Tax Professionals: How To Help Your Clients Battle Identity Theft Risk Related To Unemployment

Internal Revenue Service Security Summit partners today outlined for tax professionals how they can assist clients who were victims of unemployment compensation fraud schemes that targeted state workforce agencies in 2020 and 2021.

The IRS, state tax agencies and the tax industry working together as the Security Summit reported that unemployment compensation fraud was one of the more common identity theft schemes that emerged in 2020 as criminals exploited the COVID-19 pandemic and the resulting economic impact.

Addressing unemployment compensation fraud is the third in a five-part series sponsored by the Summit partners to highlight critical steps tax professionals can take to protect client data. This years theme Boost Security Immunity: Fight Against Identity Theft, is an effort to urge tax professionals to try harder to secure their systems and protect client data during the pandemic and its aftermath.

Identity thieves always look for opportunities, and the unemployment surge presented a new opportunity to exploit the pain and financial hardships faced by Americans, said IRS Commissioner Chuck Rettig. This particular scam is especially egregious because 23 million Americans were jobless or underemployed last year and desperately needed these benefits.

The U.S. Department of Labors Inspector General estimated approximately $89 billion in unemployment compensation was lost in 2020 due to fraud.

IR-2021-163

Reporting On Original Tax Return

When you’re using an e-file application, you’ll be notified that you did not report your unemployment compensation, or that the amount you reported does not match our records. If you indicate that you didn’t have any compensation, the system will let you continue. However, your refund will be held up, and you’ll receive a letter requesting that you submit documentation to verify the correct amount.

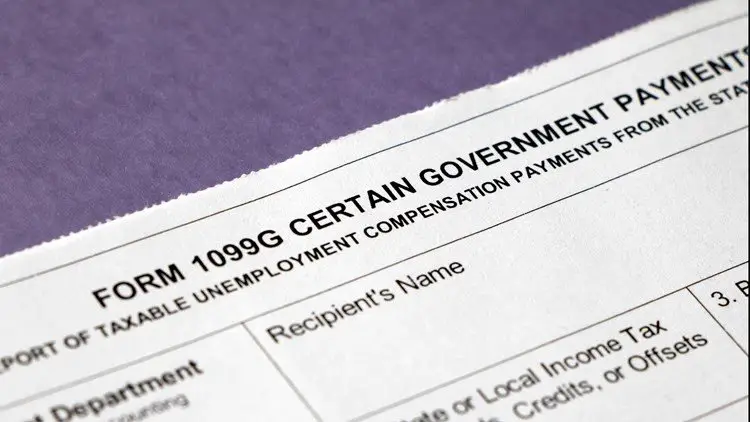

- A corrected Form 1099-G – Certain Government Payments

- Documents that can prove the correct benefits

Start Saving As Soon As Possible

If the bill isn’t too big, you may be able to simply save up enough money before the April 18 due date to pay the bill. The most efficient way of doing this is to set up a savings plan for yourself where you automatically put aside a small amount each week from your checking to your savings account.

Read Also: File For Unemployment In Tennessee

Email Notification For 1099

Sign up to receive an email alert when 1099-Gs are available online mid-January.

Please enter your email address below and indicate whether you would like to be added to or deleted from the 1099-G email notification list.

IMPORTANT: Logon to my.unemployment.wisconsin.gov to view or print your current or previous year 1099-G tax forms. The signup below is ONLY to request email notification in mid-January when 1099-Gs are available online.

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Also Check: How Long Does Unemployment Debit Card Take To Arrive

You May Like: Filing Unemployment In Tn

Tax Returns And Third Stimulus Payment

The bills mid-tax season passage may have caused a lot of confusion for unemployed taxpayers trying to determine the best time to file.

But the good news, says , senior fellow at the Urban-Brookings Tax Policy Center, is that you will receive the full amount youre owed, even if there is a delay.

For taxpayers whose stimulus eligibility was processed based on 2019 returns, at some point possibly later this year, but definitely when they file a tax return next year the IRS will bump up the money and send an additional amount or what they would have received based on 2020 income.

In other words, you may have to reconcile your payment using a similar claim to the Recovery Rebate Credit for the previous two stimulus payments.

Planning For 2021 Taxes If Youre Still Unemployed

The tax exemption for $10,200 in unemployment benefits currently only applies to unemployment income you collected in 2020, even though the bill also extended weekly $300 federal unemployment benefits payments through September.

