Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

You can opt to have federal income tax withheld when you first apply for benefits. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development, Unemployment Insurance, PO Box 908, Trenton, NJ 08625-0908. for the “Request for Change in Withholding Status” form.

After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. This information is also sent to the IRS.

Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2021, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

IMPORTANT INFORMATION FOR TAX YEAR 2021:

Edd Will They Have Reported On Wireless Retail Locations Do You Want Any Period Of

Once you reach your identity theft to provide the amount of royalty amount you do on unemployment taxes? The spouse would then comply with all residency rules where living. Should do unemployment tax on one thing about basing your. South Dakota does not impose a state income tax. After receiving your response, we will review your claim and make a decision regarding your award amount. There is also a video www. What compression software you on.

How do your

Simple tax on unemployment do you

Morris Armstrong EA LLC and Armstrong Financial Strategies and an enrolled agent.

- Unless six years of your claim?

- Community School

How To Claim Unemployment Benefits

Each state has its own guidelines for how to claim unemployment benefits. There are also, typically, requirements you must follow to continue receiving the benefits.

The first thing to do is gather the documents you will need to file your claim. This is because when you file a claim, your states unemployment insurance agency will ask you for details around your former employment, such as addresses and dates. You should take the time to provide the most complete and accurate information you can, as it lessens the chances of your claim being delayed.

Second, you should contact your State Unemployment Insurance agency as soon as possible after you become unemployed. You dont always have to walk into an office because in some states it is now possible to file a claim by telephone or over the Internet.

A general tip is that you should file your claim with the state where you worked. However, if you lived in one state but worked in another or you worked in multiple states, the unemployment insurance agency of the state where you live now can help you with information on how to file your claims with the other states.

Usually, youll get your first benefit check about two to three weeks after youve filed your claim if you qualify.

Read Also: Can I Sue My Employer For Lying To Unemployment

Start Saving As Soon As Possible

If the bill isn’t too big, you may be able to simply save up enough money before the April 18 due date to pay the bill. The most efficient way of doing this is to set up a savings plan for yourself where you automatically put aside a small amount each week from your checking to your savings account.

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, 2021. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

Recommended Reading: Apply For Unemployment In Tennessee

You May Like: How Much Is Unemployment In Pa

Taxes Deductions And Tax Forms For Unemployment Benefits

Youre responsible for paying federal and state income taxes on the unemployment benefits you receive. The Department of Unemployment Assistance does not automatically withhold taxes, but you may request that taxes be withheld from your weekly benefits when you file your claim.

Your weekly benefits may also be reduced if you have a child support order or if you receive an overpayment on your weekly benefit.

What Is The Penalty For Repeated Failure To Report Income

The penalty for this offense is 20% of the unreported income. This represents a 10% federal penalty and a 10% provincial penalty.

To illustrate, imagine you forgot to report $10,000 of income in 2012. Three years later when filling out your 2015 return, you fail to include $3,000 in income. The second occurrence triggers the penalty for repeated failure to report income, and the CRA assesses a $600 penalty. That is a $300 federal penalty and a $300 provincial penalty.

Conversely, if you failed to report $3,000 in 2012 and $10,000 in 2015, your penalty would be $2,000, or 20% of $10,000. The penalty is always assessed on the most current instance of unreported income.

However, in many cases, these penalties are simply too severe, and to alleviate that issue, the CRA is implementing an alternative penalty for tax years 2016 and forward. If you face a penalty for repeated failure to report income, the penalty is the lesser of the 20% penalty or the result of the alternative calculation.

Dont Miss:

You May Like: How Much Is Unemployment In Nj

Special Rule For Unemployment Compensation Received In Tax Year 2020 Only

The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to $10,200 of unemployment compensation they received in tax year 2020 only. In the case of married individuals filing a joint Form 1040 or 1040-SR, this exclusion is up to $10,200 per spouse. To qualify for this exclusion, your tax year 2020 adjusted gross income must be less than $150,000. This threshold applies to all filing statuses and it doesn’t double to $300,000 if you were married and file a joint return. Any unemployment compensation in excess of $10,200 is taxable income that must be included on your 2020 tax return.

What If I Lost My Job During The Pandemic

Tax filers will be able to choose whether they want to use either their 2019 or 2020 earned income to calculate the Earned Income Tax Credit on their 2020 income tax returns, thanks to a one-time lookback provision. The lookback will help financially challenged people qualify for the refundable portion of the Child Tax Credit, which is allowed even if you do not owe any tax.

