Reporting Unemployment Benefits On Your Tax Return

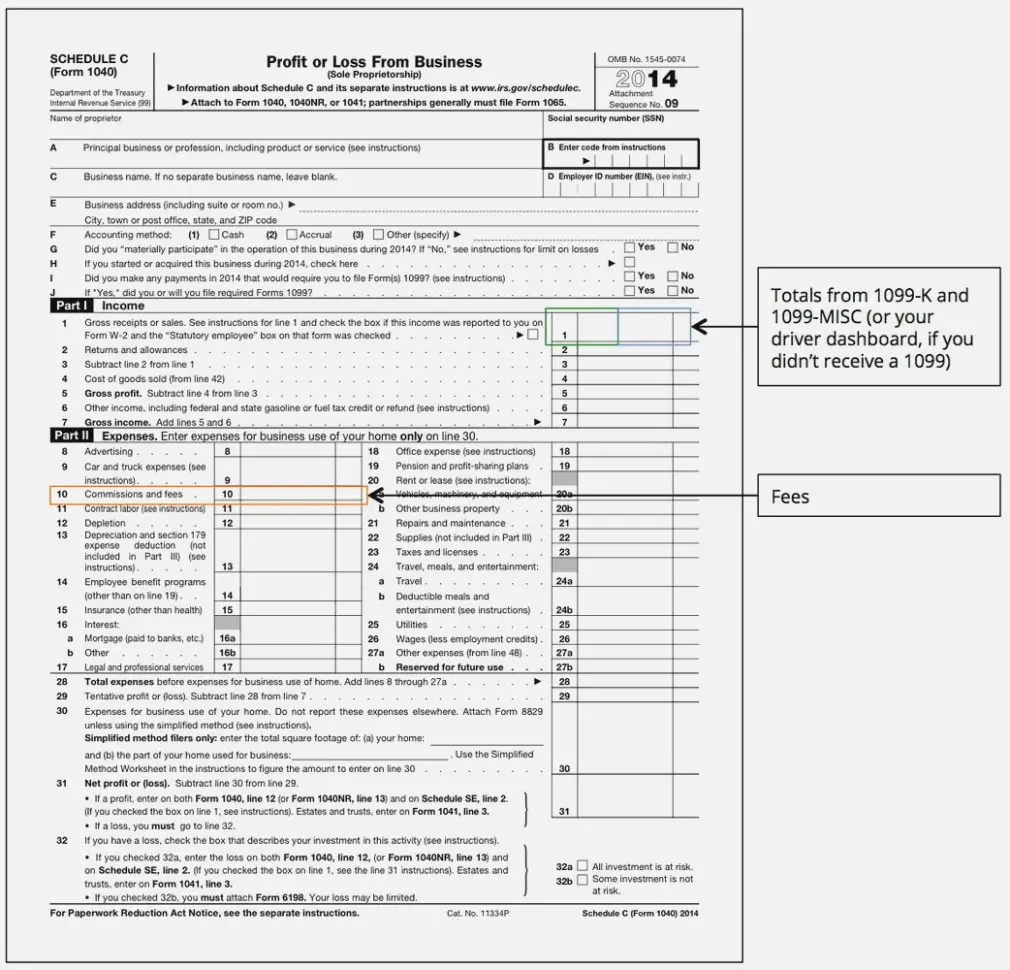

You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The amount will be carried to the main Form 1040. Remember to keep all of your forms, including any 1099-G form you receive, with your tax records.

If you use TurboTax to file your taxes, well ask about your unemployment income and put the information in all the right tax forms for you.

TurboTax is here to help with our Unemployment Benefits Center. Learn more about unemployment benefits, insurance, eligibility and get your tax and financial questions answered.

How Can I Get My 1099

To access your Form 1099-G online, log into your account at unemployment.state.mi.us. Under I Want To, select View 1099-G. If you did not select electronic as your delivery preference by January 9th, 2021, you will automatically be mailed a paper copy of your Form 1099-G.

What do I do if I did not receive a 1099-G?

If you did not receive a Form 1099-G, check with the government agency that made the payments to you. If you received a state or local income tax refund for 2012 and you reside in Conn., Mo., N.J., N.Y. or Penn your Form 1099-G may be available to you only in an electronic format.