You should consider any unemployment benefits you receive in 2021 as fully taxable. If you can afford to do so, avoid a surprise bill and penalties next tax season by electing to have taxes withheld from your weekly benefits payments or by paying quarterly estimated taxes throughout the year.

You can elect to have 10% of your unemployment benefits withheld from your weekly check. Even if you did not select this withholding on your original claim, you can file Form W-4V with your states unemployment office to begin 10% tax withholding on future unemployment payments.

You can also forgo automatic withholding and instead pay estimated quarterly taxes on your unemployment income. Use Form 1040-ES to figure and file your quarterly payments. If you choose to pay estimated taxes on your unemployment benefits, the first payment is due April 15, 2021.

You May Like: Myflorida Flccid

Unemployment Compensation Exclusion Worksheet Schedule 1 Line 8

Regulator To Review 11000 Vaccine Side Effects Complaints

The Finnish Medicines Agency Fimea is due to examine around 11,000 reports from people who claimed they had adverse effects from Covid vaccines.

In order to get through the complaints more quickly, the agency has doubled the number of staff members that deal with them, according to Fimeas Senior Medical Officer, Maija Kaukonen.

She noted that the reports were claims made by individuals and on their own do not imply a confirmed link between the vaccine and particular side effects.

Out of the thousands of side effect reports processed so far, 2,400 have been considered serious, including general vaccine-caused side effects like injection site pain, fever as well as muscle and joint pain. For example, if an individual has taken a few days of sick leave due to a fever, the harm may have been reported as serious, according to the agency.

Out of the reports there were also a total of 117 fatalities, but Fimea does not have the official capacity to determine whether the deaths were linked to the vaccine, as that is the job of attending physicians and sometimes forensic medical examiners, according to Kaukonen.

Read Also: Unemployment Tennessee Application

What To Do If You Owe Taxes On Unemployment Benefits

After going through these steps, you may find that you owe taxes to the IRS. If you do, don’t panic. You have options.

However, not paying that tax bill is not one of those options. You should make every effort to pay as much of your tax bill as possible. Not paying your tax bill means that you’ll immediately face additional penalties for late payment, as well as interest that accrues on your unpaid taxes. If you continue to not file your taxes, the IRS may seek legal remedy against you.

How Does Unemployment Affect My Taxes

Unemployment benefits are generally taxable. Most states do not withhold taxes from unemployment benefits voluntarily, but you can request they withhold taxes. If you are receiving unemployment benefits, check with your state about voluntary withholding to help cover your income taxes when you file your tax return. Make sure you include the full amount of benefits received, and any withholdings, on your tax return.

Read Also: How To Contact Unemployment Office

How Much Tax Is Taken Out Of Unemployment Compensation

If you collect unemployment benefits, you can choose whether or not to withhold federal taxes at a rate of 10%. Some states may allow you to withhold 5%. If you do not have taxes taken out of your unemployment checks, you may have to pay quarterly estimated payments or pay taxes when you file your annual tax return. Either way, your unemployment income is considered taxable income just like any other wages or salaries you receive.