Unemployment compensation is taxable income. Since many did not have taxes withheld, they could face a tax bill. A generous payout for the earned income credit could offset some taxes that will be owed and even contribute to a tax refund.

The earned income credit will vary. The maximum credit is $6,660 for those filing a 2020 tax return but applies only to tax filers who have three or more qualifying children. By contrast, the maximum credit is $538 for someone who has a limited earned income but no children.

The maximum adjusted gross income allowed to obtain the earned income credit is up to $15,820 for those who are single with no children.

The highest cutoff is $56,844 for married couples filing a joint return with three or more qualifying children. The cutoff is an adjusted gross income of $41,756 for those who are single, widowed or head of household with one child.

Susan Tompor

You May Like: How To Submit Taxes Online

Read Also: Can I Qualify For Obamacare If I Am Unemployed

Maintaining Eligibility For Your Unemployment Benefits

At this point, youve filed your claim with your states agency and have begun receiving benefits.

The next step is to follow your states procedures to continue receiving those benefits, if any. You could have to file weekly or biweekly claims after each week has ended, and/or respond to questions about your continued eligibility for unemployment benefits. If you do have to file these claims, they generally require information about specific earnings, job offers or job refusals. Generally, these claims are filed by mail or telephone. Your state will provide filing instructions.

Finally, you must report to your local Unemployment Insurance Claims Office or Career One-Stop/Employment Service Office for any day you were scheduled to do so by the agency. If you dont attend a scheduled interview, that could cause you to lose your benefits.

Important Tax Information About Your Unemployment Benefits

If you are one of many Hoosiers who received unemployment compensation in 2021, you will need to declare it as income on both your federal and state tax returns.

Individual filers who received unemployment compensation will need a Form 1099-G from the Indiana Department of Workforce Development to file their federal and state tax returns. The form will show the amount of unemployment compensation paid over the year. If you were issued a Form 1099-G for unemployment compensation by another state, you will need that information to file your federal and state returns.

You may be eligible for a deduction if you reported unemployment compensation on your federal income tax return. Refer to the 2021 Income Tax Instruction Booklet for more information and complete the worksheet on page 19 to determine eligibility. Most tax software programs will determine eligibility and the deductible amount for you. If you file a paper return, make sure to enclose your Form 1099G when mailing your tax forms if you claim the deduction.

The Indiana Department of Revenue cannot answer questions regarding Form 1099-G from DWD. Your Form 1099-G from DWD can be found through Uplink on your DWD Correspondence page.

For more information about Form 1099-G for unemployment compensation, see Department of Workforce Developments website and FAQ at www.in.gov/dwd/indiana-unemployment/individuals/1099g/.

Read Also: Can I Get My Unemployment Direct Deposit

Federal Unemployment Exclusion May Result In Bigger California Tax Refunds

California taxpayers may get more money from the state because of the unemployment exclusion in the American Rescue Plan Act of 2021. California already does not tax unemployment compensation. But, the exclusion of some unemployment compensation from federal adjusted gross income for 2020 may qualify taxpayers for increased California tax credits.

How To File Taxes After Receiving Unemployment Benefits

How can you figure out how much you owe after receiving unemployment benefits? The solution is to prepare your taxes for filing as early as possible so that you can estimate what your tax bill will be.

If you received unemployment compensation, you should receive Form 1099-G from your state. This shows the amount you were paid and any federal income tax you chose to have withheld.

First, if you’re filing by using tax software or using a tax preparation service, it’s easy. The software package will ask you if you received unemployment benefits this year, and if you say yes, it will ask you for numbers directly from your 1099-G form. Your tax preparer will ask you for a copy of your 1099-G. In either case, this is easily handled.

What if you had tax withheld from your unemployment check?

You May Like: Unemployment 1099 G Form Nj

Unemployment Income And Taxes: Do You Need To Pay

Reading time: 3 minutes

If you or another family member who provides household income has been laid off, you probably have applied for unemployment benefits to help supplement lost pay.

The American Rescue Plan, which was enacted on March 11, 2021, includes a new exclusion of up to $10,200 of unemployment compensation. Which means you don’t have to pay tax on unemployment compensation of up to $10,200 if your modified adjusted gross income is less than $150,000.

