Individual Income Tax Information For Unemployment Insurance Recipients

- Current: 2020 Individual Income Tax Information for Unemployment Insurance Recipients

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return.

Total taxable unemployment compensation includes the new federal programs implemented in 2020 due to COVID-19:

- Federal Pandemic Unemployment Compensation

For additional information, visit IRS Taxable Unemployment Compensation.

Note: Benefits are taxed based on the date the payment was issued.

What To Do If You Owe Taxes On Unemployment Benefits

After going through these steps, you may find that you owe taxes to the IRS. If you do, dont panic. You have options.

However, not paying that tax bill is not one of those options. You should make every effort to pay as much of your tax bill as possible. Not paying your tax bill means that youll immediately face additional penalties for late payment, as well as interest that accrues on your unpaid taxes. If you continue to not file your taxes, the IRS may seek legal remedy against you.

If I Repaid An Overpayment Will It Be Reflected On My 1099

No. DES reports the total amount of benefits paid to you in the previous calendar year on your 1099-G, regardless of whether you repaid any overpayment. If you repaid part or all of an overpayment during the previous calendar year, you may be able to deduct the repaid amounts on your income tax return. The repaid amount should be reported on the tax return submitted for the year the repayment was made.

Don’t Miss: Why Is My Unemployment Still Pending

Why Would Your Refund Come By Snail Mail

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouses name or a joint account. If thats not the reason, you may be getting multiple refund checks, and the IRS can only direct-deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS next best way to refund your money quickly.

Its also important to note that for refunds, direct deposit isnt always automatic. Some are noticing that like the stimulus checks, the first two payments for the child tax credit were mailed. Just in case, parents should sign in to the IRS portal to check that the agency has their correct banking information. If not, parents can add it for the next payment in September.

For more information about your money, heres the latest on federal unemployment benefits and how the child tax credit could impact your taxes in 2022.

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

You May Like: Apply For Washington State Unemployment

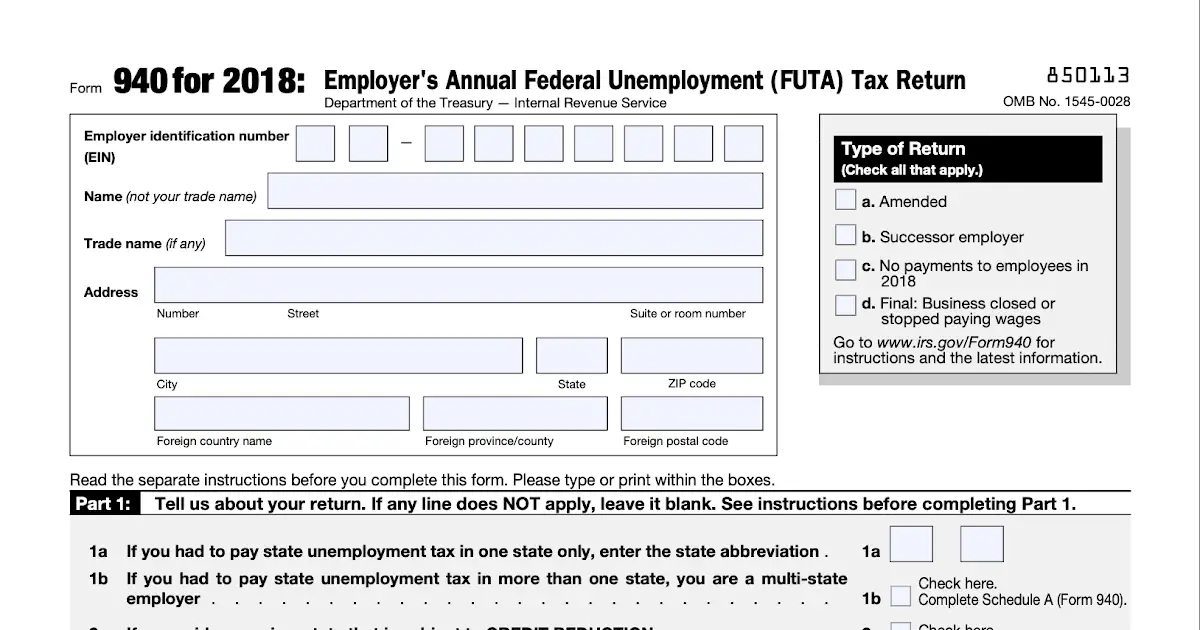

State Unemployment Tax Act Laws

The unemployment compensation program is based on federal law, the Federal Unemployment Tax Act . State laws for unemployment tax are collectively called State Unemployment Tax Act laws, but each state has its own law and some states might have a different name for their law.

