Taxes On Unemployment Benefits

All benefits are considered gross income for federal income tax purposes. This includes benefits paid under the federal CARES Act, Federal Pandemic Unemployment Compensation , state Extended Benefits , Trade Adjustment Assistance , Pandemic Unemployment Assistance , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance . DES reports these benefits to the Internal Revenue Service for the calendar year in which the benefits were paid.

You may choose to have federal income tax withheld from your unemployment benefit payments at the rate of 10% of your gross weekly benefit rate , plus the allowance for dependents .

The amount deducted for state income tax will be 10% of the amount deducted for federal taxes, which is currently calculated as 1% of the gross weekly benefit amount. Please Note: State income tax cannot be withheld from the $300 additional weekly benefit in Lost Wages Assistance and the $600 additional weekly FPUC benefit for regular UI claims. Claimants who received FPUC and/or LWA in regular UI will be responsible for paying any tax due on those amounts when filing state income taxes for calendar year 2020.

After selecting your tax withholding on the initial Unemployment Insurance application, you can change your withholding preferences by completing the Voluntary Election for Federal/State Income Tax Withholding form . After completing the form, submit it to DES by mail or fax.

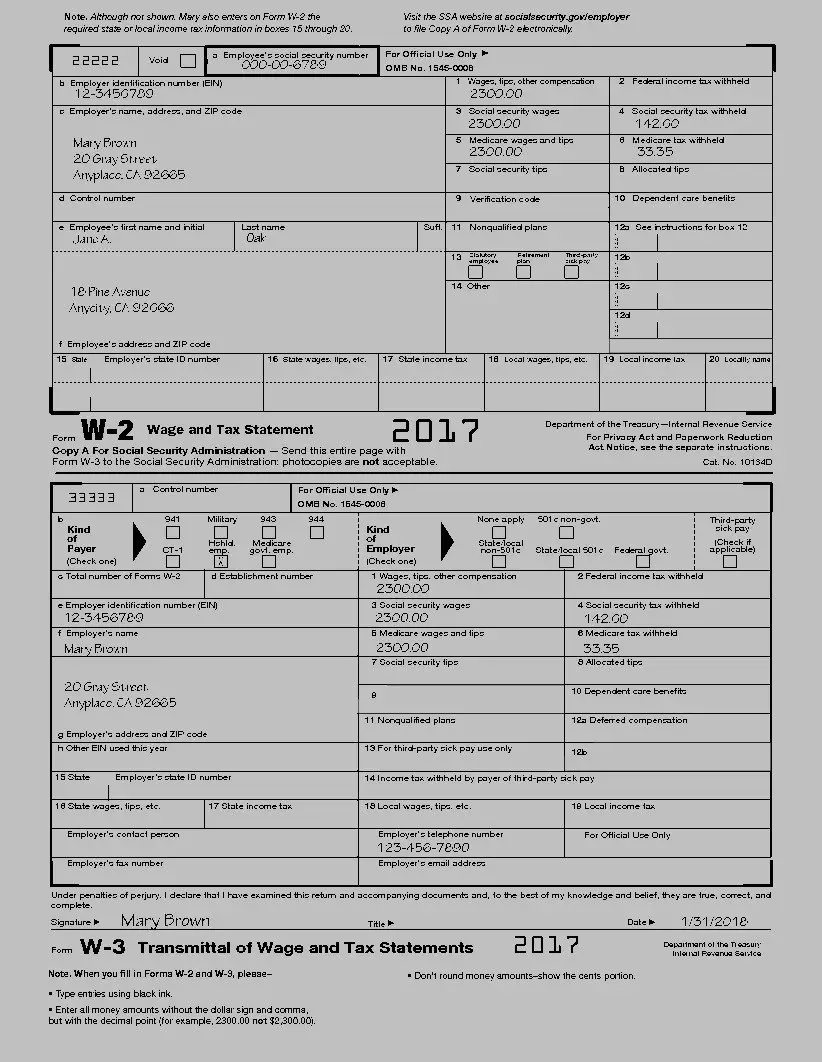

What To Do If You Cant Find Your W 2 Form

The W 2 form is usually mailed to you or made accessible online by the company you work for. If the form is lost, missing, or you cant find it online, contact your employer immediately. Its a good idea to call the IRS if you dont receive the W2 by mid-February.

In the worst-case scenario, you can fill out Form 4852 and attach it to your tax return. The substitute wage and tax statement allows you to input the same details. A tax extension is another possibility and buys you more time.

Your best bet is to file on time. If the W 2 arrives later, and the information is different from your estimates provided, Form 1040X can be filled out to correct any discrepancies, and amend the previous years tax return.

Look Up Your 1099g/1099int

To look up your 1099G/INT, you’ll need your adjusted gross income from your most recently filed Virginia income tax return .

