Reporting Unemployment Benefits At The Federal Level

For most states, you will receive Form 1099-G in the mail from your state unemployment office. Find out how you can obtain your 1099-G. On Form 1099-G:

- In Box 1, you will see the total amount of unemployment benefits you received.

- In Box 4, you will see the amount of federal income tax that was withheld.

- In Box 11, you will see the amount of state income tax that was withheld.

You dont need to attach Form 1099-G to your Form 1040 or Form 1040-SR.

In certain states, you will not automatically be mailed a Form 1099-G. You will have to access your Form 1099-G online through your unemployment portal or call your state unemployment office to request that they mail your Form 1099-G. In other states, you will only be mailed a Form 1099-G if you selected that as your delivery preference.

| States that will not mail 1099-Gs at all | Connecticut, Indiana, Missouri, New Jersey, New York, and Wisconsin |

| States that will mail or electronically deliver 1099-Gs depending on which option you opted-into | Florida, Illinois, Michigan, North Carolina, Rhode Island, Tennessee, and Utah |

If you received Form 1099-G, but didnt file for unemployment benefits, this may be a case of identity theft and fraud. Contact your state unemployment office immediately for additional information and how to report the potential fraud.

Unemployment Federal Tax Break

The latest COVID-19 relief bill , gives a federal tax break on unemployment benefits. This means that you dont have to pay federal tax on the first $10,200 of your unemployment benefits if your adjusted gross income is less than $150,000 in 2020. The $150,000 income limit is the same whether you are filing single or married.

For paper filers, the IRS published instructions on how to claim the unemployment tax break: New Exclusion of up to $10,200 of Unemployment Compensation. For online filers, the IRS has stated that tax software companies have updated their systems to reflect the unemployment federal tax break. If you file your taxes online and havent filed for 2020 yet, you may want to make sure your tax software is updated before filing your tax return.

If you filed your 2020 tax return before this new law change, the IRS is asking you not to file an amended return and not to take any additional steps. The IRS will automatically issue refunds starting in May and into the summer to those who qualify. If you claimed tax credits such as the Earned Income Tax Credit and Child Tax Credit , the IRS will also automatically issue refunds if you qualify for a higher amount because the tax break changed your income level.

If your state decides to give you a state tax break and you already filed your state return, you should check to see if you are newly eligible for any state tax credits.

Are Government Benefits Taxable

- Check with your local benefits offices you may be eligible for state and federal benefits due to the change in your income. Benefits such as SNAP, housing subsidies, childcare subsidies, and many others are generally not taxable. Gifts from various organizations, such as local food pantries and utility and gas programs are usually tax-exempt.

Read Also: How Do You Know If Your Va Disability Is Permanent

Your Tax Responsibilities When Youre Unemployed

When youre out of work, unemployment benefits can help keep you going financially hopefully until you can find another job.

Unemployment benefits can come from multiple sources, including the following:

- The Federal Unemployment Trust Fund

- State unemployment insurance

- A company-financed fund

- A private fund to which you voluntarily contributed

Generally, unemployment income is taxable as income at the federal level and may be at the state level, too, depending on where you live. But if you receive unemployment benefits from a private fund that you voluntarily contribute to, its only federally taxable if the benefits you receive exceed the amount you paid into the fund.

In addition to paying tax on unemployment benefits, if you worked part of the year before losing your job, you may also be responsible for paying federal income tax on those wages, as well.

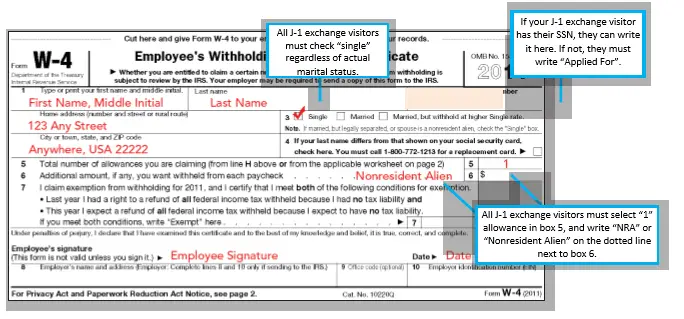

Typically, employers withhold federal and state taxes from wages, based on how much you earned and information you provided on your W-4 form. Whether you owe any additional tax on those wages will depend on the selection you made on your W-4 form and whether your former employer withheld enough federal income tax from your paycheck. If they took out too little, you could owe taxes on that income when you file your returns.

