Where Do I Find My 1099

Faq: Paying Federal Income Tax On Your Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes.

For important information on the 2020 tax year, click here.

Below are answers to frequently asked questions about benefit payments and taxes.

I received a 1099-G but did not receive Unemployment Insurance compensation payments in 2020. What does this mean?

If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2020, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

What if the amounts on my 1099-G form are not correct?

Please note: Your 1099-G reflects the total amount paid to you in 2020, regardless of the week that payment represents.

Meaning, if you were paid in 2020 for weeks of unemployment benefits from 2019, those will appear on your 1099-G for 2020. Similarly, if you were paid for 2020 weeks in 2021, those will not be on your 1099-G for 2020 they will appear on your 1099-G for 2021.

If you were overpaid benefits, your 1099-G will still reflect, per federal law, the amount of funds paid to you, regardless of any funds you have returned. Please refer to the section titled Repayments in the IRS Publication 525 Taxable and Nontaxable Income for guidance on how to report overpayments/returned funds.

How can I find out the balance of my Unemployment Insurance claim, and the year-to-date taxes withheld?

How To Calculate Futa

Only the first $7,000 of payments to any employee in a calendar year is subject to FUTA tax (after deducting To calculate your FUTA tax liability for each payroll, follow this process:

Begin with the FUTA taxable wages for a pay period , plus:

- Most fringe benefits, including wages and salaries, commissions, fees, bonuses, vacation allowances, sick pay, and the value of goods, lodging, food, and other non-cash benefits, and

- Employer contributions to employee retirement plans, and

- Other specific payments, as noted above.

From this amount, deduct:

- All payments that are exempt from FUTA tax and

- All amounts for each employee over $7,000 for the year.

You will need this total for all employees for the FUTA report on Form 940.

Then, take the total amount up to $7,000 for all employees and multiply it by 0.6% to get the amount of unemployment tax due.

Set aside this amount in a liability account .

Recommended Reading: Pa Unemployment Ticket Number Tracker

Reporting Unemployment Benefits At The State And Local Level

If your state, county, or city collects income tax on your unemployment benefits, keep your Form 1099-G for reference. You may have to attach it to your state, county, or local income tax return. If so, keep a copy for yourself.

Check with your states Department of Revenue and relevant county and local government tax agency for instructions on how to report your unemployment benefits at the state and local level.

Ei Benefits Are Taxable Income

Whether its due to the arrival of a baby, seasonal work changes, or layoffs, many Canadians will at some time in their life claim Employment Insurance . EI payments are taxable income, and as such, they affect your taxes just like any other type of income, and in some cases, you may have to repay these benefits.

Also Check: Va Unemployability Process

Can I Cash Out My 401k If I Get Laid Off

Heres what you can do with a 401 if you are laid off: Leave the money in your 401 if you have more than $5,000. Move the funds into an individual retirement account or 401 plan at a new job. Withdraw the funds and face potential penalties.

Do I Have To File Taxes If I Only Received Unemployment

Unemployment compensation is considered taxable income by the IRS and must be reported on your federal tax return. Each individual who gets unemployment benefits during the year receives an IRS Form 1099âG from the state unemployment division.

Expenses are paid by you. For example, if you got $10,000 in public assistance and paid $7,000 out of pocket, you are not considered the head of the home.

About Article Author

Raymond Morison is a creative and strategic thinker who loves to help others succeed. He has an undergraduate degree from Boston College and master’s from MIT in Media Arts and Sciences. Raymond’s interests include technology, entrepreneurship, and design.

Tags

You May Like: Www.njuifile.net Online

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 15, 2021.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

Dependent Care And Child Tax Credits

If you have children, you may qualify for the child tax credit, which is $2,000 per qualifying child. And if your child tax credit amount exceeds your tax obligation for the year, you may be able to claim the Additional Child Tax Credit of $1,400 per qualifying child.

If you had to pay someone to watch your child or other dependent while you looked for work, you may also be able to claim the nonrefundable child and dependent care tax credit. For 2019 taxes, the amount of credit is between 20% and 35% of allowable expenses, which maxes out at $3,000 for one qualifying person or dependent, or $6,000 for two or more qualifying persons or dependents.

