How To File Form 1099

Posted: If you received a Form 1099-G for unemployment compensation that you received during the year, you can enter this in your account go to: Federal Section. Income Select My Forms. Form 1099-G Box 1 Unemployment Compensation. Add or Edit a 1099-G. The exclusion will be applied automatically based on the entries in the program.

You May Like: Where Do I Get My W2 From Unemployment

If I Repaid An Overpayment Will It Be Reflected On My 1099

No. DES reports the total amount of benefits paid to you in the previous calendar year on your 1099-G, regardless of whether you repaid any overpayment. If you repaid part or all of an overpayment during the previous calendar year, you may be able to deduct the repaid amounts on your income tax return. The repaid amount should be reported on the tax return submitted for the year the repayment was made.

Heres What You Can Do:

Step One: Report Identity Theft to ODJFSComplete this online form. ODJFS will issue confirmation emails to everyone who files a report with information about identity theft and protection. The agency will process the reports, conduct investigations and, if necessary, issue corrections to the Internal Revenue Service on 1099s issued to victims.

Step Two: File Your Taxes ODJFS recommends that you follow the following tax-filing guidance regarding identity theft from:

Step Three: Protect Your Identity Many resources are available for victims of identity theft to help them protect their identities. ODJFS strongly urges anyone who suspects they may be a victim of identity theft to take appropriate action to protect themselves. Here are some resources we recommend:

- Federal Trade Commission Resources at identitytheft.gov

LINKS: ttps://odjfs2.secure.force.com/OUIOFraudEmployerReportingPortal

Q: How do I know if someone has fraudulently filed for Unemployment Benefits in my name?

A: If you have received one or more of the following and you did not file for Unemployment Benefits in 2020, you may have had a fraudulent claim made in your name:

Q: What should I do if I receive one of the forms/notifications listed above?

A: You should follow these steps, in order:

Recommended Reading: How To File Unemployment Taxes In Ohio

Reminder For Those Receiving Unemployment Benefits: Report Your Benefits When You File Your Tax Return

The IRS reminds taxpayers that unemployment benefits are taxable, and they should watch their mail for a Form 1099-G. In some states, taxpayers may be able to receive the Form 1099-G by visiting their state’s unemployment website where they signed up for account benefits to obtain their account information.

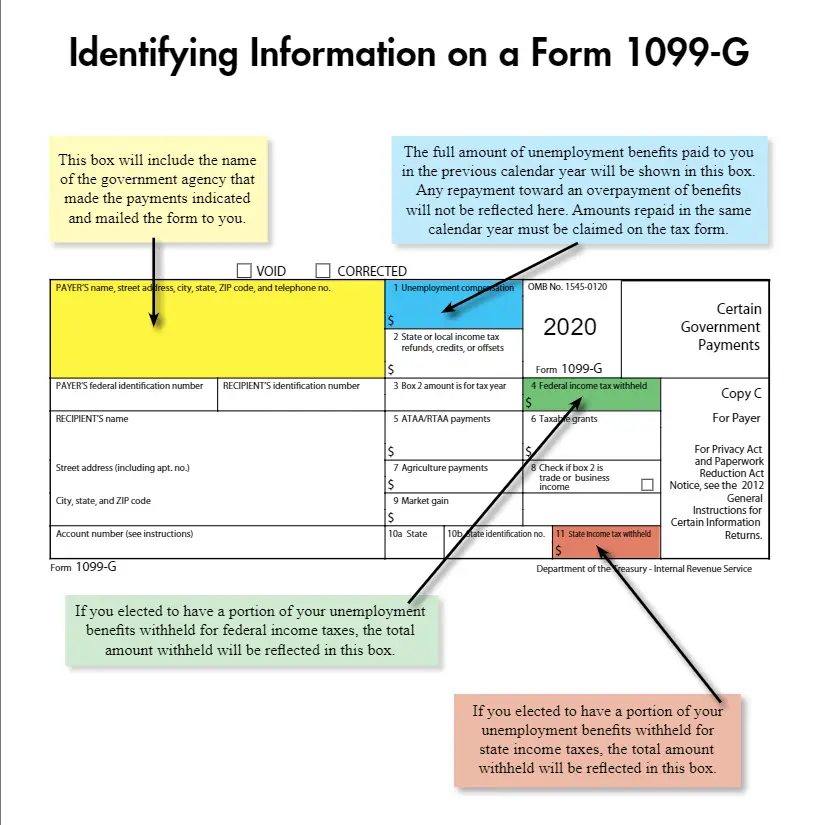

Starting in January 2021, unemployment benefit recipients should receive a Form 1099-G, Certain Government Payments from the agency paying the benefits. The form will show the amount of unemployment compensation they received during 2020 in Box 1, and any federal income tax withheld in Box 4. Taxpayers report this information, along with their W-2 income, on their 2020 federal tax return. For more information on unemployment, see Unemployment Benefits in Publication 525.