Where can I get my 1099G form online?

Form 1099-G

- Visit the Department of Labors website.

- Log in to your NY.Gov ID account.

- Select Unemployment Services and View/Print 1099-G.

Request Your Unemployment Benefit Statement Online

-

Because unemployment benefits are taxable, any unemployment compensation received during the year must be reported on your federal tax return. If you received unemployment benefits in 2020, you will receive Form 1099-G Certain Government Payments .

The statements, called 1099-G or âCertain Government Payments,â are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

You can choose to receive your 1099-G, electronically through MiWAM or by U.S. mail.

To receive your 1099-G electronically, you must request your delivery preference by January 9, 2021. Your statement will be available to view or download by mid-January. If you do not select electronic, you will automatically receive a paper copy by mail.

To receive your 1099-G online:

1 Log into MiWAM

2 Under Account Alerts, click Please select a delivery preference for your 1099 Form

3 Under Delivery Preference for Form 1099-G, click Electronic. Your email address will be displayed.

4 â Review and Submit. You will receive an email acknowledging your delivery preference.

To receive your copy by mail, follow the steps above and select paper as your delivery preference.

Read Also: Where To Get Help With Unemployment

What Is Form 1099

1099-G form details the whole quantum of taxable unemployment benefits paid to you. This Covers:

- Unemployment Insurance benefits include civil Extensions, Pandemic Additional Compensation, Pandemic Emergency Unemployment Compensation, and Lost Wages Assistance.

- Pandemic Unemployment aid benefits

- Disability Insurance compensations are collected as a substitute for UI benefits.

- Disaster Unemployment Assistance benefits

- Paid Family Leave benefits

- Form 1099-G also reports any amount of civil and state income duty withheld.

- Identity theft/fraud alert: If you receive a 1099-g but did not collect unemployment insurance benefit payments in 2020, you may be the victim of identity theft. Report by calling our fraud hotline at 609-777-4304.

The 15200 Excluded From Income Is All Of The 5000 Unemployment Compensation Paid To Your Spouse Plus 10200 Of The 20000 Paid To You

How do i get my w2 from unemployment benefits. Unemployment benefits including Federal Pandemic Unemployment Compensation FPUC Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Lost Wages Assistance LWA and Extended Benefits EB are taxable income. But you dont have to wait for your copy of the form to arrive in the mail. You have to access it on the states web site.

Phoenix 602 612-8705 or 888 305-1348 or Tucson 520 770-3357 or 520 770-3358. Call Tele-Serv at 800-558-8321 and select option 2 to request a duplicate 1099-G. If you got unemployment in 2020 but your 1099-G includes benefits for weeks you didnt claim.

You can view 1099-G forms for the past 6 years. If you are found ineligible to receive unemployment insurance benefits you will receive a determination explaining the reason. Those who received unemployment benefits for some or all of the year will need a 1099-G form.

Said another way offsets taken from your unemployment insurance payments have. Box 29225 Phoenix Arizona 85038-9225. Follow the instructions to report the 1099-G Fraud.

You may contact the Benefit Payment Control Unit via telephone at 410-767-2404 use prompts 1 1 4 1 4 to obtain a computer printout of repayments made to. If you received unemployment your tax statement is called form 1099-G not form W-2. For wages you should receive a W-2 from your employer or employers.

Form 1040 Es Estimated Tax For Individuals Estimated Tax Payments Tax Payment Estimate

Also Check: Can You Transfer Money From Unemployment Debit Card

Filing Your Return Without Your 1099

You can file your federal tax return without a 1099-G form as long as you are informed of:

- The full amount of unemployment benefits paid to you during the previous calendar year.

- The number of federal taxes withheld, if any, during the previous year.

You dont have to attach the 1099-G form to your federal income tax return. If it is essential to file a state income tax return, you may need to attach a copy of the 1099-G to your state return. Review your countrys instructions on how to fill the state income tax return.

Several professional tax preparers need a paper copy of your 1099-G form when completing your federal tax return for you.

