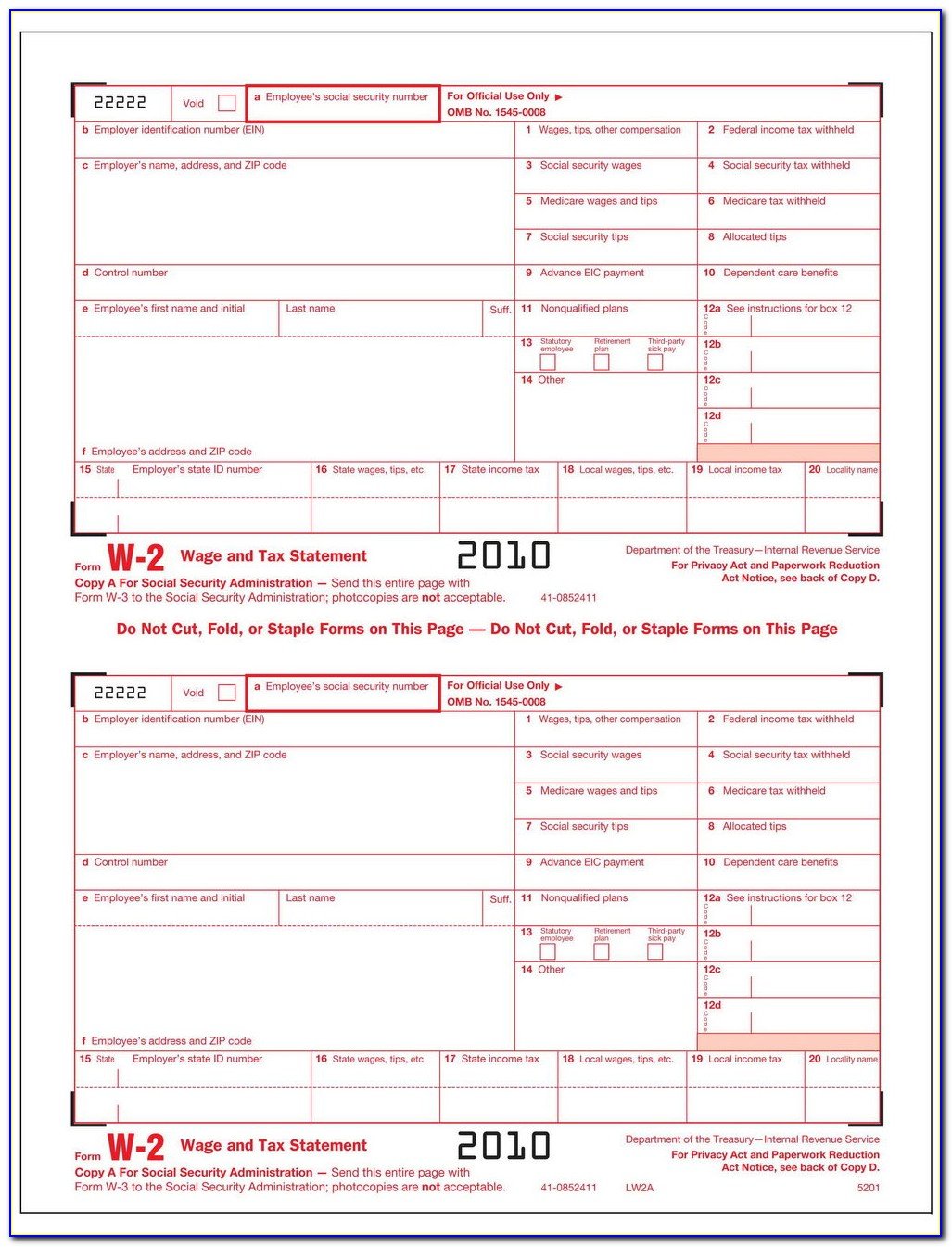

Can I Print Out A 1040 Tax Form

To access online forms, select Individuals at the top of the IRS website and then the Forms and Publications link located on the left hand side of the page. You will then see a list of printable forms, including the 1040, 1040-EZ, 4868 form for an extension of time and Schedule A for itemized deductions.