The percentage is based on your adjusted gross income, and you must have earned income in order to claim the credit. This means that if your only source of income in a year was unearned from unemployment benefits, for example you would not be eligible to claim this credit.

You May Like: Apply Louisiana Unemployment

What If I Did Not Receive A Confirmation Email By The Agency After I Filed My Report For Fraud

The agency suggests that you should submit the Identity Theft request again at the following link:

Saving the confirmation that you have submitted a request for Identity Theft and other report for fraud is important. Proof of these requests and reports can be helpful for tax purposes.

Other ways to report fraud:

- You may file a report with your local law enforcement agency.

- You can fill out the Office of Inspector Generals online Allegation Form, available at .

- Confirmation of a filed identity theft complaint with the Federal Trade Commission can be found at . You will want to share that a person has used your personal information to receive public benefits.

If You Included Your Unemployment Income Already The Irs Wont Require You To File An Amended Tax Return In Most Cases

Since we are in the middle of tax season, you may have already filed and claimed your full unemployment benefits on your tax return.

According to the IRS, more than 23 million Americans filed for unemployment last year. On March 31, the IRS announced taxpayers who have already filed would not have to resubmit their tax returns in most cases the IRS will adjust qualifying returns automatically in two phases.

The IRS will start with single taxpayers who qualify for the tax break and then process taxpayers who filed jointly. It estimates that taxpayers will begin to receive tax refunds as early as May, and the agency will continue to process refunds through the summer. If you owe taxes, the IRS will apply any adjustment to outstanding taxes due.

However, if you expect your tax return adjustment makes you eligible for a tax credit or an increase of a tax credit previously claimed, you will need to file an amended tax return to claim the credit.

For example, lets say, for instance, you qualify for the Earned Income Tax Credit . However, because of the unemployment tax break, your income has changed and you may now be eligible for a higher credit. In this instance, the IRS requests you to file an amended tax return to claim the increase or any other credit you may now be entitled to due to the reduction of income.

Also Check: Njuifile Net Direct Deposit

Income Tax 1099g Information

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Maryland Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year. This may be different from the week of unemployment for which the benefits were paid.

1099-Gs are required by law to be mailed by January 31st for the prior calendar year. By January 31, 2021, the Division will deliver the 1099-G for Calendar Year 2020. By January 31, 2021, the Division will send the 1099-G for Calendar Year 2020.

1099-Gs are not available until mid-January 2021. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G may NOT be forwarded by the United States Postal Service. The BPC unit cannot update your mailing address. You must update your mailing address by updating your personal information in the BEACON portal, on the Maryland Unemployment Insurance for Claimants mobile app, or by contacting a Claims Agent at 667-207-6520.

If you wish to request a duplicate 1099-G for prior years, send your request to the Maryland Department of Labor – Benefit Payment Control Unit at .

What is the Payer’s Federal Identification number? The the Maryland Department of Labor Federal ID # is: 52-2006962.

Earned Income Tax Credit

The earned income tax credit, or EITC, is a federal income tax credit for working people with low to moderate income. If you earned money through wages or self-employment work before losing your job, you might qualify for this credit in the tax year in which you had eligible income.

But unemployment benefits dont count as earned income for the purpose of the EITC, so if you didnt have any earned income in the tax year, you wont be able to claim this credit. Eligibility also depends on other factors, including your filing status, the number of qualifying children you can claim, and the amount of your earned income.

The credit is refundable, meaning that, in addition to reducing the amount you owe, it could give you a refund over the amount of tax you paid in.

Recommended Reading: Bankofamerica.com Kdol Debit Card

State Income Taxes On Unemployment Benefits

It may not be just the IRS you have to worry about. Many states tax unemployment benefits, too. There are several that do not, though California, Montana, New Jersey, Pennsylvania, and Virginia do not charge taxes on unemployment benefits. Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Eight states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

- Disability Insurance benefits received as a substitute for UI benefits

- Disaster Unemployment Assistance benefits

- Paid Family Leave benefits

Form 1099-G also reports any amount of federal and state income tax withheld.

