File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How Do I Know If The Amount Listed On My 1099

If you have access to your HIRE account, you may want to look at your Claim Summary page to see the benefits you have been paid out throughout the weeks you have filed. Both your weekly benefit amount and your additional Loss Wage Assistance, , and Federal Pandemic Unemployment Compensation, , are counted as benefits paid to you.

However, this option may not be helpful if you have received benefits under several unemployment programs in 2020. This is because Claimants often have their claim summary page refreshed, for example, when filing a new claim for an extension of benefits or consideration of another benefit program.

You May Like: What Is The Deadline To File Your Taxes

The Federal American Rescue Plan Act Of 2021 Includes A Provision That Allows Individuals To Exclude Up To $10200 Of Unemployment Compensation From Federal Tax Does This Exclusion Also Apply To New York State Tax

No. Under longstanding New York State law, unemployment compensation is subject to tax, which means you should report the full amount of unemployment compensation on your New York State personal income tax return. If you exclude unemployment compensation on your federal return, as allowed under the American Rescue Plan Act of 2021, you must add back the excluded unemployment compensation on your New York State return.

Form IT-558, New York State Adjustments due to Decoupling from the IRC, has been updated to report this add-back as adjustment code A-011. See Personal income tax up-to-date information for 2020 .

If you have not yet filed your 2020 New York State return, and file using software, the software should already account for this update and add back the unemployment compensation excluded from federal gross income. If you do not file using software, make sure to add back the federal unemployment compensation exclusion. If you already filed your 2020 New York State return, and you did not add back unemployment compensation that was excluded from your federal gross income, then you must file an amended return with New York State. If you did not exclude unemployment compensation from your federal gross income, do not file an amended return with New York State.

Recommended Reading: Make Money Unemployed

Also Check: I Collected Unemployment What Do I Need For Taxes

Computing Your State Unemployment Tax Liability

Calculating what you owe in state unemployment taxes is simply a matter of multiplying the wages you pay each of your employees by your tax rate. However, every state limits the tax you must pay with respect to any one employee by specifying a maximum wage amount to which the tax applies. Once an employees wages for the calendar year exceed that maximum amount, your state tax liability with respect to that employee ends.

State unemployment tax rates are individually assigned to each employer each year, and every state uses an experience-rating system of some kind to determine an employers applicable tax rate for the year. Although these systems vary in how theyre actually administered, they share the goal of assigning lower tax rates to employers whose workers suffer the least involuntary unemployment and higher rates to employers whose workers suffer the most involuntary unemployment.

What if youre new to the system because youve only recently hired your first employees? Youll pay tax at a fixed rate until youve contributed to the states unemployment compensation program for a specified period of time and established experience with your employees and unemployment.

Work smart

Keeping the number of unemployment insurance claims filed by former employees to a minimum can produce significant payroll tax savings. For example, in all states the most favorable unemployment tax rates are 1 percent or less.

Also Check: When Does The 300 Unemployment Start

How Are Unemployment Benefits Taxed

Unemployment benefits are designed to replace a portion of your regular wages. As such, the IRS treats them like any other wages and taxes them at your ordinary income tax rate.

Whether youll actually owe taxes on unemployment benefits, and the rate youll pay, depends on your overall tax situation and tax bracket.

The state that paid your unemployment benefits should send you a Form 1099-G showing how much unemployment income you received and how much taxes it withheld.

Don’t Miss: Can I Get Unemployment If I Was Fired For Misconduct

Are Taxes On Unemployment Being Waived

Partially. President Joe Biden signed a massive relief bill into law on March 11 that allows the first $10,200 in unemployment benefits collected in 2020 to be excluded from gross income. That means theyre income-tax free. People who earned up to $150,000 are eligible.

The tax relief does not apply to benefits collected in 2021.

Make A Voluntary Payment

An employer may, at any time, make a payment to its experience rating account in excess of the required amount referred to in Section 19 of the Michigan Employment Security Act. This payment is called a Voluntary Payment.

An employer has 30 days from the mail date of Form UIA 1771, Tax Rate Determination for Calendar Year 20XX, or up to 120 days from the beginning of the calendar year, whichever comes first, to submit a voluntary payment to reduce the current year’s tax rate. Any voluntary payment received outside of this time period will be included in the calculation of the next calendar year’s tax rate. Once a voluntary payment is submitted and accepted by UIA, it is irrevocable . UIA provides an online voluntary payment worksheet which helps employers determine if making a voluntary payment will reduce their tax rate.

A voluntary payment can be paid online by selecting the Operate a Business option from the Michigan Business One Stop web site and selecting the task UIA Voluntary Payment. Selecting this task will link you to the online services offered by UIA through the Michigan Web Account Manager .

Once on the Welcome page for MiWAM, select the account id. From the Tax Account Information page on the left hand navigation bar, under I Want To’ select Voluntary Payment Worksheet. To a voluntary payment, select the Account Services tab and Voluntary Payment.

