When Should I Receive My Unemployment Tax Form

Go the website of your states labor department. Navigate to the page that provides information on unemployment claims. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question. In most cases, 1099-Gs for the previous year are mailed on or before January 31. For example, if you collected unemployment in 2018, the 1099-G should have been mailed by January 31, 2019. While on your states website, copy the contact information so you can contact the office directly if necessary.

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Claim ID, also referred to as Claimant ID in letters

- Current mailing address

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters we’ve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

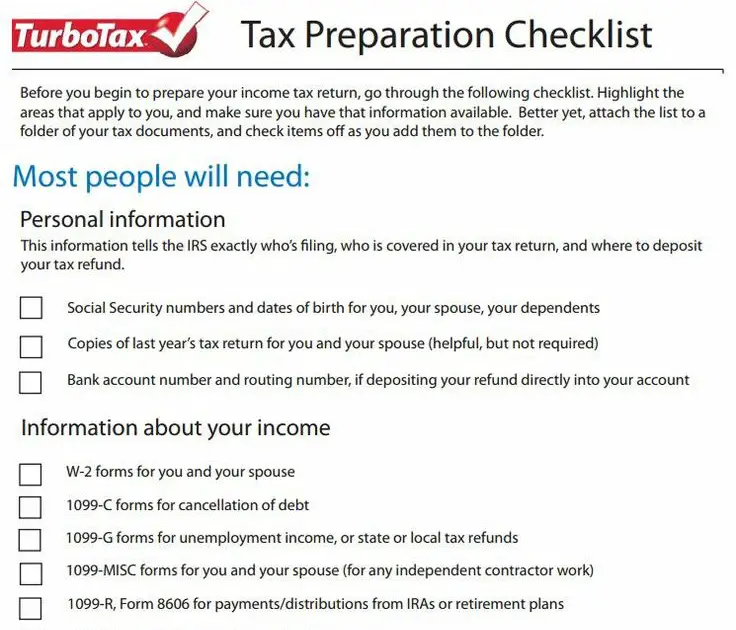

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Dont Miss: Employer Tax Identification Number Lookup

You May Like: How Do I Get Unemployment Insurance For My Business

Unemployment Benefits Are Tax

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The U.S. unemployment rate peaked in April 2020 at 14.8%a level not seen since data collection began in 1948before declining to a still-high 6.7% in December to close out the year.

That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits during filing season in 2021 for 2020 tax returns. The good news is that up to $10,200 of those benefits received in 2020 are tax-free for those who earned less than $150,000 in modified adjusted gross income, thanks to the American Rescue Plan Act of 2021. After that point, however, unemployment benefits are taxable income.

The ARPA applies only to federal taxes, the return youll file with the IRS in 2021. Several states have indicated that theyre still going to tax unemployment benefits, so check with your state to find out how it plans to proceed.

Learn more about taxes on your 2020 unemployment benefits.

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2021 New York State Form 1099-G statement is the same as the 2020 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

Also Check: How To Apply For Unemployment In Chicago

What If I Havent Filed A Tax Return

TAXPAYERS had until May 17 to file an extension if they needed more time to submit their returns.

If you didnt file a tax return or an extension, but should have, you need to take action or the penalties you face may increase.

If you file your return over 60 days late, youll have to pay a $435 fine or 100% of the tax you owe whichever is less.

However, there is no penalty for filing a late return after the tax deadline if a refund is due, said the IRS.

If you didnt file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest.

You wont have to pay the penalties if you can show reasonable cause for the failure to do so on time we explain how in our guide.

These Are The States That Will Either Mail Or Electronically Deliver Yourform 1099

Florida

You can access your Form 1099-G through your Reemployment Assistance account inbox. The fastest way to receive your 1099-G Form is by selecting electronic as your preferred method for correspondence. Go to My 1099-G in the main menu to view Form 1099-G from the last five years.

Illinois

Access yourForm 1099-Gonline by logging into your account atides.illinois.gov. If you havent already, you will need to create an .

Indiana

Access yourForm 1099-Gonline by logging into your account atin.gov. Go to your Correspondence page in your Uplink account.