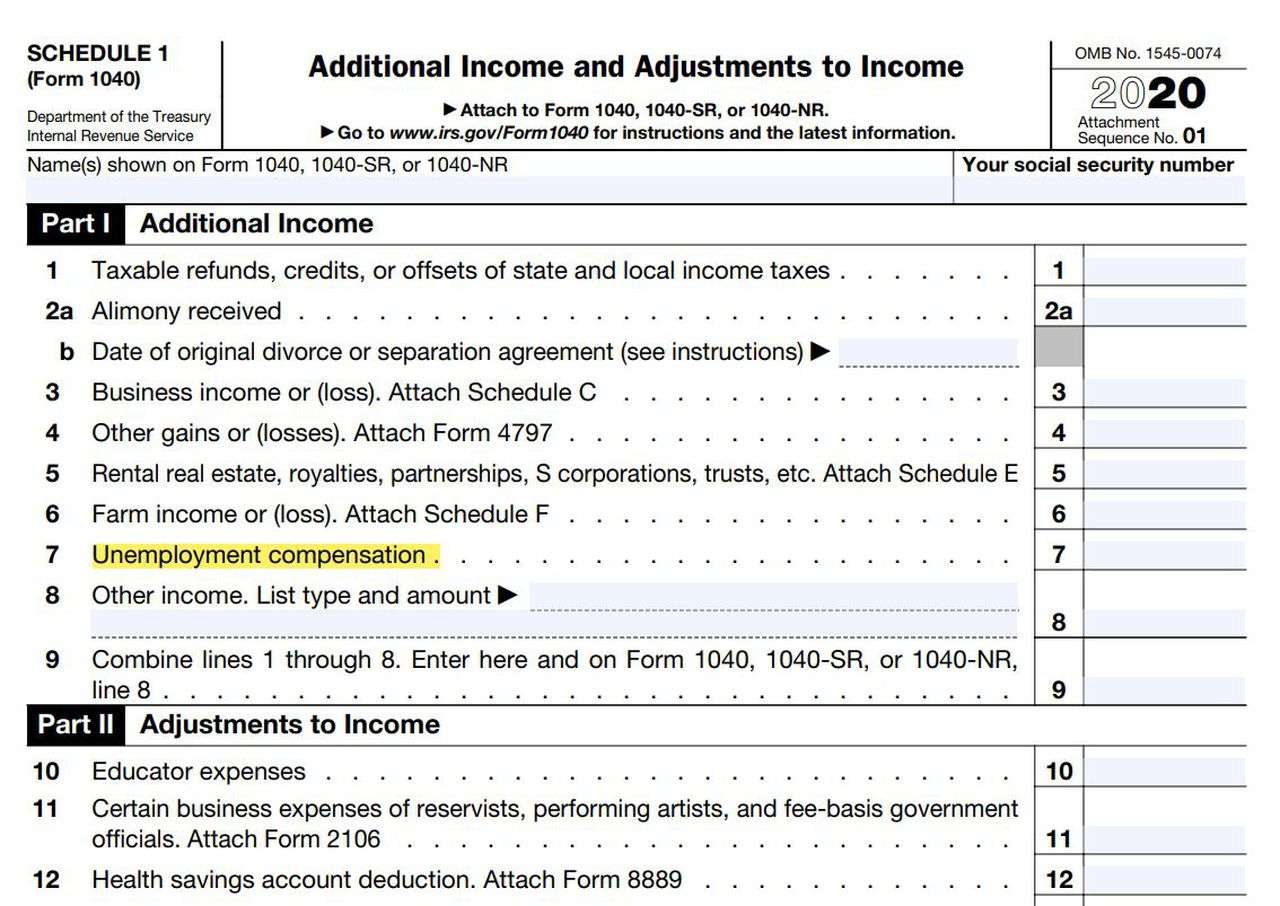

Reporting Unemployment Benefits On Your Tax Return

You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The amount will be carried to the main Form 1040. Remember to keep all of your forms, including any 1099-G form you receive, with your tax records.

If you use TurboTax to file your taxes, well ask about your unemployment income and put the information in all the right tax forms for you.

TurboTax is here to help with our Unemployment Benefits Center. Learn more about unemployment benefits, insurance, eligibility and get your tax and financial questions answered.

You May Like: Can You Overdraft Reliacard

State Income Taxes On Unemployment Benefits

It may not be just the IRS you have to worry about. Many states tax unemployment benefits, too. There are several that do not, though California, Montana, New Jersey, Pennsylvania, and Virginia do not charge taxes on unemployment benefits. Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Eight states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

How Do You Claim Unemployment Benefits

Navigating unemployment can be confusing and frustrating at any time. With the recent changes from the CARES Act and other legislation, you may be even more unsure about eligibility and how to claim unemployment benefits.

This post will outline the normal rules for eligibility for unemployment benefits. Well also cover how to apply and how to file unemployment income on your taxes.

Looking for details on the latest coronavirus unemployment relief? Visit our coronavirus resource center.

Have other tax-related unemployment questions? Be sure to visit our Unemployment Resource Center.

Recommended Reading: Www Njuifile Net Espanol

These Are The States That Will Either Mail Or Electronically Deliver Your Form 1099

California

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at and select 1099G at the top of the menu bar on the home page.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by: logging into your account at selecting 1099G at the top of the menu bar > View next to the desired year > Print or Request Paper Copy.

You can also request a paper copy by calling 1-866-333-4606.

Florida

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at myflorida.com and go to My 1099-G & 49Ts in the main menu.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed at 1099grequest.myflorida.com.

Illinois

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at ides.illinois.gov. Illinois Department of Employment Security will send an email notification with instructions to access the document from the Illinois Department of Employment Security website.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by calling 338-4337.

Indiana

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at in.gov. You will find your Form 1099-G on your Correspondence page.

If you opted into electronic delivery:

Michigan

Mississippi

Utah

State Unemployment Insurance Rates

State Unemployment Insurance rates are assigned to businesses by their state tax agencies. Rates are determined by many different factors such as how many former employees receive unemployment benefits and the business industry. New employers are generally assigned the states new business rate.