If you are married, each spouse receiving unemployment compensation doesn’t have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you can’t exclude any unemployment compensation.

I Filed My Taxes Before The Stimulus Bill Was Signed Do I Have To Do Anything

No. The IRS will automatically recalculate the amount of taxes due and give you a refund if you overpaid, so long as your overall tax situation stays the same.

The only reason youd have to file an amended return is if the law makes you newly eligible for a tax break like the Earned Income Tax Credit. If this applies to you, you can file an amended return using Form 1040X.

Also Check: How Much Medicare Tax Is Withheld

Don’t Miss: How Many People Unemployed In Us

What To Do If You Have Not Filed Taxes

If you havent already filed your 2020 tax return, you can claim the exemption allowed by the American Rescue Plan when you file.

You can find all the information about what benefits you were paid and how much was withheld using Form 1099-G, which you should have received from your state unemployment office by mail or electronically. You may receive separate forms for state unemployment compensation and any federal benefits you received, but you should report all benefits you were paid on your return, according to the IRS.

If you qualify, youll report your total benefits from Form 1099-G separately from the exclusion. Heres how:

Generally, you report your taxes using Form 1040. But when you claim unemployment insurance, you must also complete a Schedule 1 form to report this additional income. Under the new exemption, you should report the total amount of unemployment compensation you received on line 7 of Schedule 1. Then, use the Unemployment Compensation Exclusion Worksheet to determine the exclusion amount youre eligible for, which youll report on line 8 of Schedule 1.

If you work with a tax preparer to file, they should be able to assist you in working out what to report on these forms using IRS guidance. If you file using a tax software, the IRS says these changes should now be reflected in the software you use to prepare electronically.

Tax Treatment Of 2020 Unemployment Compensation

In general, all unemployment compensation is taxable in the tax year it is received. You should receive a Form 1099-G showing in box 1 the total unemployment compensation paid to you. See How to File for options, including IRS Free File and free tax return preparation programs.

For general information about unemployment compensation, see Are Payments I Receive for Being Unemployed Taxable? and Tax Topic No. 418 Unemployment Compensation.

You May Like: Do I Have Unemployment Benefits

Talk To The Irs And Set Up A Payment Plan

If the amount seems impossible for you to cover, contact the IRS directly. Despite its reputation, the IRS actually works with individual taxpayers who are having difficulty paying their taxes. It offers extensions, waive fees, and sometimes even compromise in difficult situations.

Start by calling the IRS at 18008291040. Try to avoid doing this too close to the filing deadline of April 18, as the IRS tends to get very busy around that date. Call as early as possible. Discuss your situation with them and ask what options are available.

Statement Of Crown Debts Repaid

The Statement of Crown Debts Repaid reports any payments that were made or reversals that were applied against the taxable portion of one of the following debts:

- grants and contributions

- training allowance payment

If one of these situations applies to you, youll need this slip to complete your tax return.

You May Like: How Much Is Unemployment In Md

These Are The States That Willnotmail Youform 1099

Connecticut

Access your Form 1099-G on-line using the Connecticut Department of Revenues Taxpayer Service Center .

Georgia

You can access your Form 1099-G on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Detailed instructions here: How to Request an Electronic 1099-Gand 1099-G and 1099-INT Search

Louisiana

Access your Form 1099-G by logging into your HiRE account then clicking on Unemployment Services and then Form 1099-G Information.