To reduce your wait time and receive your 1099G via email, or using the MD Unemployment for Claimants mobile app.

Michigan

If you did not select electronic as your delivery preference by January 9th, 2021, you will automatically be mailed a paper copy of your Form 1099-G.

To view or download your Form 1099-G,

o sign into your MiWAM account ando click on I Want To, theno 1099-G then choose the tax year.

To change your preference, log into MiWAM.

o Under Account Alerts, click Request a delivery preference for Form 1099-G and thenselect the tax year.

Mississippi

To access yourForm 1099-Gonline, log into your account and follow the instructions sent by email on where you can view and print yourForm 1099-G.

North Carolina

Division of Employment SecurityP.O. Box 25903Raleigh, NC 27611-5903

Utah

Read Also: How To Prove Job Search For Unemployment

These Are The States That Will Not Mail You Form 1099

Missouri

- To access your Form 1099-G, log into your account through at uinteract.labor.mo.gov. From the UInteract home screen, click View and Print 1099 tab and select the year to view and print that years 1099-G tax form.

- The Missouri Division of Employment Security will mail a postcard no later than January 31, 2021, notifying anyone who has not accessed their Form 1099-G online about the availability of the form and how to access it.

New Jersey

- To access your Form 1099-G, check your email. You will receive your Form 1099-G by email. You can also use the Check Claim Status tool to get yourForm 1099-G.

- If you prefer to have your Form 1099-G mailed, you may request a copy from your Reemployment Call Center. It may take 10 business days to receive a copy of your Form 1099-G.

New York

- To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the Unemployment Services button on the My Online Services page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

- If you prefer to have your Form 1099-G mailed to you, you can call 1-888-209-8124. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

Wisconsin

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

- Unemployment Insurance benefits including Federal Extensions , Pandemic Additional Compensation , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance

- Pandemic Unemployment Assistance benefits

- Disability Insurance benefits received as a substitute for UI benefits

- Disaster Unemployment Assistance benefits

- Paid Family Leave benefits

Form 1099-G also reports any amount of federal and state income tax withheld.

You May Like: Unemployment Rate In United States

Irs Schedule For Unemployment Tax Refunds

With the latest batch of payments on Nov. 1, the IRS has now issued more than 11.7 million unemployment compensation refunds totaling over $14.4 billion. The IRS announced it was doing the recalculations in phases, starting with single filers with no dependents and then for those who are married and filing jointly. The first batch of these supplemental refunds went to those with the least complicated returns in early summer, and batches are supposed to continue for more complicated returns, which could take longer to process.

Adhd And Tax Disability Benefits

If you have been diagnosed with attention deficit hyperactivity disorder , you could be eligible for tax disability benefits. That said, a diagnosis is not an automatic approval for a tax credit. The reason being that ADHD comes in varying degrees and it needs to be established how this condition affects your daily life. All of the factors need to be considered during the application process. If you or a loved one with ADHD display a certain behaviour which is disruptive to daily life, this could result in a tax credit being approved.

The most important concern is determining the difference between mild and severe ADHD since this will determine whether or not you are eligible. Although this disability is not as clearly visible as, lets say, somebody suffering from paralysis, it can still be debilitating. The Canadian government recognizes this and offers financial support in the form of the Disability Tax Credit.

Also Check: How To Earn Money While Unemployed

Get Paper Unemployment Tax Forms

If you decide not to file electronically, you also have the option of filing your unemployment taxes using paper forms. You must use our original forms, and mail them back to us. We do not accept copies because our unemployment tax forms use unique ink that allows the information to be scanned into our computer system. Copy machines cannot reproduce the ink, so when someone submits a copy of the form, the information must be hand-keyed into the system.

If you file using a tax/wage form that is not an Agency original form, you may have to pay a penalty.