You May Like: Tn Unemployment Application

Exceptions To Ei Repayment Requirements

In some cases, you may earn above the threshold and still not be required to repay any of your benefits. Most significantly, if you have not earned any EI income during the 10 previous years, you do not have to repay any of your benefits. For example, if you report EI payments for the 2020 tax year and have not reported EI payments for any of the 10 previous years, you do not have to repay any of your EI payments, regardless of how high your income.

However, if you reported EI payments in any year between 2009 and 2019, as well as 2020, you are required to repay a portion of your benefits if your net income exceeds the threshold.

How Taxes On Unemployment Benefits Work

You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for unemployment income you received in 2021. The full amount of your benefits should appear in box 1 of the form. The IRS will receive a copy of your Form 1099-G as well, so it will know how much you received. You dont have to include the form when you file your return.

Unemployment benefits arent subject to Medicare or Social Security taxes, only to income tax. This may help reduce your overall tax burden in the year you claim them.

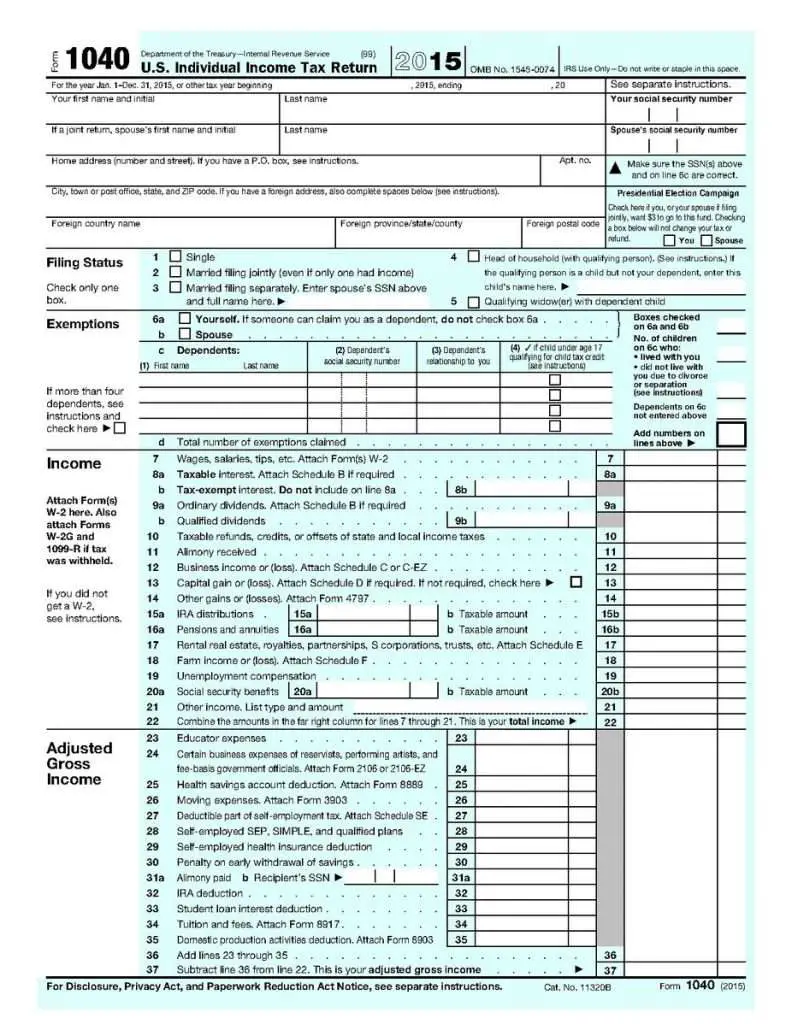

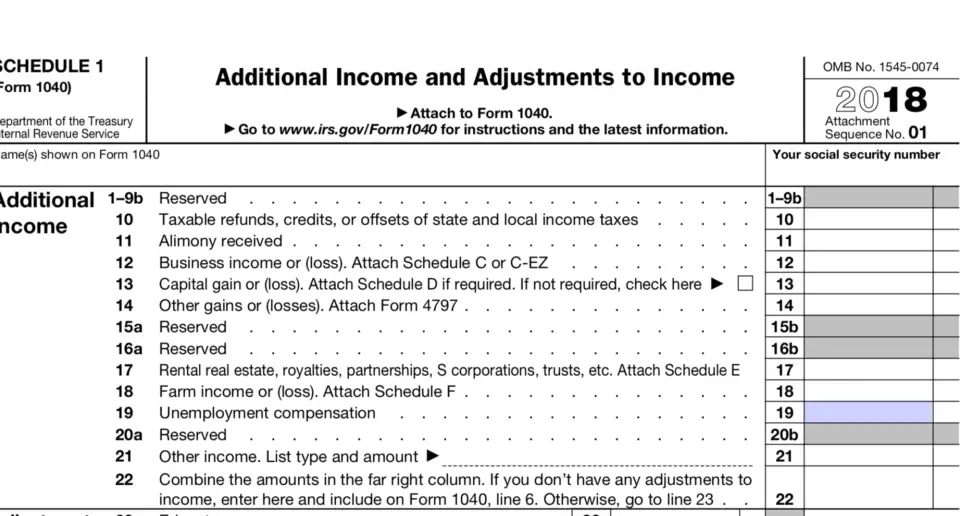

When youre ready to file your tax return for 2021, write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1, Additional Income, and Adjustments to Income. You must file Schedule 1 with your Form 1040 or 1040-SR tax return. Line 7 is clearly labeled, Unemployment compensation. The total amount from the Additional Income section of Schedule 1 is then entered on line 8 of your tax return.

You must report your unemployment benefits on your tax return even if you dont receive a Form 1099-G. Go to your states website if you didn’t receive one and think you should havesome states may not mail out paper versions of the form. The form is usually available electronically, but you can also call your state unemployment office.

If you receive a Form 1099-G but did not collect unemployment benefits in 2021, report it to the paying authority as soon as possible.

Also Check: Www.njuifile.net Direct Deposit

Irs: Unemployment Compensation Is Taxable Have Tax Withheld Now And Avoid A Tax

IR-2020-185, August 18, 2020