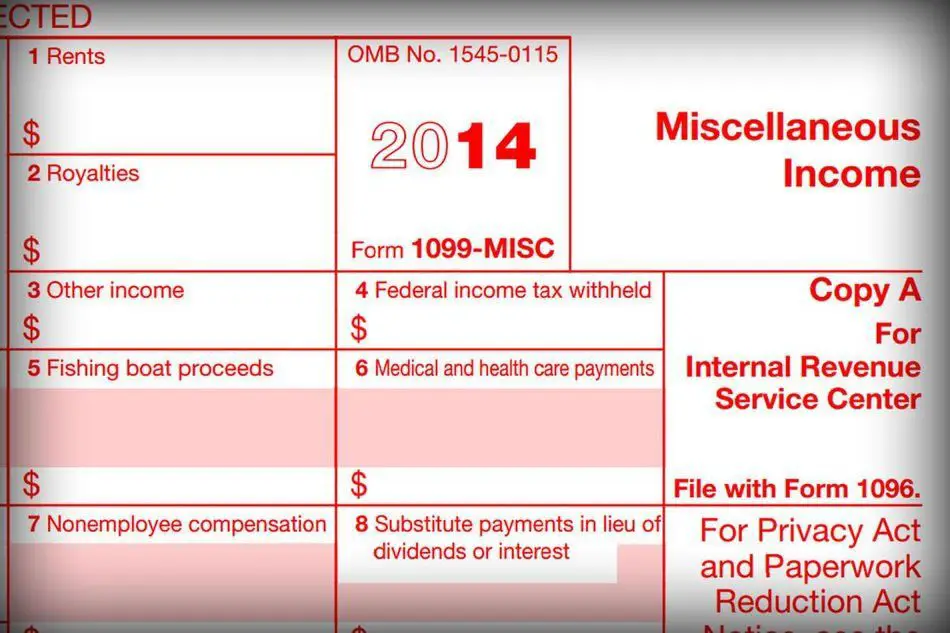

Can 1099 Copy B Be Printed On Plain Paper

Copy B, C, 1 and 2 can be printed on plain paper with black ink. The W-2, W-3, W-2C and W-3C are different. In contrast, all 1096, 1098, 1098, 1099, 3921, 3922, 5498 forms are submitted to the IRS and must be submitted on their red-ink forms. Or file electronically and you can skip the paper forms entirely.

Recommended Reading: Can You Get Food Stamps On Unemployment

Individual Income Tax Information For Unemployment Insurance Recipients

- Current: 2020 Individual Income Tax Information for Unemployment Insurance Recipients

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return.

Total taxable unemployment compensation includes the new federal programs implemented in 2020 due to COVID-19:

- Federal Pandemic Unemployment Compensation

- Pandemic Emergency Unemployment Compensation

- Pandemic Unemployment Assistance

For additional information, visit;IRS Taxable Unemployment Compensation.

Note: Benefits are taxed based on the date the payment was issued.

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

- Disability Insurance benefits received as a substitute for UI benefits

- Disaster Unemployment Assistance benefits

- Paid Family Leave benefits

Form 1099-G also reports any amount of federal and state income tax withheld.

You May Like: How To Get Health Insurance If You Are Unemployed

Can 1099 Employees File For Unemployment Benefits

Unemployment benefits for self-employed workers are generally not available, but the coronavirus pandemic changed this in many states.

By: Sean Ludwig, Contributor

While 1099 employees previously did not qualify for unemployment benefits, the CARES Act has since created new provisions that permit it amidst the COVID-19 pandemic.

For decades, the unemployment insurance program in the U.S. has helped provide a cushion for those who unexpectedly find themselves out of work. But what about those self-employed workers who lose their business or cant find work?

Traditionally, 1099 workers have not been eligible to receive unemployment benefits. However, the COVID-19 pandemic changed this norm, and federal coronavirus legislation opened the door for some independent workers to receive benefits. Below we answer some of the most common questions surrounding 1099 workers and unemployment benefits that can be obtained.