Disagree With Your 1099

Important:

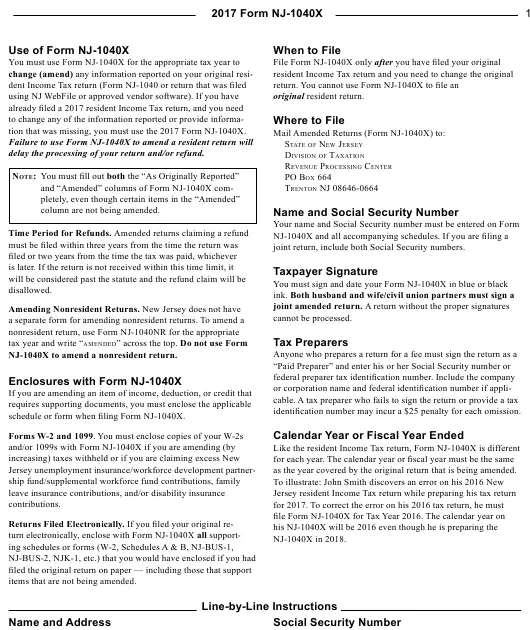

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Next Section

Read Also: Do You Need To Report Unemployment On Your Taxes

Don’t Miss: Car Loans For Unemployed Single Mothers

Tax Impact Of Benefits

Unemployment benefits are included along with your other income such as wages, salaries, and bank interest . The total amount of income you receive, including your unemployment benefits, and your filing status determines if you need to file a tax return.

TurboTax Tip: Use the TurboTax Unemployment Center to learn more about unemployment benefits, insurance, and eligibility.

What Is Reported On My 1099

DES reports the total amount of unemployment benefits paid to you in the previous calendar year on your 1099-G. This amount is based upon the actual payment dates, not the period covered by the payment or the date you requested the payment. This amount may include the total of benefits from more than one claim.

Recommended Reading: Does My Employer Pay My Unemployment

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

How To Get Your 1099

You may choose one of the two methods below to get your 1099-G tax form:

- Online:The 1099-G form for calendar year 2021 will be available in your online account at labor.ny.gov/signin to download and print by mid-January 2022.

- If you do not have an online account with NYSDOL, you may call:1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via U.S. Mail. The form will be mailed to the address we have on file for you.