To fund unemployment insurance payments, FUTA authorizes the IRS to collect an unemployment tax from employers to fund state workforce agencies that provide benefits to unemployed workers. Employers must pay unemployment taxes to both the federal unemployment tax system and their state system.

The unemployment compensation system is unique among U.S. laws because its almost totally funded by employer taxes. The federal unemployment tax is paid only by employers, and only three states collect taxes from workers.

Irs To Recalculate Taxes On Unemployment Benefits Refunds To Start In May

IR-2021-71, March 31, 2021

WASHINGTON To help taxpayers, the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

The legislation, signed on March 11, allows taxpayers who earned less than $150,000 in modified adjusted gross income to exclude unemployment compensation up to $20,400 if married filing jointly and $10,200 for all other eligible taxpayers. The legislation excludes only 2020 unemployment benefits from taxes.

Because the change occurred after some people filed their taxes, the IRS will take steps in the spring and summer to make the appropriate change to their return, which may result in a refund. The first refunds are expected to be made in May and will continue into the summer.

For those taxpayers who already have filed and figured their tax based on the full amount of unemployment compensation, the IRS will determine the correct taxable amount of unemployment compensation and tax. Any resulting overpayment of tax will be either refunded or applied to other outstanding taxes owed.

There is no need for taxpayers to file an amended return unless the calculations make the taxpayer newly eligible for additional federal credits and deductions not already included on the original tax return.

Read Also: How To Earn Money When Unemployed

Also Check: How To Sign Up For Unemployment In Indiana

Still Living Paycheck To Paycheck

Some top economists have called for more direct aid to Americans. More than 150 economists, including former Obama administration economist Jason Furman, signed a letter last year that argued for recurring direct stimulus payments, lasting until the economy recovers.

Although the economy is improving, millions of people continue to suffer from reduced income and have not been able to tap government aid programs, Nasif said. Only 4 in 10 jobless workers actually received unemployment aid, according to a from economist Eliza Forsythe.

Many people never applied for unemployment benefits because they didnt think they were eligible, while others may have given up due to long waits and other issues.

Youll see reports about how the economy is starting to grow, but there are a lot of Americans living paycheck to paycheck, and for a lot of them the government relief programs havent been able to help, said Greg Nasif, political director of Humanity Forward.

You May Like: How To Earn Money When Unemployed

Note On Taxable Income

The American Rescue Plan Act of 2021 contains provisions regarding taxable unemployment compensation. Please direct all tax filing questions to the IRS, and visit their website for the most recent guidance and FAQs.

Image source: /content/dam/soi/en/web/ides/icons_used_on_contentpages/IDES_icon_blue_warning_67px.png

You May Like: Do I Have To Put Unemployment On My Taxes

Topic No 418 Unemployment Compensation

The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. Unemployment compensation includes amounts received under the laws of the United States or of a state, such as:

- State unemployment insurance benefits

- Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund

- Railroad unemployment compensation benefits

- Disability benefits paid as a substitute for unemployment compensation

- Trade readjustment allowances under the Trade Act of 1974

- Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and

- Unemployment assistance under the Airline Deregulation Act of 1978 Program

- Benefits from a private fund if you voluntarily gave money to the fund and you get more money than what you gave to the fund.

If you received unemployment compensation during the year, you must include it in gross income. To determine if your unemployment is taxable, see Are Payments I Receive for Being Unemployed Taxable?

Before You Register With Your State For Suta Taxes

When you hire your first employee, you must register with your state’s unemployment tax agency and begin calculating your unemployment tax rate and putting money aside from each payroll to pay unemployment taxes. Before you apply, here are some things you need to know:

- How to apply

- The wage base and tax rate, and the new employee rate

- What types of wages are subject to SUTA taxes

- What employees are covered

Don’t Miss: How To Get Medical Insurance While Unemployed

When Should I Receive My Unemployment Tax Form

Go the website of your state’s labor department. Navigate to the page that provides information on unemployment claims. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question. In most cases, 1099-Gs for the previous year are mailed on or before January 31. For example, if you collected unemployment in 2018, the 1099-G should have been mailed by January 31, 2019. While on your states website, copy the contact information so you can contact the office directly if necessary.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Should I Have Taxes Withheld From Unemployment Benefits

Read Also: Does Being Unemployed Affect Credit Score

Taxes On Unemployment Benefits

All benefits are considered gross income for federal income tax purposes. This includes benefits paid under the federal CARES Act, Federal Pandemic Unemployment Compensation , state Extended Benefits , Trade Adjustment Assistance , Pandemic Unemployment Assistance , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance . DES reports these benefits to the Internal Revenue Service for the calendar year in which the benefits were paid.