To request our paper forms:

Send an email to or call 855-TAX-WAGE

Dont Miss: How To Do Taxes On Doordash

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, 2021. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

Recommended Reading: Does Being Unemployed Affect Car Insurance

Read Also: How Much Is Unemployment In Colorado

New Exclusion Of Up To $10200 Of Unemployment Compensation

If your modified adjusted gross income is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you dont have to pay tax on unemployment compensation of up to $10,200. If you are married, each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you cant exclude any unemployment compensation. If you file Form 1040-NR, you cant exclude any unemployment compensation for your spouse.

The exclusion should be reported separately from your unemployment compensation. See the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure your exclusion and the amount to enter on Schedule 1, line 8.

When figuring the following deductions or exclusions from income, if you are asked to enter an amount from Schedule 1, line 7 enter the total amount of unemployment compensation reported on line 7 and if you are asked to enter an amount from Schedule 1, line 8, enter the amount from line 3 of the Unemployment Compensation Exclusion Worksheet. See the specific form or instructions for more information. If you file Form 1040-NR, you arent eligible for all of these deductions. See the Instructions for Form 1040-NR for details.

Unemployment Tax Refunds: Key Things To Know

In late May, the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the provision in the American Rescue Plan waived taxes on up to $10,200 in unemployment insurance benefits for individuals earning less than $150,000 a year. With the latest batch of payments in July, the IRS has now issued more than 8.7 million unemployment compensation refunds totaling over $10 billion.

The first batch of these supplemental refunds went to those with the least complicated returns , and batches are supposed to continue throughout the summer for more complicated returns. On July 13, the IRS said it sent out 4 million more payments via direct deposit and paper check, and another 1.5 million went out starting July 28.

According to an igotmyrefund.com forum and another discussion on , some taxpayers who filed as head of household or as married with dependents started receiving their IRS money in July or getting updates on their transcript with dates in August and September.

Heres a quick recap of what we know:

Now playing: Your tax questions answered in 3 minutes

3:26

Also Check: Dasher Tax Form

You May Like: What To Do When You Re Unemployed And Broke

How Do I Get My 1099

To obtain your 1099-G From from the Oklahoma Unemployment Security Commission, you can visit this link to request the form online. To request the form you would scroll down to the bottom of the page and click on Claimant Access and continue through the screens to request the 1099-G.

As an alternative you can contact the Oklahoma Unemployment Security Commission at 962-4651 to request the form by phone.

Using Unemployment Tax Registration

Employers must register with the Texas Workforce Commission within 10 days of becoming subject to the Texas Unemployment Compensation Act. TWC provides this quick, free, online service to make registering as easy as possible.

You will answer a series of questions about the ownership of the business and the number of locations operated. Once the registration is complete, liable employers will receive a TWC Tax Account Number and may be able to file wage reports and submit unemployment tax payments online.

The registration process takes approximately 20 minutes. The system will automatically save partial registration information once the initial details have been entered. Incomplete registrations will be accessible through this Internet site for one year you can come back later to continue the registration process.

Also Check: What Time Does The Unemployment Office Close

Unemployment Compensation Subject To Income Tax And Withholding

The Tax Withholding Estimator on IRS.gov can help determine if taxpayers need to adjust their withholding, consider additional tax payments, or submit a new Form W-4 to their employer. For more information about estimated tax payments or additional tax payments, visit payment options at IRS.gov/payments.

The Federal Unemployment Tax Act , with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax. For a list of state unemployment tax agencies, visit the U.S. Department of Labor’s Contacts for State UI Tax Information and Assistance. Only the employer pays FUTA tax it is not deducted from the employee’s wages. For more information, refer to the Instructions for Form 940.

Q3 I Already Filed An Amended Return To Claim The Unemployment Compensation Exclusion Will This Cause Any Issues Or Delay My Refund

A3. No. The IRS can identify a duplicate claim or mixed adjustment scenarios. If the Form 1040-X has changes other than unemployment compensation exclusion, only the part of the claim that was not adjusted when we applied the exclusion will be considered after we apply the exclusion. Filing a Form 1040-X wont increase the time it takes the IRS to make the automatic correction or reduce the time it takes to process your automatic correction.

Dont Miss: What Day Does Unemployment Get Deposited In Nc

You May Like: How To Apply For Unemployment In Louisiana