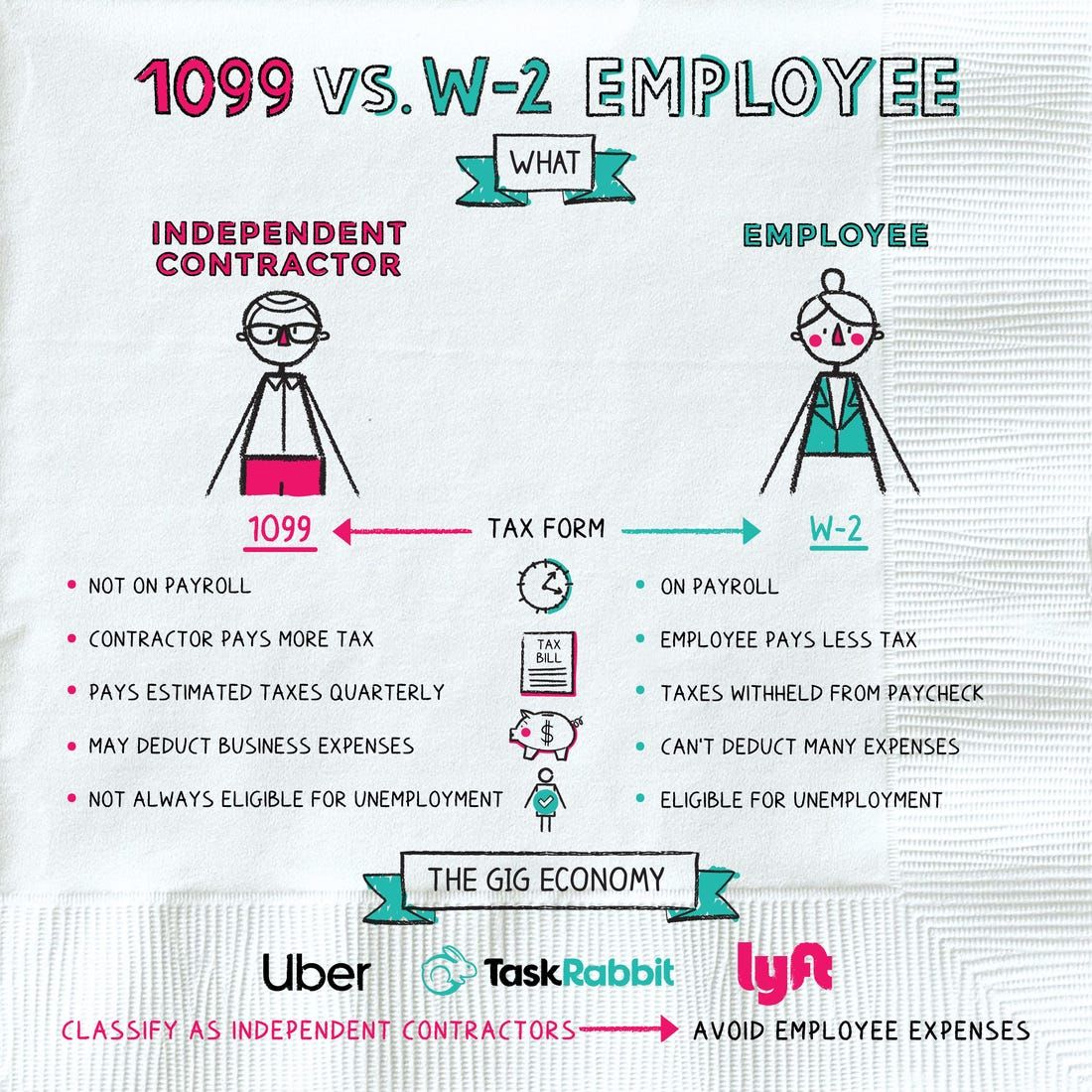

Don’t Miss: Can Independent Contractors Get Unemployment

Where To Find Your 1099

We will mail a paper copy of your 1099-G to the address we had on file for you on December 31, 2021.

We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31, 2022.

It is too late to change your address for the 1099-G mailing, but you can access your 1099-G online.

- Pandemic Unemployment Assistance payments

- Supplemental payments

- Any other kind of unemployment benefit

The total on your 1099-G includes any amounts that were withheld on your behalf, such as:

- Overpayment offsets

Your 1099-G total does NOT include benefit payments that were processed in 2022, even if those payments were for weeks in 2021.

Can U Get My W2 From My Unemployment

You do not get a W-2 for unemployment benefits. You get a 1099G, and no, TurboTax cannot get it for you. You have to get it yourself. Usually you need to go to the stateâs unemployment web site to get it and print it out. To enter it on your tax return, go to Federal> Wages & Income> Unemployment /Government benefits on Form 1099G

There are some employers who make W-2âs available for import to TurboTax, but not all do this. And it is late in the year, so it might not even still be available for import at this time. You might have to ask your employer for a copy of the W-2 that was issued in January.

Recommended Reading: How To File For Unemployment In California Online

Recommended Reading: Can I Get Unemployment On Maternity Leave

These Are The States That Willnotmail Youform 1099

Connecticut

Access your Form 1099-G on-line using the Connecticut Department of Revenues Taxpayer Service Center .

Georgia

You can access your Form 1099-G on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Detailed instructions here: How to Request an Electronic 1099-Gand 1099-G and 1099-INT Search

Louisiana

Access your Form 1099-G by logging into your HiRE account then clicking on Unemployment Services and then Form 1099-G Information.

Missouri

Access your Form 1099-G online at or by calling the Missouri Department of Revenue at 573-526-8299. You will need your social security number, zip code and filing status on your most recently filed tax return. Taxpayers living outside of the United States will need to enter 00000 in place of a zip code.

New Jersey

Access your Form 1099-G by visiting New Jerseys Department of Treasury website.

New York

To access yourForm 1099-G, log into your account atlabor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Wisconsin

Log on, then select Get your 1099-G from My UI Home to access your 1099-G tax forms.