Please note: This 1099-G does not include any information on unemployment benefits received last year. If you’re looking for your unemployment information, please visit the VEC’s website.

Note: We will not mail paper 1099G/1099INT forms to taxpayers who chose to receive them electronically unless we receive a request for paper copies of these forms from the taxpayer. We will automatically mail paper forms to taxpayers who did not opt to receive them electronically.

Recommended Reading: How Do I Sign Up For Unemployment In Nc

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 15, 2021.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

Read Also: How Much Does Health Insurance Cost If You Are Unemployed

What If I Believe The Information On My Form Is Incorrect

Please know that we are aware of a mailing and printing processing issue that will impact the delivery and mailing of 1099-G information. Further updates will be provided at

Information for victims of unemployment fraud

In 2020, an international crime ring used previously stolen personal information to fraudulently claim unemployment benefits in states across the country. If you believe youre a fraud victim, or if youve already reported fraud to us but received a 1099-G for fraudulently paid benefits, please see the tax information for fraud victims page: .

Recommended Reading: Esd Wa Gov Unemployment Have This Information Ready

Guide To Unemployment And Taxes

OVERVIEW

The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return. State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year.

If you received unemployment benefits this year, you can expect to receive a Form 1099-G Certain Government Payments that lists the total amount of compensation you received. The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return. Some states also count unemployment benefits as taxable income.

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Donât Miss: Can I Get Obamacare If I Am Unemployed

Also Check: How Do I Change My Address For Unemployment Online

These Are The States That Will Either Mail Or Electronically Deliver Your Form 1099

California

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at and select 1099G at the top of the menu bar on the home page.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by: logging into your account at selecting 1099G at the top of the menu bar > View next to the desired year > Print or Request Paper Copy.

You can also request a paper copy by calling 1-866-333-4606.

Florida

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at myflorida.com and go to My 1099-G & 49Ts in the main menu.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed at 1099grequest.myflorida.com.

Illinois

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at ides.illinois.gov. Illinois Department of Employment Security will send an email notification with instructions to access the document from the Illinois Department of Employment Security website.

- If you prefer to have your Form 1099-G mailed, you may request for a copy to be mailed by calling 338-4337.

Indiana

If you opted into electronic delivery:

- To access your Form 1099-G online, log into your account at in.gov. You will find your Form 1099-G on your Correspondence page.

If you opted into electronic delivery:

Michigan

Utah

What Is A 1099

The 1099-G is a tax form for Certain Government Payments. Every January, we send a 1099-G form to people who received unemployment benefits during the prior calendar year. If you received unemployment benefits during 2020, youll need the information to file your taxes. Claimant tax information cannot be shared over the phone and claimants are not able to access this information by calling the UI Claimant Assistance Center.

NOTE: Claimants will likely receive multiple 1099-G forms for 2020. This is due to receiving benefits from multiple programs. Those programs that claimants would receive a 1099-G form form include:

- UI – Regular Unemployment Insurance benefits

- PEUC – Pandemic Emergency Unemployment Compensation

- EB – Extended Benefits

- High EB – High Extended Benefits

- FPUC – Federal Pandemic Unemployment Compensation

- PUA – Pandemic Unemployment Assistance

- LWA – Lost Wage Assistance

- VSTS – Vermont Short Term Supplement

- $1,200 – Vermont Treasury’s FPUC advance in April 2020

Also Check: Www.njuifile.net Direct Deposit

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Name

- Claim ID, also referred to as Claimant ID in letters

- Current mailing address

- Date of birth

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters we’ve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

- Name

How To Get My W2 Form From Unemployment

The form will show the amount of unemployment compensation they received during 2020 in Box 1 and any federal income tax withheld in Box 4. After signing in scroll down to the Unemployment Insurance section on the right side of the page and select Unemployment Services.

60 Important Papers And Documents For A Home Filing System Checklist Home Filing System Estate Planning Checklist Organizing Paperwork

Also Check: How Do I Change My Address For Unemployment Online

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

You can opt to have federal income tax withheld when you first apply for benefits. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development, Unemployment Insurance, PO Box 908, Trenton, NJ 08625-0908. for the “Request for Change in Withholding Status” form.

After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. This information is also sent to the IRS.

Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2020, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

IMPORTANT INFORMATION FOR TAX YEAR 2020:

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

- Disability Insurance benefits received as a substitute for UI benefits

- Disaster Unemployment Assistance benefits

Read Also: How To File For Unemployment In Tn

You May Like: Njuifile.net 1099

Although Some States Will Enable You To Download Your Unemployment W2 Form And The 1099

How to get w2 from unemployment nj. Log on to your account at the New Jersey Department of Labor and Workforce Development NJLWD Unemployment Insurance Benefits website see Resources by clicking on File a Continued Claim If you filed your original claim using the website you created an account when you filed and should use the same username and password you entered then. The year-end statement provides all the required information for inclusion on a W-2 form. So I would like to get my W2 form from NJ government.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. PPP is based on Schedule C profit which is not what the UI offices are looking at again in my state and its not income. In most cases state UI is only paying benefits based on W-2 income what they do in my state or some type of average claim amount if youre 100 1099 what my friends in other states are getting.