Voluntary payments can be mailed to:

Unemployment Insurance Agency

PO Box 33598

Detroit, Michigan 48232-5598

Read Also: When Will I Receive My Unemployment Tax Refund

Irs To Automatically Issue Refunds On Tax

In good news for many taxpayers, the IRS said that, beginning in May and continuing through the summer, it will automatically issue refunds to eligible people who already filed a tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan Act, P.L. 117-2 . Under this process, eligible taxpayers will not have to file amended returns to receive a refund.

The American Rescue Plan Act, enacted on March 11, allows taxpayers with modified adjusted gross income of less than $150,000 on their tax return to exclude unemployment compensation up to $20,400 if married filing jointly if both spouses received unemployment benefits and $10,200 for all others, but only for 2020 unemployment benefits.

The IRS explained that, according to the Bureau of Labor Statistics, over 23 million U.S. workers nationwide filed for unemployment last year and some self-employed workers qualified for benefits for the first time. The IRS said it is trying to determine how many workers affected by the tax change already have filed their tax returns.

The IRS explained that for those taxpayers who already have filed and figured their tax based on the full amount of unemployment compensation, it will determine the correct tax amount of unemployment compensation and tax generally. Any resulting overpayment of tax will be either refunded or applied to other outstanding taxes owed.

Sally P. Schreiber, J.D., is a JofA senior editor.

What To Know About The Unemployment Tax Break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds have averaged more than $1,600.

However, not everyone will receive a refund. The IRS can seize the refund to cover a past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.

As the IRS continues issuing refunds, they will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as IRS TREAS 310 TAXREF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.

You May Like: How To Start Getting Unemployment

Employer Liability For Unemployment Taxes

In order to fund unemployment compensation benefit programs, employers are subject to federal and state unemployment taxes depending on several factors. These factors include the sums employers pay their employees, the unemployment claims filed against the business, and the type & age of the business.

Employers must pay federal and state unemployment taxes so as to fund the unemployment tax system. Unemployment compensation is intended to pay benefits to workers when they are laid off through no fault of their own.

Are Disability Insurance Benefits Taxable

In most cases, Disability Insurance benefits are not taxable. However, if you are receiving unemployment benefits, then become ill or injured and begin receiving DI benefits, the DI benefits are considered a substitute for unemployment benefits, which are taxable.

If DI benefits are taxable, you will receive a notice with your first benefit payment. You will receive a Form 1099G for your federal return only. You can access your Form 1099G information in your UI Online account.

If you received unemployment benefits before filing a claim for DI benefits and did not receive a Form 1099G, contact the 1099G Service Line at 1-866-401-2849, Monday through Friday, from 8 a.m. to 5 p.m. except on state holidays.

If you have more questions, you can contact the IRS at 1-800-829-1040. TTY: 1-800-829-4059.

Don’t Miss: Same Day Loans For Unemployed

Unemployment Tax Break 2021

The Internal Revenue Service allows taxpayers to waive up to $10,200 earned through unemployment compensation. Most taxpayers can benefit from this tax break. The income limit for this tax break is $150,000 which applies to all taxpayers regardless of their filing status. Whether you file taxes as single, married filing jointly, or head of household, your income must be less than $150,000. If you make a single dollar above this limit, you wont get this tax break.

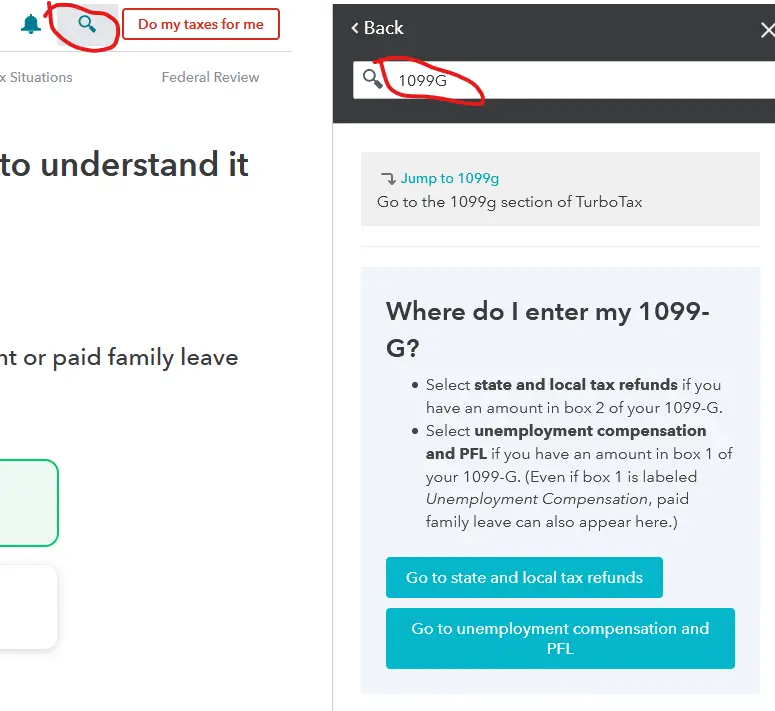

Here is how to claim the unemployment tax waiver.