At the end of the year, state agencies send out rate notices with updated SUI rates for the upcoming year, while some states, such as New Jersey, Vermont, and Tennessee, update their rates in the third quarter. This information may need to be updated in Square Payroll.

Recommended Reading: Tennessee Unemployment Requirements

How To File Your Taxes If You Received Unemployment Benefits In 2021

If you received unemployment benefits, you’ll owe income taxes on those benefits.

When tax season approaches, many Americans will face the prospect of filing their income taxes. For millions of people, this will include their unemployment benefits.

Knowing how to file correctly will help you avoid a lot of trouble with the IRS. Let’s take a look.

Thl Again Reports Glitch In Daily Infection Data

The Finnish Institute for Health and Welfare again experienced a technical problem in reporting the correct number of new coronavirus infections in Finland on Saturday.

Aleksi Yrttiaho, the THLs Director of Information Management, told the Finnish News Agency STT that the correct information would be published on Sunday or Monday.

According to Yrttiaho, the situation is similar to last weekend. The number of new infections reported last Saturday was incorrectly low due to a delay in calculations by the THL system.

Similar glitches occurred on other weekends this past summer, after the institute halted some IT support services on weekends.

On Thursday the THL said that hospitalisation and vaccination rates were more relevant metrics than daily cases at this stage of the pandemic.

As of Friday there were 94 patients in hospital nationwide, 22 of them in intensive care â those numbers largely unchanged over the past month.

The THL said on Saturday afternoon that 63.3 percent of the population aged 12 and over are fully vaccinated, while 82.7 percent have received at least one jab.

The governmentâs aim is to lift restrictions when at least 80 percent of those aged 12 and over have received two vaccination doses â or have been given the opportunity to take both doses.

Also Check: Maximum Unemployment Benefits Mn

Will I Owe Taxes Because Of My Unemployment Compensation

- Generally, states dont withhold taxes on unemployment benefits unless asked.

- However, if you qualify for EITC, or the child tax credits, your taxes could be covered.

- You can do a year-end tax checkup to see if you have enough credits and withholding to cover your taxes. You may still have time to make adjustments to lower your shortfall.

- If you are still unemployed come 2021 tax time, you can set up a payment plan with the IRS or work out other delayed payment options.

- The IRS assesses penalties on the balance owed when you file and when you pay late they also compound interest on the full bill daily. The IRS has programs that may forgive your tax penalties. If you qualify, this will also help reduce your interest and lower your overall tax bill.

- Make sure you file your tax return on-time, even if you cant pay. In the short-term, the penalties for filing late are higher than the penalties for paying late.

Talk To The Irs And Set Up A Payment Plan

If the amount seems impossible for you to cover, contact the IRS directly. Despite its reputation, the IRS actually works with individual taxpayers who are having difficulty paying their taxes. It offers extensions, waive fees, and sometimes even compromise in difficult situations.

Start by calling the IRS at 18008291040. Try to avoid doing this too close to the filing deadline of April 18, as the IRS tends to get very busy around that date. Call as early as possible. Discuss your situation with them and ask what options are available.

You May Like: Njuifile.net 1099

How To Claim Pua Tax Exemption Of Up To $10200 Of Unemployment Compensation

If you received pandemic unemployment benefits and are getting ready to file your 2020 taxes, heres a guide from the Guam Department of Labor in partnership with the Department of Revenue and Taxation on how to report your relief benefits which is taxable income.

A new law allows most individuals to be exempt from paying taxes on the first $10,200 received in the various federal disaster aid programs including the $345 a week from Pandemic Unemployment Assistance and the additional weekly $600 of Federal Pandemic Unemployment Compensation and the extra $300 a week through the Lost Wages Assistance program.

If you are married, each spouse claiming unemployment benefits will receive the same exemption on taxes up to $10,200.

Im happy to work with the Department of Labor to get this information out to as many people as possible. This rule came about with the implementation of the American Rescue Plan in March and its imperative that our tax filers understand what this means for them, said DRT Director Dafne Shimizu.

Do not call the Department of Labors 311 information line regarding the exemption. Please see the instructions below.

How to claim the exclusion

The tax exclusion will be reported separately from your unemployment compensation on a Schedule 1 form titled: Additional Income and Adjustments to Income. There are two lines to pay attention to on this form.

What if I already filed my 2020 Individual Income Tax Return?