I was lost my job and got unemployment benefit 2010. Amounts over 10200 for each individual are still taxable. Please let me know how to get it and process.

Jersey Division of Taxation have established official 2019 W-2 reporting guidelines for New Jersey. If you still havent received your W-2 use Form C 4267 Employees Substitute Wage and Tax Statement. Additionally a year-end summary of all payment activity is mailed to employers by January 15.

You can also use Form 4506-T to request a copy of your previous years 1099-G.

Aatrix Nj Wage And Tax Formats

Also Check:

The 15200 Excluded From Income Is All Of The 5000 Unemployment Compensation Paid To Your Spouse Plus 10200 Of The 20000 Paid To You

How do i get my w2 from unemployment benefits. Unemployment benefits including Federal Pandemic Unemployment Compensation FPUC Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Lost Wages Assistance LWA and Extended Benefits EB are taxable income. But you dont have to wait for your copy of the form to arrive in the mail. You have to access it on the states web site.

Phoenix 602 612-8705 or 888 305-1348 or Tucson 520 770-3357 or 520 770-3358. Call Tele-Serv at 800-558-8321 and select option 2 to request a duplicate 1099-G. If you got unemployment in 2020 but your 1099-G includes benefits for weeks you didnt claim.

You can view 1099-G forms for the past 6 years. If you are found ineligible to receive unemployment insurance benefits you will receive a determination explaining the reason. Those who received unemployment benefits for some or all of the year will need a 1099-G form.

Said another way offsets taken from your unemployment insurance payments have. Box 29225 Phoenix Arizona 85038-9225. Follow the instructions to report the 1099-G Fraud.

You may contact the Benefit Payment Control Unit via telephone at 410-767-2404 use prompts 1 1 4 1 4 to obtain a computer printout of repayments made to. If you received unemployment your tax statement is called form 1099-G not form W-2. For wages you should receive a W-2 from your employer or employers.

Form 1040 Es Estimated Tax For Individuals Estimated Tax Payments Tax Payment Estimate

Recommended Reading: Bankofamerica.com/kdol

Income Tax 1099g Information

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Maryland Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year. This may be different from the week of unemployment for which the benefits were paid.

1099-Gs are required by law to be mailed by January 31st for the prior calendar year. By January 31, 2021, the Division will deliver the 1099-G for Calendar Year 2020. By January 31, 2021, the Division will send the 1099-G for Calendar Year 2020.

1099-Gs are not available until mid-January 2021. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G may NOT be forwarded by the United States Postal Service. The BPC unit cannot update your mailing address. You must update your mailing address by updating your personal information in the BEACON portal, on the Maryland Unemployment Insurance for Claimants mobile app, or by contacting a Claims Agent at 667-207-6520.

If you wish to request a duplicate 1099-G for prior years, send your request to the Maryland Department of Labor â Benefit Payment Control Unit at .

What is the Payerâs Federal Identification number? The the Maryland Department of Labor Federal ID # is: 52-2006962.

Recommended Reading: Pa Unemployment Ticket Number Status

What To Do If You Lost Your W

The W-2 form is a vital piece of info for most tax filers as it confirms the income you earned for that tax year. Sometimes known as the Wage and Tax Statement, this is sent out by employers at the beginning of every calendar year.

These businesses, by law, have to mail the W-2 forms by January 31 so that filers have sufficient time to submit their taxes by the April 15 deadline for filing taxes. Your Employer also has to send a copy of your W-2 straight to the IRS.

What if you dont have your W-2 form, what should you do next? As per the IRS, you have a few options to think about:

You May Like: Do You File Unemployment On Taxes

Read Also: Ways To Make Money While Unemployed

Here Are 2 Good Places To Get A Copy Of Your W2 Online:

TurboTax W2 Finder will find and retrieve your W2,which allows you to file your taxes as soon as you are ready. This year you can lookup W2 easier than ever before! Just follow the TurboTax screens as it guides you to finding your W2 online.

Millions of employers and financial institutions participate, so the odds are good your W2 will be available to download. You save time by doing so, and it ensures that your information is delivered accurately.

H& R Block W2 Finder will also find and access your W2. When using an online-based company like H& R Block, you will have the capability to get your W2 data online. You wont have to wait for your forms to come in the mail.

The H& R Block search page can find your W2 in 3 easy steps. You can then import your W2 data into your tax return for free, so that you can get your refund as soon as possible!