Fill out Schedule 1 like you normally would and report the unemployment compensation earned during 2020. You can then use the Unemployment Compensation Exclusion Worksheet to figure out the amount youre eligible to waive from taxable income. This will enable you to waive the majority of your unemployment compensation.

Although most taxpayers are eligible for the unemployment tax waiver, you might have already filed taxes as the news on this came out a bit late with the American Rescue Plan. If youve already filed taxes, you need to amend your 2020 tax return. This will enable you to waive off the unemployment compensation and you wont pay taxes on up to $10,200 received in unemployment. This tax waiver will enable you to keep up to the designated amount if your AGI is less than $150,000.

Irs: Unemployment Compensation Is Taxable Have Tax Withheld Now And Avoid A Tax

IR-2020-185, August 18, 2020

WASHINGTON With millions of Americans now receiving taxable unemployment compensation, many of them for the first time, the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year.

Withholding is voluntary. Federal law allows any recipient to choose to have a flat 10% withheld from their benefits to cover part or all of their tax liability. To do that, fill out Form W-4V, Voluntary Withholding RequestPDF, and give it to the agency paying the benefits. Don’t send it to the IRS. If the payor has its own withholding request form, use it instead.

If a recipient doesn’t choose withholding, or if withholding is not enough, they can make quarterly estimated tax payments instead. The payment for the first two quarters of 2020 was due on July 15. Third and fourth quarter payments are due on September 15, 2020, and January 15, 2021, respectively. For more information, including some helpful worksheets, see Form 1040-ES and Publication 505, available on IRS.gov.

Don’t Miss: What Is Considered Misconduct For Unemployment In California

Request A Corrected 1099

If your 1099-G has an incorrect amount in total payment or tax withheld, you can request a revised form.To request a corrected form: Complete Form UIA 1920, Request to Correct Form 1099-G, and submit it to UIA. Mail completed forms to: Unemployment Insurance Agency, 1099-G, P.O. Box 169, Grand Rapids, MI 49501-0169.

Other Factors Youll Need To Consider:

I am collecting unemployment will that impact my income tax?

- Unemployment benefits are taxable.

- Unemployment compensation is not considered earned income for the Earned Income Tax Credit , childcare credit, and the Additional Child Tax Credit calculations and can reduce the amount of credits you may have traditionally received.

Don’t Miss: Can You Claim Unemployment If You Quit

Already Filed A Tax Year 2020 Tax Return

In most cases, if you already filed a 2020 tax return that includes the full amount of your unemployment compensation, the IRS will automatically determine the correct taxable amount of unemployment compensation and the correct tax. If you paid more than the correct tax amount, the IRS will either refund the overpayment or apply it to other outstanding taxes owed or other debts. The IRS began performing the corrections starting in May 2021 and continues to review tax year 2020 returns and process corrections to issue any applicable refund that is due. If the exclusion of unemployment compensation now qualifies you for deductions or credits not claimed on your original return, you should file an amended return. For example, if you did not claim the Earned Income Tax Credit on your originally filed return because your AGI was too high, and the special exclusion allowed for unemployment compensation received in tax year 2020 reduced your AGI, you should file an amended return to claim the EITC if now eligible.

Exception: If you have qualifying children and received a CP08 or CP09 notice stating you may be eligible for the Additional Child Tax Credit or Earned Income Tax Credit, you do not need to file an amended return. Instead, you can simply respond to the notice if you are eligible for the credit.

See Topic D: Amended Return for more information on filing amended returns and additional exceptions to the amended return requirement.

How To Prepare For Your 2021 Tax Bill

You can have income tax withheld from your unemployment benefits, so you dont have to pay it all at once when you file your tax returnbut it wont happen automatically. You must complete and submit Form W-4V to the authority paying your benefits. Withheld amounts appear in box 4 of your Form 1099-G.

You can have federal taxes withheld from your benefits, but it is limited to 10% of each payment. This may not be enough to adequately cover taxes on the benefits you received. If youve returned to work, you can opt to have extra tax withheld from your paychecks through the end of the year to help cover taxes owed on your unemployment benefits as well as your regular pay.

Your other option is to make advance estimated quarterly payments of any tax you think you might owe on your benefits. You have until Jan. 15 to make estimated tax payments on any benefits you receive between September and December of the prior tax year. In fact, you must do so if sufficient tax wasnt withheld from your unemployment benefit payments. You could be charged a tax penalty if you dont pay as you go through either additional withholding or estimated payments during the tax year.

Also Check: How Is Your Social Security Retirement Benefit Calculated

Don’t Miss: Can I Get Medi-cal While On Unemployment