You may choose to have federal income tax withheld from your unemployment benefit payments at the rate of 10% of your gross weekly benefit rate , plus the allowance for dependents .

The amount deducted for state income tax will be 10% of the amount deducted for federal taxes, which is currently calculated as 1% of the gross weekly benefit amount. Please Note: State income tax cannot be withheld from the $300 additional weekly benefit in Lost Wages Assistance and the $600 additional weekly FPUC benefit for regular UI claims. Claimants who received FPUC and/or LWA in regular UI will be responsible for paying any tax due on those amounts when filing state income taxes for calendar year 2021.

After selecting your tax withholding on the initial Unemployment Insurance application, you can change your withholding preferences by completing the Voluntary Election for Federal/State Income Tax Withholding form . After completing the form, submit it to DES by mail or fax.

What Is Reported On My 1099

DES reports the total amount of unemployment benefits paid to you in the previous calendar year on your 1099-G. This amount is based upon the actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

Also Check: Can I Get An Apartment On Unemployment

How Do I Know If The Amount Listed On My 1099

If you have access to your HIRE account, you may want to look at your Claim Summary page to see the benefits you have been paid out throughout the weeks you have filed. Both your weekly benefit amount and your additional Loss Wage Assistance, , and Federal Pandemic Unemployment Compensation, , are counted as benefits paid to you.

However, this option may not be helpful if you have received benefits under several unemployment programs in 2020. This is because Claimants often have their claim summary page refreshed, for example, when filing a new claim for an extension of benefits or consideration of another benefit program.

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Continuation Coverage. The page links to information about COBRA including:

Don’t Miss: Will The Extra $600 Unemployment Be Extended

What Happens To The Amount Of Tax Money The Government Collects If Unemployment Is High

A period of persistently high unemployment could be expected to reduce the amount of money the government collects in taxes. Of course, national taxation is a complex system thats always subject to shifts in political winds and economic forces. If a government wasnt collecting enough revenue, it could theoretically change the tax code as needed to make up for those losses.

How To Get My 1099 From Unemployment To File Taxes

Many taxpayers are unaware that the unemployment income they received is taxable, just like earned income. The key difference is that unemployment income is taxed at a lower rate. Also, thanks to the American Recovery and Reinvestment Act , the first $2,400 of unemployment income is untaxed. In any event, you should list your unemployment income should on your return. Your state unemployment office should send you the 1099-G form listing that amount, but there are ways to request the form in the mail.

Tips

-

If you have received unemployment income at any point during the year, you will be required to complete and return IRS Form 1099-G. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly.

You May Like: How Can You Qualify For Unemployment

Request A Corrected 1099

If your 1099-G has an incorrect amount in “total payment” or “tax withheld,” you can request a revised form.To request a corrected form: Complete Form UIA 1920, Request to Correct Form 1099-G, and submit it to UIA. Mail completed forms to: Unemployment Insurance Agency, 1099-G, P.O. Box 169, Grand Rapids, MI 49501-0169.

Where Do I Find My 1099

Also Check: What Is The Unemployment Percentage In The United States

Don’t Miss: How Much Taxes Do You Have To Pay On Unemployment

How To Calculate And Pay State Unemployment Tax

by Ryan Lasker | Updated Aug. 5, 2022 First published on May 18, 2022

When a business finds itself in a financial bind, sometimes layoffs feel like the only option.

Unemployment benefit programs step in when employees are let go for reasons outside of their control. Employers pay unemployment tax to their state and the federal government so employees have a softer landing if theyre laid off.

How Do I Get Information On State Unemployment Taxes

Unemployment insurance in the U.S. is facilitated through federal and state agencies that are set up to pay employees who have lost their jobs through no fault of their own. Each state has eligibility requirements to get these payments and employers must pay into their states fund to provide benefits.

Recommended Reading: How Do You File Unemployment On Your Taxes

Sui Tax Rate By State

Here is a list of the non-construction new employer tax rates for each state and Washington D.C. . Note that some states require employees to contribute state unemployment tax.

** Some states are still finalizing their SUI tax information for 2021 . For example, Texas will not release 2021 information until June due to COVID-19. We will update this information as the states do.

| State |

|---|

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

You can opt to have federal income tax withheld when you first apply for benefits. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development, Unemployment Insurance, PO Box 908, Trenton, NJ 08625-0908. for the Request for Change in Withholding Status form.

After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. This information is also sent to the IRS.

Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2020, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

IMPORTANT INFORMATION FOR TAX YEAR 2020:

Don’t Miss: What To Do When Unemployment Benefits Are Exhausted In Ny