Earned Income Tax Credit

The earned income tax credit, or EITC, is a federal income tax credit for working people with low to moderate income. If you earned money through wages or self-employment work before losing your job, you might qualify for this credit in the tax year in which you had eligible income.

But unemployment benefits dont count as earned income for the purpose of the EITC, so if you didnt have any earned income in the tax year, you wont be able to claim this credit. Eligibility also depends on other factors, including your filing status, the number of qualifying children you can claim, and the amount of your earned income.

The credit is refundable, meaning that, in addition to reducing the amount you owe, it could give you a refund over the amount of tax you paid in.

Don’t Miss: Ways To Make Money When Unemployed

Talk To The Irs And Set Up A Payment Plan

If the amount seems impossible for you to cover, contact the IRS directly. Despite its reputation, the IRS actually works with individual taxpayers who are having difficulty paying their taxes. It offers extensions, waive fees and sometimes even compromise in difficult situations.

Start by calling the IRS at 18008291040. Try to avoid doing this too close to the filing deadline of April 15, as the IRS tends to get very busy around that date. Call as early as possible. Discuss your situation with them and ask what options are available.

Help With Unemployment Benefits And How To File Your Taxes

We understand that you may have a lot on your plate right now. Where your taxes are concerned, H& R Block is here to help. Be sure to visit our Unemployment Tax Resource Center for help with unemployment related topics.

Free tax filing with unemployment income: You can include your Form 1099-G for free with H& R Block Online Free.

Worried your taxes are too complex for H& R Block Free Online? Check out Blocks other ways to file.

Related Topics

Finding your taxable income is an important part of filing taxes. Learn how to calculate your taxable income with help from the experts at H& R Block.

You May Like: Apply Unemployment Louisiana

What To Do If You Owe Taxes On Unemployment Benefits

After going through these steps, you may find that you owe taxes to the IRS. If you do, dont panic. You have options.

However, not paying that tax bill is not one of those options. When facing a tax bill, it may be tempting to just not pay it at all. That would be a big financial mistake.

You should make every effort to pay as much of your tax bill as possible. Not paying your tax bill means that youll immediately face additional penalties for late payment, as well as interest that accrues on your unpaid taxes. If you continue to not file your taxes, the IRS may seek legal remedy against you.

State Income Taxes On Unemployment Benefits

It may not be just the IRS you have to worry about. Many states tax unemployment benefits, too. There are several that do not, though California, Montana, New Jersey, Pennsylvania, and Virginia do not charge taxes on unemployment benefits. Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Eight states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

Don’t Miss: Tennessee Unemployment Qualifications

Take Out A Personal Loan

Another option to consider if you cannot pay your taxes in full is a personal loan. You may be able to borrow money from family or friends to pay your tax bill.

Many family members and friends may be wary to lend money to you. This has nothing to do with them not trusting you or concerns about your character, but rather a fear of damaging your relationship with them. One option is to consider collateral for that loan. You give them an item of value to hold. If you repay the loan in the timeframe that you promised, they give the item back to you otherwise, they keep the item.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Also Check: Va Form For Individual Unemployability

How Do You Claim Unemployment Benefits

Navigating unemployment can be confusing and frustrating at any time. With the recent changes from the CARES Act and other legislation, you may be even more unsure about eligibility and how to claim unemployment benefits.

This post will outline the normal rules for eligibility for unemployment benefits. Well also cover how to apply and how to file unemployment income on your taxes.

Looking for details on the latest coronavirus unemployment relief? Visit our coronavirus resource center.

Have other tax-related unemployment questions? Be sure to visit our Unemployment Resource Center.

You May Need To Adjust Your Spouses Income Tax Withholding

One way you can increase your current after-tax income, if you and your spouse were both working, is to have your spouse adjust his or her income tax withholding.

If your spouses withholding is based on the assumption you both earned an income, he or she is almost certainly having too much withheld for your current circumstances.

The working spouse should file a new Form W-4 with his or her employer to adjust the amount of income tax withheld.

You May Like: Application For Unemployment Tn

Making Estimated Tax Payments

You might be required to make payments directly to the IRS as quarterly estimated tax payments if you elect not to have taxes withheld from your unemployment benefits. This works out to a payment once every three months. You can elect to do this instead of having 10% withheld from every unemployment check, giving yourself a little bit of wiggle room when money is tight.

You might even have to make quarterly payments in addition to withholding from your benefits. You’re obligated to make estimated payments if you expect that you’ll owe at least $1,000 after accounting for all taxes withheld from all your sources of income, and if you expect that your withheld taxes plus any refundable tax credits you’re eligible for will be less than 90% of what you’ll owe, or 100% of the total taxes you paid last year.