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary; withholding taxes is not required. If you ask us to withhold taxes, we will withhold;10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

Recommended Reading: Can You File Taxes If You Only Received Unemployment

Unemployment Compensation Exclusion Worksheet Schedule 1 Line 8

a. Yes. Stop You can’t exclude any of your employment compensationb. No. Go to line 8

;

What Is Reported On My 1099

DES reports the;total;amount of unemployment benefits;paid;to you in the previous calendar year on your 1099-G. This amount is based upon the;actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

You May Like: What Is The Tax Rate On Unemployment Benefits

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review. ;

You may send the form back to NYSDOL via your online account, by fax, or by mail. ;Follow the instructions on the bottom of the form. ;

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Next Section

Continue

These Are The States That Will Not Mail You Form 1099

Missouri

- To access your Form 1099-G, log into your account through at uinteract.labor.mo.gov. From the UInteract home screen, click View and Print 1099 tab and select the year to view and print that years 1099-G tax form.

- The Missouri Division of Employment Security will mail a postcard no later than January 31, 2021, notifying anyone who has not accessed their Form 1099-G online about the availability of the form and how to access it.

New Jersey

- To access your Form 1099-G, check your email. You will receive your Form 1099-G by email. You can also use the Check Claim Status tool to get your Form 1099-G.

- If you prefer to have your Form 1099-G mailed, you may request a copy from your Reemployment Call Center. It may take 10 business days to receive a copy of your Form 1099-G.

New York

- To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

- If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

Wisconsin

Read Also: Can I Apply For Unemployment After Disability

How Do I Access 1099 In Quickbooks

How do I access 1099 in QuickBooks?

Can you download 1099 forms?;When you file a physical Form 1099-NEC, you cannot download and submit a printed version of Copy A from the IRS website. Instead, you must obtain a physical Form 1099-NEC, fill out Copy A, and mail it to the IRS. Learn how to get physical copies of Form 1099-MISC and other IRS publications for free.

Can I print my 1099 online?;Get a copy of your Social Security 1099 tax form online. You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

What happens if I lost my 1099?;Often, a lost 1099 may be missing because the issuer has the wrong address for you. A missing 1099 for interest income issued by banks can be also be replaced by asking the bank to send a duplicate. The same goes for K-1 returns issued by partnerships. Banks also often have 1099s available on their websites.

When Should I Receive My Unemployment Tax Form

Go the website of your state’s labor department. Navigate to the page that provides information on unemployment claims. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question. In most cases, 1099-Gs for the previous year are mailed on or before January 31. For example, if you collected unemployment in 2018, the 1099-G should have been mailed by January 31, 2019. While on your states website, copy the contact information so you can contact the office directly if necessary.

You May Like: How Much Does Unemployment Pay In Illinois

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes.;The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Income Tax 1099g Information

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Maryland Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year. This may be different from the week of unemployment for which the benefits were paid.

1099-Gs are required by law to be mailed by January 31st for the prior calendar year. By January 31, 2021, the Division will deliver the 1099-G for Calendar Year 2020. By January 31, 2021, the Division will send the 1099-G for Calendar Year 2020.

1099-Gs are not available until mid-January 2021. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G may NOT be forwarded by the United States Postal Service. The BPC unit cannot update your mailing address. You must update your mailing address by updating your personal information in the BEACON portal, on the Maryland Unemployment Insurance for Claimants mobile app, or by contacting a Claims Agent at 667-207-6520.

If you wish to request a duplicate 1099-G for prior years, send your request to the Maryland Department of Labor – Benefit Payment Control Unit at .

What is the Payer’s Federal Identification number? The the Maryland Department of Labor Federal ID # is: 52-2006962.

Don’t Miss: Can You Refinance Mortgage If Unemployed

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail; then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

Notice To Representatives Of Deceased Claimants

Q: How do I access the 1099-G tax form if I am the representative of a deceased claimant?;

A: For the New York State Department of Labor to provide you with information belonging to a deceased unemployment insurance claimant, you must first show that you are legally authorized to receive this information. ;Authorization often comes from the New York State Surrogate Court, and may be one of the following:;

- Appointment as an Executor

- Letters of Administration

- Appointment as a Voluntary Administrator

If the deceased claimant had no assets, or all property owned by the deceased claimant was owned in common with someone else, then no Executor or Administrator may have been appointed. The representative of the deceased claimant must provide proof that they are authorized to obtain the information. In this case, a surviving spouse should provide NYS DOL with:

Please submit proof that you are authorized to receive the deceased claimants information using one of the following methods:

You May Like: How Do You Set Up Direct Deposit For Unemployment