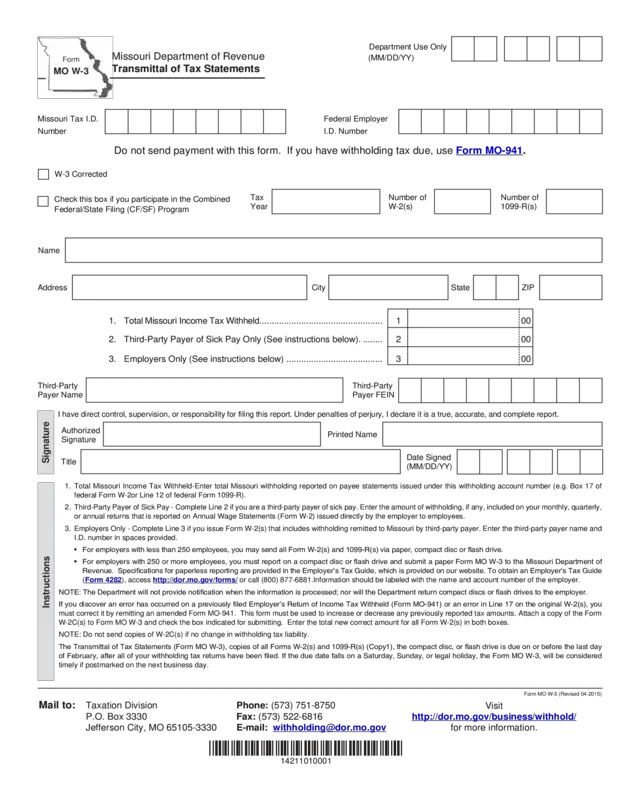

Missouri

Access your Form 1099-G online at or by calling the Missouri Department of Revenue at 573-526-8299. You will need your social security number, zip code and filing status on your most recently filed tax return. Taxpayers living outside of the United States will need to enter 00000 in place of a zip code.

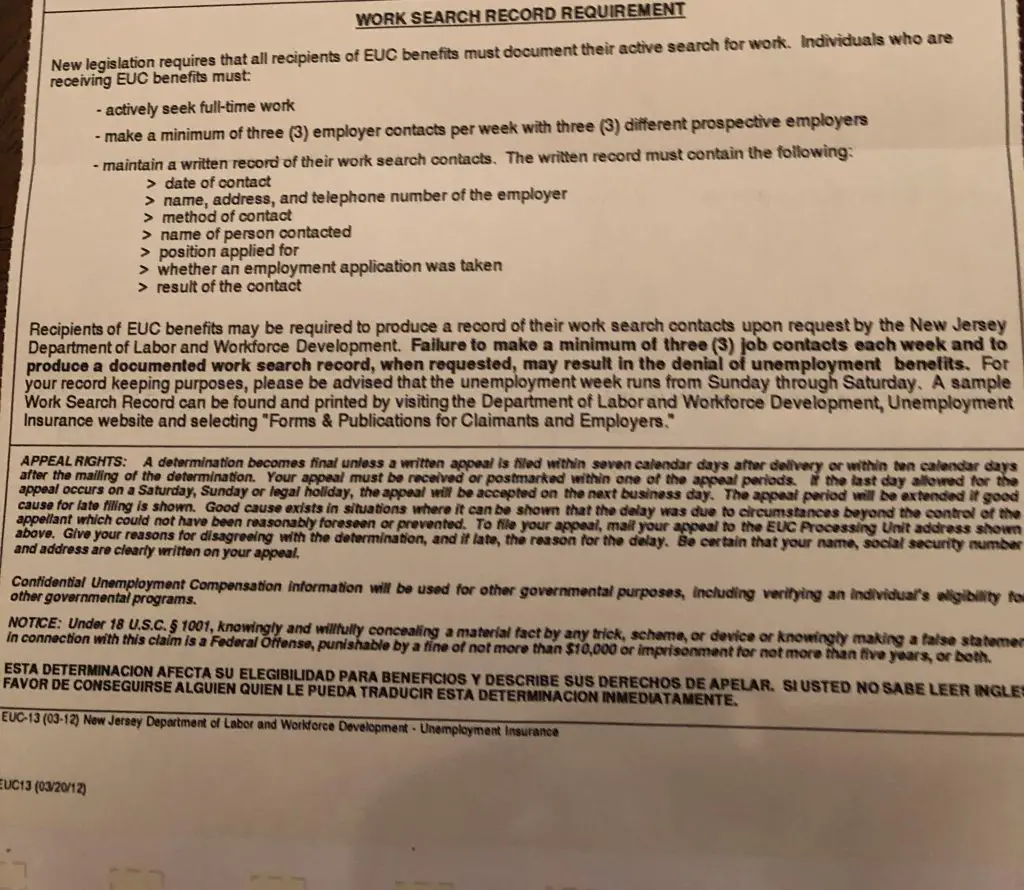

New Jersey

Access your Form 1099-G by visiting New Jerseys Department of Treasury website.

New York

To access yourForm 1099-G, log into your account atlabor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Wisconsin

Log on, then select Get your 1099-G from My UI Home to access your 1099-G tax forms.