If You Included Your Unemployment Income Already The Irs Wont Require You To File An Amended Tax Return In Most Cases

Since we are in the middle of tax season, you may have already filed and claimed your full unemployment benefits on your tax return.

According to the IRS, more than 23 million Americans filed for unemployment last year. On March 31, the IRS announced taxpayers who have already filed would not have to resubmit their tax returns in most cases the IRS will adjust qualifying returns automatically in two phases.

The IRS will start with single taxpayers who qualify for the tax break and then process taxpayers who filed jointly. It estimates that taxpayers will begin to receive tax refunds as early as May, and the agency will continue to process refunds through the summer. If you owe taxes, the IRS will apply any adjustment to outstanding taxes due.

However, if you expect your tax return adjustment makes you eligible for a tax credit or an increase of a tax credit previously claimed, you will need to file an amended tax return to claim the credit.

For example, lets say, for instance, you qualify for the Earned Income Tax Credit . However, because of the unemployment tax break, your income has changed and you may now be eligible for a higher credit. In this instance, the IRS requests you to file an amended tax return to claim the increase or any other credit you may now be entitled to due to the reduction of income.

You May Like: How To Pay Unemployment Tax

Also Check: New York Unemployment 1099 G

Reporting Unemployment Identity Theft

Recommended Reading: Can Llc Owner Collect Unemployment

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

You May Like: How To File For Unemployment In Oklahoma

Look Up Your 1099g/1099int

To look up your 1099G/INT, you’ll need your adjusted gross income from your most recently filed Virginia income tax return .

Please note: This 1099-G does not include any information on unemployment benefits received last year. If you’re looking for your unemployment information, please visit the VEC’s website.

Note: We will not mail paper 1099G/1099INT forms to taxpayers who chose to receive them electronically unless we receive a request for paper copies of these forms from the taxpayer. We will automatically mail paper forms to taxpayers who did not opt to receive them electronically.

Questions On Impact Of Unemployment Compensation Benefits Including Repayment And Overpayment On Your Form 1099

How will I know how much unemployment compensation I received?

If you received unemployment compensation or PUA during the year, you should receive Form 1099-G from the Delaware Division of Unemployment Insurance. The form will indicate the total amount of benefits received and the amount of federal taxes withheld. You will need to add the payment that is noted in the 1099-G form when preparing and reporting your income taxes to the Internal Revenue Service

If I repaid benefits that I had received, will I receive a 1099-G?

If you received UI benefits in the same year during which you repaid an overpayment of benefits, you will receive a 1099-G for that year. If you only repaid benefits received from prior benefit years, you will not receive a 1099-G.

What if I received an overpayment of benefits in one year and I repaid any of it in the same or subsequent calendar year?

Note: The total payment section on your 1099-G form includes all benefits paid to you during the calendar year, including benefits that were applied to an overpayment.

For more information on how to report your repayment of UC benefits on your tax return, see Unemployment Benefits and Repayments in IRS Pub. 525 or contact the IRS directly at 800-829-1040.

If I am no longer collecting unemployment benefits, how can I pay the tax due?

Recommended Reading: How To File For Unemployment In Florida

You May Like: Can I Fill Out Unemployment Online

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Taxes On Unemployment Income

Due to the pandemic, Ohioans who earned less than $150,000 do no have to pay state or federal income tax on the first $10,200 in unemployment income they received in 2020. Heres how to get these tax benefits:

Federal income tax

If you havent filed your taxes yet:

- On the standard federal 1040 form, you will list the full amount of unemployment benefits you received on line 7 titled capital gain or ,according to the IRS.

- This total is listed on a 1099-G form you received. Because of potential unemployment fraud, you should check that that number matches what you actually got.