You might want to consult with a tax professional because the whole equation can be complicated. You could accrue additional penalties if you don’t pay enough tax, either through withholding or estimated tax payments.

What Happens To The Amount Of Tax Money The Government Collects If Unemployment Is High

A period of high unemployment may reduce the amount of money the government collects in taxes. Of course, national taxation is a complex system that’s always subject to political and economic changes. For example, if a government doesn’t collect enough revenue from taxes, it could potentially increase taxes the next tax year to make up for those losses.

You May Like: Emerald Card Overdraft

Already Filed A Tax Return

In most cases, if you already filed a tax return that includes the full amount of your unemployment compensation, the IRS will automatically determine the correct taxable amount of unemployment compensation and the correct tax. If you paid more than the correct tax amount, the IRS will either refund the overpayment or apply it to other outstanding taxes owed. The first refunds are expected to be made in May and will continue throughout the summer. There is no need to call the IRS or file a Form 1040-X, Amended U.S. Individual Income Tax Return. See IRS to recalculate taxes on unemployment benefits refunds to start in May for guidance. However, if as a result of the excluded unemployment compensation you now qualify for deductions or credits not claimed on your original return, you should file an amended return. For example, if you did not claim the Earned Income Tax Credit on your originally filed return because your AGI was too high, but the exclusion allowed for unemployment compensation now reduces your AGI, you should file an amended return to claim the credit if now eligible.

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, 2021. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

Also Check: Filing For Unemployment In Pennsylvania

Send In An Estimated Tax Payment

If you dont withhold taxes upfront, your other option is to submit an estimated tax payment. There are two different options for doing so. The first is to submit a payment using the IRS online payment portal. The second option is to print Form 1099-ES and mail your payment to your regional IRS processing center. Regardless of which option you choose, make sure to keep a receipt of when you sent the payment so you can report your estimated tax payment on your return.

If you have a TaxAct account, you can sign back in and the product will help you calculate your payment and complete the proper vouchers. Unfortunately, if you already filed your tax return, you cant set up direct deposit payments. But as mentioned earlier, you can still set up a payment plan using the IRS portal. The IRS also has instructions to help you calculate your estimated payment.

If You Cant Pay Your Taxes On Time

If you do end up owing the government money and cant pay your taxes on time, the IRS offers several payment plan options that can help you.

But be aware that not paying the full amount you owe by the filing deadline will mean youll pay interest and possibly penalties on the unpaid amount even if you arrange a payment plan with the IRS.

Don’t Miss: Applying For Unemployment In Tn

Do I Need To Pay Taxes On My Unemployment Benefits

Yes. Unemployment benefits are like wages, and you must report it as income on your tax return if you earned enough income to need to file taxes. BUT, the first $10,200 of unemployment benefits you received is not taxable by the IRS. If you received more than $10,200 in unemployment benefits, that will be taxed.

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Don’t Miss: How To Apply For 100 Va Unemployability

Stimulus Checks And Expanded Unemployment Benefits

The COVID-19 pandemic has led to severe economic hardship, with millions of Americans losing their jobs. As a response, Congress passed three key legislation that expanded unemployment benefits and delivered direct stimulus payments to provide economic relief. As more and more people about 20 million people since November 2020 are claiming unemployment benefits, these are the key things to know:

If You Included Your Unemployment Income Already The Irs Wont Require You To File An Amended Tax Return In Most Cases

Since we are in the middle of tax season, you may have already filed and claimed your full unemployment benefits on your tax return.

According to the IRS, more than 23 million Americans filed for unemployment last year. On March 31, the IRS announced taxpayers who have already filed would not have to resubmit their tax returns in most cases the IRS will adjust qualifying returns automatically in two phases.

The IRS will start with single taxpayers who qualify for the tax break and then process taxpayers who filed jointly. It estimates that taxpayers will begin to receive tax refunds as early as May, and the agency will continue to process refunds through the summer. If you owe taxes, the IRS will apply any adjustment to outstanding taxes due.

However, if you expect your tax return adjustment makes you eligible for a tax credit or an increase of a tax credit previously claimed, you will need to file an amended tax return to claim the credit.

For example, lets say, for instance, you qualify for the Earned Income Tax Credit . However, because of the unemployment tax break, your income has changed and you may now be eligible for a higher credit. In this instance, the IRS requests you to file an amended tax return to claim the increase or any other credit you may now be entitled to due to the reduction of income.

Don’t Miss: Va Disability 100 Unemployability