Help With Unemployment Benefits And How To File Your Taxes

We understand that you may have a lot on your plate right now. Where your taxes are concerned, H& R Block is here to help. Be sure to visit our Unemployment Tax Resource Center for help with unemployment related topics.

Free tax filing with unemployment income: You can include your Form 1099-G for free with H& R Block Online Free.

Worried your taxes are too complex for H& R Block Free Online? Check out Blocks other ways to file.

Related Topics

Finding your taxable income is an important part of filing taxes. Learn how to calculate your taxable income with help from the experts at H& R Block.

You May Like: How Do I Sign Up For Unemployment In Ohio

How Can I Download My 1099

If you were out of work for some or all of the previous year, you arenât off the hook with the IRS. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Youâll also need this form if you received payments as part of a governmental paid family leave program. But you donât have to wait for your copy of the form to arrive in the mail. In many states, you can download your 1099-G directly from the Department of Revenue.

Will Unemployment Send Me A W2

Yes, unemployment compensation is reported on your tax return differently than, and separately from, W-2 wage income. For wages, you should receive a W-2 from your employer or employers. For unemployment compensation benefits, you should probably receive a Form 1099-G from your state government.

Where do I get my w2?

If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return, you can order a copy of the entire return from the IRS for a fee. Complete and mail Form 4506, Request for Copy of Tax Return along with the required fee. Allow 75 calendar days for us to process your request.

How do I get my 1099-G from unemployment Online Indiana?

If you need to get a 1099-G, go to www.in.gov/dwd/1099G.htm. Type in your user name and password to log onto your account. Then click the View My 1099G icon under the Smartlinks section. Remember to drop off this 1099G when you drop off your tax information.

Read Also: What Is The Government Doing To Help Unemployment

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

How Do I Get My Unemployment Tax Form

to request a copy of your 1099-G by mail or fax. If you havent received your 1099-G copy in the mail by Jan. 31, there is a chance your copy was lost in transit. Your local office will be able to send a replacement copy in the mail then, you will be able to file a complete and accurate tax return.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. You can also use Form 4506-T to request a copy of your previous years 1099-G. You can download Form 4506-T at IRS.gov or order it from 800-TAX-FORM. Mail the completed form to the IRS office that processes returns for your area. If you are not sure which office it is, check the Form 4506-T instructions.

Read Also: How Do I Get Unemployment W2

How To Get Your W2 Form Online

Online tax filing helps users to get their W2 form online quickly. They have a free W2 finder that you can use to search for yours.

After you get your W-2, you can start filing your taxes online, or you can download a copy so you can print it out and attach it to your tax return.

Its a much faster process than waiting for your W2 to come out in the mail. With over 100 million W2s available online, theres a good chance youll be able to find yours.

Maintaining Eligibility For Your Unemployment Benefits

At this point, youve filed your claim with your states agency and have begun receiving benefits.

The next step is to follow your states procedures to continue receiving those benefits, if any. You could have to file weekly or biweekly claims after each week has ended, and/or respond to questions about your continued eligibility for unemployment benefits. If you do have to file these claims, they generally require information about specific earnings, job offers or job refusals. Generally, these claims are filed by mail or telephone. Your state will provide filing instructions.

Finally, you must report to your local Unemployment Insurance Claims Office or Career One-Stop/Employment Service Office for any day you were scheduled to do so by the agency. If you dont attend a scheduled interview, that could cause you to lose your benefits.

Read Also: Is Unemployment Taxable In California

How Will I Recieve My 1099

1099-G forms will be sent via United States Postal Service. 1099-G forms cannot be sent by email, fax or any other electronic method. 1099-G forms are mailed to the address on record as of January 1, 2022. The USPS will not forward 1099-G tax forms unless it has a change of address on file.

- PUA Claimants: If you filed for benefits in PUA, your 1099-G has been mailed to you. The Department is also currently working to upload 1099-G forms for PUA claimants to the PUA online portal. We will notify you as soon as PUA 1099-G forms are available online..

- If you filed in the regular unemployment insurance system, we are unable to upload your 1099-G to your online claimant portal due to system limitations.

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Donât Miss: Can I Get Obamacare If I Am Unemployed

You May Like: Unemployment Mortgage Assistance Program Nevada