- Then, you list the amount you can exclude on line 8 titled other income as a negative amount . For example, if you received $12,000 in unemployment, you would list here, because that is the maximum amount you can exclude from income taxes.

If you have already filed your taxes:

State income tax

If you havent filed your taxes yet:

- You do not need to list unemployment benefits on state tax forms because they will be accounted for in your federal adjusted gross income.

If you have already filed your taxes:

- You do need to file an amended return for state income tax and school district income tax. Make sure you check the box for an amended return and provide a reason: your federal adjusted gross income decreased.

Also Check: Unemployment Tennessee Apply

Read Also: How Much Does An Unemployment Attorney Cost

Approximately 20000 Unemployed Ohio Workers Still Waiting For 1099

CLEVELAND Approximately 20,000 unemployed Ohio workers are still waiting for their 1099-G forms that are needed to file taxes this year because the forms were not generated by the states system, according to Bill Teets, Communications Director, Ohio Jobs and Family Services.

In a statement to News 5, Teets wrote, We do not yet know why, and our primary focus is on resolving that issue so we can get those 20,000 reissued. It is a matter of identifying, and then testing potential fixes, which weve been doing for several days now.

Weve received close to 1,000 requests to reissue 1099s and have been keeping current with those, according to Teets.

Cleveland resident Greg McPherson, 62, said he is one of the unemployed Ohio workers still waiting for a 1099-G.

Its disgusting, he said. This is our government, who is supposed to be working for the people and theyre treating the people like dirt.

News 5 Investigators reached out to ODJFS about the missing tax forms after McPherson and another News 5 viewer alerted us to the issue.

Its now March 3 and I still havent gotten my 1099 from our government, he said. Its not fair. Why arent they held accountable when we are?

McPherson said he has called the state to ask for a new 1099-G form, but, so far, no one has been able to help him.

Every time I called I always got a different answer. Nobodys on the same page, he said. Its incompetence at its finest.

Read Also: Maximum Unemployment In Mn

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Recommended Reading: Apply For Unemployment Tennessee

Don’t Miss: What Is The Average Unemployment Rate

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Claim ID, also referred to as Claimant ID in letters

- Current mailing address

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters we’ve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

You May Like: How To Look Up Unemployment Records

Which Turbotax Is Best For You

Figuring out all these specifics can be stressful. But doing your income taxes doesnt need to be, when you use TurboTax Online.

However, if you do feel a bit overwhelmed, consider TurboTax Live Assist & Review and get unlimited help and advice from a real person as you do your taxes. Plus, theres a final review before you file. Or, choose TurboTax Live Full Service and have one of our tax experts do you return from start to finish.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Recommended Reading: How To File For Unemployment In Missouri

Preparing Your Tax Year 2020 Tax Return Now

You can still claim the special exclusion for unemployment compensation received in tax year 2020 if you havent filed your 2020 tax return and your AGI is less than $150,000. Tax year 2020 returns can be filed electronically only by paid or volunteer tax return preparers. If you prepare a prior year tax return yourself, you must print, sign, and mail your return. There are various types of tax return preparers, including certified public accountants, enrolled agents, attorneys, and others who can assist you in filing your return. For more information about these and other return preparers who might be right for you, visit Need someone to prepare your tax return? on IRS.gov/filing. Instructions and an updated worksheet about the exclusion can be found in the 2020 Form 1040 and 1040-SR Instructions PDF. These instructions can assist taxpayers who have not yet filed to prepare returns correctly.

Also Check: How Can I Quit My Job And Get Unemployment

Are Disability Insurance Benefits Taxable

In most cases, Disability Insurance benefits are not taxable. However, if you are receiving unemployment benefits, then become ill or injured and begin receiving DI benefits, the DI benefits are considered a substitute for unemployment benefits, which are taxable.

If DI benefits are taxable, you will receive a notice with your first benefit payment. You will receive a Form 1099G for your federal return only. You can access your Form 1099G information in your UI Online account.

If you received unemployment benefits before filing a claim for DI benefits and did not receive a Form 1099G, contact the 1099G Service Line at 1-866-401-2849, Monday through Friday, from 8 a.m. to 5 p.m. except on state holidays.

If you have more questions, you can contact the IRS at 1-800-829-1040. TTY: 1-800-829-4059.