WASHINGTON With millions of Americans now receiving taxable unemployment compensation, many of them for the first time, the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year.

Withholding is voluntary. Federal law allows any recipient to choose to have a flat 10% withheld from their benefits to cover part or all of their tax liability. To do that, fill out Form W-4V, Voluntary Withholding Request PDF, and give it to the agency paying the benefits. Don’t send it to the IRS. If the payor has its own withholding request form, use it instead.

If a recipient doesn’t choose withholding, or if withholding is not enough, they can make quarterly estimated tax payments instead. The payment for the first two quarters of 2020 was due on July 15. Third and fourth quarter payments are due on September 15, 2020, and January 15, 2021, respectively. For more information, including some helpful worksheets, see Form 1040-ES and Publication 505, available on IRS.gov.

Repayment Of Employment Benefits

- For the 2020 tax year, if you received EI payments and your net income was greater than $67,750, the Canada Revenue Agency requires you to repay 30 percent of your net income over the threshold.

- However, if that amount exceeds the total amount of benefits you earned, you only need to repay the amount of benefits you received.

For example:

- If your net income was $77,750 in 2020 and you resceived EI benefits that year, you earned $10,000 over the threshold. As a result, you must repay $3,000, or 30% of $10,000.

- But if you only received $2,000 in benefits, you would only repay $2,000.

Recommended Reading: Oklahoma Unemployment Apply

Can I Still Withdraw From My 401k Without Penalty In 2021

Although the initial provision for penalty-free 401k withdrawals expired at the end of 2020, the Consolidated Appropriations Act, 2021 provided a similar withdrawal exemption, allowing eligible individuals to take a qualified disaster distribution of up to $100,000 without being subject to the 10% penalty that would

Reporting Your Unemployment Benefits On Your 2020 Tax Return

Posted on:

The information provided on this post does not, and is not intended to, represent legal advice. All information available on this site is for general informational purposes only. If you need legal help, you should contact a lawyer. You may be eligible for our free legal services and can apply by calling our Covid Legal Hotline at 1-844-244-7871 or applying onlinehere.

Read Also: Njuifile.net Sign In